For those new to the stock market, “Options Strategies for Beginners” is a key term that can open doors to informed trading choices. Let’s explore strategies that balance risk and reward for novice traders.

Further Reading: Price Action Trading Simplified

Essential Options Strategy: The Covered Call

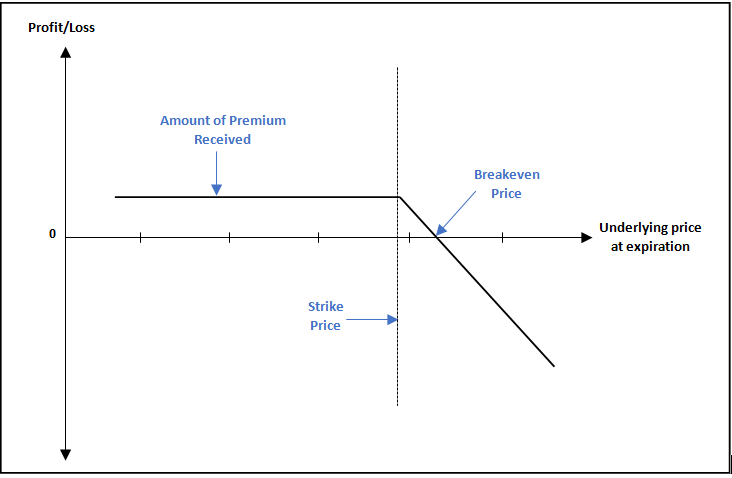

The covered call is a fundamental “Options Strategy for Beginners” where you sell call options against stock you own. It’s a protective measure against falling stock prices, offering a premium that cushions financial impacts.

Cash-Secured Puts: A Starter Option Strategy

For beginners, cash-secured puts are a prudent “Options Strategy.” It involves selling put options at a desired purchase price, earning a premium while preparing to buy the stock if necessary.

The Collar Strategy: Options Safety Net for Starters

Among “Options Strategies for Beginners,” the collar strategy stands out. It combines a covered call with a protective put, providing a safety net against significant losses.

Credit Spreads: Controlled Options for New Traders

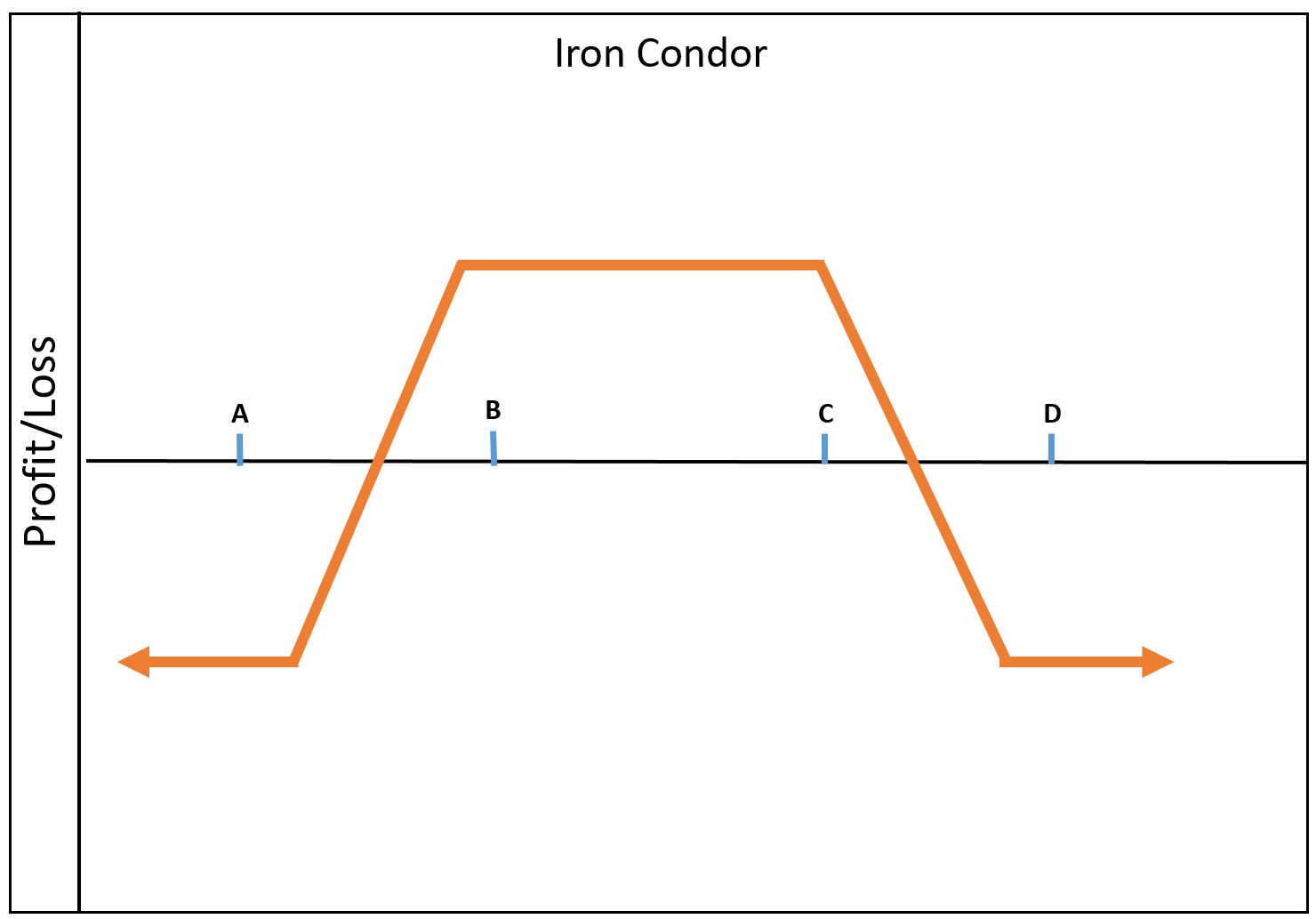

A credit spread is a savvy “Options Strategy for Beginners,” involving buying and selling options that limit financial exposure while still offering a potential for profit.

This strategy pairs a put credit spread with a call credit spread, balancing risk and reward effectively.

This strategy pairs a put credit spread with a call credit spread, balancing risk and reward effectively.

Diagonal Spreads: Advanced Yet Accessible Beginner Options

Diagonal spreads, a more advanced yet accessible “Options Strategy for Beginners,” mix options with different strikes and expiries, offering a dynamic approach to market entry.

Learn about diagonal spreads here:

Diagonal Spreads: A Strategic Approach for New Options Traders

Navigating Options Trading as a Beginner

“Options Strategies for Beginners” is more than just a term—it’s the foundation of successful trading. With the right knowledge and strategies, beginners can confidently convert opportunities into gains.

5 Comments