Exploring Algorithmic Options Trading

Algorithmic Options Trading is rapidly becoming a popular method to master the Options trading arena. While basic trading tutorials often cover Option trading, a quick refresher can help you better understand its place. Options are contracts that grant buyers the right, but not the obligation, to buy or sell an asset at a predetermined price on a specific date.

Options are typically utilized for risk hedging. When they are traded using algorithms, this practice is termed Algorithmic Options Trading. This approach adheres to a set of pre-planned rules for decision-making, offering a blend of automation and adaptability to market changes. It promotes organized trading in options, enhancing liquidity in the markets.

Also Read: Volatility Smile In Options

Algorithmic vs Automated Trading: A Comparison

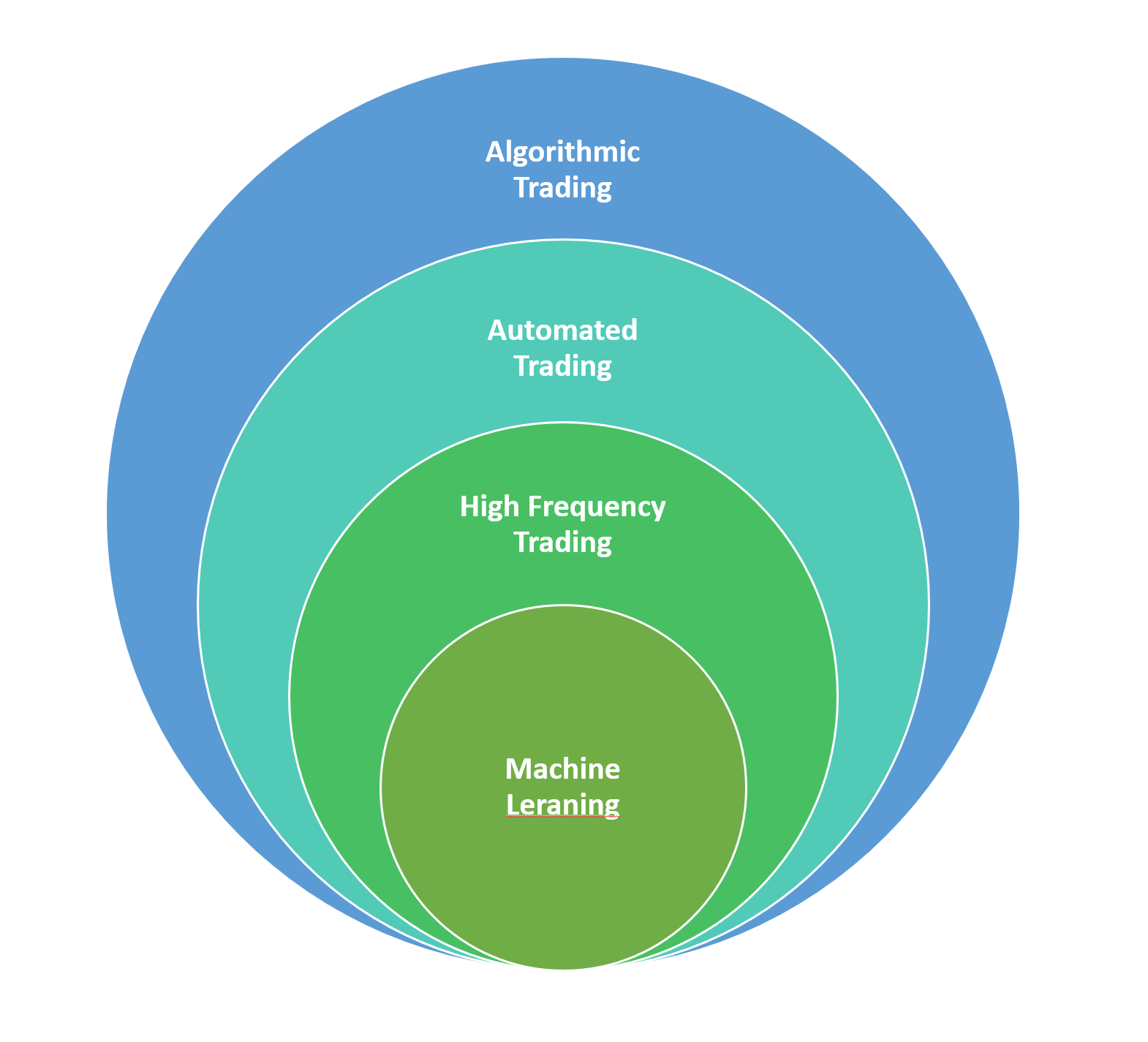

Diving deeper into Algorithmic Options Trading, it’s crucial to differentiate it from automated trading. Algorithmic trading employs specific rules for buying or selling, developed from extensive backtesting with historical data.

Contrarily, automated trading executes trades without human input. An algorithm’s trade signal leads to immediate execution. It’s fair to say that automated trading falls under the broader umbrella of algorithmic trading.

Contrarily, automated trading executes trades without human input. An algorithm’s trade signal leads to immediate execution. It’s fair to say that automated trading falls under the broader umbrella of algorithmic trading.

Essential Tools for Algorithmic Options Trading

Success in Algorithmic Options Trading largely hinges on the right tools. A well-chosen tool ensures a profitable and enriching trading experience.

Amibroker: Gaining popularity among tech-savvy investors, Amibroker stands out as a leading trading analysis software, especially for Options trading. Its affordable licensing and growing user community make it a trusted tool, although it’s primarily for analysis, not direct trading.

Metatrader: This versatile platform supports Options trading across various asset classes. Its wide availability across trading terminals offers flexibility and potential for maximized profits.

eToro: This platform doubles as a social network, enabling traders worldwide to share strategies. Its compatibility with various technologies facilitates easy access to diverse trading ideas.

Robinhood: Offering free trading services, Robinhood is more suitable for stocks than options. However, aligning your trading needs with its features can yield significant advantages.

Using the right trading tool in algorithmic options trading enhances trade speed and efficiency, leading to sustained gains.

Unique Aspects of Algorithmic Options Trading

Algorithmic trading in options has unique features compared to stocks and commodities trading.

Versatile Trading Dimensions: Options trading offers more complex variables than stocks and commodities. It involves considering factors like volatility and price ranges, not just price movements.

No Exit Fees for Expired Options: Options trading allows you to ‘set and forget’ your trades, thanks to selective algorithms that offer flexibility.

Enhanced Leverage: Options trading provides greater leverage, enabling trading on a larger asset base with limited funds, thus increasing profitability chances.

Advantage to Sellers: Options sellers benefit from premiums, securing profits even if the underlying trade doesn’t follow predictions.

Diverse Options Strategies: Traders can employ various options strategies based on market conditions, with algorithmic suggestions enhancing decision-making.

Also Read: Selecting the Best Stocks for Options Trading

Managing Risks and Backtesting

Despite its benefits, algorithmic options trading comes with its set of risks:

Network and Timing Issues: For volatile trades, ensuring the algorithm accounts for slippages during backtesting is vital to avoid impractical results.

Realistic Risk Limits: Combining positions and setting actual risk limits, as informed by effective backtesting, can mitigate risks inherent in short stock positions.

Backtesting is crucial in minimizing risks in options trading, with historical data playing a key role in generating reliable results.

Leveraging Technical Analysis

Technical analysis can further enhance profitability in algorithmic options trading, utilizing past trends to forecast future movements and providing clear entry and exit points.

Also Read: How to Trade Options using Market Profile?

Final Thoughts

While algorithmic options trading offers numerous benefits, it demands careful execution, especially with multi-legged strategies. Timely execution of all trade components is crucial.

Its predictability, based on backtested strategies, can make trading routines more manageable, providing insights into potential profits and risks.