Unlocking the Potential of Stock Trading: Stock trading can be a swift route to earning extra income, whether it’s hourly, daily, monthly, or yearly. Success, however, hinges on knowing the ins and outs of the trade.

Within this realm, options trading stands out as a lucrative avenue. Among its strategies is the Jade Lizard Option Strategy, known for its fancy name and equally impressive results when used correctly.

Let’s explore when and how to apply the Jade Lizard Option Strategy effectively.

Decoding the Jade Lizard Option Strategy

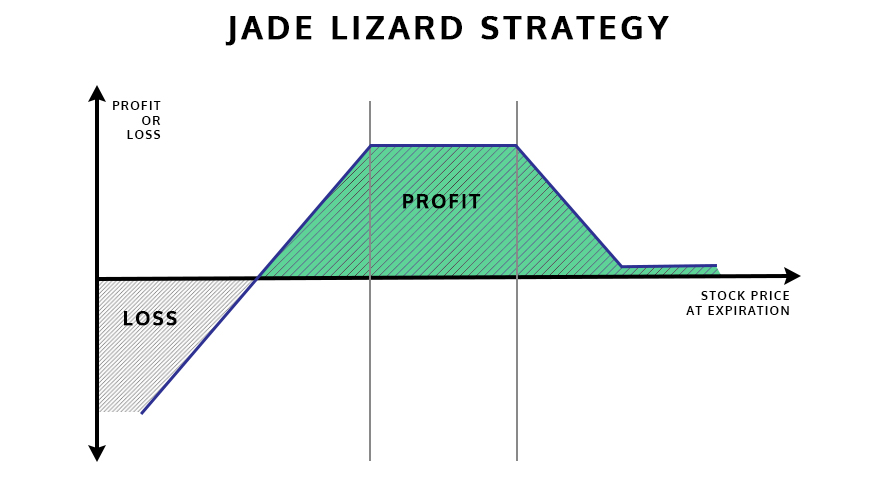

Imagine a chess move in the stock market: that’s the Jade Lizard option for you. It’s a unique blend of a bear vertical call spread with an OTM PUT option, making it slightly bullish.

Here’s the breakdown: You buy a call option at one price, sell another at a lower price, and then sell an OTM put option at an even lower price. All these moves should align with the same expiry date.

What you get is a premium credit, opening doors to potential profits based on market movements.

Also Read: Most Successful Options Strategies for Beginners

Twisted Sister: The Reverse Strategy

On the flip side, there’s the “Twisted Sister,” the exact opposite of the Jade Lizard. This strategy is slightly bearish, comprising a bull vertical call spread with an OTM call option sale.

It involves selling a put option at a specific price, buying another put at a lower price, and then selling an OTM call at a higher price.

Why the Jade Lizard Shines

The Jade Lizard shines in the options trading universe for its efficiency in generating smooth, quick profits. It’s like a secret weapon, reducing risks while offering hedged option positions that are virtually risk-free.

While it may cap the maximum profit, it significantly lowers risks, particularly when market movements are unpredictable.

Strategic Timing for the Jade Lizard

The ideal moment to deploy the Jade Lizard is when market volatility becomes apparent. It’s also effective when stocks are oversold, leading to a potential rise or stabilization in asset prices.

Implementing the Jade Lizard Strategy

Here’s how to set up the Jade Lizard:

- Start by selling a put option.

- Then, sell a call credit spread, ensuring your total credit exceeds the spread’s width.

- Aim for the underlying to have minimal movement. Maximum profit occurs if it expires between the short put and call spread.

- As long as your credit surpasses the call spread width, even a significant upside move won’t cause a loss.

This strategy effectively sells a put at maximum profit while avoiding the costliest option on the board.

Also Read: How To Pick The Best Stocks For Options Trading?

Final Takeaways

The Jade Lizard option strategy holds promise for sustainable returns, but it’s not without its complexities. We’ve covered its essential aspects here, but remember: any strategy’s success ultimately relies on personal experience and pragmatic analysis.

One Comment