Initially, most stock market enthusiasts are drawn to Intraday Trading, but they often abandon it after experiencing substantial losses. This could be attributed to their inability to navigate the volatile market or a lack of a well-structured trading plan. There could be other factors at play, depending on variables like experience and knowledge. Seasoned experts often advise novice traders to stay away from Intraday Trading and try their hand at Long-term investments first. However, I don’t entirely concur with this viewpoint. Any trading strategy grounded in technical analysis performs similarly in Intraday timeframes as it does in higher timeframes. The principles of Technical Analysis and chart patterns remain consistent, regardless of the timeframe or investment duration. Additionally, with the introduction of Margin Trading, Intraday Trading can yield remarkable results. All you need is a sound strategy, prudent stock selection, and effective risk management. In this article, we will explore a seven-point strategy on how to select stocks for Intraday Trading. Following these steps will enhance your chances of profiting from intraday trading.

1. Identify the Most ‘Popular’ Stocks

When considering stocks for Intraday trading, focus on those that have maintained popularity and stability over the years. These stocks should be part of broader indices such as Nifty, Sensex, BankNifty, or actively traded in the F&O market. These stocks exhibit consistent trending patterns in Intraday charts and are less susceptible to unexpected market volatility. Avoid investing in Penny stocks or recently listed stocks for Intraday trading, as many of them are influenced by promoters and insiders.

2. Volume Takes Center Stage

In Intraday timeframes, volume plays a pivotal role in trading decisions. Volume indicates the number of traders actively buying or selling a stock, directly reflecting its popularity. Any technical analysis concept works best with stocks that have decent trading volumes. For instance, if you are a trendline breakout trader, always verify the volume of the breakout candle for confirmation. To select stocks for Intraday Trading, compare the stock’s previous day volume with its ten-day average volume. If you notice increasing volume, the stock becomes an ideal Intraday candidate.

3. Consider the Bid-Ask Spread

Another crucial factor in choosing stocks for Intraday Trading is the Bid-Ask spread. For beginners, the Bid price represents the selling price, while the Ask price represents the buying price. Intraday Trading aims to capture small price movements and secure profits. Therefore, a significant gap between the Bid and Ask prices makes it challenging to profit, except in cases of substantial price swings. Consider the following examples of two stocks:

Stock 1

Stock 2

For Stock 1, the Bid-Ask spread is 0.25 Paise, making it a suitable candidate for Intraday Trading. Conversely, for the second stock, it is 1.15 Rupees, despite having a lower underlying price compared to the first. The Bid-Ask spread is directly linked to the volume of traded quantities.

4. Consider Social Media Insights

Monitor trending stocks on platforms like Twitter, Facebook, or other forums. These stocks garner significant attention and trading volume from fellow traders worldwide. Recent studies suggest that social media influences traders’ collective psychology, directly impacting stock price movements.

5. Stay Informed with News Channels

In your technical analysis lessons, you may have heard that “price discounts everything,” implying that there’s no need to consider news that could affect stock price movements. While this holds true for Swing trading, it’s not the case for Intraday Trading. Significant earnings announcements or major deals can directly impact stock prices and trading volumes in the Intraday market. Therefore, it’s essential to check for any significant news related to a stock before entering a trade.

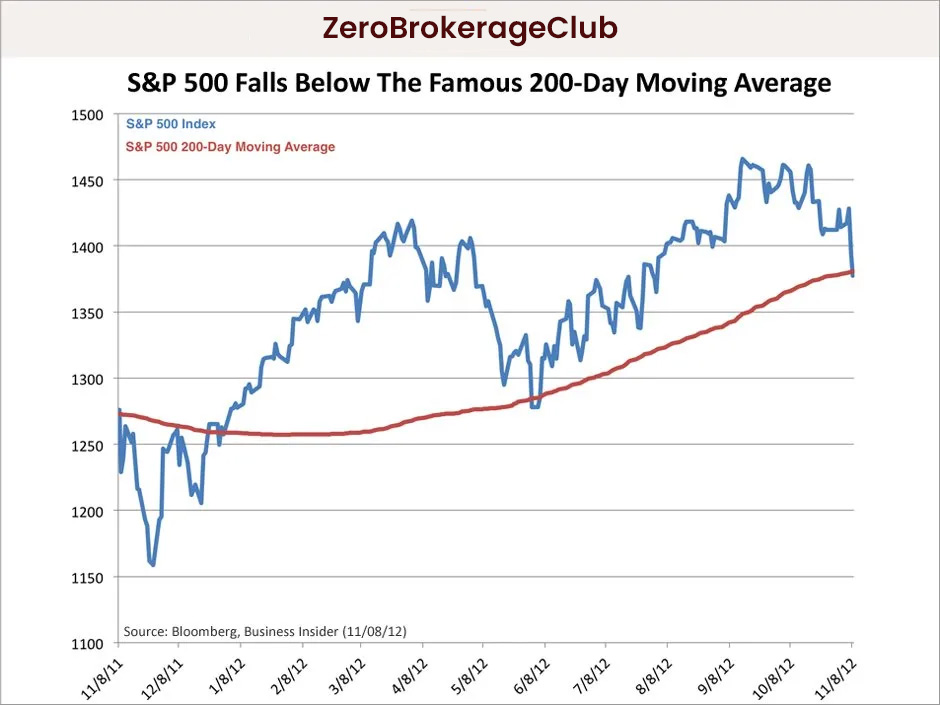

6. Watch the 200 Day Moving Average

In technical analysis, moving averages serve as crucial indicators to assess a stock’s overall trend. Among these moving averages, the 200-day MA stands out as the most reliable. For instance, if a stock’s price is above the 200-day Moving Average, it’s considered in an uptrend, and vice versa. Therefore, always check the 200-day moving average before making Intraday trading decisions. Avoid buying stocks that are in a downtrend as indicated by the 200-day moving average, and vice versa. You can explore our Excel-based Trading system based on the 200 SMA here.

7. Take Note of Open Interest

The concept of Open Interest applies exclusively to F&O traded stocks, so disregard it if you exclusively trade in the cash market. According to Investopedia, Open interest represents the total number of open options and/or futures contracts for a given day. You can find the Open Interest parameter in any Futures quote for a particular stock.

The relationship between prevailing price trends and open interest can be summarized as follows:

| Price | Open Interest | Interpretation |

| Rising | Rising | Market is Strong |

| Rising | Falling | Market is Weakening |

| Falling | Rising | Market is Weak |

| Falling | Falling | Market is Strengthening |

Therefore, always double-check the price and open interest before making any Intraday trading decisions.

Explore some of our most popular Intraday Trading Methods below:

6 Comments