In the intricate world of trading systems, the integration of a stop-loss mechanism is fundamental to safeguard your investments against the swift and often unforeseen fluctuations of the market. This comprehensive article delves into the nuances of how to effectively calculate Stop Loss using Excel, equipping you with a vital tool in your trading arsenal. Whether you prefer to establish your stop loss as a fixed value or opt for it to be a dynamic percentage of your overall investment, this guide offers clear, step-by-step instructions to enhance your financial strategy and protect your capital in the volatile trading environment.

Recommended Reading: Mastering Drawdown Calculation in Excel

Static Stop Loss

A static stop loss comes into play when your exit strategy is clear, especially if the market moves against your position. For instance, if you purchase a stock at 100 and decide to exit if it drops to 95, your stop loss is set at 5 points. Static stop loss can be based on factors like support and resistance levels, pivot points, or price action strategies.

Percentage-Based Stop Loss

In a percentage-based stop loss, you set the threshold as a percentage of your total investment. For example, if you’ve invested 10000 in a stock and you’re prepared to risk a maximum of 2% in a downturn, your exit point would be when your investment’s value drops to 9800.

System traders often prefer percentage-based stop loss as it adapts to the security’s price fluctuations.

Excel Sheet Calculation for Stop Loss

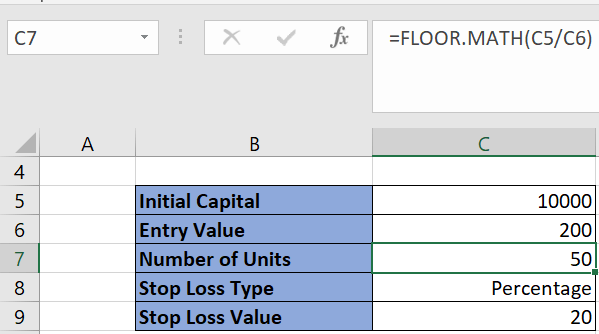

To calculate stop loss in an Excel sheet, input these details:

- Initial Capital: The starting investment amount for your trade.

- Entry Value: The price at which you enter the trade.

- Stop Loss Type: Choose between static or percentage-based stop loss.

- Stop Loss Value: Set this as points for a static stop loss, or as a percentage for a percentage-based stop loss.

With these inputs, the Excel sheet will automatically perform the following calculations:

- Number of Units: Determines the quantity of securities you can buy. It’s calculated by dividing your initial capital by the entry value.

The calculation uses the floor function to round off fractional values.

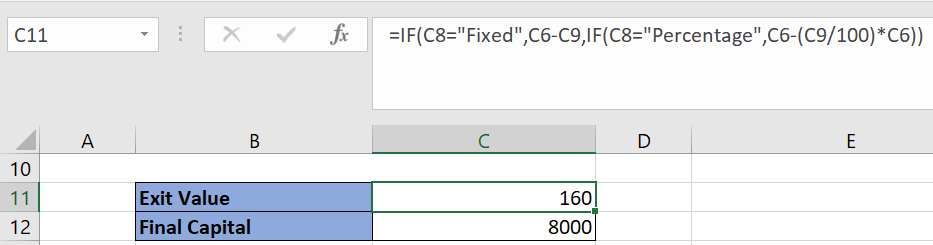

- Exit Value: For a static stop loss, it’s the entry value minus the stop loss value. For a percentage-based stop loss, it’s the entry value reduced by the percentage of the stop loss value.

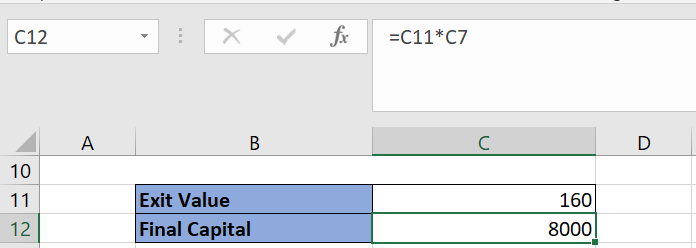

- Final Capital: Calculated by multiplying the exit value with the number of purchased stocks.

Further Reading: Essential Insights on Stop Loss Strategies

Excel Sheet Download

Access the sample Excel sheet for stop loss calculation through this link:

4 Comments