Understanding Stop Loss Orders: Protecting Your Investments

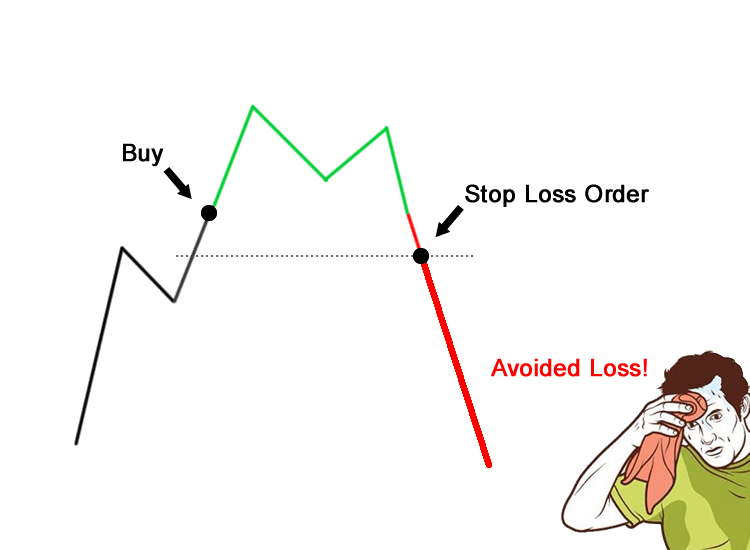

Are you familiar with the concept of life insurance? Well, consider Stop Loss orders as a similar safeguard for your investments. In the realm of trading, stop loss strategies act like financial safety nets, stepping in when a trade veers off course. This ensures that you can sell your shares to limit potential losses. Safeguarding your hard-earned money is crucial, and we’re here to help you comprehend how stop loss works and explore effective strategies for stock market trading.

For further insights, read: How To Use Google Finance For Informed Trading Choices?

1. The Basics of Stop Loss

As the name implies, a stop loss acts as a safety net against financial losses. Investors establish a predefined threshold to prevent unforeseen downturns. This threshold can apply to a specific stock or an entire portfolio. For example, if a stock drops to 10% below its original price, it’s time to sell. Imagine you buy a stock at $50 per share – set your stop loss at $45. Of course, you can choose to sell if the stock drops by 20% – the percentage is your call. The key is to stick with your decision. When you notice that a stock is losing value, sell it as soon as it falls to your chosen percentage below its initial purchase price.

2. When to Set Your Stop-Loss Order

It’s advisable to place the stop-loss order immediately after entering a trade. While some opt for a mental stop, we strongly advise against it. Once your stop-loss level is reached, it’s time to exit. Overthinking will only lead to bigger losses.

3. Setting the Trigger Price for Stop Loss

When selecting trigger prices, opt for common price increments. Common prices like $100 are preferable to something like $123.78. Wondering why? It’s simple – common trigger prices reduce the risk of your stock “trading through” your set limit.

4. Various Stop Loss Strategies

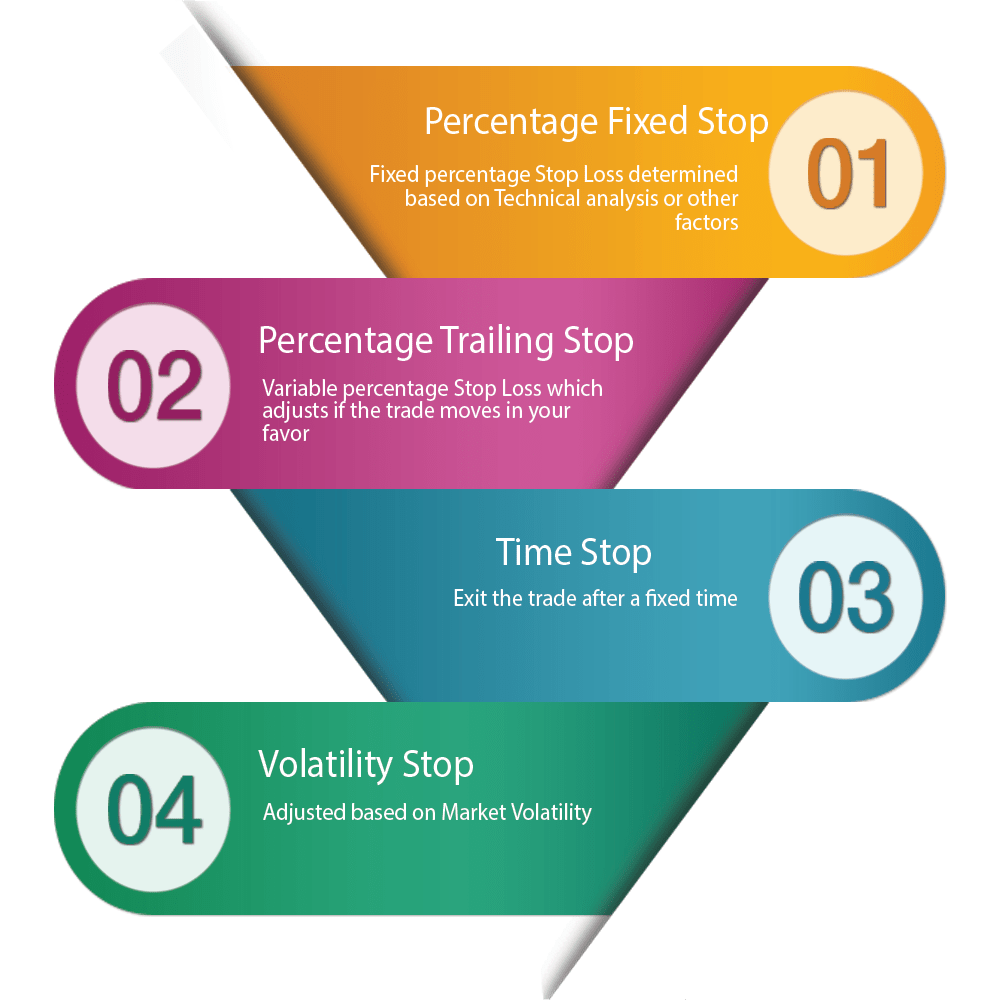

a. Percentage Fixed Stop

This is the most common type of stop loss. Traders set a trigger price at which their position is automatically sold. The trigger price is a fixed percentage below the purchase price. For example, if a stock is bought at $100, a 5% stop loss will trigger an automatic sell order at $95.

b. Percentage Trailing Stop

This is an intriguing strategy where the stop loss trigger price gradually adjusts in your favor. You can specify the adjustment rate when placing a trailing stop loss order. For instance, if you bought a stock at $100 with an initial stop loss of $95 and a trailing rate of 0.5 points per 1 point, when the stock reaches $101, the stop loss automatically adjusts to $95.5. Trailing stop loss safeguards profitable positions from significant losses caused by unexpected events.

c. Time Stop

A time-based stop loss strategy involves exiting trades during extended periods of inactivity and sideways movement. If your trade isn’t showing the expected upward movement, it’s better to exit and wait for a new signal instead of hoping for a change that may never come.

d. Volatility Stop

This strategy adapts to market conditions. When volatility is high, traders use a wider stop loss to account for larger market swings. During low volatility, a more conservative stop loss is employed. Bollinger Bands and Average True Range (ATR) are some methods used to define stop losses based on volatility.

For further reading, explore: Ed Seykota: A Legendary System Trader

5. In Conclusion

A well-structured stop loss strategy provides you with the freedom to focus on other matters rather than constantly monitoring stock performance. With the right strategies, you can reduce the anxiety associated with substantial losses. The key is to maintain an open mind and trade wisely. Implement these stop loss strategies for stock market trading to enhance your chances of success. Remember, never dwell on past decisions. Move forward confidently with your next trade.

Embrace the present and future without regrets.

9 Comments