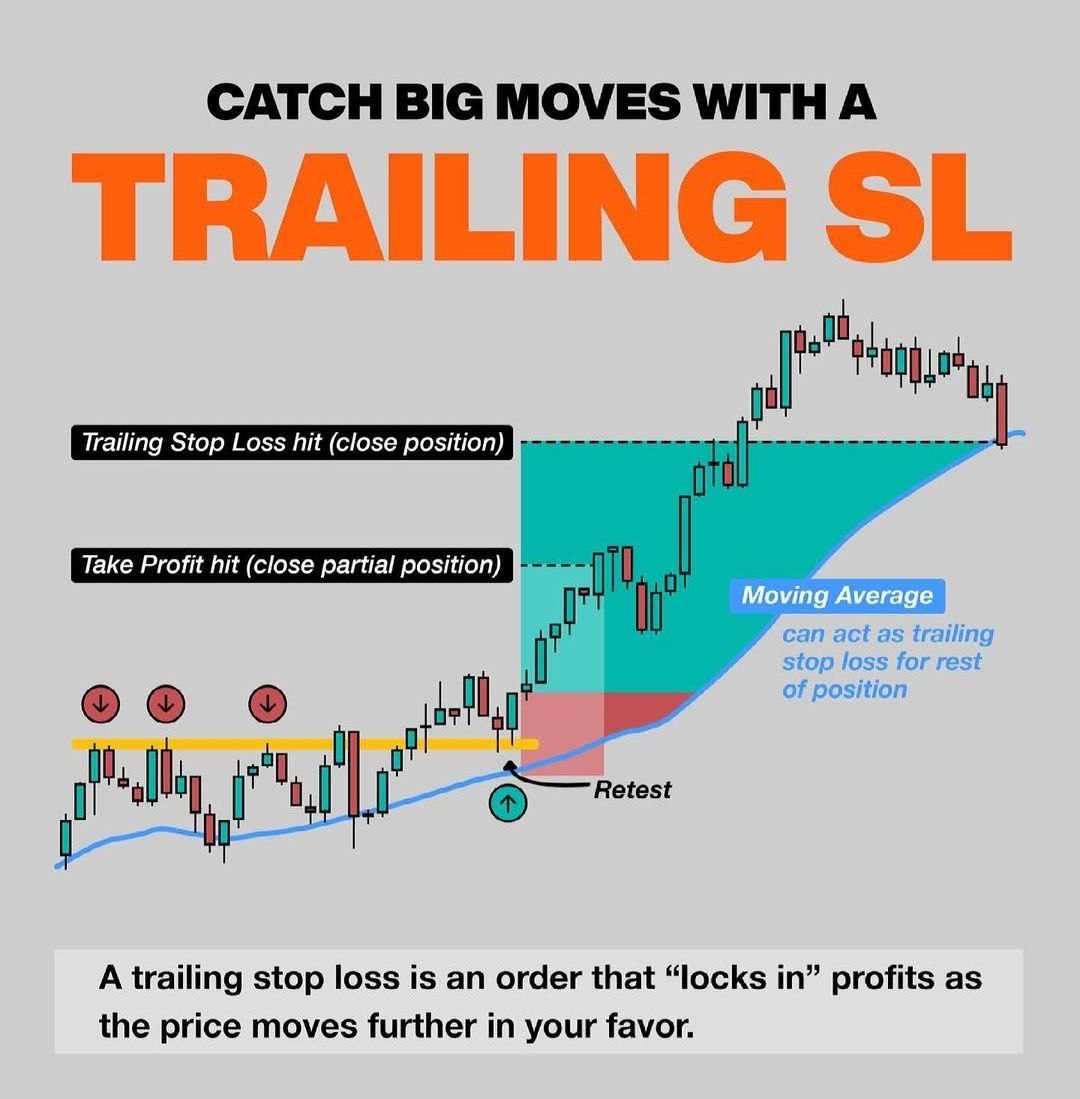

Navigating Trading with Trailing Stop Loss: Controlling losses in trading can be tough. Thanks to technology, online brokers are constantly innovating ways to limit losses. One effective method is the ‘trailing stop loss,’ which dynamically adjusts your stop loss with price movements.

When the security’s price moves favorably, the stop loss follows suit. But if the price turns against you, the stop loss holds its ground, safeguarding your position.

This article will delve into the trailing stop loss, explaining its use and identifying the most effective strategies.

Also Read: All you wanted to know about Stop Loss Strategies

Understanding Trailing Stop Loss in Trading

Experiencing losses is part of the stock market, but if you’re keen on protecting your profits while managing risks, a trailing stop loss (TSL) is an ideal solution.

A TSL ensures your unrealized gains don’t vanish due to sudden price changes.

Let’s compare a traditional stop loss with a trailing stop loss:

Let’s compare a traditional stop loss with a trailing stop loss:

Imagine buying stock at $100 and setting a conventional stop loss at $95. If the stock rises to $110 but then falls back to $95, you incur a $5 loss instead of a $10 profit.

With a TSL, the scenario changes. Set to adjust with price movements, the TSL could rise with the stock price, securing your profits as the stock climbs.

Here’s a breakdown of how TSL works:

- Buy Stock at $100, Stop Loss = $95, TSL = $95

- Stock rises to $102, TSL adjusts to $95

- Stock rises to $110, TSL adjusts to $103

- As the stock falls to $103, the TSL is hit, securing a gain instead of a loss

In this example, TSL turns a potential loss into a $3 gain, whereas a traditional stop loss would have led to a 5% loss.

Different Types of Stock Trading Orders

There are five main types of orders in stock trading:

- Market Order: Buy or sell stock at the current market price without price control.

- Limit Order: Set a specific price for buying or selling, preventing unwanted transactions.

- Stop Loss Order: Close your position at a predetermined price to limit losses.

- Stop Limit Order: A combination of limit and stop orders, activating a limit order upon reaching the stop price.

- Trailing Stop Order: Similar to a stop order, but it dynamically adjusts the stop price with the market.

Also Read: How to calculate Stop Loss in an Excel Sheet?

Advantages of Trailing Stop Loss

Let’s explore the benefits of using a TSL:

- It doesn’t limit your profit potential.

- Offers flexibility in customizing your risk management plan.

- Acts as a profit protector.

- Allows for any chosen percentage as the TSL.

- Prevents impulsive decisions by focusing on pre-set goals.

- Applicable for both long and short positions.

- No additional charges from brokers for placing a TSL order.

Closing Thoughts on Trailing Stop Loss

A TSL order is an effective risk management tool. It prevents a winning trade from turning into a loss or reduces the loss if the trade doesn’t pan out.

Ready to incorporate trailing stop loss orders into your trading strategy?