The Weekly Breakout Trading Strategy is a dynamic approach in technical analysis, designed to capitalize on significant market movements following periods of consolidation. This strategy focuses on pinpointing critical price levels where a market breakout is likely, enabling traders to take long or short positions based on the direction of the breakout. This versatile strategy applies to various financial markets, such as stocks, commodities, and forex. In this article, we’ll explore the Weekly Breakout Trading Strategy Amibroker AFL Code, which is available for free download and can be imported into Amibroker.

Related Read: Ichimoku Cronex Taichi Indicator AFL Code

Amibroker AFL code for the Weekly Breakout Trading Strategy

console.log( 'Code is Poetry' );//------------------------------------------------------

//

// Formula Name: Weekly Breakout Trading Strategy

// Website: https://zerobrokerageclub.com/

//------------------------------------------------------

_SECTION_BEGIN("Weekly Breakout Trading Strategy");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

Plot( Close, "Price", colorWhite, styleCandle );

// Define Inputs

WeeksBack = Param("Weeks Back", 20, 1, 100, 1);

Threshold = Param("Threshold", 1, 0.1, 10, 0.1);

// Define Variables

PrevHigh = Ref(HHV(H, WeeksBack), -1);

PrevLow = Ref(LLV(L, WeeksBack), -1);

// Calculate Breakout Levels

BreakoutLong = PrevHigh + Threshold * (PrevHigh - PrevLow);

BreakoutShort = PrevLow - Threshold * (PrevHigh - PrevLow);

// Define Trading Signals

BuySignal = C > BreakoutLong;

SellSignal = C < BreakoutShort;

// Plot Breakout Levels

Plot(PrevHigh, "Previous High", colorGreen, styleLine);

Plot(PrevLow, "Previous Low", colorRed, styleLine);

Plot(BreakoutLong, "Long Breakout", colorBlue, styleLine);

Plot(BreakoutShort, "Short Breakout", colorBlue, styleLine);

// Plot Buy/Sell Signals

PlotShapes(IIf(BuySignal, shapeUpArrow, shapeNone), colorGreen, 0, Low);

PlotShapes(IIf(SellSignal, shapeDownArrow, shapeNone), colorRed, 0, High);

// Apply Trading Signals

Buy = BuySignal;

Sell = SellSignal;

_SECTION_END();

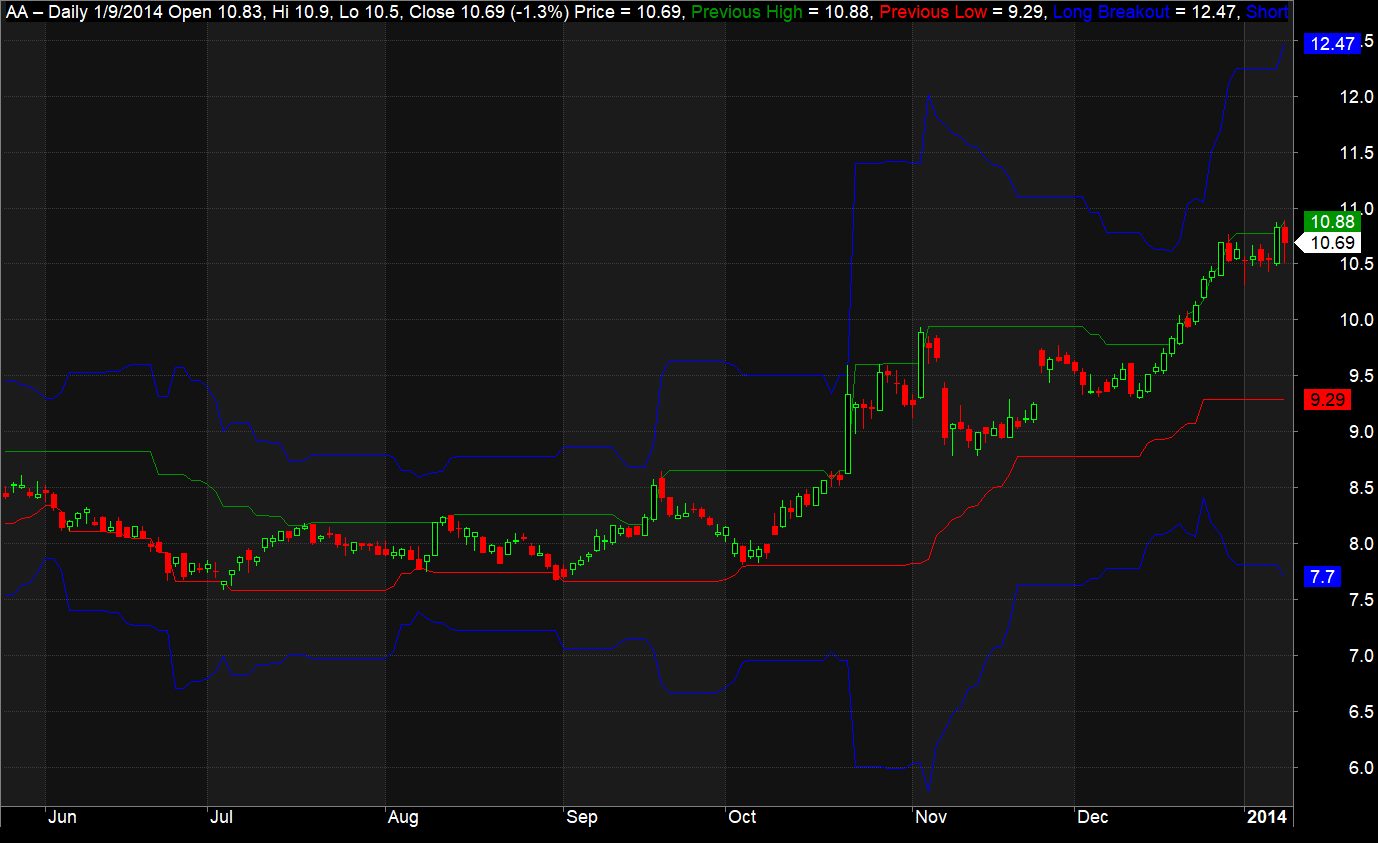

Visual Guide: Amibroker AFL for Weekly Breakout Trading Strategy

Take a look at the AFL in action:

Decoding the AFL Code

Let’s break down the code, line by line:

The Param function sets up the strategy’s inputs: WeeksBack determines the number of weeks for identifying previous highs and lows, and Threshold defines the percentage distance from these points to establish breakout levels.

// Define Inputs

WeeksBack = Param("Weeks Back", 20, 1, 100, 1);

Threshold = Param("Threshold", 1, 0.1, 10, 0.1);

Ref function retrieves past data points. HHV and LLV find the highest and lowest values over the specified period, determining previous highs and lows.

// Define Variables

PrevHigh = Ref(HHV(H, WeeksBack), -1);

PrevLow = Ref(LLV(L, WeeksBack), -1);

BreakoutLong and BreakoutShort using the previously identified highs and lows, modified by the Threshold value. These represent the levels at which to initiate long or short trades.

// Calculate Breakout Levels

BreakoutLong = PrevHigh + Threshold * (PrevHigh - PrevLow);

BreakoutShort = PrevLow - Threshold * (PrevHigh - PrevLow);

BuySignal activates when the closing price surpasses the BreakoutLong level, while SellSignal triggers when it falls below BreakoutShort.

// Plot Breakout Levels

Plot(PrevHigh, "Previous High", colorGreen, styleLine);

Plot(PrevLow, "Previous Low", colorRed, styleLine);

Plot(BreakoutLong, "Long Breakout", colorBlue, styleLine);

Plot(BreakoutShort, "Short Breakout", colorBlue, styleLine);

// Plot Buy/Sell Signals

PlotShapes(IIf(BuySignal, shapeUpArrow, shapeNone), colorGreen, 0, Low);

PlotShapes(IIf(SellSignal, shapeDownArrow, shapeNone), colorRed, 0, High);

// Apply Trading Signals

Buy = BuySignal;

Sell = SellSignal;

- The initial four lines plot the previous highs and lows using the

Plotfunction, as well as the breakout levels for long and short positions. - Subsequent lines use

PlotShapesto visually represent buy or sell signals with up or down arrows on the chart. - The concluding lines set the conditions for executing trades based on the

BuySignalandSellSignalvariables.

One Comment