High Frequency Trading, commonly known as HFT, has captured the attention of financial markets. Its popularity has surged over the past decade. Many people mistakenly believe that HFT is exclusively for large hedge funds or mathematical geniuses. However, that’s not entirely true. Even individual retail traders can engage in HFT if they possess the necessary resources and knowledge. This post aims to introduce HFT to retail traders and explain some HFT strategies. Since HFT relies on Algorithmic Trading, we recommend reading the introductory article below first:

Introduction to Algorithmic Trading

What Is High-Frequency Trading?

High-frequency trading is a computerized trading system that employs powerful supercomputers to execute buy and sell orders in fractions of a second. These supercomputers analyze vast amounts of data across different sectors and timeframes to make the best trading decisions. Traders must input predefined trading algorithms into these computers before going live. Some HFT systems also incorporate artificial intelligence to learn and optimize trading algorithms. Speed plays a crucial role in the success of HFT. Typically, traders with the fastest execution speeds outperform those with slower execution speeds. As of 2012, it was estimated that over 50% of exchange volume came from high-frequency trading orders. The next section will describe some of the most popular high-frequency trading strategies.

High-Frequency Trading Strategies

While there are no fixed rules for selecting HFT strategies, some strategies enjoy more popularity and wider use among HFT trading firms than others. The following high-frequency trading strategies are gathered from various sources:

- Statistical Arbitrage: This strategy capitalizes on temporary deviations in various statistical parameters among different securities. High-frequency statistical arbitrage is actively applied to all liquid securities, including equities, bonds, futures, foreign exchange, etc. Even classical arbitrage can be employed by examining the price parity of securities in different exchanges or spot and future markets. The TABB Group estimated that high-frequency arbitrage strategies generated annual aggregate profits exceeding US$21 billion in 2009.

- Option Pricing Disparity: Typically, it takes some time for option prices to follow stock prices and vice versa. Modern HFT systems can accurately model these differences to identify profitable trades. To gain a better understanding, read about options pricing and the Black-Scholes model.

- News-Based HFT Systems: Company news in electronic text format is available from various sources, including commercial providers like Bloomberg, public news websites, and Twitter feeds. Automated systems can identify company names, keywords, and sometimes semantics to trade on news before human traders can process it.

- Momentum Ignition: This strategy aims to create a surge in a stock’s price by executing a series of trades to attract other algorithmic traders. The instigator knows that after the artificially induced rapid price movement, the price will return to normal, allowing the trader to profit by taking a position early and trading out before it fades.

- Pair Trading: Pair trading is a market-neutral strategy where two highly correlated instruments are bought and sold together when there is a certain degree of deviation in their correlation. Typically, the selected stocks or commodities for pair trading are from the same sector and move together during most market events. Pair trading in intraday timeframes through HFT systems has yielded impressive results. Learn more about pair trading here.

In addition to the above strategies, you can adapt any intraday strategy for HFT. However, exercise caution in terms of risk management and execution speed. HFT trading firms often place their servers near the exchange to gain a speed advantage over others. Explore our articles and systems on intraday trading at the link below:

Intraday Trading Methods and Systems

Additionally, find the tools you need to automate your intraday trading strategies here.

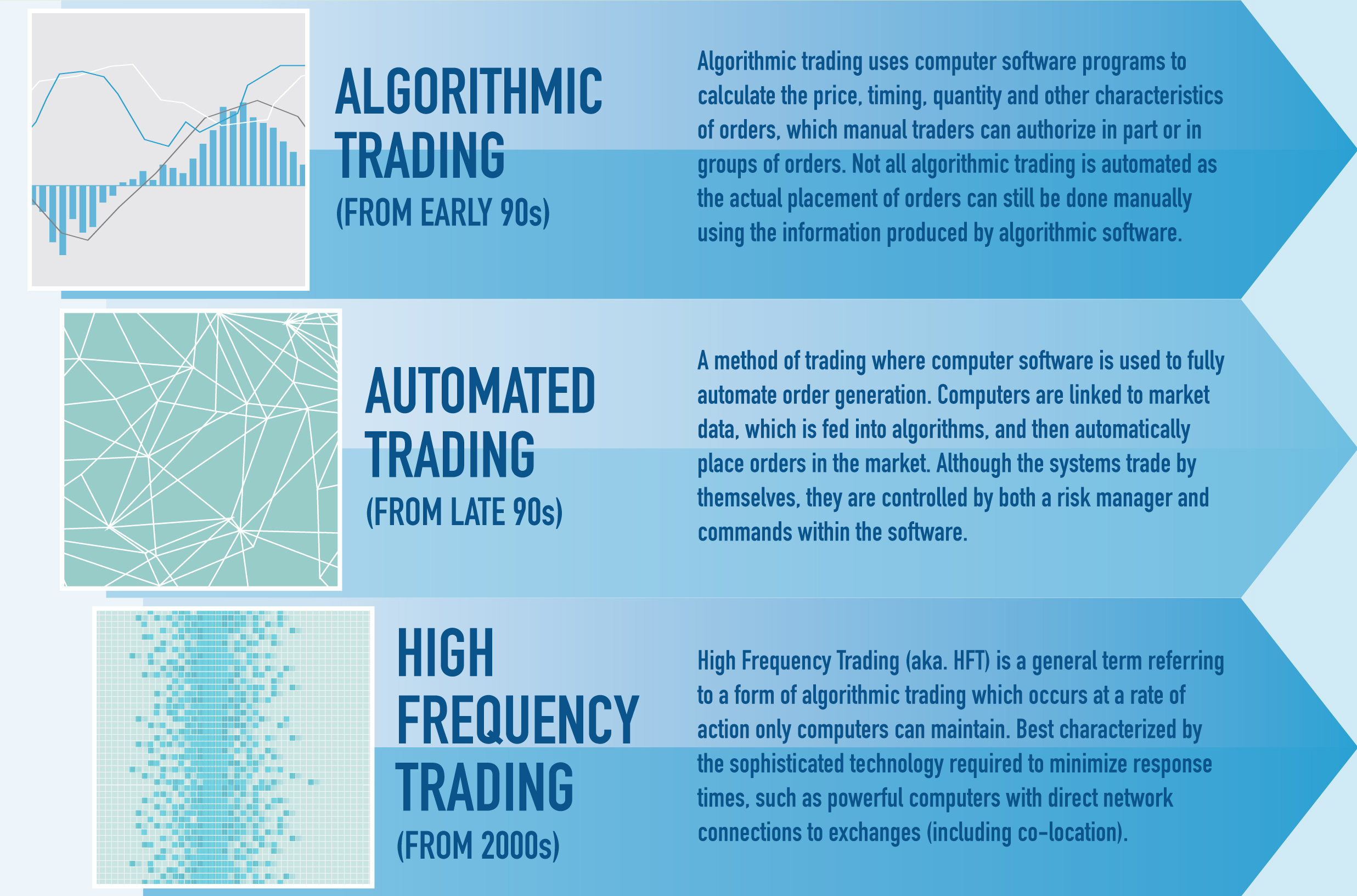

HFT, Algorithmic Trading, and Automated Trading

These three terms are often used interchangeably, but they are not identical. Automated Trading is a subset of Algorithmic Trading, while HFT is a subset of Automated Trading. The image below provides a better explanation:

Benefits and Risks

The major benefit of high-frequency trading is the increased market liquidity it generates. Bid-Ask spreads have significantly reduced since the advent of HFT. It has also created vast opportunities in financial markets, particularly in algorithmic trading firms and mathematical modeling. However, there are also many controversies associated with HFT. HFT has replaced a large number of broker-dealers and relies on mathematical models and algorithms to make decisions, eliminating human decision-making and interaction. Decisions occur in milliseconds, which can lead to significant market movements without apparent reasons. For instance, on May 6, 2010, the Dow Jones Industrial Average (DJIA) experienced its largest intraday point drop ever, declining 1,000 points and dropping 10% in just 20 minutes before rebounding. A government investigation attributed this event to a massive automated order that triggered the sell-off, an event known as the Flash Crash.

Despite these controversies, we believe that HFT will shape the future of financial markets. A day may come when computers compete with each other without human intervention. Please share any other high-frequency trading strategies you have in mind apart from those mentioned above, and we would be happy to include them in this article.

One Comment