Unlocking the Potential of Backtesting Trading Strategies

When it comes to building a resilient trading system, the cornerstone is undoubtedly backtesting trading strategies. This essential practice involves reviewing your strategy against historical data to confirm its effectiveness. It’s a crucial step for anyone looking to ensure their trading approach is robust before taking it to the live markets.

Choosing Your Path: Real-Time Testing vs. Backtesting

Consider this scenario: you’ve noted a stock often climbs after it surpasses its 20-day moving average. Faced with this insight, you have two paths to choose from:

- The Gamble: You could apply this finding directly in the live market and hope for the best. This approach is fraught with risk.

- The Informed Approach: Alternatively, you could employ backtesting trading strategies against historical data, significantly boosting your confidence in the strategy’s validity.

This informed approach, backtesting, is a time-tested method for assessing a trading strategy’s potential.

The Four-Step Backtesting Process Simplified

Backtesting unfolds in four simple steps:

- Step 1: Clearly define your trading strategy and its rules. For automated tools, you may need to translate these into code.

- Step 2: Select the financial instruments for your test.

- Step 3: Compile historical price data that’s both accurate and comprehensive, capturing a range of market behaviors. For instance, swing trading strategies should be backed by at least five years of data.

- Step 4: Test your strategy with this data, keeping an eye on key metrics like returns and risk-reward ratios to evaluate performance.

The initial steps can be manually handled, but the last step benefits greatly from automated software.

Here’s what a backtesting summary looks like in Amibroker:

In seconds, Amibroker presents all the critical data needed to assess your system’s potential, saving months of manual work.

In seconds, Amibroker presents all the critical data needed to assess your system’s potential, saving months of manual work.

Further Reading: Amibroker vs MetaStock: Picking the Right Trading Software

Refining Backtesting Results for Reliable Strategies

Positive backtesting results are encouraging, but do they promise success in the real market? For the most part, they do. Yet, there’s a 20% chance of encountering issues like Optimization Bias or Look-ahead Bias. However, these challenges are not insurmountable.

Testing a strategy on past data runs the risk of creating a perfect fit for that specific data, potentially failing under future conditions. Therefore, ensuring your strategy can withstand different market scenarios is vital.

To craft a robust trading system, here are a few straightforward strategies:

- Simplicity is key. A crowded system with too many indicators is likely to fit the past too well, which might not work for future markets.

- Introduce variability to your data or rules, and then retest your strategy. If it consistently performs well, it’s a sign of a solid system. This method is called Monte Carlo Simulation.

- Divide your data into two segments: in-sample for initial testing and optimization, and out-of-sample for validation. If your system succeeds with both, you’re on the right track. This iterative process is called Walk Forward Optimization.

These steps, crucial for creating a profitable trading system, can be laborious if done manually. Amibroker can automate them, enhancing efficiency.

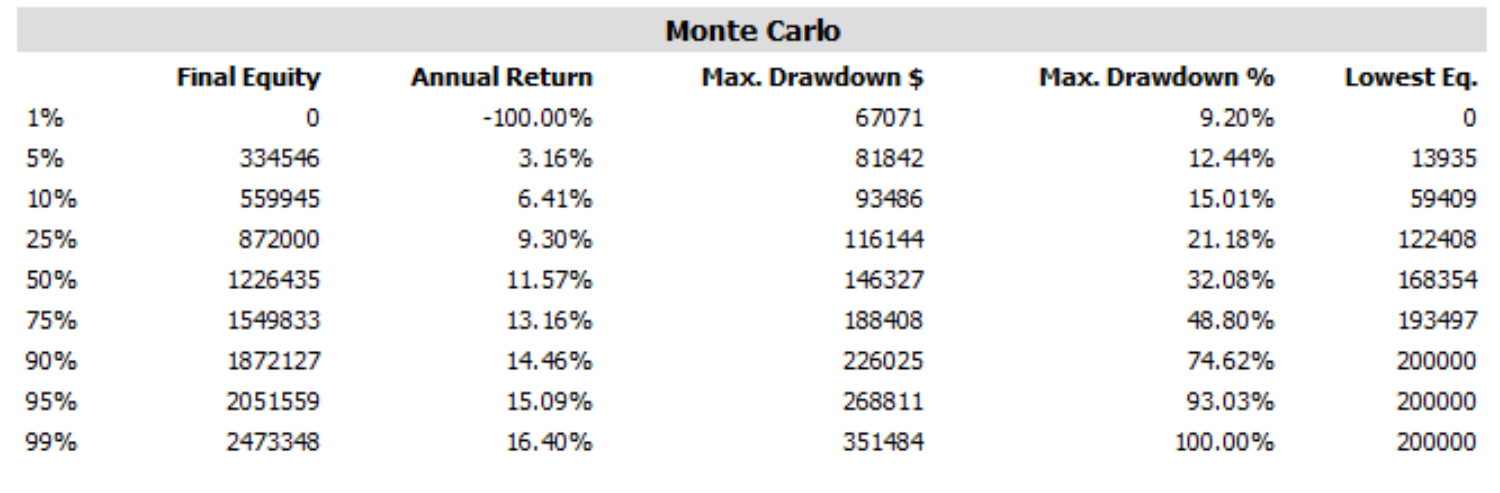

Consider a Monte Carlo simulation example from Amibroker:

This image displays percentile levels, showing the lower performance threshold for a set percentage of tests. For example, the 5th percentile indicates the performance that was not exceeded in 95% of the test runs.

This image displays percentile levels, showing the lower performance threshold for a set percentage of tests. For example, the 5th percentile indicates the performance that was not exceeded in 95% of the test runs.

Additional Insights: Earning Passive Income Through Algorithmic Trading

In the competitive world of trading, relying solely on backtesting against historical data is no longer sufficient. To truly stand out, you must prepare your system for the most challenging market conditions. Techniques like Monte Carlo Simulation and Walk Forward Optimization are critical tools for achieving this goal.

6 Comments