Traders use various strategies for steady returns in the Stock Market. Some rely on fundamentals, others swear by technical analysis, while beginners often trade on news and intuition. Beyond learning Fundamental or Technical analysis, mastering Risk Reward Ratio and Money Management is crucial for long-term trading success. Remember, safeguarding your capital is the first step to growing it.

Also Read: Virtual Trading Platforms in India: Learning to Invest Without Risks

The Importance of ‘Risk Reward Ratio’

In this post, we’ll delve into a vital money management tool: the ‘Risk Reward Ratio’. It’s a mathematical measure comparing the potential loss (Risk) to the potential profit (Reward) in a trade. For example, if you risk 1000 Rupees aiming for a 2000 Rupee profit, your risk-reward ratio is 1:2. Assessing the risk-reward ratio of a strategy is essential for sustained success. Most modern trading platforms include this ratio in back-testing reports. A 1:2 risk-reward ratio is often seen as favorable, while lower ratios can deplete capital over time.

Case Study: The Power of Risk Reward Ratio

Consider a trader with a 40% success rate strategy (40 profitable trades out of 100). Back-testing over 10 years, he finds an average 1:3 ratio, meaning his profits are three times his losses. With 60 losing trades at 1000 Rupees each and 40 winning trades at 3000 Rupees, he nets a 60,000 Rupee profit. However, many traders focus on improving their success rate rather than the risk-reward ratio. New traders often cut profits short and let losses run, worsening their risk-reward ratio.

Graphical Insights and Profitability

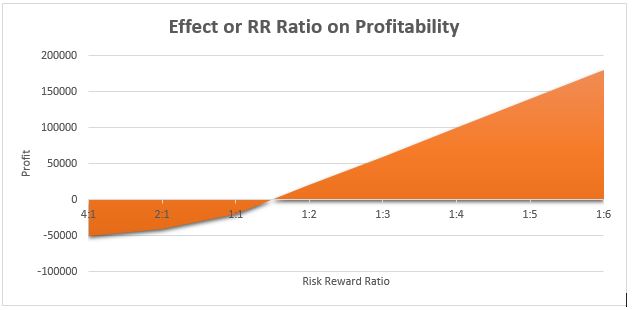

The following graph shows profitability against the risk-reward ratio for 100 trades, each with a constant 1000 Rupee risk and a 40% success rate.

Profitability improves with a better ratio. The break-even point is around 1:1.5.

Success Rate

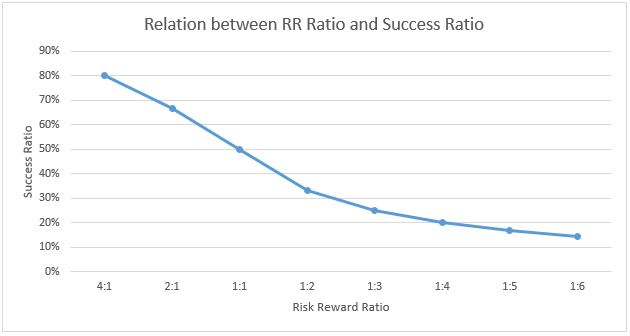

The next graph illustrates the relationship between success rate and risk-reward ratio.

For a system with an 80% success rate, the break-even ratio is 4:1. A ratio better than this results in profits. Conversely, with a 1:6 ratio, you only need a 14% success rate to break even.

Conclusion for Long-Term Success

Always consider both the Ratio and Success Rate in your trading decisions. This approach fosters long-term success and is simple yet often overlooked by many traders.

4 Comments