People often ask, “Who makes more money in the stock market? Investors or Traders?” The answer varies, but we’ve broken it down in this blog post to share our thoughts on the matter.

Differences Between Investors and Traders

In the stock market, there are two main types of players:

- An Investor buys and holds stocks for a long time, hoping their value will increase.

- A Trader buys and sells stocks quickly, even within a day, aiming for fast profits or accepting quick losses.

Investors choose stocks based on company performance, like profits and management quality. Traders focus more on price patterns, market news, and technical analysis.

Both methods have their merits, and the best choice depends on what suits your personality and how much risk you’re comfortable with.

Also Read: Technical Analysis vs Fundamental Analysis

Who Really Earns More?

Many believe that investors make real wealth while traders tend to lose money over time. But this isn’t always true!

A disciplined trader can outperform an investor in profits. Here’s an example:

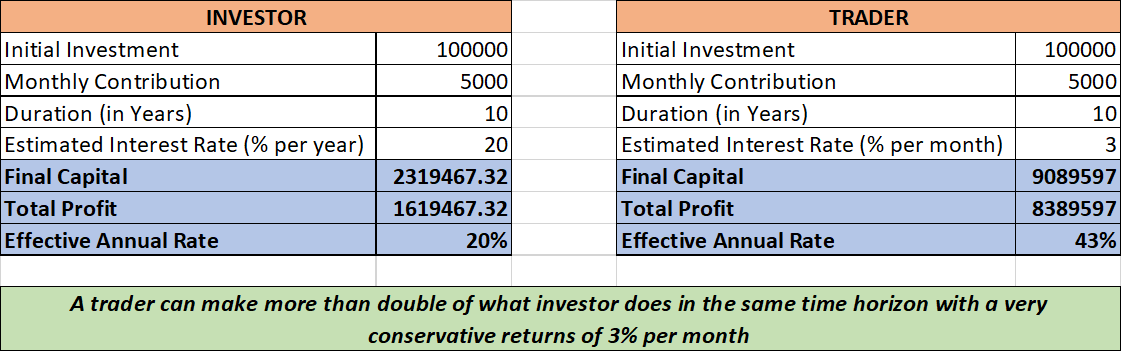

Imagine an investor earns 20% annually starting with $10,000 and adds $5,000 every month. A trader begins with the same amount but targets 3% monthly.

Here’s how their capital stacks up after 10 years:

As shown, a trader can potentially make more than an investor due to three key reasons:

- Traders benefit from frequent compounding (monthly or even weekly), unlike investors who see gains mostly in the long term.

- Traders can change their strategies as needed. They can short sell, trade intraday, or venture into futures and options to reach their monthly target. On the other hand, investors’ annual returns typically range between 12-25%.

- Traders are less affected by overnight risks or unexpected market events, while investors may see significant drops due to such incidents.

Achieving 3% Monthly Profits

The secret is to stick to your trading system. Many systems can yield up to 10% monthly, but people often quit after a few losses.

Find backtested systems based on Amibroker at this link, or explore automated systems on the Tradetron marketplace.