Unlocking Passive Income with Algorithmic Trading

Are you searching for a way to generate income with minimal effort?

Would you like to escape the daily grind of a 9 to 5 job while still making money?

If your answer is yes, you’re in the right place. This article delves into strategies for achieving a consistent source of passive income through algorithmic trading.

Understanding Algorithmic Trading

Algorithmic trading acts as your smart assistant for making financial decisions.

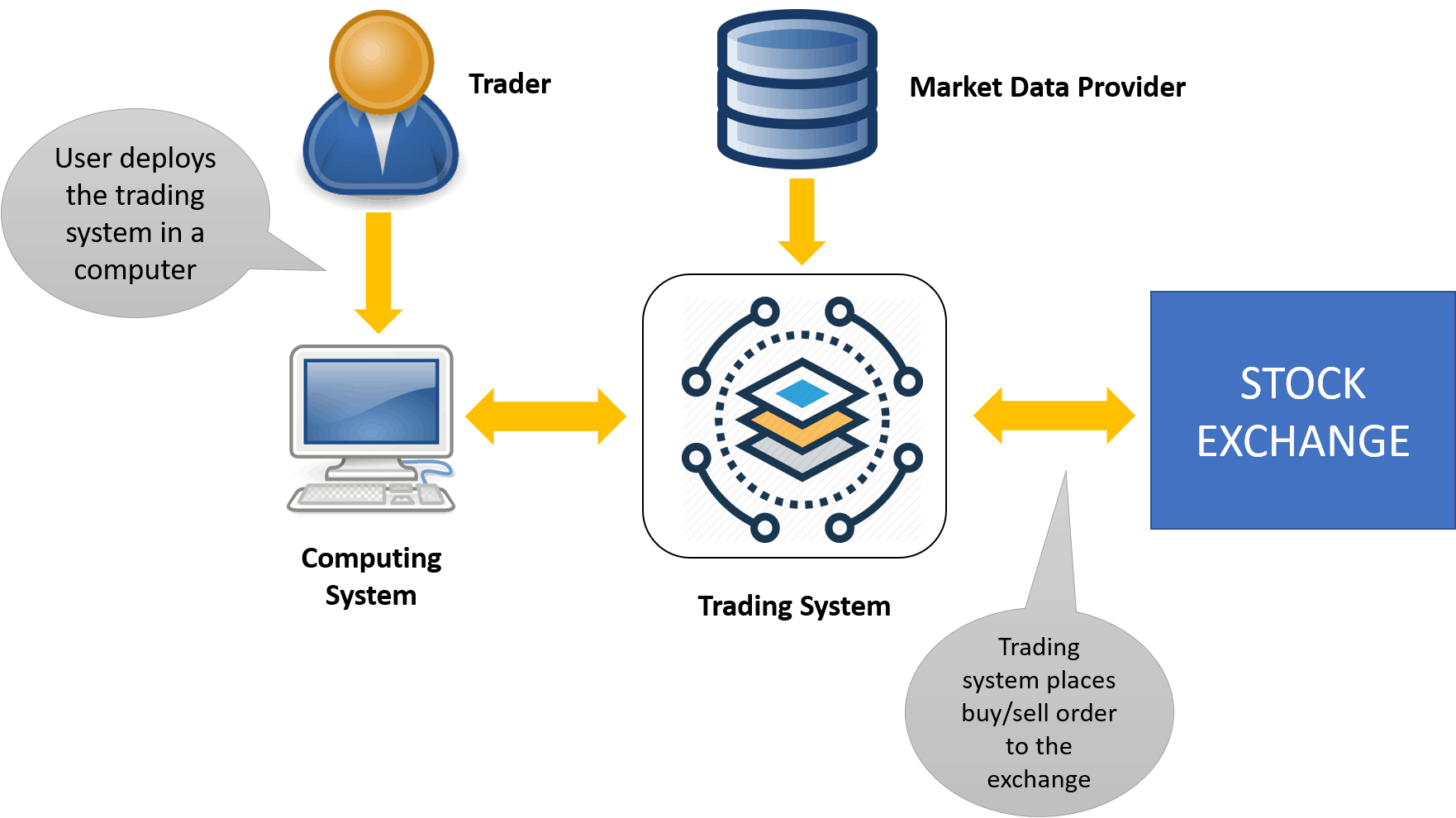

How does it work? Well, it relies on advanced mathematical models and quantitative analysis. The real magic happens through computer programs, where a skilled programmer crafts a precise set of instructions (an algorithm) designed to execute optimal trades for maximum profit.

These algorithms take into account factors like price, timing, and currency conversion. The beauty of algorithmic trading is that it reduces or eliminates the need for human intervention, paving the way for consistent profitability.

Consider it as a well-oiled mechanism that promotes structured trading and increases market activity over time.

Consider it as a well-oiled mechanism that promotes structured trading and increases market activity over time.

You establish the rules, and then you can relax, free from the need to constantly monitor live prices and charts. The algorithm does the heavy lifting, allowing you to profit with minimal effort.

Getting Started with Algorithmic Trading

To embark on this journey, you’ll need to transform your trading strategy into a computer program. While this may sound challenging, your program also requires access to a trading account to execute trades on your behalf. If this feels overwhelming, you can explore established strategies or seek assistance from skilled programmers to set up the necessary infrastructure. Alternatively, you can simplify the process by using pre-made trading software like Amibroker.

For a smooth experience, ensure you have a reliable internet connection, as you’ll want your system to operate without interruptions. Extensive testing is essential, and it may involve some trial and error. When issues arise, identify the problem, assess the context, and make necessary adjustments. Fortunately, you can simulate potential challenges before entering the actual market, where risks are higher.

Given the frequent testing, it’s advisable to maintain a record of historical data. This enables you to assess how your model performs under different conditions and make adjustments to your program as needed.

But Wait, There’s More…

Algorithmic trading isn’t solely about a computer program. You also require a dependable source of market data, the foundation of your system. Real-time price data is crucial for tracking market fluctuations and identifying the ideal moments to execute trades, whether buying or selling. Your system needs rigorous testing and optimization using historical data. Once you grasp the process, you can enjoy the benefits of passive income with minimal effort.

Also Read: Unlocking the Power of Algorithmic Trading

There’s a Catch, Though!

While algorithmic trading may appear straightforward, managing and executing it can be challenging. The ease of setting up an algorithmic trading system also attracts others, resulting in substantial competition. Over time, it may become more demanding than simply sitting back and relaxing.

7 Comments