Backtesting stands as a fundamental element in the development of trading systems. Testing systems on historical data is essential to confidently forecast future performance. While backtesting may seem intricate to beginners, advancements in technology have simplified and accelerated the process. This article delves into the Best Tool for Backtesting Trading Systems, focusing on insights from a leading technologist.

Best Tool for Backtesting Trading Systems

Among the numerous trading systems developed, the majority have been backtested using Amibroker. This tool stands out for its efficiency and user-friendly interface.

For more intricate systems, particularly those requiring detailed statistical analysis, Python (specifically the zipline module) is often the tool of choice.

Here are key factors influencing the choice between Amibroker and Python for backtesting:

- Amibroker excels in scenarios involving portfolio backtesting with dynamic position sizing and stop-loss strategies.

- Python is preferred for strategies demanding complex statistical computations like correlations or standard deviations.

While both Amibroker and Python can effectively perform various backtesting tasks, Amibroker offers several built-in features that facilitate efficiency. Python, known for its versatility, allows for the creation of customized backtesting logic, though it requires coding everything from scratch. Python is ideal for those well-versed in programming and looking for a more tailored approach.

Further Reading: Amibroker vs Python for Trading System Development

Why Choose Amibroker for Backtesting?

Amibroker’s most notable advantage is its rapid execution speed, enabling complex strategy backtests on extensive data within seconds, outpacing other tools.

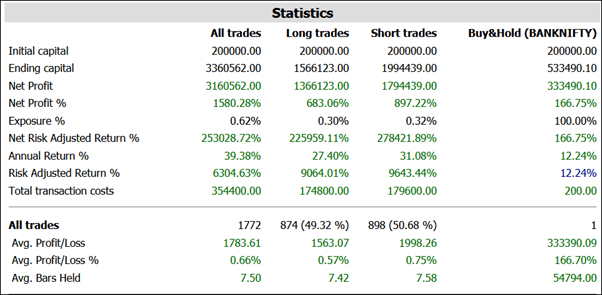

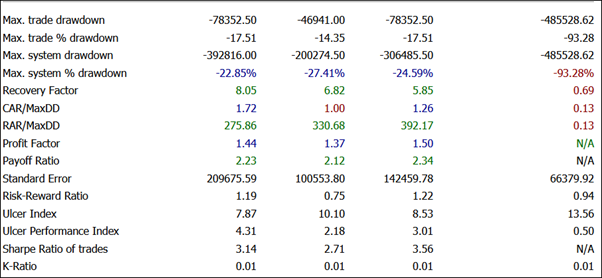

Its comprehensive and descriptive backtesting reports are also highly regarded for their ability to clearly represent system performance.

For example, review the backtesting report of the Stop Loss Hunter System:

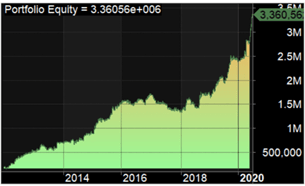

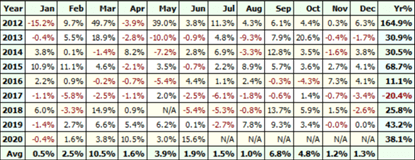

Additionally, Amibroker provides equity curve and profit table visualizations post-backtesting, offering a comprehensive view of the system’s performance over time:

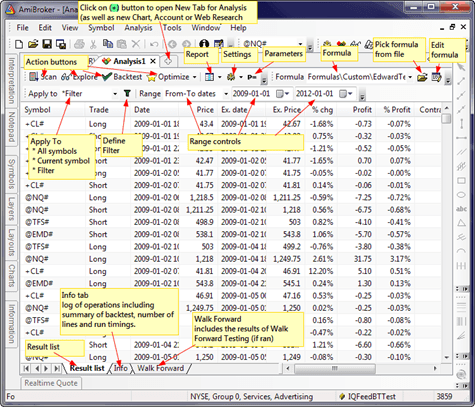

The question arises – can past performance accurately predict future results? To address this, Amibroker integrates Monte Carlo simulation and Walk Forward Testing, crucial for evaluating a system’s robustness in varying market conditions.

Monte Carlo simulation introduces randomness into data or rules, retesting the system multiple times to emulate actual market behavior.

Walk Forward Optimization splits historical data into in-sample and out-of-sample sets for initial backtesting and optimization, followed by validation on out-of-sample data. Profitable results in both datasets indicate a reliable system.

Amibroker simplifies these advanced processes into a few user-friendly clicks:

Despite its sophisticated capabilities, Amibroker is accessible and intuitive, even for those without a programming background.

Read More: Mastering Backtesting Trading Strategies for Market Success

Concluding Insights

There are several compelling reasons to choose Amibroker as the best tool for backtesting. It combines comprehensive features with an error-free interface, making it an ideal choice for both beginners and experienced traders. Beginners will appreciate the ease of getting up to speed, while professionals can explore new capabilities over their current tools.

Python remains a strong alternative, particularly for quantitative analysis-focused systems.

For more on Amibroker, explore the following resource:

Getting Started with Amibroker – Features, Pros-Cons & Resources

2 Comments