Unlocking Success in Swing Trading: Effective Stock Screening Strategies

Swing trading offers significant opportunities in the stock market, and key to this is learning effective stock screening for swing trading. This method involves holding positions beyond a day, but not as long as traditional long-term trades, offering a middle ground.

This approach benefits from price shifts due to major corporate changes, potentially unfolding over several weeks. The crux of success in swing trading lies in adept stock screening.

Strategies for Screening Stocks Efficiently

While a range of fundamental and technical analysis tools exist, here are some straightforward techniques to spot the right stocks in the prevailing market environment:

- Understanding Market Cap Dynamics: Typically, large-cap stocks show less swing than their small-cap counterparts. Assess the price volatility of particular stocks, which could be linked to specific events or forecasted movements. Noticeably, the futures and options segment often exhibits more swing, especially during rollover weeks.

- Gauging Market Conditions: The overall market sentiment, whether bearish or bullish, plays a significant role in stock price dynamics. Also, monitor the Volatility Index closely as it can heavily influence expected swings. In highly volatile markets, expect more pronounced swings.

- Finding High-Momentum Stocks: During periods of significant market swings, prioritize stocks with high momentum, which could be driven by news or events. Often, these stocks are the day’s volume buzzers or top trades, offering an accessible path for new traders to capture substantial profits.

- Leveraging Technical Indicators – Moving Averages: Technical indicators, particularly moving averages, provide insights into stock price trends, aiding in identifying stocks with potential swings. They offer precise and accurate guidance, focusing purely on price movements.

- Conducting Sectoral Reviews: Identifying strong stocks within high-performing sectors is essential, allowing traders to make the most of sectoral movements for optimal swing trading opportunities.

Top Technical Indicators for Stock Screening in Swing Trading

Various technical indicators can guide you in screening stocks for swing trading. Selecting the most effective ones is crucial. Here’s an overview of some popular techniques:

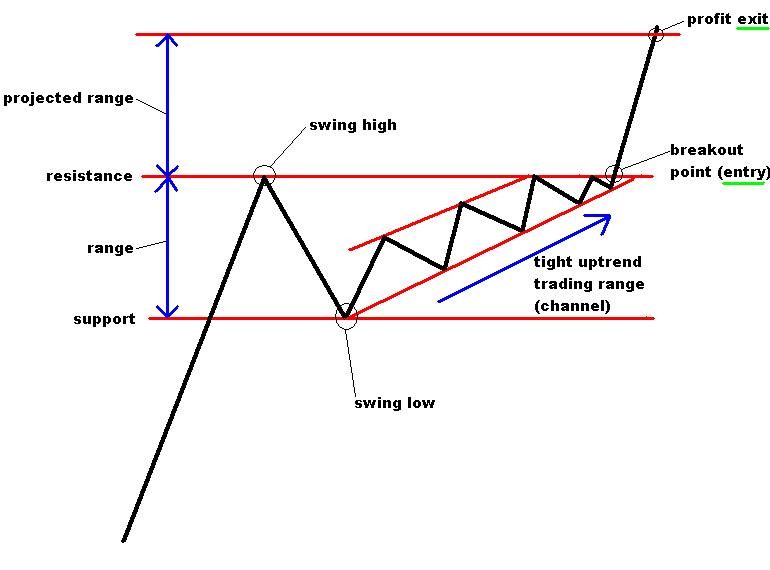

- Observing Support, Resistance, and Breakouts: Watch for breakouts in support and resistance levels, as they can trigger large swings. Carefully filter stocks to capitalize on these movements.

- Analyzing Price Indicators: Simple technical analysis methods like observing 50-day or 200-day moving averages can pinpoint active stocks and help avoid underliquid stocks.

- Targeting Stocks Near 20-Day Highs: Utilize this approach to identify stocks likely to experience near-term swings, where the size of your investment can play a decisive role.

- Utilizing ADX: Blend ADX with moving averages to isolate stocks following a specific trend. A high ADX value indicates a robust trend.

- Implementing Exponential Moving Averages: This technique helps in spotting stocks in an upward trend, indicating potential pullbacks. It’s a strategic way to identify high-volume stocks and key sectoral players.

- Applying VWAP: Use Volume Weighted Average Price (VWAP) for pinpointing stocks with strong trends in intraday trading, calculated by price-volume multiplication over specific periods.

Additional Learning: Comprehensive Guide to Swing Trading for Beginners

Conclusion

To sum up, successful stock screening for swing trading involves a focus on momentum stocks and understanding the current market dynamics. This strategy is particularly beneficial for newer traders. Moreover, adopting event-driven positions can offer clearer insights into expected price swings, easing the path to profitable trading.

2 Comments