If you’re versed in the Tradetron algo trading platform, then you’re likely aware of its strategy marketplace, a hub for deploying algorithmic strategies developed by others. With a vast array of choices, pinpointing the best strategies can seem daunting. We provide essential guidelines to simplify the selection process and help you discover the best strategies from the Tradetron marketplace.

For a deeper understanding of Tradetron and its capabilities, refer to this comprehensive article.

Strategies Showcase: Navigating the Marketplace

Tradetron’s marketplace ranks strategies based on several criteria:

- Assets Under Management (AUM)

- Sharpe Ratio

- Average Monthly Rate of Change (ROC)

- Number of Live Deployments

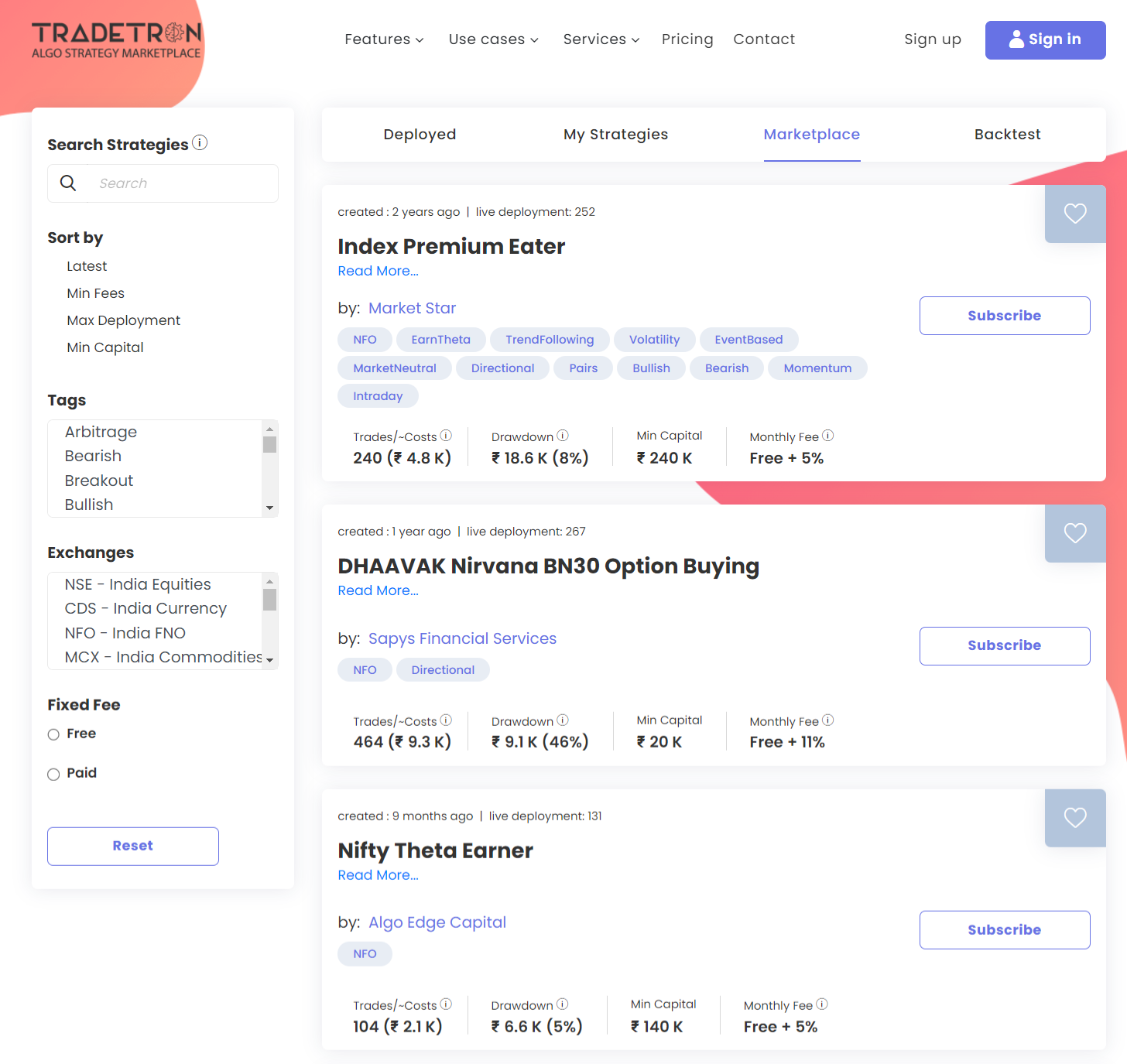

Strategies on the marketplace’s front page often outshine others, as shown in this screenshot of the Tradetron marketplace.

These top-listed strategies are the initial go-to choices, further refined by filters like exchange, tags, or capital requirements.

These top-listed strategies are the initial go-to choices, further refined by filters like exchange, tags, or capital requirements.

Key Parameters: Drawdown and Sharpe Ratio

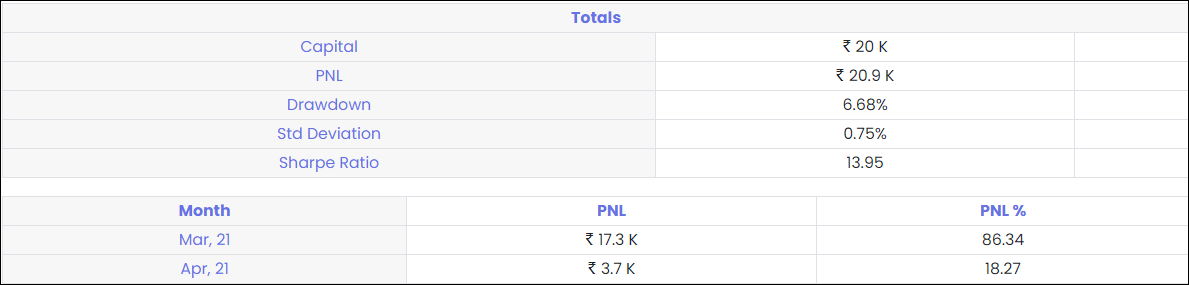

Look for strategies with a low Drawdown and a high Sharpe ratio, crucial markers of a strategy’s efficacy. These metrics are usually in the statistics section of each strategy.

Aim for strategies with a performance record spanning at least three months. Strategies with shorter track records, like the one shown, warrant additional observation before live implementation.

Understanding Strategy Descriptions

Strategy descriptions offer valuable insights, including traded instruments, trade frequency, and strategy type (intraday or positional).

Choose strategies that align with your trading style. For instance, avoid high-frequency scalping strategies if cost-efficiency is key, or steer clear of positional strategies if overnight risks are a concern. The description also provides information on the minimum capital requirement, a vital aspect in your selection process.

Avoid strategies with vague or incomplete descriptions, as they often lack transparency.

Further Reading: How to Create a Strategy in Tradetron: A Step-by-Step Tutorial

Engaging with Strategy Creators

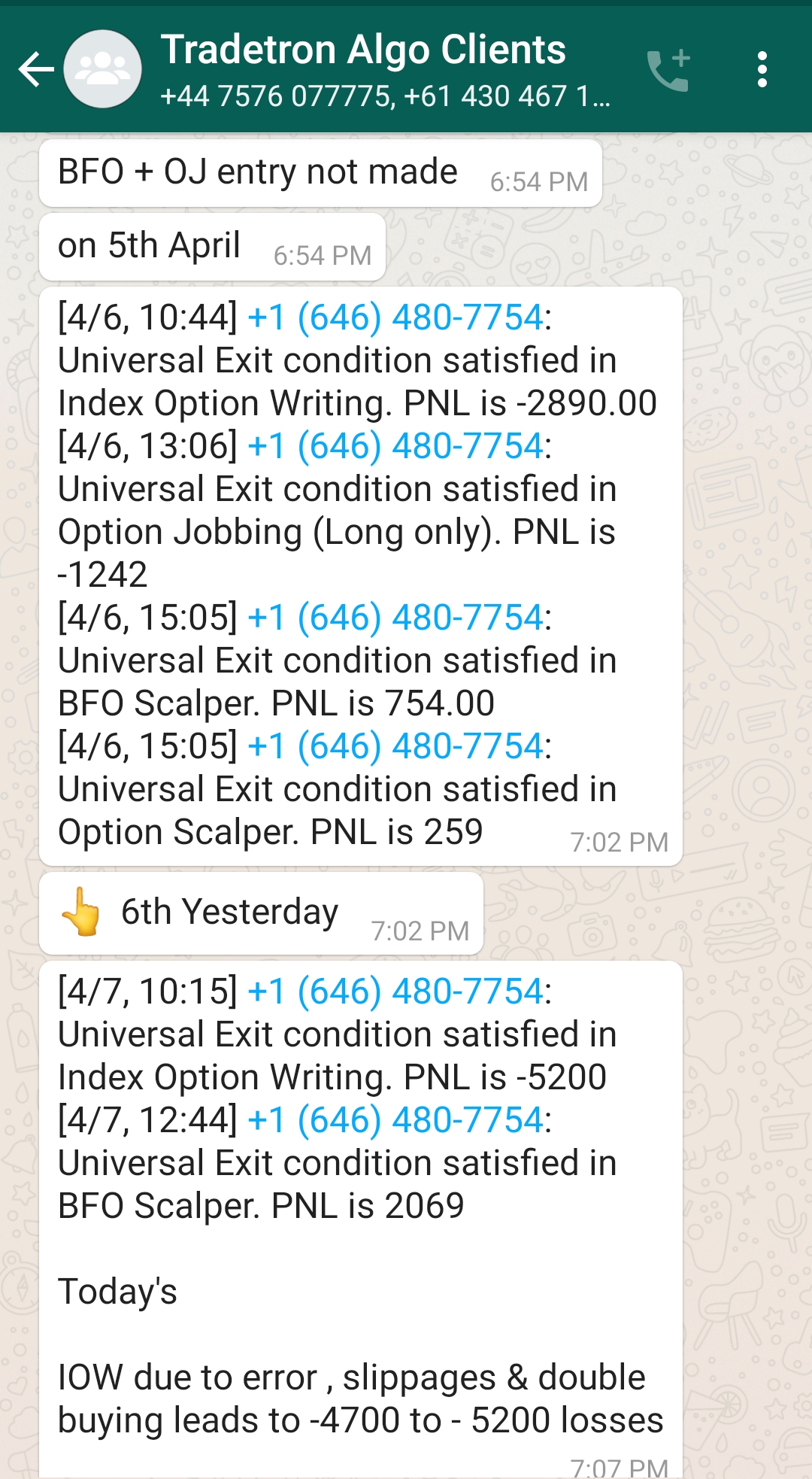

The accessibility of the strategy creator is crucial for guidance and troubleshooting. Test their responsiveness by reaching out via the strategy page’s email option or by joining their Telegram group, if mentioned in the description.

Creators’ Commitment to Their Strategies

Differentiate between creators who list multiple strategies with paper trading results and those who actively invest in their few listed strategies. The latter, who risk their capital, are typically more reliable.

Example: Creators like “FirstChoice Investments Consultant” share daily performance reports, demonstrating confidence in their strategies.

Prefer creators who showcase real trading results over those limited to paper trading.

Evaluating Strategy Fees

While evaluating paid strategies, distinguish between those with a fixed monthly fee and those operating on a profit-sharing model. Opt for strategies with reasonable fees to ensure profitability after accounting for commissions and taxes.

Importance of Initial Paper Trading

Before committing to live deployment, paper trade the strategy for a month. This practice helps in understanding the strategy’s nuances and assessing its real-world performance.

Remember, paper trading outcomes may not always mirror live trading results. Exercise patience and thorough evaluation before proceeding to live trading.

Our guide aims to streamline your journey in selecting the best strategies from the Tradetron marketplace. If you have additional insights or criteria, please share them in the comments.

Discover Tradetron’s plans, starting at 250 per month. Register through this link to begin your exploration.

3 Comments