Discover the Power of Tradetron in the Automated Trading Platform

Tradetron is leading the way in automated trading platform and algorithmic trading with its unique features and cloud-based setup. It offers retail traders and portfolio managers the ability to fully automate strategies easily and monetize them with a subscription-based service. Explore Tradetron and unlock your trading potential here.

Tradetron emerged as a top contender in our review of India’s rising automated trading platforms. Haven’t seen the review yet? Check it out here.

Understanding Tradetron

Tradetron, a cloud-based algorithmic trading platform, enables users to:

- Create and backtest strategies

- Automate strategy execution

- Subscribe to and utilize marketplace strategies

- Monetize personal strategies through subscriptions

Develop a strategy that, for instance, buys a stock when it crosses the 200-period moving average and exits at either a 20% profit or 5% loss. With Tradetron’s cloud-native environment, no software installation is needed. It operates on global servers, ensuring swift strategy execution connected to Indian and US brokers. Read more about creating strategies in Tradetron here.

How Tradetron Functions

Tradetron leverages API-based microservices for automating trading strategies. Strategy conditions set in Tradetron trigger broker API calls for order placement.

Its robust trading engine manages data from various providers and seamlessly integrates with multiple brokers. Start your journey with Tradetron by clicking here.

Key Features of Tradetron

Tradetron stands out in the automated trading world with features like:

User-Friendly Strategy Builder

Create strategies without coding, using a wide range of technical indicators and data types. Organize strategies into sets, each with unique conditions, and apply them to individual or grouped instruments.

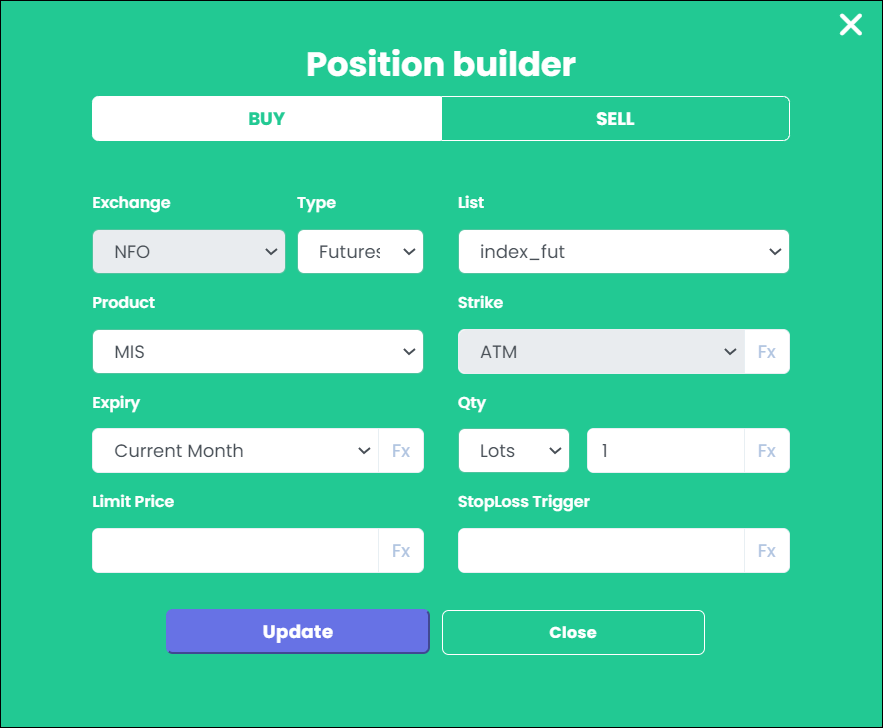

Dynamic Position Builder

Define position details such as quantity, order type, and instrument dynamically. Use formulas to adapt strategies to market changes, especially useful for options trading.

Strategy Adjustment with Repair Once and Continuous

Adjust your strategy with ‘Repair Once’ for one-time condition fulfillment or ‘Repair Continuous’ for ongoing checks, enhancing risk management and position sizing.

Access a Wealth of Strategies with the Marketplace

For beginners, Tradetron’s marketplace is a treasure trove of strategies created by others. Evaluate and subscribe to strategies based on performance metrics and interact with strategy creators.

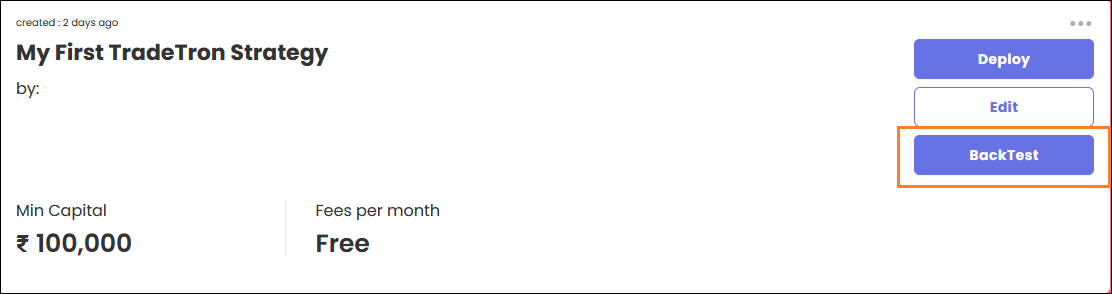

Efficient Backtesting

Validate your strategy’s historical performance with Tradetron’s backtesting feature, considering different price assumptions for accurate results.

Versatile Execution Options

Choose how your strategy executes trades, from fully automated to manual execution based on alerts.

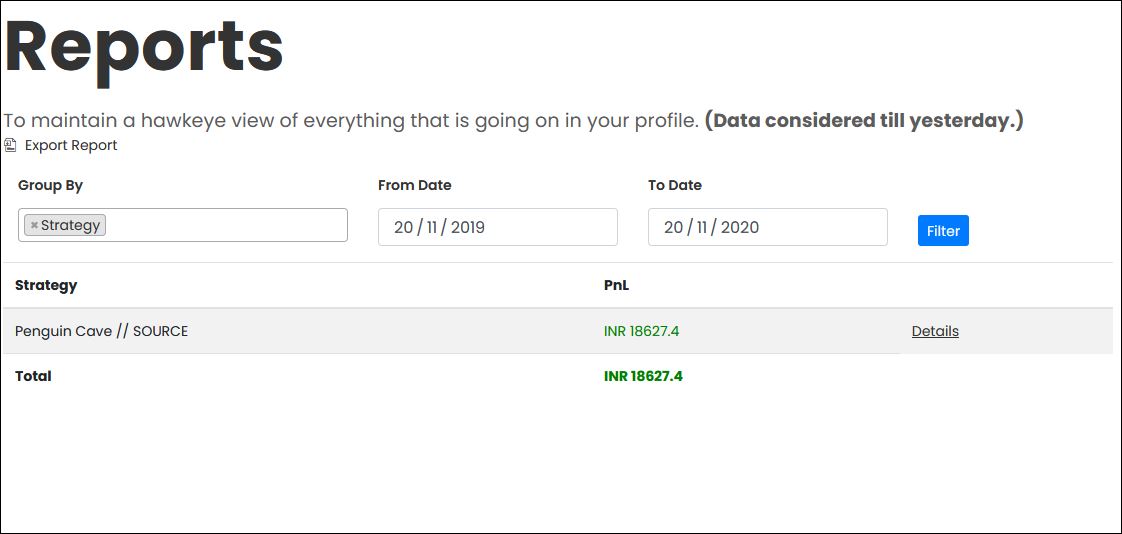

Comprehensive Reporting

Track your algos’ performance with Tradetron’s simple and self-service reports, customizable by various filters.

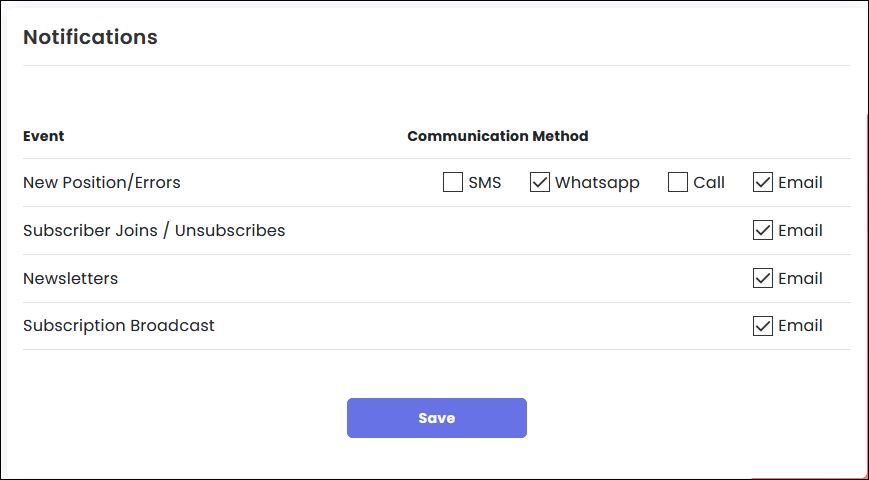

Real-Time Notifications

Stay informed with immediate notifications for order executions and any issues, delivered through your preferred channels.

Learn More: Essential Tradetron Keywords for Strategy Creation

Learn More: Essential Tradetron Keywords for Strategy Creation

Getting Started with Tradetron

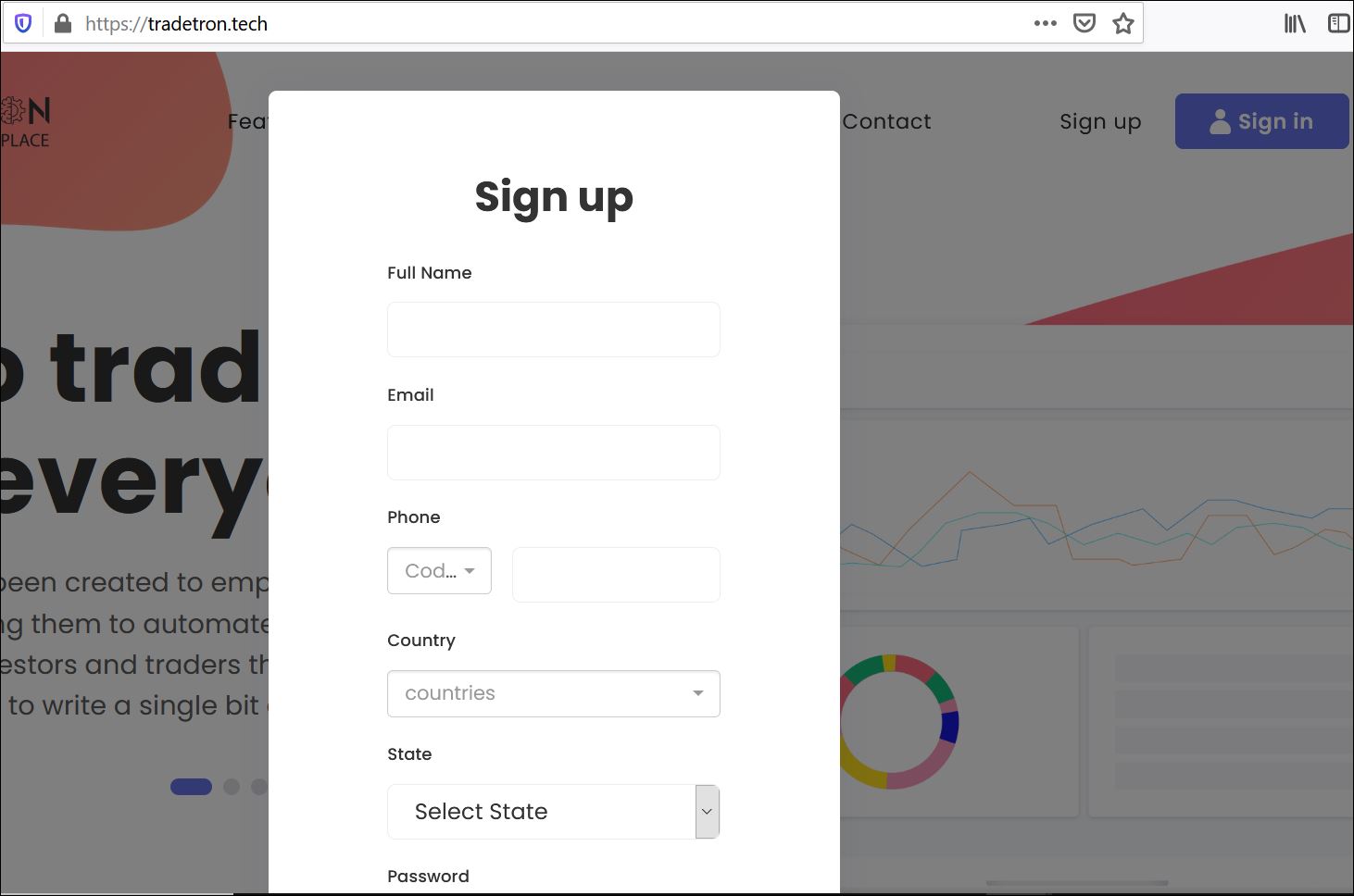

Step 1: Sign Up for Tradetron

Create an account on Tradetron by following this link. Register using your details or through Facebook/Google for quicker access.

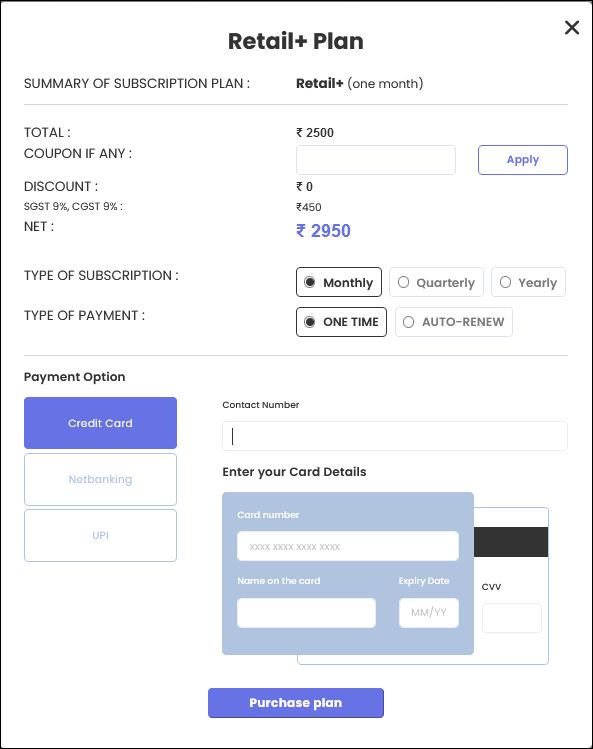

Step 2: Choose a Subscription Plan

After logging in, select a plan that fits your needs from the ‘Subscriptions’ section. The Retail plan is recommended for most users, offering a yearly saving option.

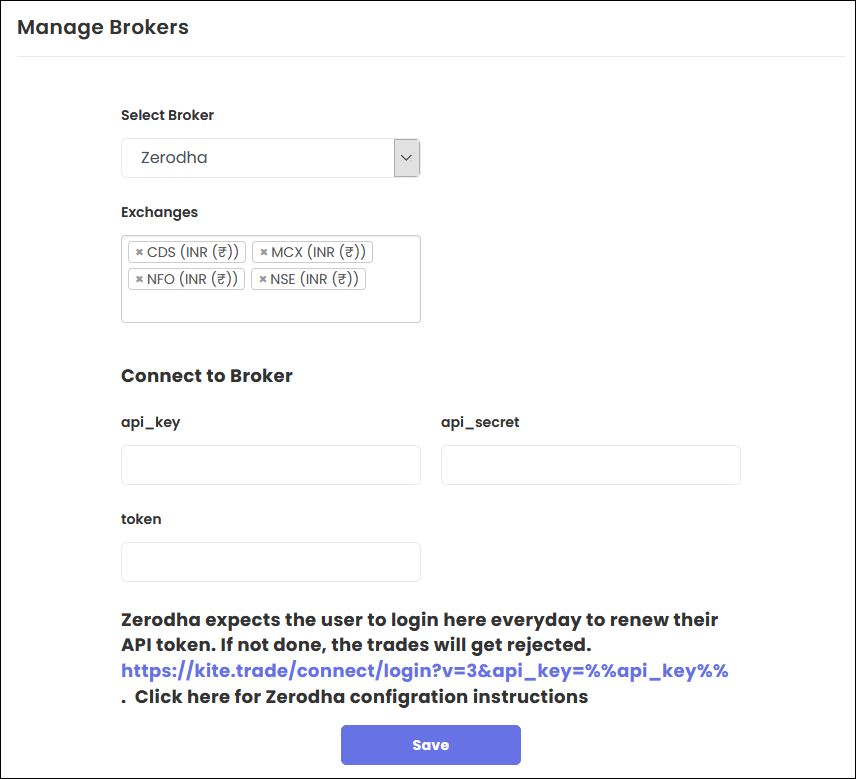

Step 3: Link Your Broker

Add your broker details under the ‘Brokers and Exchanges’ section to integrate your trading account with Tradetron.

For API key generation steps for different brokers:

Fyers | Upstox | IIFL | Zerodha | 5Paisa

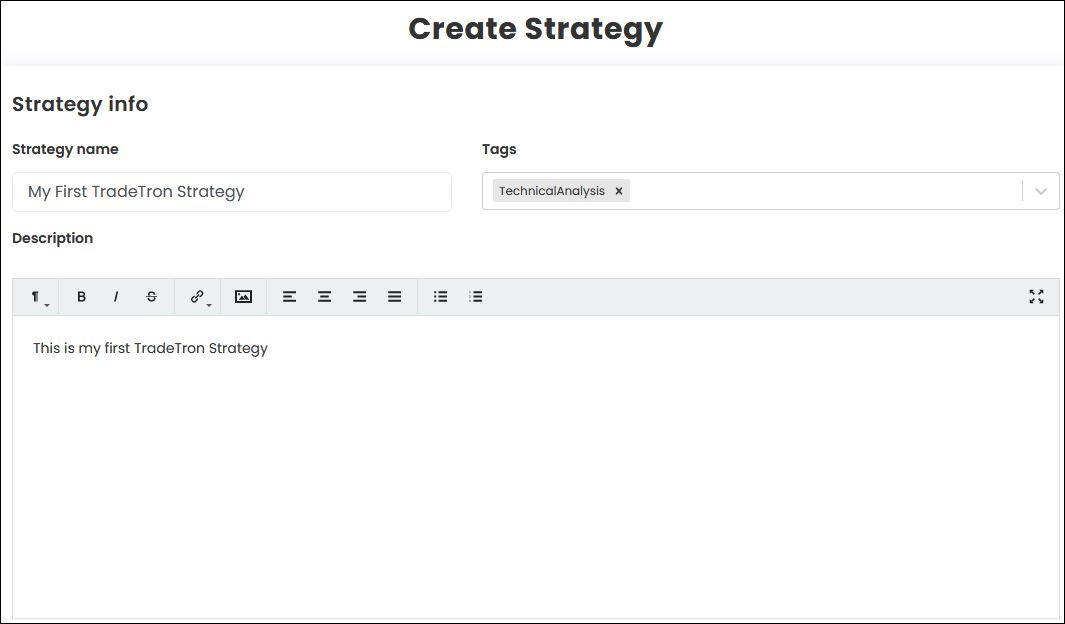

Step 4a: Build Your Strategy

Develop your own strategy using Tradetron’s intuitive interface. No coding is required – just drag and drop conditions using the platform’s comprehensive keyword list.

Explore existing templates and videos to help you get started: Templates | Videos.

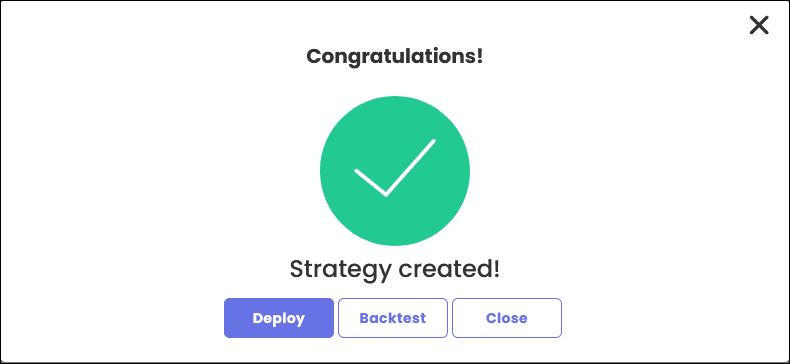

Deploy or backtest your strategy to see its effectiveness.

Note: The free plan limits you to one strategy and does not allow backtesting.

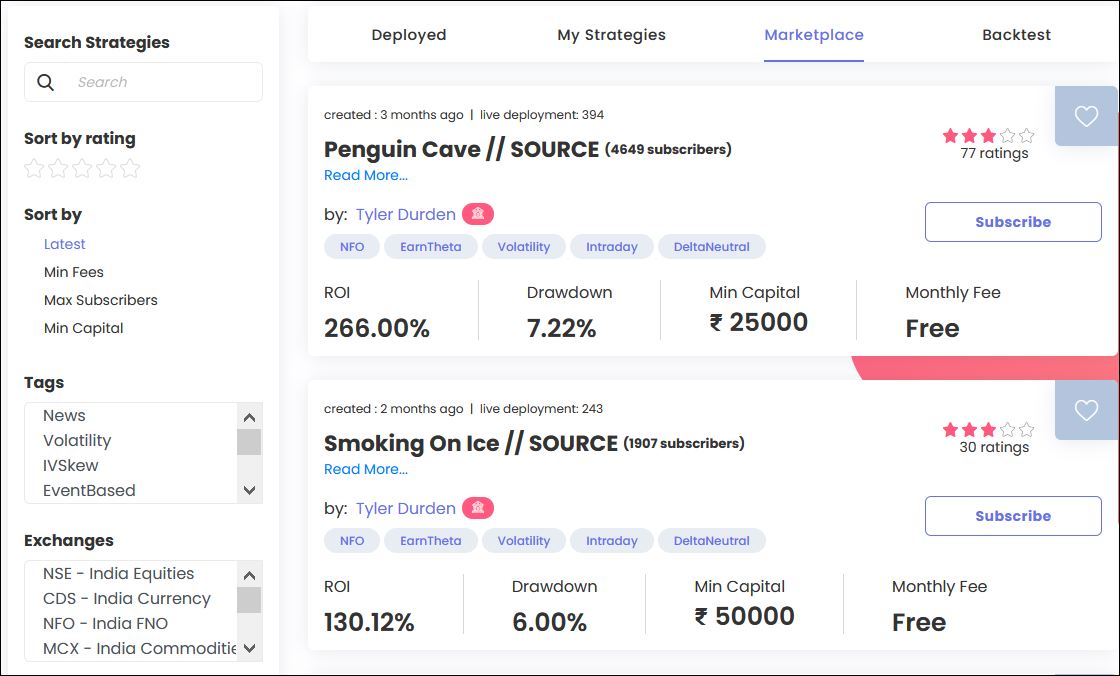

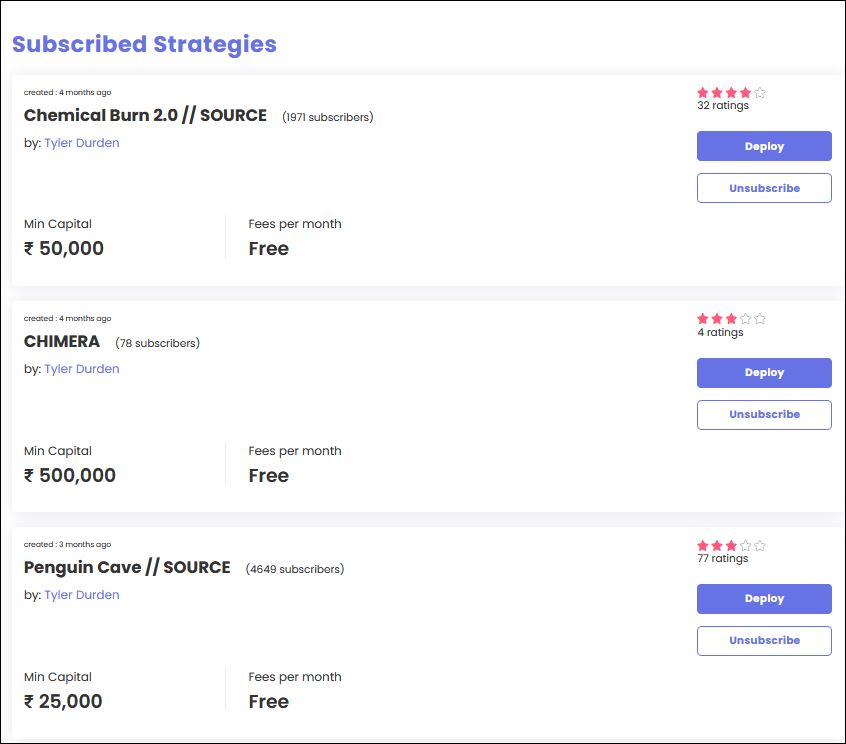

Step 4b: Subscribe to Marketplace Strategies

Access a variety of strategies in the Tradetron marketplace, and subscribe to ones that align with your trading style. Each strategy provides detailed descriptions and historical performance data.

Choose from free or premium strategies, with details available on each strategy’s page. After subscribing, manage your strategies under ‘My Strategies’ and deploy them for live trading.

For guidance on selecting the best strategies, visit this link.

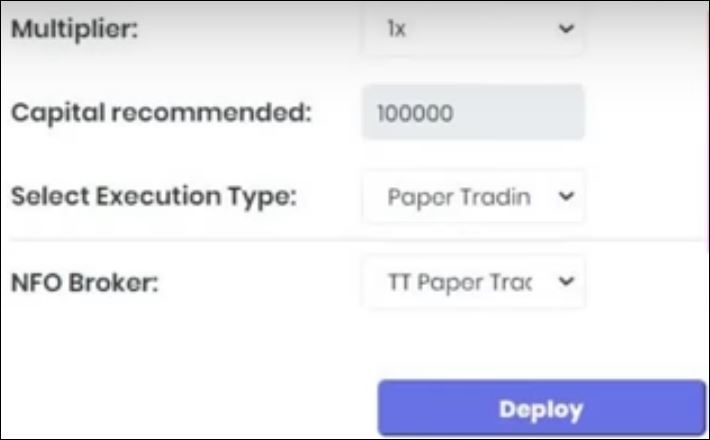

Step 5: Activate Your Strategy

Activating a strategy for live trading involves choosing the multiplier, execution type, and broker. Select from options like fully automated or manual execution based on alerts.

Verify the proper execution of trades during market hours, and stay updated with notifications for each transaction.

Understanding Tradetron’s Subscription Costs

Tradetron’s subscription starts at a reasonable 300 INR per month, scaling up to 15000 INR for institutional plans. In the US, the range is $10 to $475 per month. Explore the latest pricing details here.

The free plan allows paper trading and one private strategy. Most users find the Retail plan optimal, while the Retail+ plan is suited for strategies needing constant condition checks.

There are no hidden costs for data or VPS, but subscribing to marketplace strategies may incur additional fees.

Why Tradetron Stands Apart

Tradetron distinguishes itself in the automated trading market with several unique aspects:

- Its cloud-native nature eliminates software installation needs.

- Tradetron offers hassle-free integration with various brokers.

- It’s a complete solution for creating, backtesting, and automating strategies – a rare find in this field.

- The platform’s marketplace fosters a collaborative environment for strategy creators and users.

- Tradetron caters to a global audience, supporting multiple instruments and exchanges.

Compare Tradetron with other automated trading platforms in this review.

Essential Tradetron Resources

Begin your Tradetron journey with these handpicked resources:

Strategy Templates | Webinars | Pricing | Strategy Marketplace | Videos

Concluding Thoughts on Tradetron as a Automated Trading Platform

Automated trading is the future, and Tradetron is paving the way for retail traders to adapt to this new trading paradigm. It offers a comprehensive suite for starting your algorithmic trading journey at an affordable cost. Its innovative technology requires minimal learning, making it ideal for traders at all levels.

Get a deeper understanding of Tradetron with this guide, and stay tuned for more in-depth articles. Begin your Tradetron adventure today!

8 Comments