For those interested in technical analysis and algorithmic trading, Amibroker often stands out as the go-to tool. Renowned for its extensive features and user-friendliness, Amibroker quickly becomes a favorite, even for those new to programming or technology. This guide dives into the world of Amibroker, exploring its capabilities, advantages and disadvantages, and all you need to know to master this impressive tool.

Introduction to Amibroker

In simple terms, “Amibroker is a cutting-edge software for technical analysis, trading system development, and backtesting”. But, why do you need software for technical analysis? The answer lies in its ability to streamline and automate complex tasks.

Without such tools, imagine the tedious task of manually creating charts, spotting patterns, and backtesting over extensive historical data. This could turn into a months-long endeavor for just one strategy.

Amibroker simplifies and automates these tasks. With a few clicks, you can access a variety of charts, apply indicators, backtest strategies, and simulate trading scenarios.

It’s a lightweight desktop application, easily installed on Windows systems, offering a hassle-free experience.

We will further explore how to install and effectively use Amibroker in the sections below.

The Story of Amibroker’s Beginnings

Among all technical analysis software available today, Amibroker stands out as the most seasoned, first introduced in 1995 on the Amiga platform.

Developed by Dr. Tomasz Janeczko for his own use, Amibroker later became a public offering. Dr. Janeczko, a Ph.D. holder in Computer Science and Telecommunication from Wroclaw University of Technology, has over 30 years of programming experience, making him the mastermind behind this successful software.

Amibroker has evolved significantly since 1995, with numerous updates enhancing its capabilities. You can follow its entire journey of innovation on Amibroker’s about us page.

Key Features of Amibroker

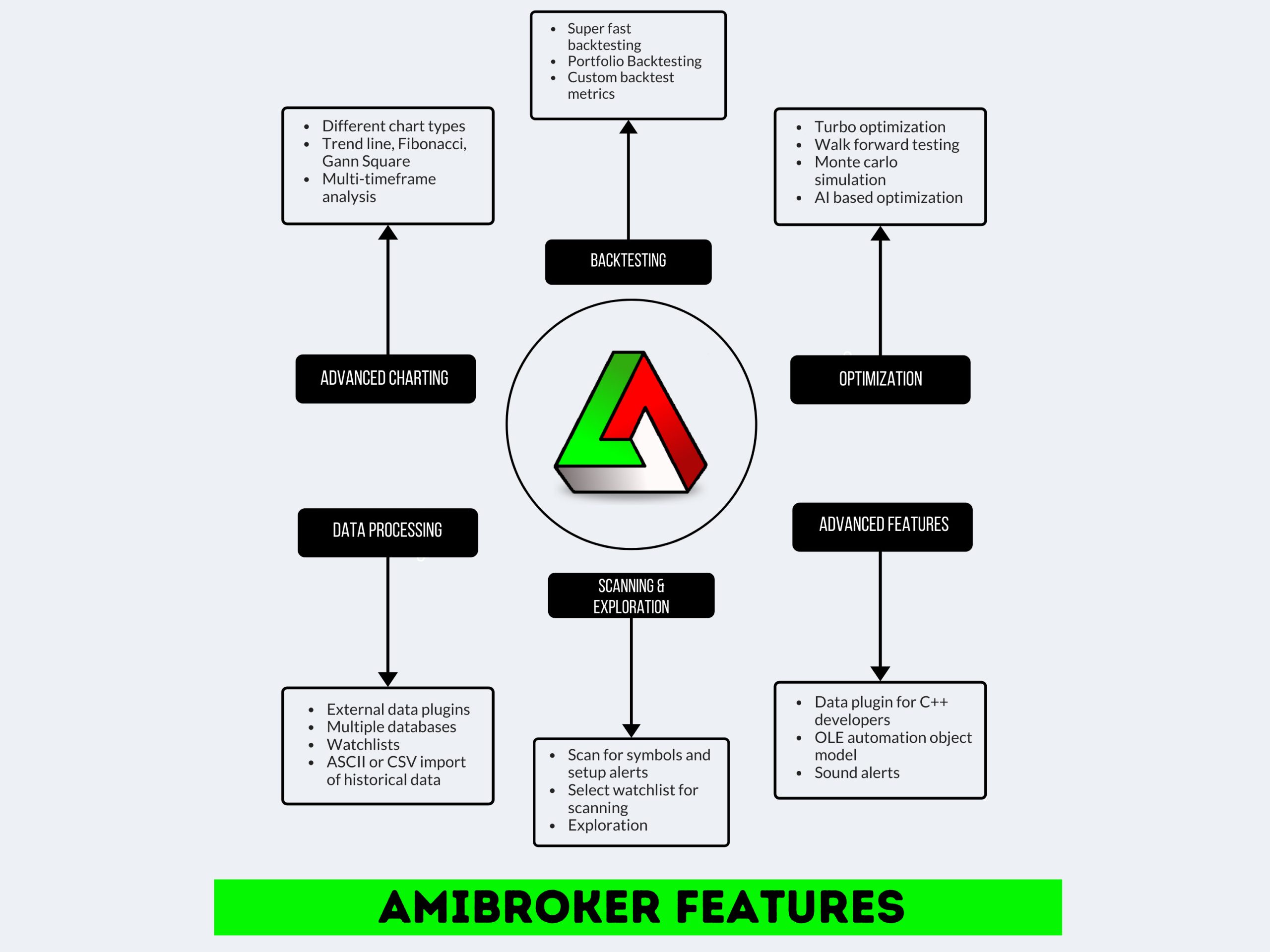

Amibroker is loaded with a variety of powerful features, making it a treasure for technical analysts and algorithmic traders.

While it’s hard to cover all features in one article, let’s look at some of the most notable ones:

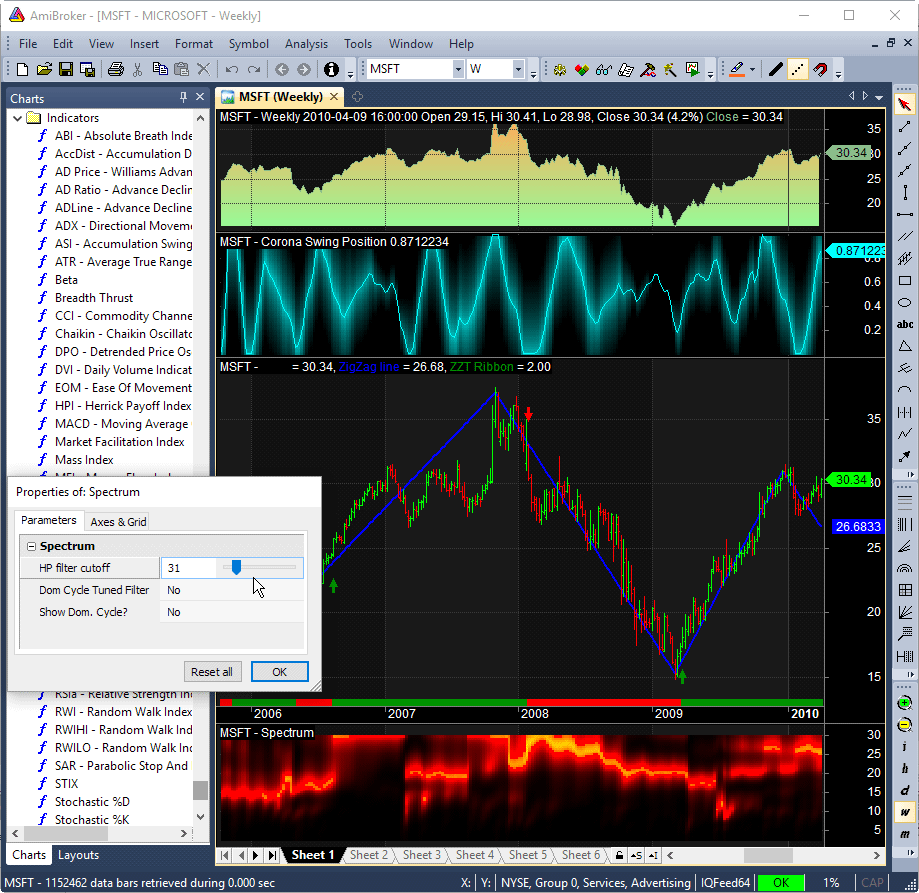

Advanced Charting Options

- Explore different chart styles like bar, candlestick, renko, and heikin-ashi.

- Enhance charts with trendlines, fibonacci sequences, and more for detailed insights.

- Easily add popular technical indicators to your charts.

- Quickly perform multi-timeframe analysis with just one click.

- Automatically interpret charts using patterns and technical indicators.

- Change chart settings in real time.

- Use the Bar Replay tool for revisiting charts with historical data, ideal for practice trading.

Efficient Backtesting

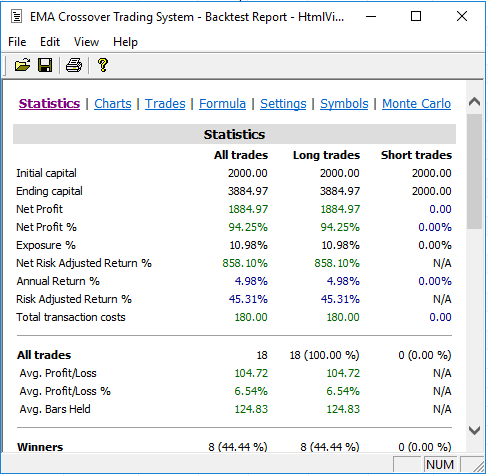

- Easily backtest your strategies on historical data with a simple click.

- Receive comprehensive backtesting reports filled with advanced metrics to assess your strategy’s performance.

- Enjoy ultra-fast backtesting, up to 100X faster than other tools.

- Manage portfolio-level backtesting and adjust the position size for each stock.

- Incorporate money management strategies, and visualize your equity curve and drawdowns.

- Customize your backtesting reports with unique metrics.

- Backtest mutual funds as well.

Optimization Tools

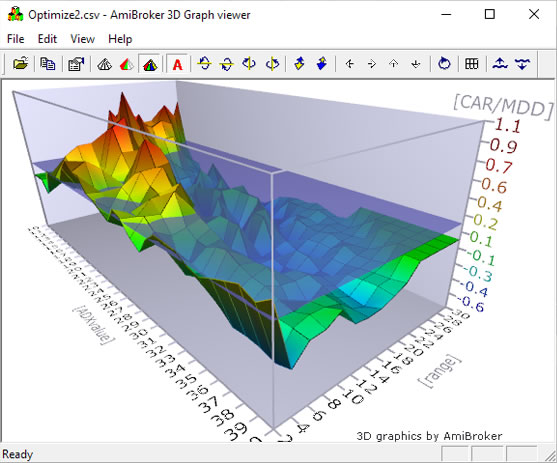

- Discover the best parameters for your trading system. Should you use a 20 or 50-period moving average? Amibroker lets you test and find the best option.

- Rapidly test thousands of parameter combinations and get detailed reports.

- Choose between thorough optimization or advanced Artificial Intelligence methods like PSO and CMA-ES.

- Analyze optimization results in a 3D interactive chart.

- Use walk forward testing to ensure optimization reliability.

- Test your system’s resilience in various market scenarios with monte carlo simulations.

Advanced Data Processing

- Handle gigabytes of data quickly and efficiently.

- Easily import historical data without needing to preprocess it.

- Connect with external plugins for real-time data feeds.

- Create numerous databases for different exchanges or instruments with no symbol limit.

- Organize symbols into groups and create custom watchlists for easy access.

Scanning and Exploration

- Set up scans and alerts for specific trading criteria, like stocks crossing the 200-period moving average.

- Conduct real-time scanning to make swift trading decisions.

- Customize scanning intervals and choose specific watchlists to scan.

- Use the powerful exploration feature for personalized scanning and reporting.

Additional Advanced Features

- Access the Amibroker data plugin for C++ developers to create custom tools.

- Automate Amibroker with the OLE automation object model and even trigger backtesting remotely through scripts, as explained here.

- Call external COM (ActiveX) objects directly from AFL scripts.

- Track your investments with the built-in portfolio manager.

- Stay updated with programmable sound alerts, pop-up windows, and email notifications.

- Link Amibroker to Telegram for instant alerts.

- Integrate auto trading interfaces with popular brokers for automated order placement.

Check out a summary of these features in the infographic below:

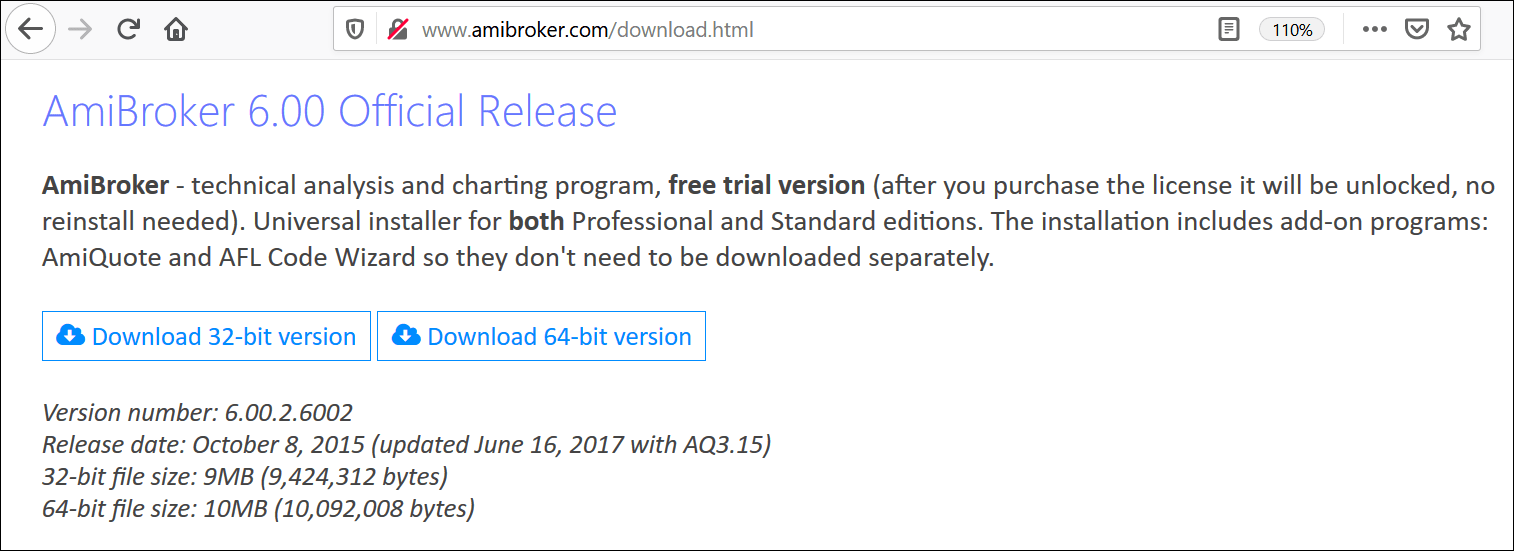

How to Install Amibroker

Installing Amibroker is a straightforward process. Simply visit the Amibroker download page and choose the version suitable for your system.

Select the 32-bit or 64-bit version based on your PC. This guide can help you determine your system type. Download and follow the installation instructions.

Select the 32-bit or 64-bit version based on your PC. This guide can help you determine your system type. Download and follow the installation instructions.

System Requirements for Amibroker

Amibroker is designed to be lightweight and efficient. The minimum system requirements are:

- CPU: Compatible with Intel or AMD x86

- Operating System: Windows 10, 8, 7, Vista, XP, 2K

- RAM: 512 MB

- Disc Space: 100 MB

For more advanced usage, a 64-bit system with at least 8 GB RAM is recommended. To use Amibroker on a Mac, consider using Parallels for compatibility.

Understanding Amibroker Formula Language (AFL)

To create your own trading system or scanner in Amibroker, you’ll use the Amibroker formula language (AFL). While knowing AFL isn’t essential for using Amibroker, since many common indicators are readily available, learning AFL can significantly enhance your capabilities. You can achieve remarkable things with AFL programming.

Put simply, AFL is a high-level programming language that lets you turn your trading strategies into executable code. This code can be used for backtesting, live trading, and real-time stock scanning.

Being array-based, AFL processes data in arrays rather than individual variables, leading to concise and easy-to-read code. Loop writing is rarely needed.

AFL provides predefined functions for common tasks, simplifying coding compared to languages like Python.

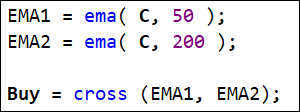

For example, to generate a Buy signal when there’s a moving average crossover, the code is straightforward:

To implement a 2% stop loss, the syntax is just as simple:

![]()

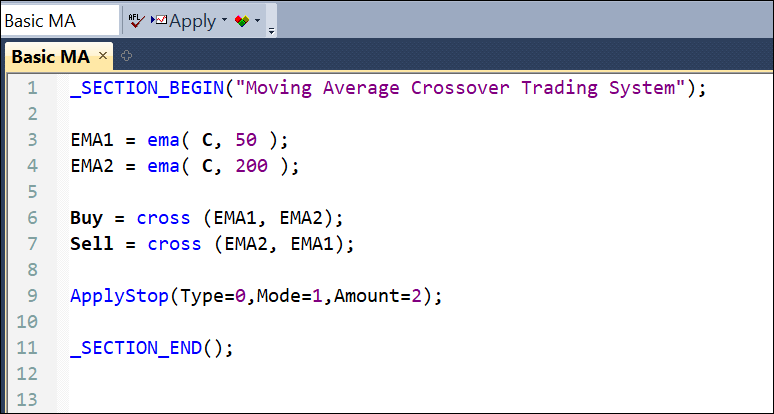

With AFL, you can build a comprehensive algorithmic trading system in less than 100 lines of code. Here’s an example of a moving average crossover system written in AFL:

Learning AFL is easier than many other programming languages, making it approachable even for those without a programming background. The built-in IDE (integrated development environment) of Amibroker, with features like syntax highlighting, auto-complete, and debugging, further eases this learning process.

Evaluating the Amibroker License

Amibroker offers a free trial for beginners. However, for professional traders, the premium version, starting at $279, includes 24 months of upgrades and is a great investment. While deciding to purchase, consider the added benefits of technical support, access to the AFL library, and more that come with the premium version.

Additional options include add-ons like AmiQuote for historical data downloads and AFL Code Wizard for converting English sentences into AFL code. Evaluate these tools during the trial period before making a purchase decision.

Learning Resources and Support for Amibroker

Starting with Amibroker is made easy with abundant resources. Begin with the official Amibroker documentation, and practice alongside to enhance your learning experience.

For a more structured approach, consider books, websites, online forums, and courses specifically designed for Amibroker training. These resources provide detailed insights and step-by-step guidance for mastering Amibroker.

Advantages and Challenges of Using Amibroker

Understanding both the strengths and limitations of Amibroker is essential. Here’s a breakdown:

Advantages

- Superior backtesting engine that outperforms other software in speed and efficiency.

- User-friendly optimization tools with advanced features like AI optimization.

- Customizable with automation capabilities and extensive support for developers.

- Simple yet powerful AFL, accessible even for beginners.

- Wide range of real-time data feed integration options.

- Responsive and helpful support, directly from the founder.

- Affordable perpetual license offering great value for its features.

Challenges

- The user interface might seem complex for new users.

- Auto trading options are limited within Amibroker, though external plugins can compensate.

- Lack of mobile app and native MacBook support.

Concluding Thoughts on Amibroker

Amibroker distinguishes itself as a premier choice in technical analysis software. Its combination of efficiency, comprehensive features, and user-friendly design makes it ideal for both beginners and seasoned traders in algorithmic trading.

Whether you are just starting or looking to enhance your trading strategies, Amibroker provides a robust platform for development and execution, making it a wise choice for anyone aiming to excel in the trading world.

16 Comments