Many of our readers frequently inquire about the “Amibroker vs TradingView” debate when choosing charting software. Selecting between these two platforms can be challenging. To assist, a thorough comparison of Amibroker versus TradingView has been conducted, analyzing various parameters.

Amibroker vs TradingView – Comparative Analysis

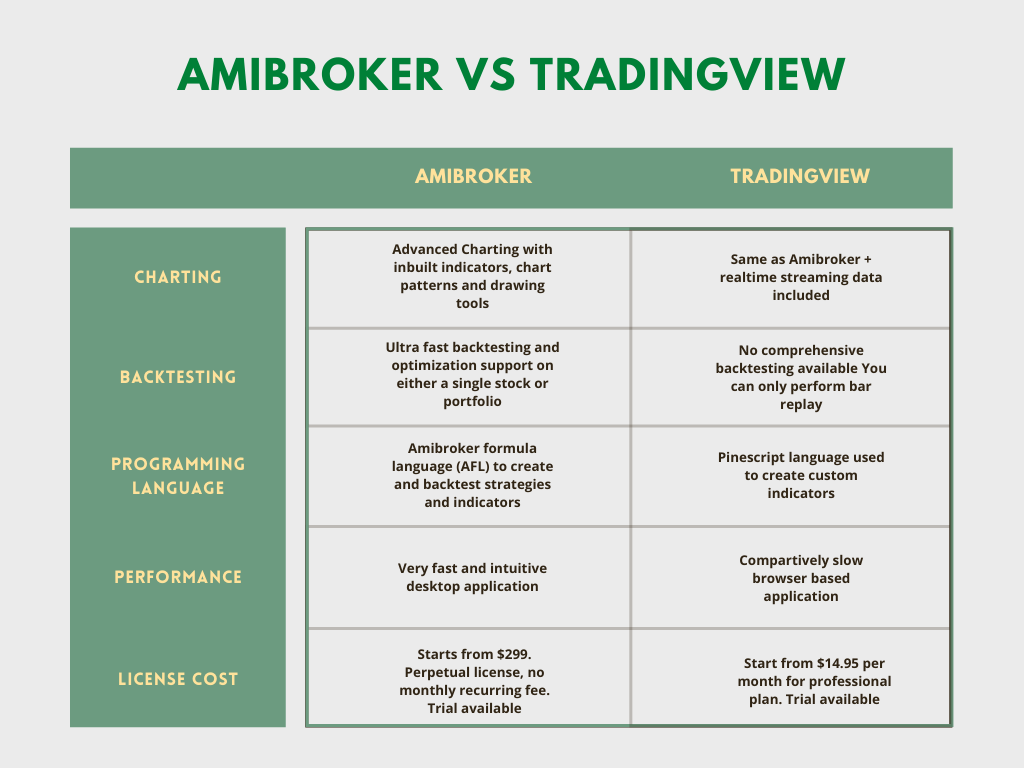

Below is a comparison table that evaluates these platforms across different criteria:

Detailed insights into each comparison factor follow.

Further Reading: Amibroker vs MetaTrader – A Detailed Comparison

Charting Capabilities

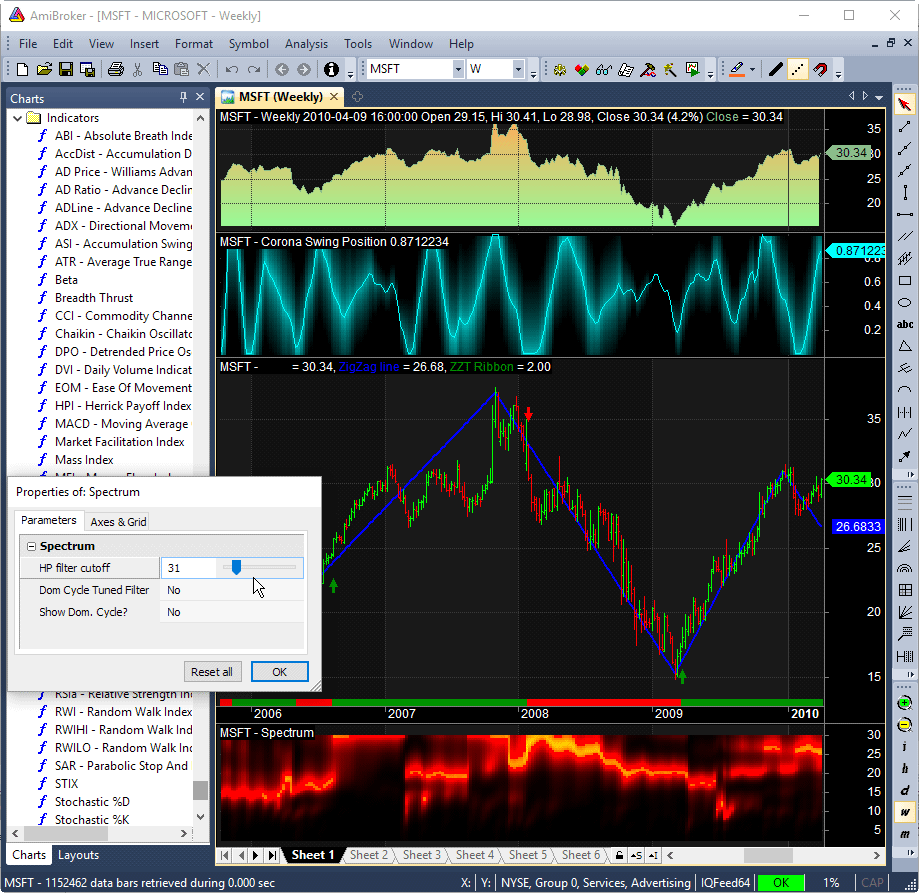

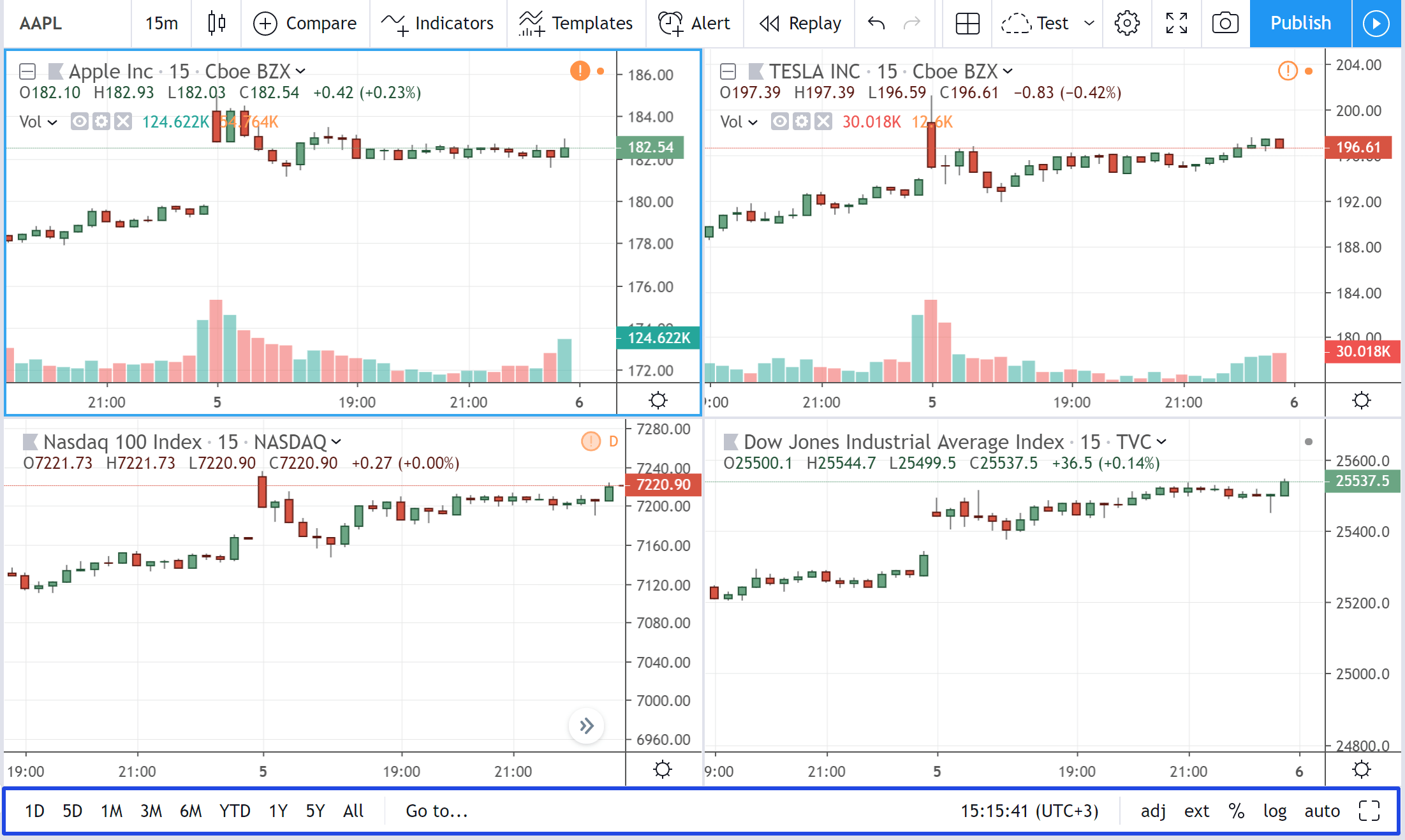

Both Amibroker and TradingView provide intuitive and comprehensive charting features. A key distinction is that Amibroker is a desktop-based software requiring installation on a computer, whereas TradingView is a web-based application accessible via any browser on any device.

Features-wise, both software offer a variety of chart types like Candlestick, Line, Renko, etc., along with the ability to overlay indicators and patterns.

Amibroker Chart

TradingView Chart

TradingView features built-in streaming data that updates charts in real-time, while Amibroker requires external data providers for data updates.

Verdict – TradingView excels in charting due to its ease of access and integrated data feed.

Backtesting Functionality

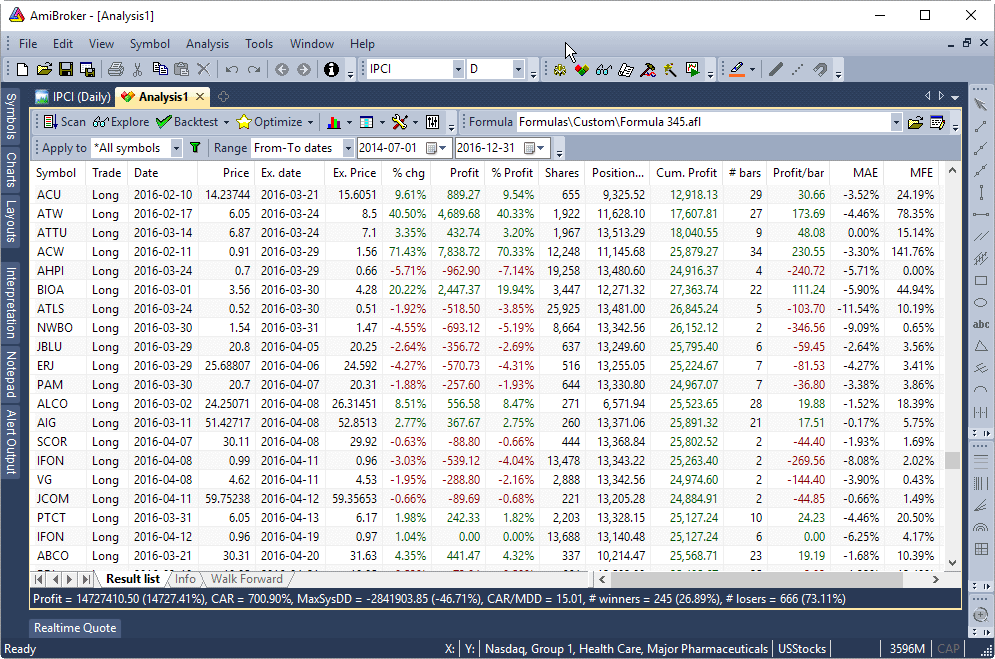

Among all trading platforms reviewed, Amibroker boasts the most advanced backtesting engine. It can backtest complex strategies on thousands of symbols in minutes. Users can also conduct walk-forward testing and Monte Carlo analysis for system validation.

TradingView, however, does not inherently offer backtesting. It mainly allows bar replays on historical data for manual system validation. Custom scripts are available for backtesting but are not part of the native offering.

Verdict – Amibroker leads in backtesting with its robust engine.

Further Reading: Mastering Amibroker: Streamlining Automated Backtesting

Programming Language Adaptability

Amibroker utilizes AFL (Amibroker Formula Language) for creating indicators, scanners, and complete trading systems. AFL’s syntax, similar to C programming, includes numerous prebuilt functions for convenience.

TradingView employs Pine Script for developing indicators and strategies, offering a suite of ready-to-use functions related to technical analysis and charting.

Verdict – Both AFL and Pine Script are potent and user-friendly. Prospective users should review the documentation of both languages and choose based on personal comfort.

Performance and Execution

Performance here refers to the speed of execution and software responsiveness.

As a desktop application, Amibroker has an advantage in performance, with rapid chart loading and backtesting capabilities.

TradingView’s performance, while efficient, is contingent on internet connection speed, as it requires online access.

Verdict – Amibroker takes the lead with its swift functionality and offline accessibility.

Licensing Costs

Both platforms offer free versions for beginners. For access to premium features, however, costs are involved.

Amibroker’s licensing starts at $299, a one-time fee including updates and support. In contrast, TradingView’s Pro plan begins at $14.95 monthly, with no lifetime license option available.

For updated pricing plans, visit:

Verdict – The choice between a one-time fee (Amibroker) or a monthly subscription (TradingView) depends on user preference and needs.

Conclusive Insights

This comparison between Amibroker and TradingView should aid in making an informed decision.

In overall features and pricing, Amibroker rates higher than TradingView. For those focusing on trading system development and backtesting, Amibroker is the recommended choice. If chart analysis and mobile accessibility are primary needs, then TradingView is the ideal option.

Learn more about Amibroker with this comprehensive guide.

One Comment