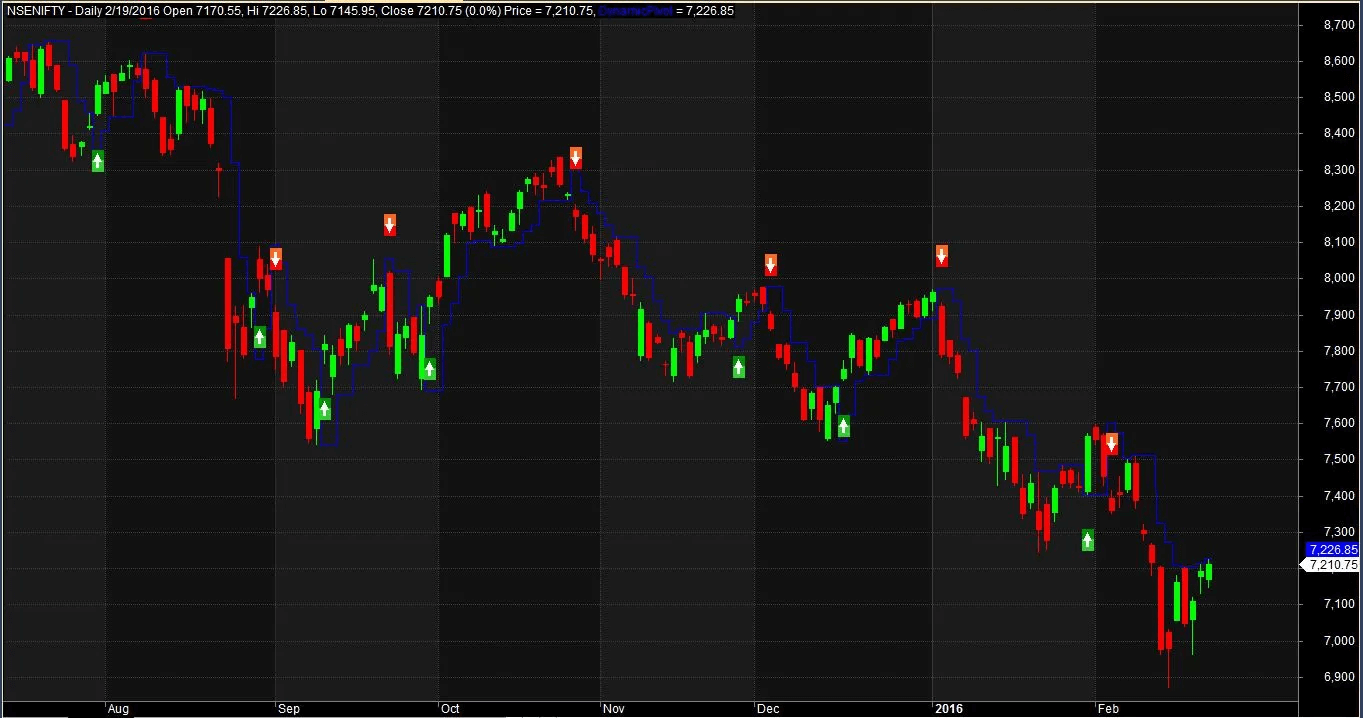

This strategy is designed around a breakout approach, generating buy/sell signals when the price crosses dynamic support/resistance levels. Support/resistance calculations rely on the highest high and lowest low values over a specified lookback period. This strategy performs well in trending markets.

For more on AFL coding and creating your own trading systems, visit this!

- Preferred Timeframe: Daily, Hourly

- Indicators Used: None

- Buy Condition: Price crosses above dynamic resistance.

- Sell Condition: Price crosses below dynamic support.

- Stop Loss: 2%

- Targets: No fixed target, Stop and reverse when AFL gives the opposite signal

- Position Size: 150 (fixed)

- Initial Equity: 200,000

- Brokerage: ₹50 per order

- Margin: 10%

AFL Code

//------------------------------------------------------

// Formula Name: Support Resistance based Trading System

// Website: zerobrokerageclub.com

//-------------------

_SECTION_BEGIN("Dynamic Support Resistance");

SetTradeDelays( 1, 1, 1, 1 );

SetOption( "InitialEquity", 200000);

SetOption("FuturesMode" ,True);

SetOption("MinShares",1);

SetOption("CommissionMode",2);

SetOption("CommissionAmount",50);

SetOption("AccountMargin",10);

SetOption("RefreshWhenCompleted",True);

SetPositionSize(150,spsShares);

SetOption( "AllowPositionShrinking", True );

BuyPrice=Open;

SellPrice=Open;

ShortPrice=Open;

CoverPrice=Open;

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

Plot( Close, "Price", colorWhite, styleCandle );

period=Optimize("Swing",3,1,25,1);

res=HHV(H,period); //resistance

sup=LLV(L,period); //support

DynamicPivot=IIf(ValueWhen(IIf(C>Ref(res,-1),1,IIf(C<Ref(sup,-1),-1,0))!=0,IIf(C>Ref(res,-1),1,IIf(C<Ref(sup,-1),-1,0)),1)==1,sup,res);

//If current close breaks the resistance then dynamic pivot level would be last support, if close breaks the support then dynamic pivot level will be last resistance

Plot(DynamicPivot, "DynamicPivot", colorBlue, styleStaircase);

Buy = Cross(C,DynamicPivot) ;

Sell = Cross(DynamicPivot,C) ;

Short = Sell;

Cover = Buy;

StopLoss=2;

ApplyStop(Type=0,Mode=1,Amount=StopLoss);

/* Plot Buy and Sell Signal Arrows */

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(Cover, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(Cover, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Sell, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Sell, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=40);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=50);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-45);

_SECTION_END();

Read Also: Unlocking Stock Market Profits: Margin Trading Explained

| Parameter | Value |

| NSE Nifty | |

| Initial Capital | 200,000 |

| Final Capital | 1,275,626.60 |

| Backtest Period | 01-Jan-2007 to 19-02-2016 |

| Timeframe | Daily |

| Net Profit % | 537.81% |

| Annual Return % | 22.48% |

| Number of Trades | 243 |

| Winning Trade % | 41.56% |

| Average Holding Period | 8.93 periods |

| Max Consecutive Losses | 6 |

| Max System % Drawdown | -28.78% |

| Max Trade % Drawdown | -60.73% |

Download the detailed backtest report here.

Please note that you can expect even better results if you allow compounding of your returns.

Additional Amibroker settings for backtesting

Go to Symbol → Information, and specify the lot size and margin requirement. Below is a screenshot showing a lot size of 75 and a margin requirement of 10% for NSE Nifty:

Read Also: Boost Your Earnings: 10 Points Daily with NSE Nifty Investment

5 Comments