When it comes to trading, countless indicators and oscillators are utilized, with the number practically being limitless. You can even craft your own custom indicators. However, regardless of the indicators used, the price remains the primary factor in their calculations. This underpins the common assertion that price is the most vital and dependable indicator. Mastering price action paves the way for success. To achieve this, understanding the Principle of Change in Polarity in Trading is crucial. This principle is a cornerstone in technical analysis and many traders base their entire trading livelihood on it. The Principle of Change in Polarity is surprisingly straightforward and easy to comprehend. Yet, it’s essential to first understand the concepts of support and resistance.

Explore More: Top 5 BTST Trading Strategies

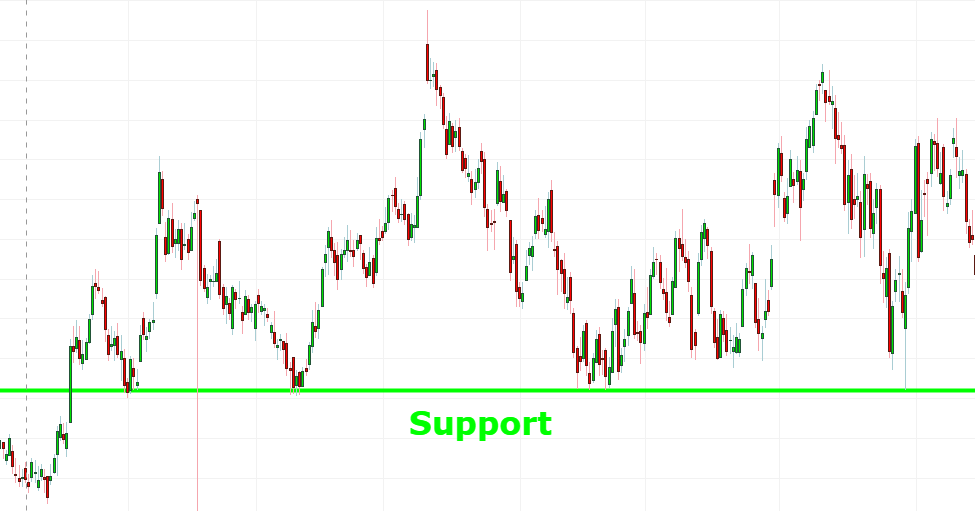

Understanding Support in Trading

In trading, support represents a price level on the chart where buying interest is strong enough to prevent further price decline. As prices near support, buyers become more active, and sellers less so, leading to a demand increase and supply decrease. This dynamic helps maintain prices above the support level. Support in trading acts like a floor, holding up the price.

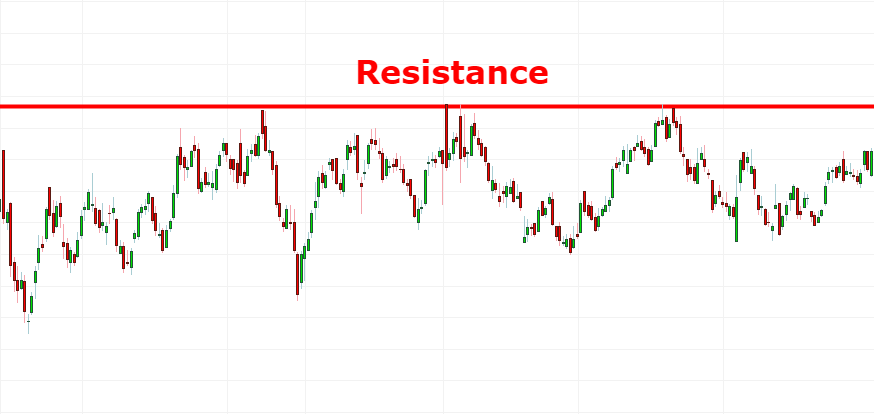

Understanding Resistance in Trading

Resistance in trading is the price zone where selling pressure is sufficient to halt rising prices. As prices approach resistance, sellers become more eager to sell and buyers less so, leading to an increase in supply and a decrease in demand. This prevents prices from exceeding the resistance level. Resistance functions as a ceiling, limiting the price’s upward journey.

Breaking through support or resistance levels in trading isn’t typically straightforward. However, when it does occur, it often results in a significant and continued price movement in that direction.

Further Insight: A Trading System Utilizing Support and Resistance in AFL

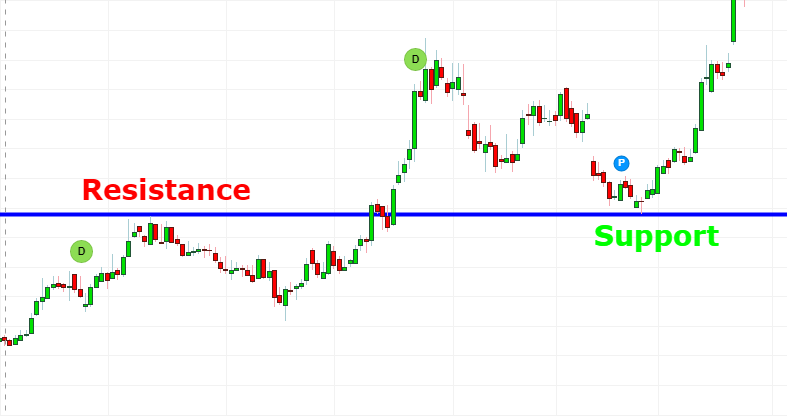

The Principle of Change in Polarity in Trading

The Principle of Change in Polarity in Trading dictates that once support is broken, it transforms into a new resistance level. Conversely, when resistance is overcome, it becomes new support. This principle illustrates how a resistance level, once surpassed, transitions into a support level.

This transformation is attributed to shifts in supply and demand within the market. When resistance is breached, it’s often indicative of a fundamental market shift, with buyers willing to pay higher prices, thus propelling the price beyond its previous resistance.

- When prices retreat to the former resistance (now support), traders recognize its significance. If the market shift is genuine, prices should not fall back into the previous range. This results in buyers stepping in at this level, alongside short-sellers covering their positions, preventing further decline.

- Similarly, when support is breached, it signifies a market change, with buyers waiting for further price drops and sellers willing to accept lower prices. As prices rise back to the former support (now resistance), traders recall its importance. If the change holds, prices shouldn’t exceed this level, leading to selling at these points, hence forming new resistance.

Conclusion

The Principle of Change in Polarity in Trading is a straightforward yet potent concept in technical analysis, easy enough for anyone to grasp, yet mastering it is a different feat. It’s one thing to understand it, but quite another to master it. Once mastered, it often eliminates the need for additional strategies. Wondering how to master it? As Miguel Ruiz succinctly puts it –

“Practice creates the master.”