Last week, we received an inquiry from Mr. X who expressed his interest in entering the Stock Market for trading. Mr. X possesses a fundamental understanding of both technical and fundamental analysis. Moreover, he has demonstrated his trading skills through paper trading with dummy accounts. However, a significant challenge stands in his way – a lack of sufficient capital. As a recent college graduate without any alternative income sources, he has saved a total of 20,000 Rupees. He perceives this amount as insufficient to embark on his trading journey. Mr. X is not alone in facing this dilemma; many individuals, like him, are captivated by the world of stock markets but refrain from participation due to perceived capital inadequacy. Fortunately, nearly every stockbroker and exchange has introduced the concept of ‘Margin Trading’ to address this common issue.

Understanding Margin Trading

Margin trading is a financial concept that enables you to purchase more securities than your available capital would normally allow. It’s akin to obtaining a loan from your broker or exchange. For instance, with a capital of 20,000 Rupees, you can acquire securities valued at 100,000 Rupees.

Eligible Securities for Margin Trading

Margin trading extends to nearly every type of security, including stocks, futures, commodities, and currency. In the cash market, brokers typically provide the margin and charge nominal interest for it. Conversely, in the futures market, the exchange provides the margin, and no interest is levied. It’s important to note that different brokers and exchanges have varying margin policies.

Benefits of Margin Trading

Consider the case of Mr. X. He possesses a 20,000 Rupee capital, which he deems insufficient for trading. However, by engaging in margin trading, he can trade with leverage, sometimes up to ten times the value of his margin, depending on the broker and order type. If he manages to achieve a 2% profit in such a trade, his total profit would amount to 4,000 Rupees (0.02 * 200,000). This constitutes a 20% return on his initial investment, a significantly higher yield compared to trading without margin.

Risks Associated with Margin Trading

Undoubtedly, margin trading carries risks along with its rewards. Since profits and losses are calculated based on the total traded amount, margin trading has the potential to deplete your entire capital. In the aforementioned example, if Mr. X incurs a loss of 5%, his total loss would be 10,000 Rupees (0.05 * 200,000), leaving him with only half of his initial capital. Therefore, implementing a stop-loss and maintaining a favorable risk-reward ratio is crucial. You can explore further insights into risk-reward ratios in our article on the topic: Risk Reward Ratio.

Calculating Margin for Different Instruments

Every broker offers a span margin calculator tool on their website. Below is the link to Zerodha’s calculator:

https://zerodha.com/margin-calculator/SPAN/

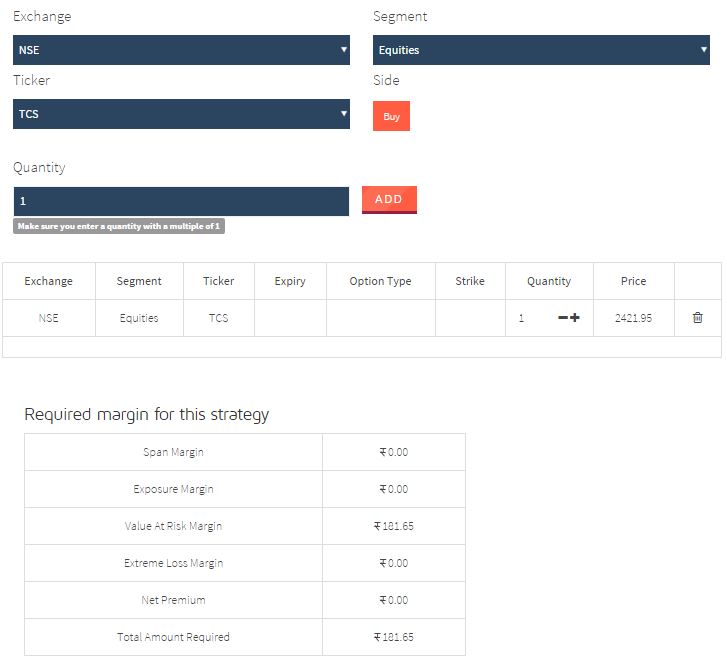

Here is a snapshot of the margin calculator for reference. You can observe that to purchase a single share of TCS, a margin of 181.65 Rupees is required. At the time of composing this article, the actual price of TCS stands at 2,421.95 Rupees. Thus, the margin requirement for TCS is 7.5%. This margin percentage varies across different instruments. You can verify these details on the provided link.

Margin Requirements for Futures

Each futures instrument is subject to distinct margin requirements determined by the exchange. Here is a sample of margin requirements for different futures instruments:

| Instrument | Lot Size | Closing Price | Margin Required | Total Underlying Value | Margin % |

| NIFTY | 75 | 7,393.45 | 44,364.26 | 554,508.75 | 8% |

| BANKNIFTY | 30 | 15,072.3 | 36,174.57 | 452,169 | 8% |

| CRUDE OIL | 100 | 2,157 | 28,582 | 215,700 | 13% |

| GOLD | 100 | 27,524 | 137,620 | 2,752,400 | 5% |

| USD-INR | 1000 | 68.17 | 1,636.84 | 68,170 | 2% |

Understanding Margin Calls

A margin call is a demand from your broker to deposit additional funds or securities into your margin account to meet the minimum maintenance margin requirement. This demand is issued when you incur unrealized losses, typically equivalent to 80% of your trading capital. Some brokers opt to automatically close your open positions rather than issuing a margin call.

Final Recommendations Before Embarking on Margin Trading

Margin trading is a valuable feature, but it must be approached with prudence. Implementing a stop loss is essential to prevent margin calls. Furthermore, the amount traded should not exceed 50% of your total trading capital. Engaging in margin trading with effective risk management can undoubtedly provide an advantage in your trading endeavors.

2 Comments