Unlocking Wealth with Dividends in Stock Markets

For sustainable wealth growth in the stock market, Dividends are crucial. Yet, many new investors tend to overlook their potential returns. This article will guide you through the benefits of investing in dividend-paying stocks and how to maximize your capital’s potential.

What Are Dividends?

Dividends are a portion of profits that companies distribute to their shareholders. Typically, they’re given as a set amount per share, or occasionally as a percentage of the face value.

For instance, if a company decides to distribute a yearly dividend of $12.5 per share, a shareholder with 1000 shares would receive $12,500 in total.

The term Dividend Yield refers to the dividend amount expressed as a percentage of the stock’s price.

The amount of dividends can vary annually and is at the company’s discretion. Sometimes, a company might pay dividends even when its annual profits are low, depending on its cash reserves.

Why Companies Distribute Dividends

There are several reasons why companies choose to pay dividends to shareholders:

- To express gratitude to shareholders and encourage long-term investment in the company.

- To enhance their reputation in the market. Companies paying regular dividends are often seen as financially stable.

- Because once started, it’s challenging to stop. Though there’s no legal obligation, discontinuing dividends might suggest financial troubles, possibly leading to a stock price decline.

Related Reading: Understanding 8 Common Stock Market Jargons

The Dividend Payout Cycle

The dividend payout process includes four key events:

- Dividend Declaration Date: During the annual general meeting (AGM), the board of directors declares the dividend amount and payment date.

- Ex-Dividend Date: This date determines eligibility for the dividend. Shareholders owning the stock on or before this date qualify for the dividend.

- Record Date: Two days after the ex-dividend date, this is when the final list of eligible shareholders is compiled.

- Dividend Payout Date: The date when dividends are actually paid to shareholders.

Eligibility for Receiving Dividend Payouts

Contrary to popular belief, one does not need to hold the company’s shares for an entire year to earn dividends.

To be eligible for dividends, you simply need to purchase the shares before the specified “Ex-Dividend Date.” For example, if the Ex-Dividend Date is August 15, buying 1000 shares on August 14 ensures eligibility for the dividend payout.

Impact of Dividends on Stock Prices

On the ex-dividend date, the stock price typically drops by about the dividend amount, reflecting the outflow of funds from the company’s reserves.

Conversely, the stock price often rises by the dividend amount on the announcement date, balancing out the overall impact.

Note that buying puts or selling calls to capitalize on the dividend-induced price drop isn’t feasible. Option contracts’ intrinsic value is adjusted on the dividend announcement date.

Further Reading: Top 5 Technical Analysis Books for Traders

Visualizing Dividend Income

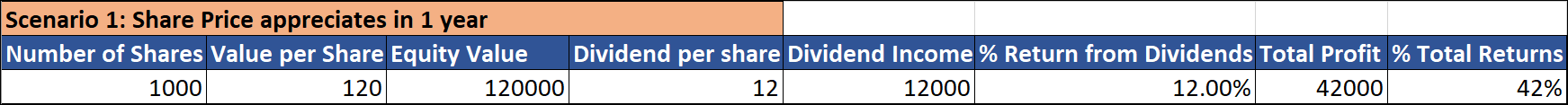

Consider the following scenario to understand potential returns from dividends:

Imagine investing in a stock before the Ex-Dividend date. The share price is $100, and you purchase 1000 shares. With a dividend per share of $10, your dividend income amounts to $10,000, yielding a 10% return on your capital.

If you stay invested for a year and the stock price appreciates by 20% with the dividend yield rising to $12, your total profit percentage combines stock price gains and dividend income, totaling a 42% net return.

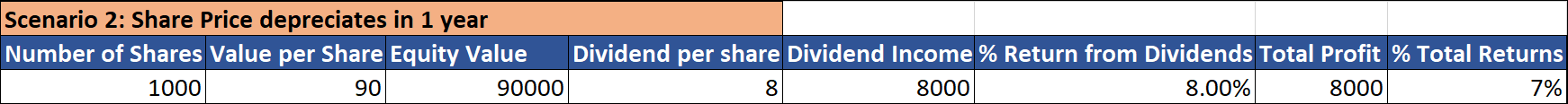

Even if the stock price drops to $90 and the dividend yield decreases to $8 over a year, you’d still realize a 7% net profit, as illustrated below:

Even if the stock price drops to $90 and the dividend yield decreases to $8 over a year, you’d still realize a 7% net profit, as illustrated below:

Identifying the Best Dividend-Paying Stocks

There’s no foolproof method to pinpoint the top dividend-paying stocks, and their payout is subject to the company’s decision. Insider knowledge would be needed to predict exact dividend amounts.

However, we’ve compiled a checklist to help identify stocks likely to offer substantial and consistent dividends:

- The company’s profitability has been on the rise for the last five years.

- There’s been a consistent growth in EPS (Earnings Per Share) over the last five years.

- Dividend per share has also shown growth over the same period.

- The growth rate of EPS aligns with that of the dividend per share.

Stocks meeting these criteria are promising candidates for dividend income investment.

Closing Thoughts on Dividend Investing

While dividend income is not a ‘get rich quick’ scheme, it’s a reliable way to build long-term wealth in the stock market. It’s advisable to invest in reputable dividend-paying stocks instead of placing your capital in bank deposits.

While predicting stock appreciation is challenging, dividend income offers a more rational and predictable return.