Enhancing Stock Market Success with Trend Analysis

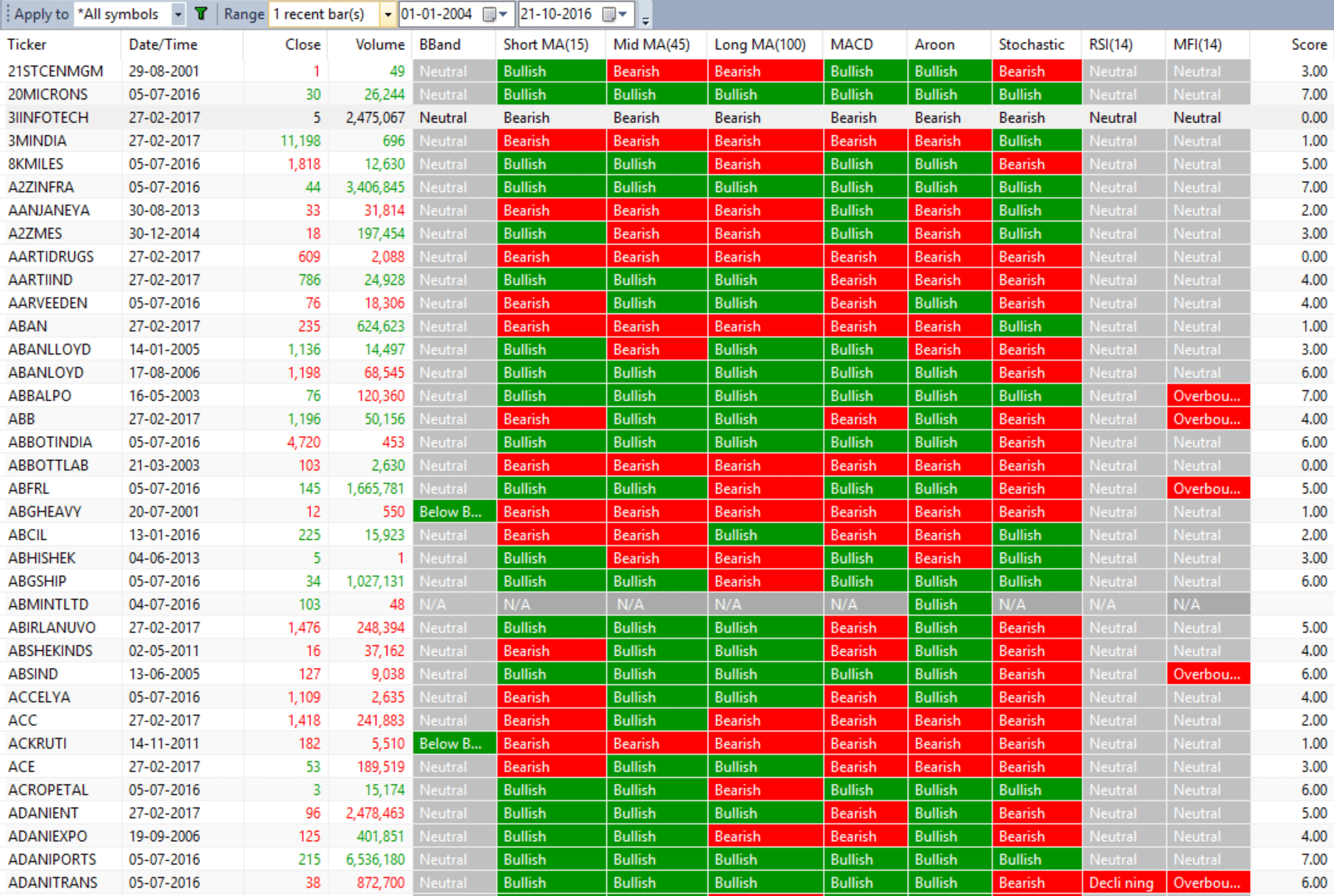

One of the most effective strategies for long-term success in the stock market is identifying and riding market trends. The foundation of this approach rests on the assumption that trends persist over a substantial timeframe. However, manually sifting through numerous stocks to pinpoint the trending ones can be a daunting task. The Amibroker exploration AFL for Trending stocks screener is designed to simplify this process. It systematically scans through your entire stock database and assigns a trend score to each stock. A trend score exceeding 5 signals an upward trend, while a score below 2 indicates a downward trend. Scores ranging from 2 to 5 reflect a state of uncertainty, suggesting caution when considering these stocks.

If you’re interested in learning AFL coding and crafting your trading systems, you can click here to explore more.

A Detailed Look at the Trending Stocks Screener – AFL

| Parameter | Value |

| Preferred Time-frame | Daily |

| Indicators Used | Simple Moving Average, Bollinger Bands, MACD, Aroon Indicator, Stochastic Indicator, RSI, MFI |

| Conditions Indicative of a Bullish Trend |

|

| Conditions Indicative of a Bearish Trend |

|

| Trend Score Calculation | The initial Trend Score is zero. One point is added for each met Bullish condition. If no Bullish conditions are met, the Trend score remains at 0. A score of 7 indicates that all Bullish conditions are met. |

Trending Stocks Screener – AFL Code

//------------------------------------------------------

//

// Formula Name: Trending Stocks Screener

// Website: https://zerobrokerageclub.com/

//------------------------------------------------------

_SECTION_BEGIN("Trending Stocks Screener");

i=0;

//52 Week High Low

High52 = HHV(High,250);

Low52 = LLV(Low,250);

//Bollinger Band

BB1=C>BBandTop(C,20,2) AND Ref(C,-1)<Ref(BBandTop(C,20,2),-1);

BB2=C<BBandBot(C,20,2) AND Ref(C,-1)>Ref(BBandBot(C,20,2),-1);

BBStatus=WriteIf(BB1,"Above Top",WriteIf(BB2,"Below Bottom",WriteIf(IsNull(MA(C,20)),"N/A","Neutral")));

BBColor=IIf(BB1,colorRed,IIf(BB2,colorGreen,colorLightGrey));

IIf(BB2,i+1,i);

//Moving Average (Short, Mid & Long Term)

MAShort = C>MA(C,15);

IIf(MAShort,i+1,i);

MAMid = C>MA(C,45);

IIf(MAMid,i+1,i);

MALong = C>MA(C,100);

IIf(MALong,i+1,i);

ShortStatus = WriteIf(MAShort,"Bullish",WriteIf(IsNull(MA(C,15)) ,"N/A","Bearish"));

ShortColor = IIf(MAShort,colorGreen,colorRed);

MidStatus = WriteIf(MAMid,"Bullish",WriteIf(IsNull(MA(C,45))," N/A","Bearish"));

MidColor = IIf(MAMid,colorGreen,colorRed);

LongStatus = WriteIf(MALong,"Bullish",WriteIf(IsNull(MA(C,100)) ,"N/A","Bearish"));

LongColor = IIf(MALong,colorGreen,colorRed);

//MACD

MACDBull=MACD(12,26)>Signal(12,26,9);

IIf(MACDBull,i+1,i);

MACDStatus=WriteIf(MACDBull,"Bullish",WriteIf(IsNull(MACD(12,26)),"N/A","Bearish"));

MACDColor=IIf(MACDBull,colorGreen,colorRed);

//Aroon

Period=14;

LLVBarsSince=LLVBars(L,Period)+1;

HHVBarsSince=HHVBars(H,Period)+1;

AroonDown=100*(Period-LLVBarsSince)/(Period-1);

AroonUp=100*(Period-HHVBarsSince)/(Period-1);

AroonOsc=AroonUp-AroonDown;

Aroon=AroonOsc>0;

IIf(Aroon,i+1,i);

AroonStatus=WriteIf(Aroon,"Bullish",WriteIf(IsNull (RSI(14)),"N/A","Bearish"));

AroonColor=IIf(Aroon,colorGreen,IIf(IsNull(RSI(14) ),colorLightGrey,colorRed));

//Stochastic

StochKBull=StochK(14,3)>StochD(14,3,3);

IIf(StochKBull,i+1,i);

StochKStatus=WriteIf(StochKBull,"Bullish",WriteIf( IsNull(StochK(14,3)),"N/A","Bearish"));

StochKColor=IIf(StochKBull,colorGreen,colorRed);

//RSI

R1=RSI(14)>30 AND Ref(RSI(14),-1)<30 AND Ref(RSI(14),-2)<30;

R2=RSI(14)<70 AND Ref(RSI(14),-1)>70 AND Ref(RSI(14),-2)>70;

IIf(R1,i+1,i);

RSIStatus=WriteIf(R1,"Improving",WriteIf(R2,"Decli ning",WriteIf(IsNull(RSI(14)),"N/A","Neutral")));

RSIColor=IIf(R1,colorGreen,IIf(R2,colorRed,colorLightGrey));

//MFI

M1=MFI(14)>80;

M2=MFI(14)<20;

IIf(M2,i+1,i);

MFIStatus=WriteIf(M1,"Overbought",WriteIf(M2,"Over sold",WriteIf(IsNull(MFI(14)),"N/A","Neutral")));

MFIColor=IIf(M1,colorRed,IIf(M2,colorGreen,colorLightGrey));

TrendScore =

IIf(BB2,1,0)+

IIf(MAShort,1,0)+

IIf(MAMid,1,0) +

IIf(MAMid,1,0) +

IIf(MALong,1,0)+

IIf(MACDBull,1,0) +

IIf(Aroon,1,0) +

IIf(StochKBull,1,0)+

IIf(R1,1,0) +

IIf(M2,1,0) ;

Filter = 1;

//AddColumn(High52,"52 Week High");

//AddColumn(Low52,"52 Week Low");

AddColumn(C,"Close",1,IIf(C>Ref(C,-1),colorGreen,colorRed));

AddColumn(V,"Volume",1,IIf(V>Ref(V,-1),colorGreen,colorRed));

AddTextColumn(BBStatus,"BBand",1,colorWhite,BBColor);

AddTextColumn(ShortStatus,"Short MA(15)",1,colorWhite,ShortColor);

AddTextColumn(MidStatus,"Mid MA(45)",1,colorWhite,MidColor);

AddTextColumn(LongStatus,"Long MA(100)",1,colorWhite,LongColor);

AddTextColumn(MACDStatus,"MACD",1,colorWhite,MACDColor);

AddTextColumn(AroonStatus,"Aroon",1,colorWhite,AroonColor);

AddTextColumn(StochKStatus,"Stochastic",1,colorWhite,StochKColor);

AddTextColumn(RSIStatus,"RSI(14)",1,colorWhite,RSIColor);

AddTextColumn(MFIStatus,"MFI(14)",1,colorWhite,MFIColor);

AddColumn(TrendScore,"Score");

_SECTION_END();

Exploration Screenshot

How to Utilize the Trending Stocks Screener

Step 1: Begin by copying the provided AFL code and configuring it within your local Amibroker.

Step 2: Download and set up end-of-day (EOD) data for your preferred exchange.

Step 3: Access the ‘Analysis’ menu and select ‘Explore.’ In the range drop-down menu, opt for ‘1 recent bar.’

Step 4: In the results, you’ll find the Trend score for each scrip. A score greater than 5 indicates bullish stocks, while a score less than 2 suggests bearish stocks.

One Comment