In the world of SaaS-based algorithmic trading, two platforms really stand out: Tradetron and Streak. This article aims to give you a detailed comparison of these two platforms, focusing on aspects that matter to those diving into algo trading. Let’s get into the details of Tradetron vs Streak.

Discovering Tradetron

Tradetron is a leader in India’s automated algorithmic trading scene. It offers an easy, web-based way to make, test, and use your trading strategies. These strategies can be set to run automatically on over 50 brokers in India and the US.

Tradetron also has a strategy marketplace where you can find and use strategies made by other traders. It’s all just a few clicks away.

For more about Tradetron, read our full review here.

Website: https://www.tradetron.tech/

Type: Web-based

Cost: Free for paper trading, plans start at INR 300 for India, $50 for US. Latest pricing here.

Special Features: Advanced technology, easy strategy creation, strategy marketplace, API integrations, supports multiple exchanges and countries

Supported Languages: Built-in language, can integrate with Python, AFL, or MQL

Getting Started: Watch how-to videos here.

Start with Tradetron by clicking this link.

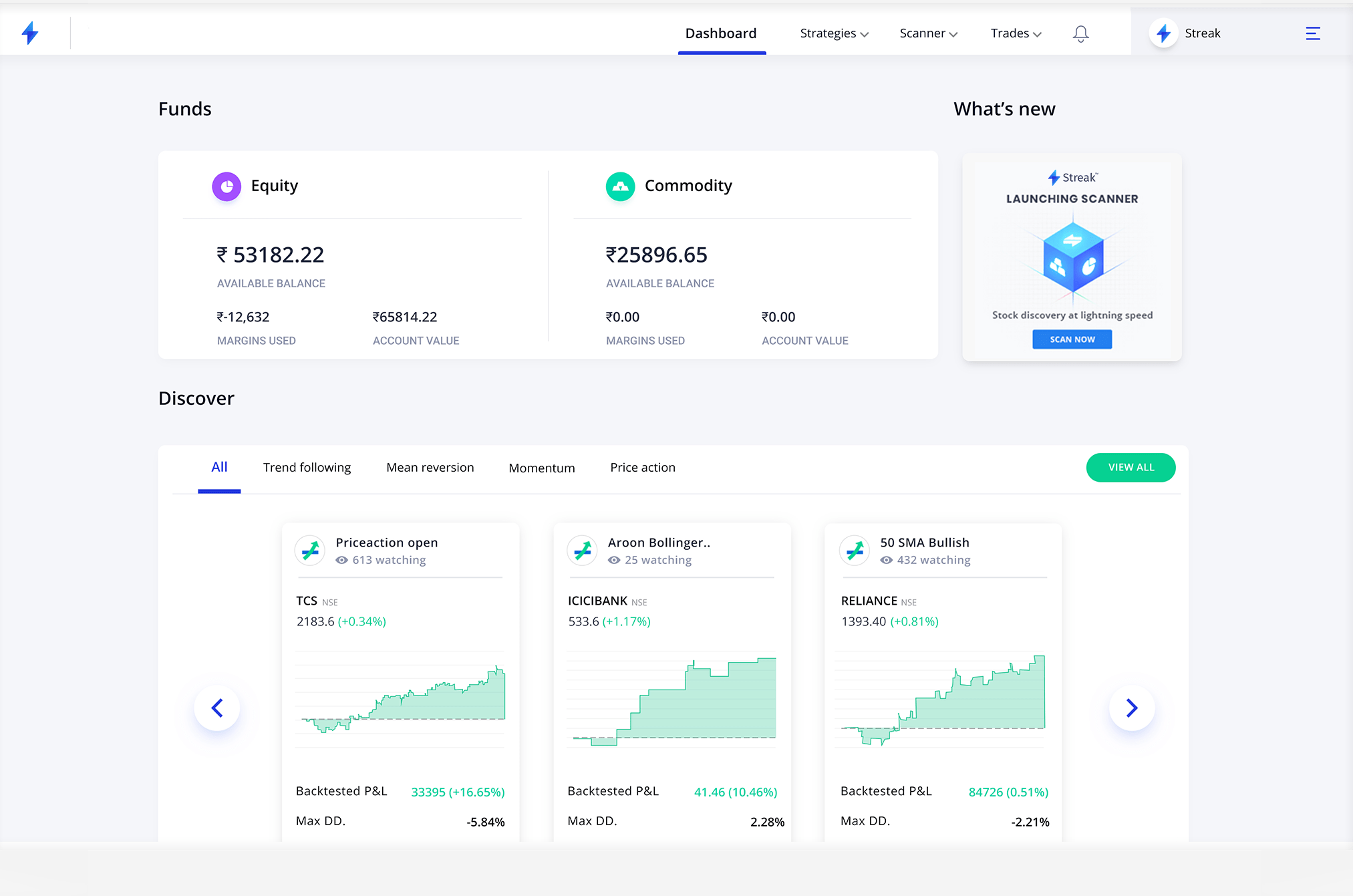

Exploring Streak

Streak, initially tied to Zerodha, is known for its simplicity in web-based algo trading.

Streak lets you create and deploy strategies based on technical analysis, backtest them, and use custom scanners to spot trading opportunities.

For a full review of Streak and other automated platforms, click here.

Website: https://www.streak.tech/

Type: Web-based

Cost: Starts at INR 690/month, 7-day free trial for new users. Latest pricing here.

Special Features: User-friendly, Scanner tool, Low cost

Supported Languages: Built-in language for strategy creation

Getting Started: Learn more at their Help portal.

Tradetron vs Streak – Feature Comparison

Now, let’s compare Tradetron and Streak on key features:

What Tradetron Offers but Streak Doesn’t

- Automate trading with over 50 brokers

- Create strategies using 100+ keywords and option Greeks

- Set specific price execution logic

- Reactivate strategies after exit

- Handle rollover on expiry

- List your strategy for others to subscribe

- Trade in international markets and cryptocurrencies

- Connect with other platforms via API

What Streak Offers but Tradetron Doesn’t

- Create scanners with technical indicators

- Quick backtesting

- Up to 300 backtests per day on starter plan

- Strong technical support

- Fewer errors due to no automation

Our Final Thoughts

Based on these features, Tradetron seems to offer more than Streak, especially with its pricing. While Tradetron excels in many areas, it does miss a scanner and has slower backtesting compared to Streak.

We hope this comparison of Tradetron vs Streak guides you in making an informed decision for your trading needs.