Value investing ranks as the foremost approach in equity investing. This approach catapulted Warren Buffet to the pinnacle of wealth. Besides him, luminaries like Benjamin Graham, David Dodd, William J. Ruane, Irving Kahn, Walter Schloss, and Charlie Munger achieved monumental success through Value Investing. This strategy has also enabled numerous retail investors to accumulate wealth. This article will delve into value investing fundamentals and its potential to generate stock market profits.

Understanding Value Investing

Benjamin Graham and David Dodd originated the value investing concept in 1934, later popularized by Graham’s 1949 book, The Intelligent Investor. Warren Buffet, too, was a disciple of Graham. Value investors rely on comprehensive fundamental analysis to pinpoint stocks with profit potential, involving a deep dive into a company’s various fundamental aspects to determine its true worth.

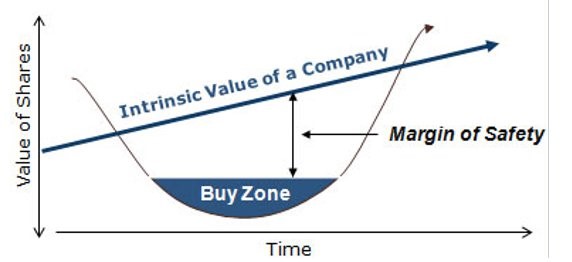

Value investing’s principle is straightforward. If you ascertain the genuine worth of something and procure it at a lower cost, you’ve secured a lucrative deal. Value investing mirrors this approach. It involves identifying companies’ true worth through fundamental analysis and investing in those whose stock prices are below their intrinsic value.

This means scouting for stocks trading below their intrinsic value, to later sell at a higher price when the market acknowledges their true value. For instance, if your analysis pegs a company’s intrinsic value at $50 per share, but it’s trading at $35, this stock presents a promising investment opportunity.

Value investors seek out stocks that, in their view, the market has underrated, betting on the market to eventually rectify this undervaluation. These investors are akin to shrewd bargain hunters, always looking for discounted deals.

More insights: Mastering Earnings Season Strategies: 10 Proven Tips for Success

Determining Intrinsic Value

While value investing may seem straightforward, its effectiveness hinges on accurately gauging a company’s intrinsic value. There’s no universal method for calculating a stock’s fair value. Investors employ a mix of quantitative and qualitative evaluations, like financial statements, cash flow, P/B ratio, P/E ratio, business models, management efficacy, and market conditions, to estimate intrinsic value and compare it against the market price for potential bargains.

Investors often factor in a margin of safety in their assessments. This means only considering stocks with a substantial gap between market price and intrinsic value, offering a buffer against analytical or calculative errors and mitigating downside risks. For instance, Benjamin Graham advised purchasing stocks priced at two-thirds or less of their calculated intrinsic value.

Further reading: Five Short Term Investment Schemes with the Best Yields

Conclusion

Value Investing is effective, proven by successful investors and various studies showing its long-term market-beating potential. However, mastering value investing is challenging. It demands the courage to go against the market tide, buying when others sell and vice versa. Additionally, it requires ample knowledge, practice, dedication, and patience.

One Comment