Market experts have long embraced Covered Call Options to elevate their market gains. It’s time for individual investors to join the bandwagon. By grasping the essentials of this covered call strategy, you can smartly enhance your earnings at the opportune moments.

Let’s dive into the concept of Covered Call Options. We’ll show you how this strategy can be a game-changer in reducing risks and amplifying returns in your portfolio.

Recommended Reading: Jade Lizard Option Strategy – A Hidden Gem for Options Traders?

Demystifying Covered Call Options

In the world of stock trading, a call option is your golden ticket. It grants you the power to buy stocks at a pre-agreed price before the deal expires. It’s like having a secret key, but you don’t always have to use it.

When we talk about ‘covered’ in Covered Call Options, it simply means the seller owns the stock already. If you’ve got the stock, your option is covered – as straightforward as that.

Imagine having a treasure chest of stocks. You can sell them at market price anytime. Issuing a Covered Call Option means you’re handing over this selling privilege to another investor. In exchange, you pocket a fixed premium. The buyer, in this case, earns the chance to buy your stocks at a fixed price before time runs out.

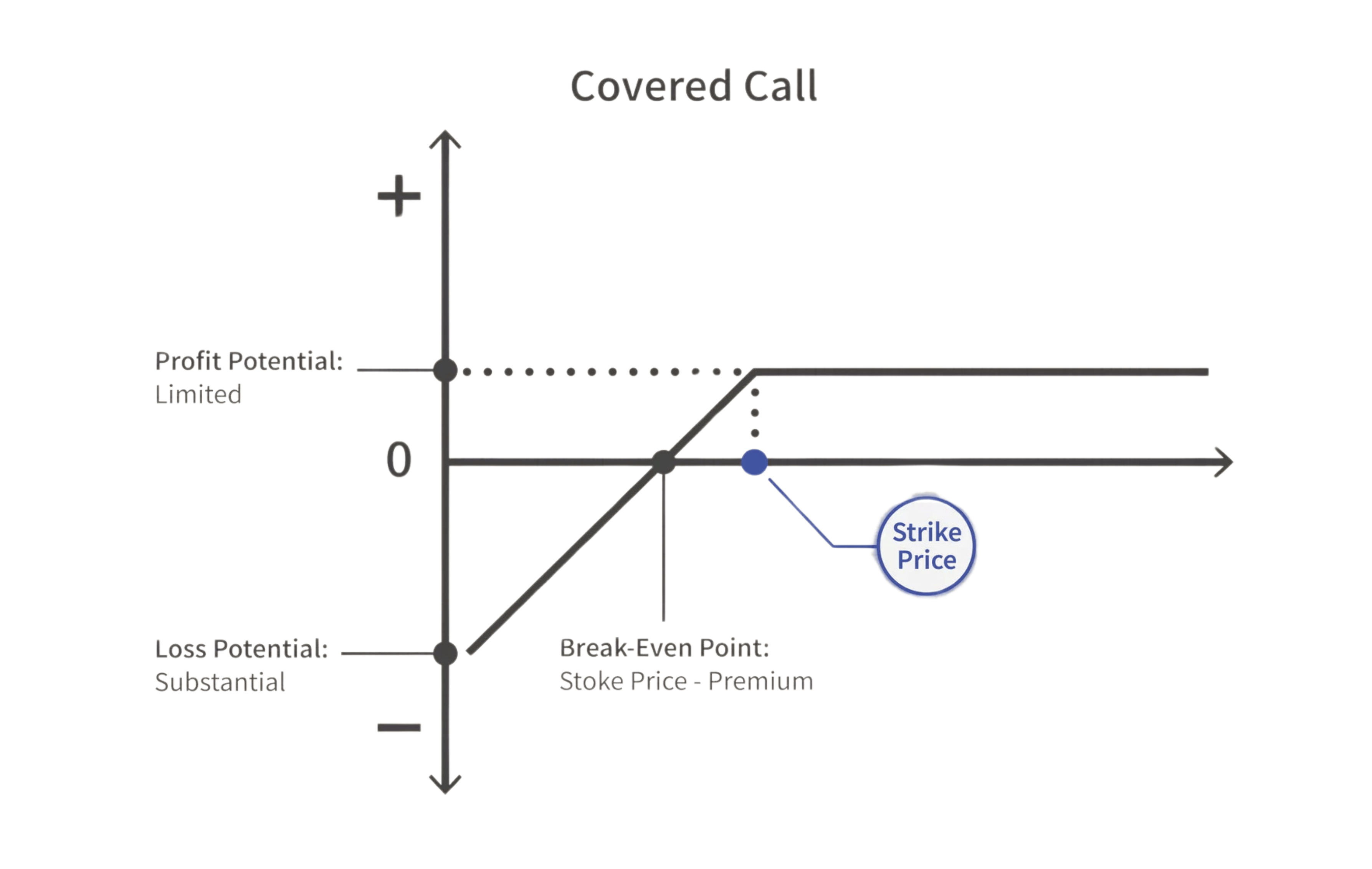

Here’s a visual treat from Investopedia, showing you the payoff graph of this strategy:

How Covered Call Options Work Their Magic

How Covered Call Options Work Their Magic

This strategy is like a financial two-step dance. First, you own stocks, and then, you sell Covered Call Options on them. What’s great is the extra cash you get as a premium, yours to keep, no matter the market’s mood.

Known for its low-risk appeal, the Covered Call Option is a favorite among traders looking to squeeze out more from their investments. Most brokerages give the green light for selling these options, even in basic trading accounts.

Here’s how you do it:

- Stock Shopping – Your journey starts with buying stocks. Be a detective here – analyze and pick wisely. Tools like a covered call stock screener can be your guide. The best picks are usually stable stocks that don’t go on rollercoaster rides.

- Selling the Dream – Once you’ve bagged the stocks, it’s time to sell Covered Call Options on them. The buyer gives you a premium for the opportunity to buy your stocks at a set price before the deadline. A quick tip: a covered call screener can be your ally in choosing which options to sell.

I see the Covered Call Option as a potential cash cow for traders, but there’s a catch. You might have to part with your stocks. So, think twice before you put your precious shares on the line, especially if they’re long-term keepsakes.

Even if things go south, your losses are cushioned by the premium you received and the fact that your option was covered. That’s a safer bet compared to other high-stakes options that can lead to unlimited losses.

While this strategy shields you from major downfalls, it also caps your winning streaks. The trade-off? You get to keep issuing Covered Call Options on the same stocks, raking in premiums, as long as the buyer keeps their hands off the ‘buy’ button.

Further Reading: Diverse Options in Derivatives Trading: A Closer Look

The Ups and Downs of Covered Call Options

The perks of selling Covered Call Options often outshine the risks. It’s a smarter move for budding investors compared to just sitting on stocks. Here’s why:

Earning Extra Bucks

When you sell a Covered Call Option, the buyer hands you a premium, a surefire income that’s yours no matter how the stocks perform. For traders hungry for more, a covered call option screener can be your secret weapon to stay ahead.

Setting Your Price Goals

Dreaming of a higher selling price for your stock? Covered Call Options can make that dream a reality, letting you aim above the market value. A covered call stock screener guides you to set ambitious yet achievable targets.

Risk? What Risk?

Imagine the worst – your stocks hit rock bottom. Even then, Covered Call Options keep your losses in check, unlike other high-risk strategies that can open a Pandora’s box of endless losses.

Of course, there are flip sides to consider. Here’s what you need to watch out for:

Cap on the Celebrations

The money you make from selling the option, plus the price difference of your stocks, is your profit ceiling. Your gains won’t soar even if the stock prices do, post the strike rate.

Holding On Longer

Life’s unpredictable. Sometimes, you need to let go of investments in a snap. But with Covered Call Options, you’re in it till the option expires. This might mean holding onto your stocks longer than you planned.

Tax Tales

Another hiccup? Taxes on your capital gains. These can vary and affect your overall game plan with Covered Call Options.

Also Read: Tackling Shiny Penny Syndrome in Stock Markets

Crucial Tips for the Individual Investor

Before you dive headfirst into options trading with Covered Call Options, pause and ponder over a few critical questions. It’s essential to gauge if you’re truly ready for this. A covered call option screener can offer insights into various securities and their potential.

Stock Ownership: Are You Ready for the Ride?

The cornerstone of the Covered Call Option strategy is the stock you own. A dip in stock prices can hit your wallet. Aim for quality stocks you’d gladly keep for the long haul.

The Decision to Sell: Are You Up for It?

Remember, with Covered Call Options, you’re bound to sell your stock at the strike price within a set period. Mull over this, especially if those stocks are close to your heart or have been in your portfolio for ages. Emotional ties and hefty tax bills on high-value stocks are real considerations.

Satisfaction with Fixed Returns: Is It Enough?

Some call options promise higher fixed returns, while others might not be as lucrative. Using a covered call screener can help you forecast profits and align them with your personal investment goals.

Selling Covered Call Options is a solid strategy for long-haul investors looking for that extra income boost. Choosing the right stocks and the ideal strike prices, with the help of a covered call option screener, is crucial for success.

So, if you’re ready to step into the world of options trading, starting with Covered Call Strategy is a wise and safe bet. But bear in mind, this isn’t everyone’s cup of tea. Using a covered call stock screener to assess your risk tolerance is a smart move before making any final decisions.

2 Comments