Introducing the High Momentum Identifier Amibroker AFL Code

Explore the High Momentum Identifier Amibroker AFL Code, a tool designed to pinpoint periods of high momentum in your preferred stocks, aiding your trading decisions. This valuable AFL code is freely available for download and easy integration with Amibroker.

Understanding High Momentum Stocks

High momentum stocks, characterized by notable upward price movement in a short timeframe, are critical in stock trading and investing, often reflecting robust investor interest and positive market sentiment.

These stocks typically exhibit solid fundamentals, encouraging earnings reports, and favorable news, contributing to their rising stock prices. Identified through technical analysis, including moving averages, relative strength index (RSI), and rate of change, these stocks are prime targets for momentum traders focusing on short-term trends with high potential for continued appreciation.

However, high momentum stocks come with their risks, including possible sudden price reversals. Traders must exercise caution, employ stop-loss orders to mitigate losses, and be wary of potential overvaluation leading to price corrections.

Overall, while high momentum stocks offer substantial return possibilities, it’s crucial to balance the potential rewards with the inherent risks in trading decisions.

Recommended Read: Mastering Volume Spread Analysis with AFL Code

High Momentum Identifier Amibroker AFL

//High Momentum Stock Identifier

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

Plot( Close, "Price", colorWhite, styleCandle );

// Set the period over which to calculate momentum

period = Param("Period", 20, 1, 100, 1);

// Calculate the rate of change over the specified period

rate_of_change = ROC(Close, period);

// Define a buy signal when the current rate of change is greater than the previous rate of change and the current volume is greater than the average volume over the past 20 periods

buy = rate_of_change > Ref(rate_of_change, -1) AND Volume > MA(Volume, 20) AND EMA(Close, 50) > EMA(Close, 200);

// Plot signals

PlotShapes(IIf(buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-40);

PlotShapes(IIf(buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-50);

PlotShapes(IIf(buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-45);

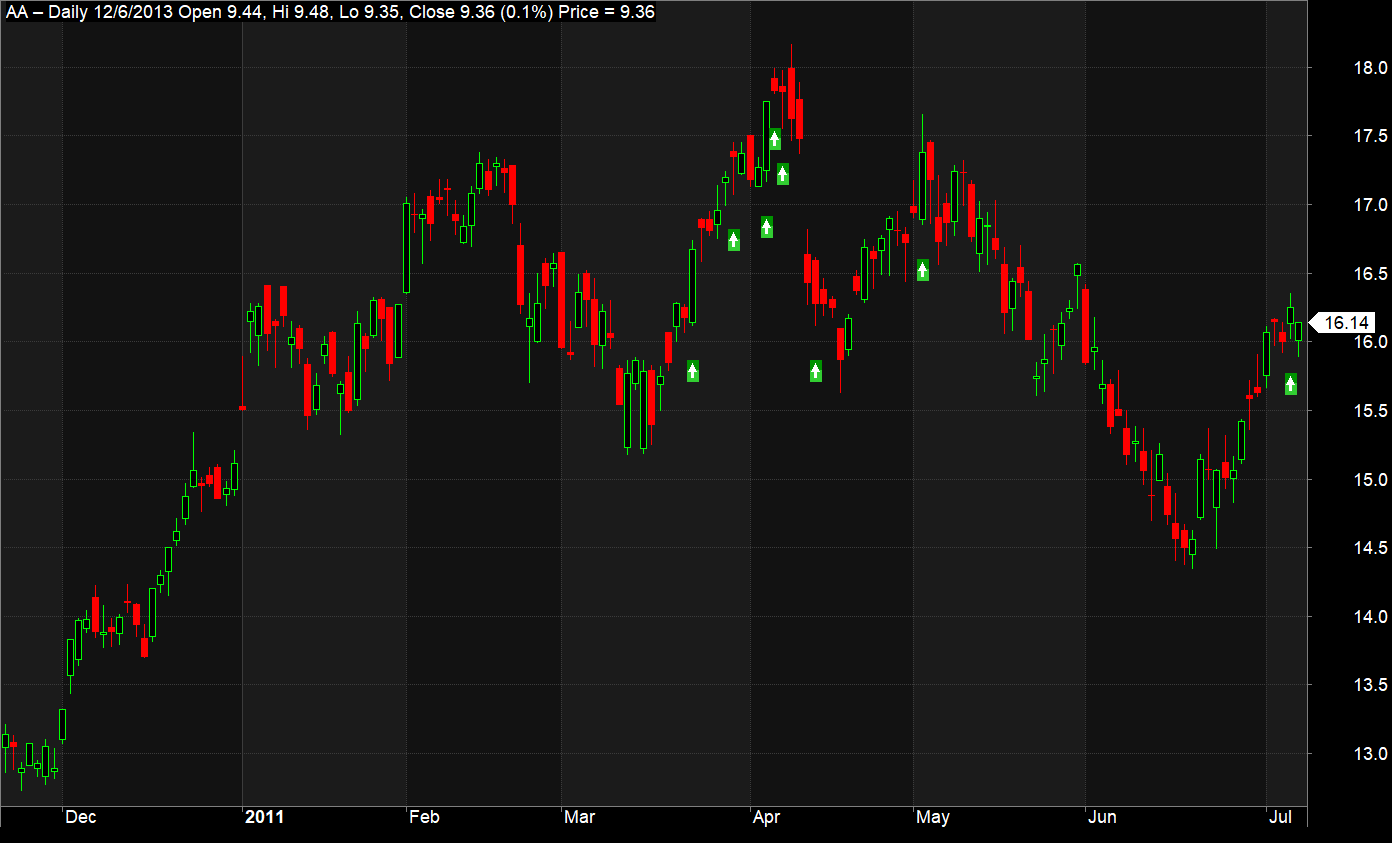

Preview of the High Momentum Identifier AFL in Action

Take a look at this AFL in action:

How the High Momentum Identifier AFL Works

The code evaluates the rate of change over a chosen period, comparing the current rate to the previous one. A buy signal emerges when the current rate exceeds the previous and when the current volume surpasses the average volume of the last 20 periods.

Beyond momentum, the code assesses trend direction by contrasting the 50-period EMA with the 200-period EMA.

Remember, this is an example AFL. It might require customization or optimization to align with specific trading strategies and market conditions.

Additional Read: Understanding the Percentage Price Oscillator with AFL Code