Investing in real estate for steady rental income has always been appealing. Who wouldn’t want a monthly 1-2% return plus the appreciation of the asset? But there’s more to explore in the world of investments.

Did you know the stock market offers a similar opportunity? Yes, you can “rent” out your stocks for consistent monthly earnings, much like real estate.

This lucrative opportunity comes through the covered call options strategy.

In this guide, we’ll juxtapose Rental Income with the Covered Call Strategy. By the end, you’ll understand which investment method aligns best with your goals.

Understanding the Basics: Rental Income vs Covered Call

Let’s break down the covered call method. You buy a stock at price “X”, and then agree to sell it at a higher price “Y” later, receiving a fee for this agreement.

This fee essentially is your ‘rent’ from stocks. As long as the stock price hovers between X and Y, your regular income keeps flowing in.

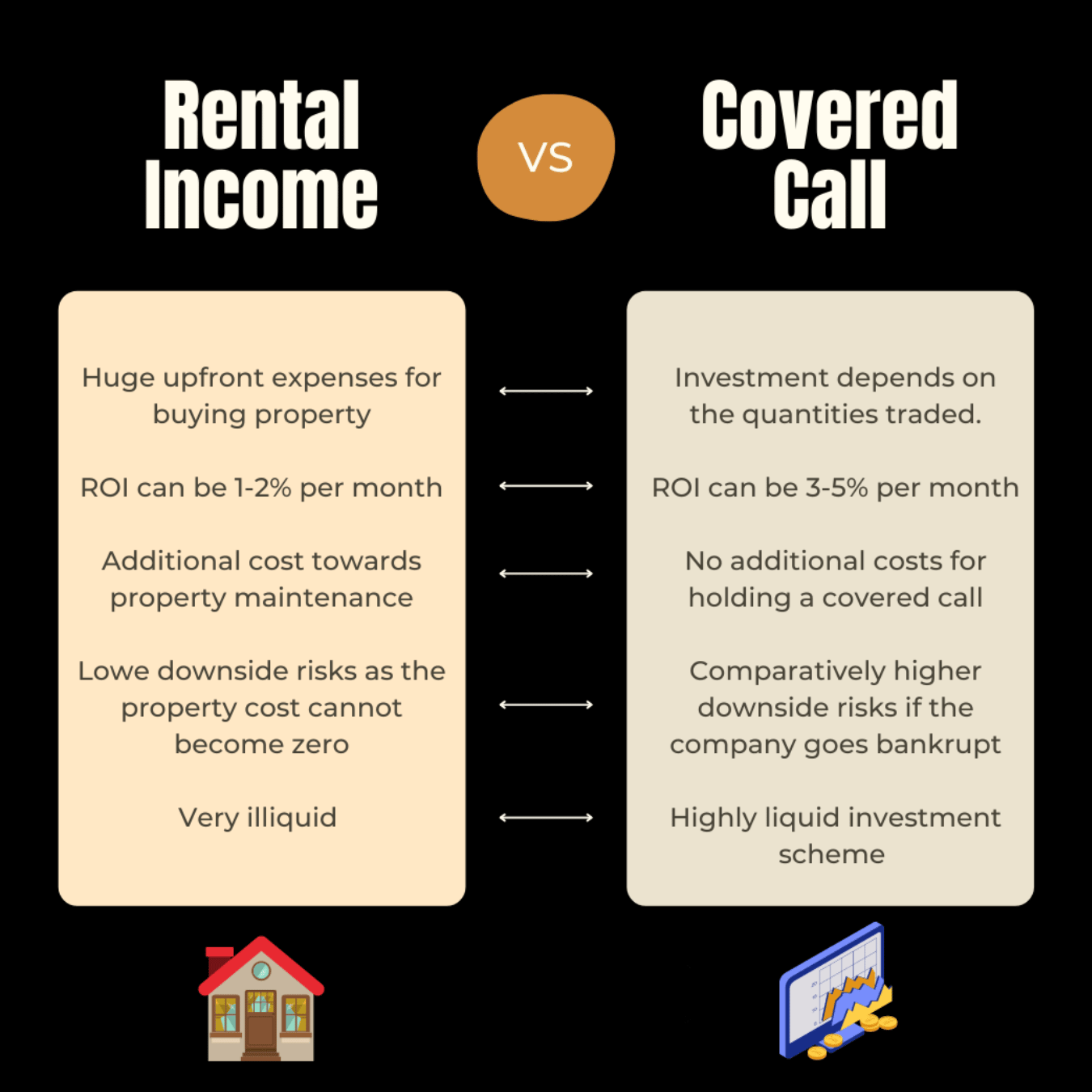

Take a look at this comparison between Rental Income and Covered Call. You’ll notice that in many aspects, the covered call often takes the lead.

Diving Deeper into Covered Call Options

Now, let’s delve deeper into how the covered call strategy works.

First off, you buy stocks. For instance, you purchase 300 shares of Stock “X” for $100 each, amounting to $30,000. At this point, the stock’s market price is $100 too.

Next, you sell a call option of Stock “X” at a strike price of $110 for $3. If the lot size is 100, you would sell 3 lots, raking in a premium of $900 (300*3).

By selling this option, expiring in a month, you allow the buyer to purchase your stocks at $110. However, the buyer isn’t forced to buy.

Potential Outcomes of Your Trade

By the month’s end, you could see one of four scenarios (assuming the option isn’t exercised):

- Outcome 1: If the stock price stays put, you pocket the $900 premium.

- Outcome 2: If the stock price hits $110, you keep the $900 and gain $3000 from your stocks.

- Outcome 3: A rise to $120 turns your premium to a $2100 loss, but nets a $6000 stock gain.

- Outcome 4: A drop to $90 lets you keep the $900, but your stock value drops by $3000.

In these scenarios, the covered call strategy curbs the maximum profit but also limits losses. Three out of four outcomes work in your favor.

This approach is excellent when you’re neutral or slightly bullish about a stock. Your strike price choice should reflect your stock price expectations till expiry.

Regularly applying this method can yield a consistent monthly income, similar to your option premium.

Yet, risks are inherent in any investment. Even real estate faces challenges like natural disasters or policy shifts.

Explore more about covered call options at this link.

Choosing Your Path: Real Estate or Covered Calls

When weighing Rental Income against the Covered Call Strategy, the latter often emerges as more practical. The liquidity and predictability of covered calls generally surpass the rigidity and unpredictability of real estate.