The Simplicity of Supply and Demand Trading

Trading can often seem intricate, with complex charts, statistical analysis, a multitude of technical indicators, and the ever-present market volatility. It can be overwhelming, like trying to decipher rocket science. However, beneath this complexity, trading can be a straightforward process. At its heart, effective predictions are made by skillfully analyzing a stock’s bullish or bearish trends. Supply and Demand Trading is a fundamental trading approach, grounded in technical analysis, that relies on understanding the dynamics of buying and selling to make predictions.

Deconstructing ‘Demand’ and ‘Supply’

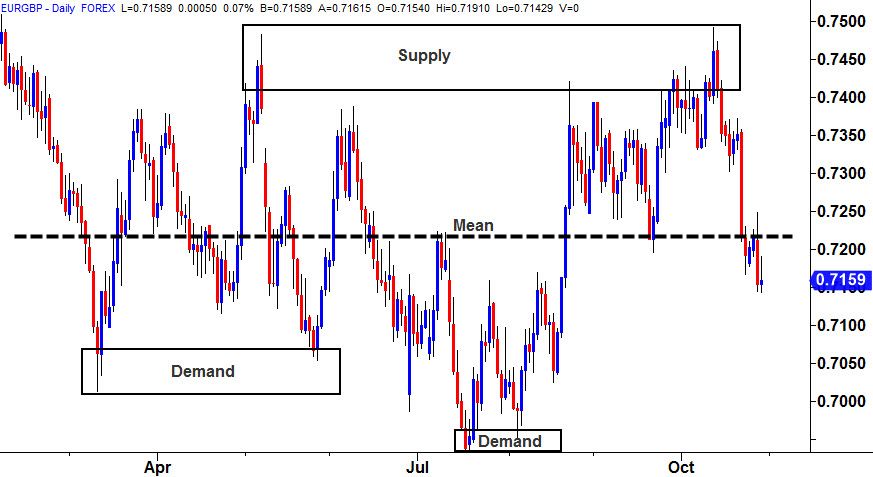

‘Demand’ signals a strong bullish presence in the market. This is also known as the ‘accumulation’ zone, where prices rise when buyers outnumber sellers. The price continues its upward trend until more sellers enter the market to fulfill buy orders.

On the other hand, ‘Supply’ indicates a bearish market sentiment. The ‘distribution’ or ‘supply’ zone is marked by more sellers than buyers. Prices decline and maintain a downward trend until buyers perceive value in trading the stock.

Take a look at this EUR-GBP chart, illustrating supply and demand zones.

Guiding Principles of Supply and Demand Trading

Before delving into supply & demand trading, keep these essential points in mind:

1. Trade in the direction of recent highs/lows

Your best chance for a successful trade is to align with the most recent highs or lows. Reversals can be challenging to predict, and if they occur, there’s usually sufficient time to adjust your trading strategy. Many traders wait for the market to revisit old zones, focusing solely on a reversal. This approach can cause you to miss out on the current trend.

2. Timing your exit

In Supply and Demand Trading, knowing when to exit is just as important as entering during a bullish trend. No one wants to buy in a supply zone. While long ranges lack institutional sales, supply zones are short-lived. Shorter demand zones are more effective, allowing re-entries to maximize returns.

3. Avoid trading in long-established zones

Some analysts suggest trading based on older zones for predicting reversals. However, reversals are unpredictable, and the only way they occur is when shareholders book profits from existing positions or place bids against the current trend. Take a look at our Support Resistance Trading system below:

Support and Resistance Trading System

Conclusion

Supply and Demand Trading is fundamentally sound. By combining technical indicators with fundamental analysis, you can make profitable predictions. However, hasty decisions won’t lead to long-term success. Observe the breaking points of bullish and bearish trends, analyze long-term behavior, and you’ll be well-equipped to trade and reap returns on your investments.