If you’re delving into the stock market, intraday trading is a term you’re likely familiar with. Yet, the actual execution may still be a mystery. We’re here to demystify strategies for successful intraday trading.

Intraday trading involves buying and selling stocks within the same day to capitalize on financial gains. It’s crucial to close all positions before the day’s trading session ends.

However, intraday trading is more challenging than it seems. Numerous factors must be considered to achieve substantial returns.

Before diving in, remember that intraday trading demands a unique mindset to manage extreme market volatility. Additionally, it’s important to evaluate your risk tolerance.

Let’s explore some top strategies for intraday trading that could enhance your trading experience.

Further Insights: The 7 Best Indicators for Intraday Trading

Strategies for Intraday Trading Success

Keep in mind that strategies alone don’t guarantee success. Their effectiveness is influenced by market conditions.

Traders should experiment with different strategies and remain adaptable to find the one that suits them best. Now, let’s delve into the strategies we believe are most effective and how to implement them.

1. The Reversal Strategy

Reversal trading, though controversial, can be highly profitable. It involves betting against current market trends.

Traders need to accurately identify and understand pullbacks. For instance, in a bullish trend, profiting from shorting a stock during a pullback can be lucrative.

Success in this strategy hinges on correctly identifying trends and pullbacks. Essentially, it requires substantial market experience and expertise in chart analysis.

2. The Moving Average Crossover Strategy

A stock’s trend is often determined by its moving average, either short-term or long-term.

A stock crossing above or below its moving average signifies a trend shift. These crossovers can guide your trading decisions in intraday markets.

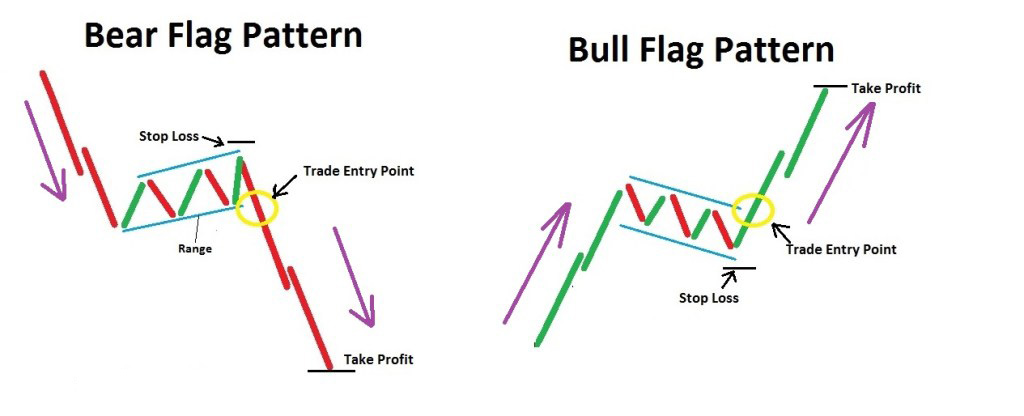

3. The Bull-Bear Flag Strategy

A rapid rise in stock prices leads to a peak, forming a pullback that resembles a flag.

Such pullbacks create a pattern of highs and lows, brimming with profit opportunities. Patience is key here.

Such pullbacks create a pattern of highs and lows, brimming with profit opportunities. Patience is key here.

4. The Gap And Go Strategy

A gap up or down occurs when the opening price differs significantly from the previous day’s close.

These gaps are often driven by news catalysts. As an intraday trader, look for stocks with high market volumes that gap over from the previous day’s close for potential profits.

The Gap And Go strategy is appealing as it offers significant gains with minimal risk. Stay observant and ready to act swiftly.

Expand Your Knowledge: Mastering Intraday Trading: A 7-Point Strategy for Success

Concluding Thoughts on Intraday Trading

The strategies we’ve outlined can help maximize your intraday trading profits.

However, be mindful of the market’s unpredictability and inherent risks. Even experienced traders cannot always accurately predict trend shifts.

Lastly, ensure your trading account is with a reliable broker offering decent leverage on intraday trades. Bet wisely and stay vigilant for price imbalances.