Options selling offers a logical approach to earning steady passive income from the stock markets. However, success in this field isn’t guaranteed for everyone. It requires a combination of strategy, precision, and perfect timing. Tradetron stands out with its advanced platform, offering a selection of finely crafted options strategies. In this article, we’ll focus on the best options selling strategies in Tradetron, with regular updates to the list.

New to the Tradetron platform? Get started with this helpful guide.

Top Strategies for Options Selling on Tradetron

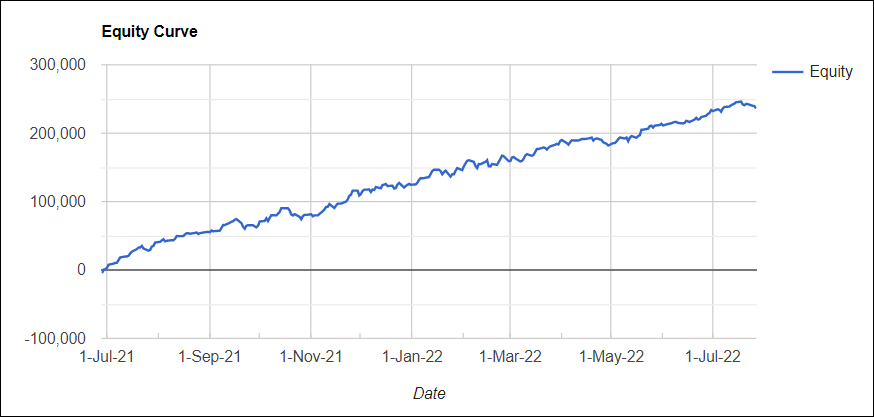

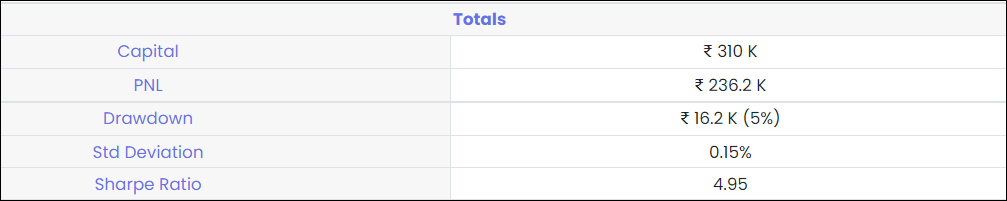

1. Index Premium Eater

The Index Premium Eater is one of the most sought-after options selling strategies on Tradetron. It’s been consistently ranked among the top 5 strategies in the marketplace.

This strategy operates on both Nifty and Banknifty options. It is an unhedged strategy, so it requires a higher capital. It thrives in various market conditions, adjusting intelligently to market shifts.

Like most options selling strategies, its primary strength lies in theta decay. After each exit, it re-enters a new trade within 5 minutes.

- Capital Required: 310,000 INR

- Stop Loss: 5,000 INR

- Target: Open with specified TSL

- Monthly Fee: 5% of Gross Profit

Equity Curve:

Backtest Results:

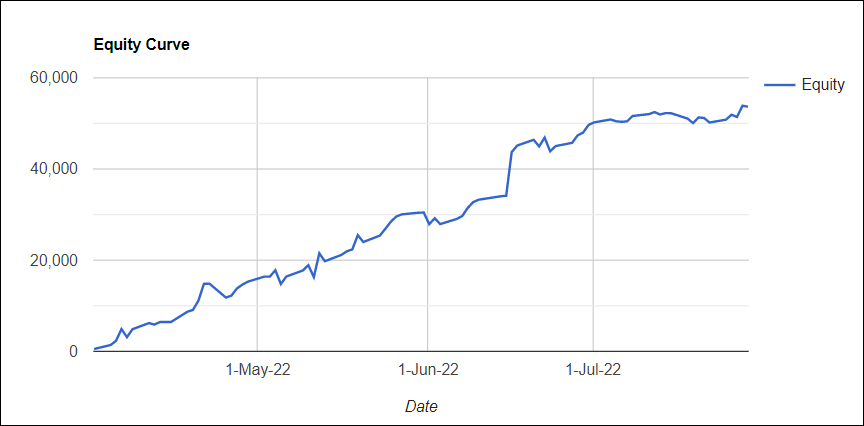

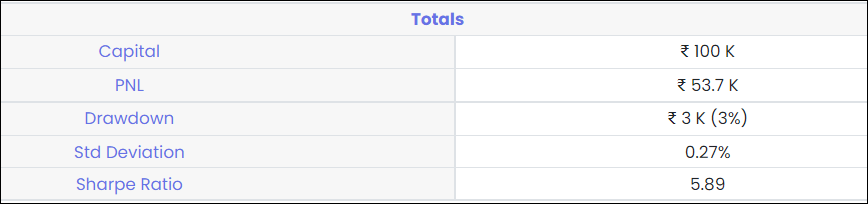

2. Low Risk Iron-Fly

Low Risk Iron-Fly is an intraday strategy based on the popular iron-fly options strategy. It actively trades on Banknifty, adjusting to market conditions every day.

- Capital Required: 100,000 INR

- Stop Loss: 4,000 INR

- Target: Open

- Monthly Fee: 10% of Gross Profit

Equity Curve:

Backtest Results:

3. Banknifty Fighter

Banknifty Fighter, a hedged intraday option selling strategy, has demonstrated solid returns recently. Unlike random option positions, it uses technical indicators and option greeks, enhancing its accuracy.

- Capital Required: 105,000 INR

- Stop Loss: 3,500 INR

- Target: Open

- Monthly Fee: 7.5% of Gross Profit

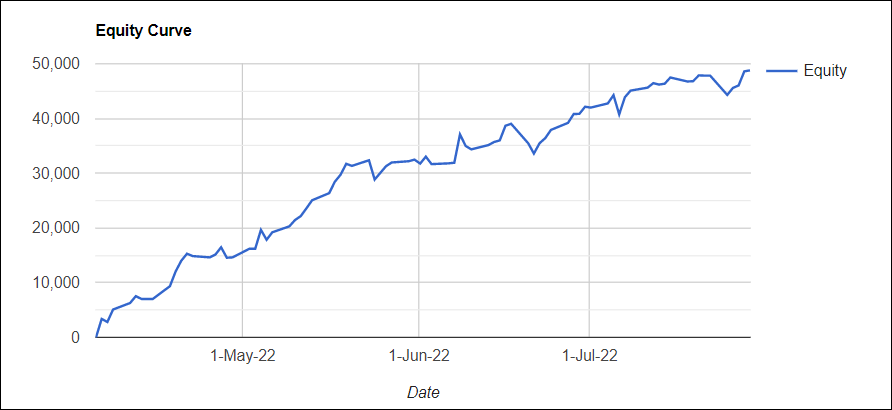

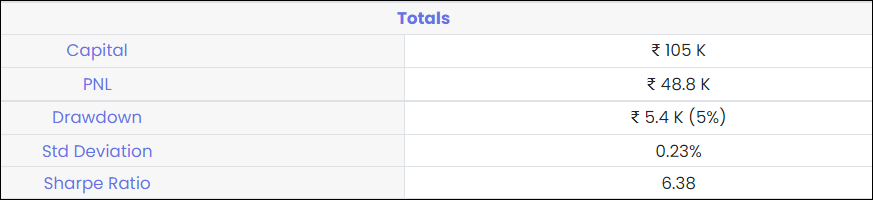

Equity Curve:

Backtest Results:

4. Daily Wages – Hybrid 50

Daily Wages – Hybrid 50 sells Banknifty straddles multiple times a day at a fixed 1:1 risk-reward ratio. The strategy re-enters trades immediately after closing the current ones, continuing until market close.

Due to its high frequency of trades, using a zero or fixed brokerage plan is advisable to prevent commissions from overshadowing profits.

This strategy stands out for its nearly linear equity curve and minimal drawdown.

- Capital Required: 200,000 INR

- Hard Stop Loss: 500

- Target: 500

- Monthly Fee: Free

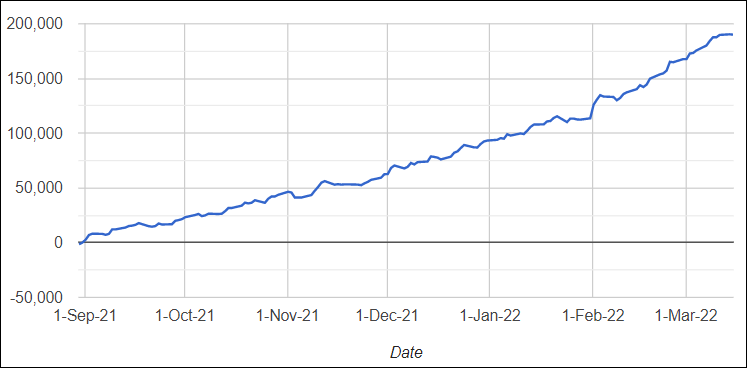

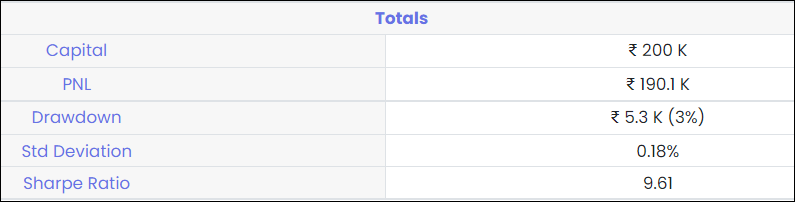

Equity Curve:

Backtest Results:

Choosing the Right Options Selling Strategy

These are our picks for the top options selling strategies on Tradetron. With so many options available, it can be challenging to pinpoint the best. Over 90% of strategies in the tradetron marketplace are focused on options selling.

While options selling demands higher capital than buying, it often has a higher success rate. Even with a low risk-reward ratio, you can achieve long-term profitability.

We recommend paper trading these strategies for at least two weeks before going live. Keep your expectations realistic, as not every trade will be profitable.

Do you have any strategies to share? Let us know in the comments section.

Begin your options selling journey with Tradetron today!