Discover the potential of the Keltner Band, a remarkable tool akin to the Donchian Band, to accurately spot trend breakouts. For veteran traders, snagging the right trend breakouts is like stumbling upon a treasure. Unlike the Bollinger band that relies on standard deviation, the Keltner band hinges on the ATR (average true range). In this guide, we’ll unveil the steps to compute the Keltner Band and delve into a trading system rooted in it. This system has undergone a backtest on NSE Nifty spanning 18 years, showcasing reliable results.

Dive into AFL coding here and set out to create your own trading systems.

Unpacking the Keltner Band Calculation

The Keltner Band is a tribute to Chester W. Keltner (1909–1998), who unveiled it in his 1960 book How To Make Money in Commodities.

Picture a central moving average line bordered by an upper and lower band. These bands derive from the average true range (ATR) of the price.

Here’s how you calculate the Keltner Band:

Central Line = 20-period moving average

Upper Keltner Band = Central Line + Multiplier * ATR(Periods)

Lower Keltner Band = Central Line – Multiplier * ATR(Periods)

The default settings are a multiplier of 2 and periods of 10.

You can tweak these constants based on your trading asset and timeframe.

Exploring the Keltner Band Trading System: An AFL Overview

| Parameter | Value |

| Preferred Time-frame | Daily |

| Indicators Used | ATR, Bollinger Bands |

| Buy Condition | High value of candle crosses above Keltner upper band |

| Short Condition | Low value of candle crosses below Keltner lower band |

| Sell Condition | Low value of candle crosses below Keltner middle band |

| Cover Condition | High value of candle crosses above Keltner middle band |

| Stop Loss | No defined SL |

| Targets | No defined target |

| Position Size | 150 (fixed) |

| Initial Equity | 200000 |

| Brokerage | 100 per order |

| Margin | 10% |

Snapshot and Code of the Keltner Band Trading System

//------------------------------------------------------

//

// Formula Name: Keltner Channel trading System

// Website: https://zerobrokerageclub.com/

//------------------------------------------------------

_SECTION_BEGIN("Keltner Channel trading System");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} – {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

//Initial Parameters

SetTradeDelays( 0,0,0, 0 );

SetOption( "InitialEquity", 200000);

SetOption("FuturesMode" ,True);

SetOption("MinShares",1);

SetOption("CommissionMode",2);

SetOption("CommissionAmount",50);

SetOption("AccountMargin",10);

SetOption("RefreshWhenCompleted",True);

SetPositionSize(150,spsShares);

SetOption( "AllowPositionShrinking", True );

Plot( Close, "Price", colorWhite, styleCandle );

//Keltner Band Code

KMid = MA (Close, 20); //Middle Line

ATRPeriod = 10; //ATR Period

KFactor = 2; //Multiplier

KValue = ATR(ATRPeriod) * KFactor;

KTop = KMid + KValue; //Upper Band

KBottom = KMid - KValue; //Lower Ban

printf("\nKTop : " + KTop );

printf("\nKBottom : " + KBottom );

printf("\nKMid : " + KMid );

Plot(KTop,"KTop",colorBlue,styleLine);

Plot(KMid,"KMid",colorGreen,styleLine);

Plot(KBottom,"KBottom",colorRed,styleLine);

Buy=Cross(High,KTop);

Short=Cross(KBottom,Low);

Sell=Cross(KMid,Low);

Cover=Cross(High,KMid);

BuyPrice=KTop;

SellPrice=KMid;

ShortPrice=KBottom;

CoverPrice=KMid;

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

Short=ExRem(Short,Cover);

Cover=ExRem(Cover,Short);

printf("\nBuy : " + Buy );

printf("\nSell : " + Sell );

printf("\nShort : " + Short );

printf("\nCover : " + Cover );

/* Plot Buy and Sell Signal Arrows */

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorGreen, 0, L, Offset=-25);

PlotShapes(IIf(Buy, shapeSquare, shapeNone),colorLime, 0,L, Offset=-35);

PlotShapes(IIf(Buy, shapeUpArrow, shapeNone),colorWhite, 0,L, Offset=-30);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorRed, 0, H, Offset=25);

PlotShapes(IIf(Short, shapeSquare, shapeNone),colorOrange, 0,H, Offset=35);

PlotShapes(IIf(Short, shapeDownArrow, shapeNone),colorWhite, 0,H, Offset=-30);

PlotShapes(IIf(Sell, shapeStar, shapeNone),colorGold, 0, L, Offset=-15);

PlotShapes(IIf(Cover, shapeStar, shapeNone),colorGold, 0,L, Offset=-15);

_SECTION_END();

Below is a glimpse of the Keltner Band AFL chart from Amibroker.

Also Explore: Intraday Trend Following Strategy: MACD and Bollinger Band

Also Explore: Intraday Trend Following Strategy: MACD and Bollinger Band

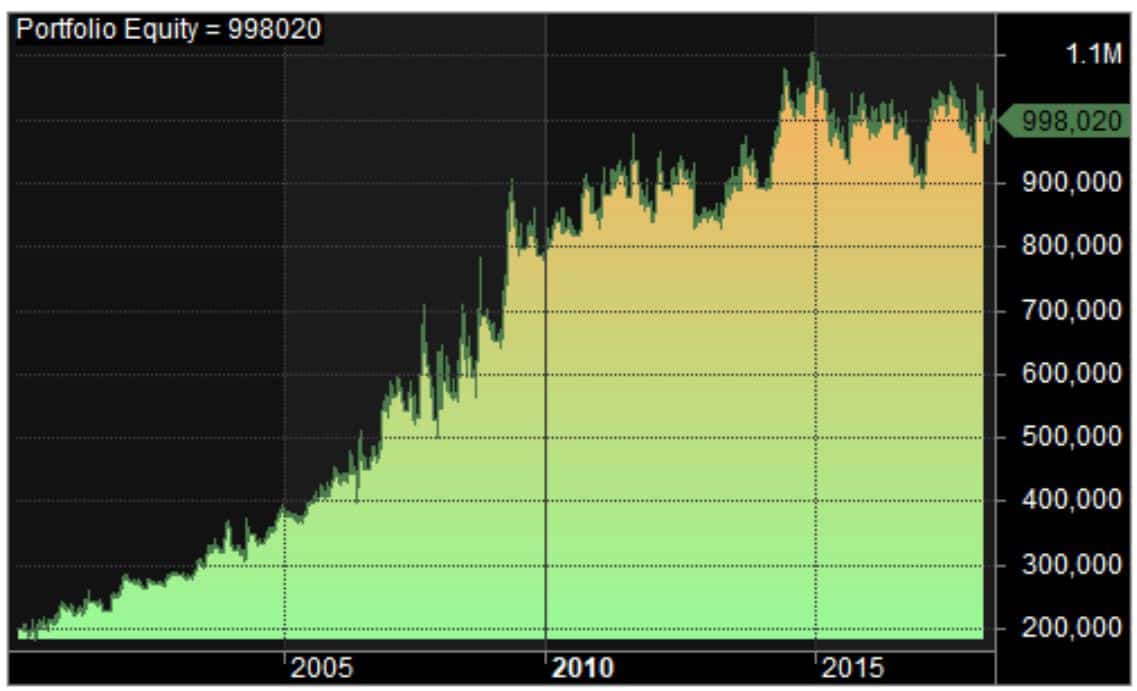

Backtest Report: Keltner Band Trading System

While it may not outshine the Donchian band trading system, this system stands robust, delivering precise signals. Test it on various instruments.

| Parameter | Value |

| Nifty | |

| Initial Capital | 200000 |

| Final Capital | 998020.42 |

| Scrip Name | NSE Nifty |

| Backtest Period | 09-Feb-2000 to 18-May-2018 |

| Timeframe | Daily |

| Net Profit % | 399.01% |

| Annual Return % | 9.14% |

| Number of Trades | 198 |

| Winning Trade % | 42.42% |

| Average holding Period | 14.74 periods |

| Max consecutive losses | 4 |

| Max system % drawdown | -29.49% |

| Max Trade % drawdown | -87.55% |

Equity Curve: A Closer Look

The equity curve showcases a steady and almost linear growth.

Profit Table: A Deep Dive

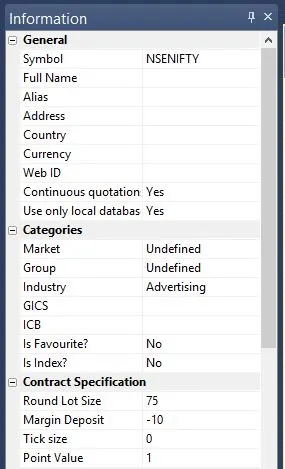

Amibroker Backtesting Settings

Head to Symbol–>Information to specify the lot size and margin requirement. The screenshot below depicts a lot size of 75 and a margin requirement of 10% for NSE Nifty:

One Comment