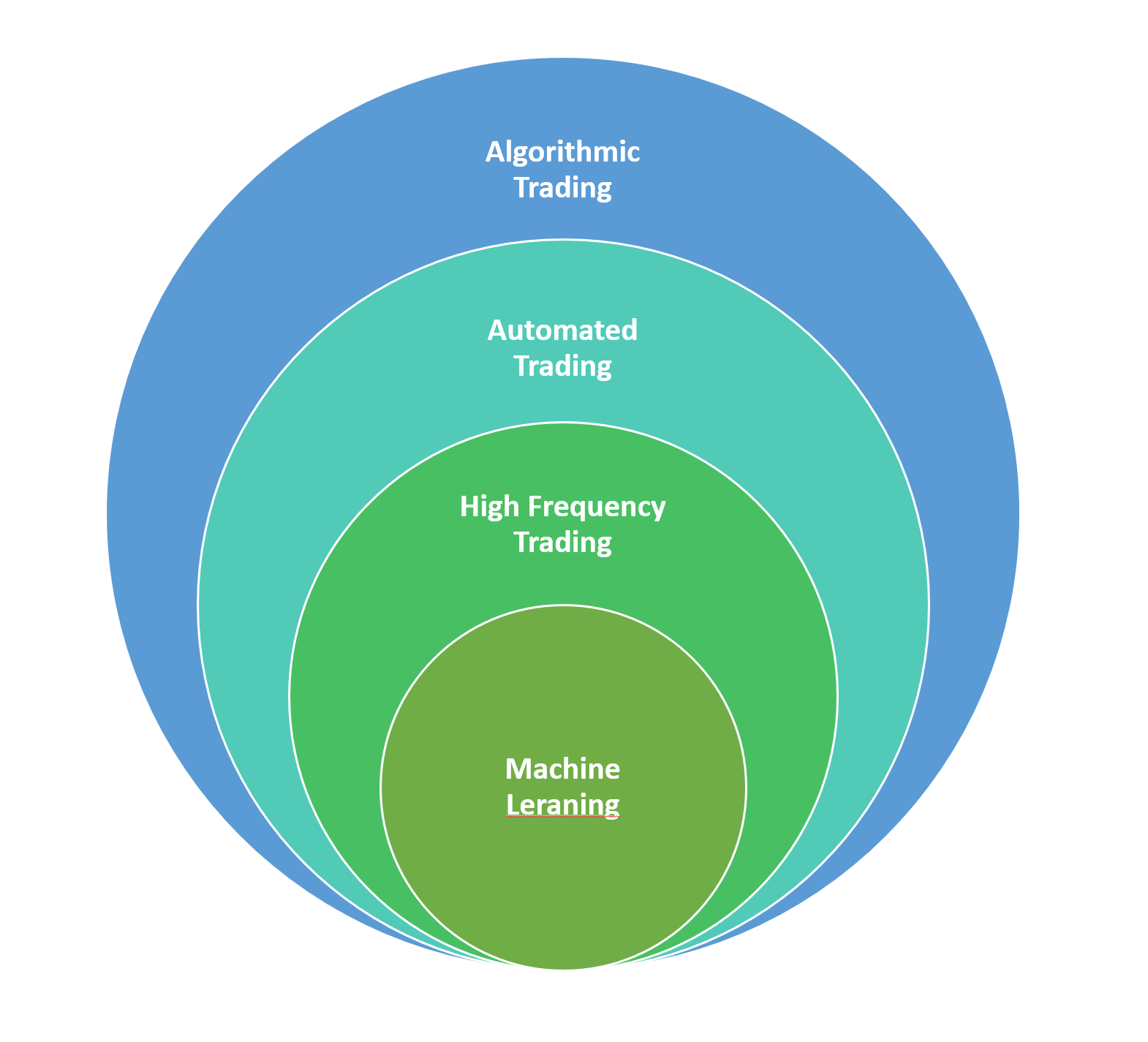

Machine Learning is changing how finance works. It uses computer programs to make smart buy/sell decisions. This is called Algorithmic Trading, and it’s now a standard practice. Recent years have seen big improvements in electronic trading, including Artificial Intelligence, Machine Learning, and High-Frequency Trading. While High-Frequency Trading is a part of Algorithmic Trading, Machine Learning is a game-changer. In this post, we explore how Machine Learning helps in trading and the many benefits it offers.

Understanding Machine Learning

In simple terms, Machine Learning is like teaching computers to learn by themselves, without human programming. They learn by using huge amounts of data and spotting patterns. Think of it as teaching a computer to recognize patterns.

For example, Facebook uses machine learning to personalize your timeline. The algorithm watches how you interact and adjusts your feed. If you often check out a friend’s photos, the system notices and shows you more of their updates.

The Impact of Machine Learning on Trading

Machine Learning goes beyond Algorithmic Trading. While Algorithmic Trading follows set rules, Machine Learning lets the rules change based on market conditions. Machine learning algorithms for trading closely analyze price trends, patterns, and other factors. This allows the rules to adapt as the market changes. Initial rules are set, but the program can adjust them automatically for better performance.

Machine Learning Algorithms have transformed stock markets. They enable quick reactions to market events and help analysts predict future stock prices based on past data. This makes Machine Learning a crucial part of modern finance.

There are many trading strategies that can use machine learning. These include support vector machines, neural networks, and decision trees. You can use machine learning to make trades based on social media signals or analyze news sentiment. It’s also possible to classify stocks into groups and adjust your investments based on the best-performing groups over time.

A Word of Caution

Remember, Machine Learning isn’t foolproof, and mistakes can happen. It can’t guarantee accurate predictions of future stock prices, especially in markets like India with high daily trade volumes. However, it’s a reliable way to make reasonably accurate predictions about stock price changes over time, making it a key part of the future of stock markets.

4 Comments