Options, as part of the financial derivatives family, are often seen as more complex than stocks or commodities. This complexity mainly comes from their unique pricing methods, which depend on various factors. In this article, we will introduce the Black Scholes Options Premium Calculator Spreadsheet. This tool makes option pricing and payoff calculations much simpler. It’s based on the Black Scholes Model and is available for download at the end of this post.

Explaining the Black Scholes Model

The Black Scholes model is a mathematical formula used to calculate the theoretical prices of options, both calls and puts. The calculation is based on six key factors:

- Price of the Underlying Asset

- Strike Price

- Time to Expiration (in years)

- Risk-Free Interest Rate

- Dividend Yield

- Volatility

Among the various models for option pricing, such as the Binomial model and the Black Scholes model, the latter is more widely adopted. Its creators, Fischer Black, Myron Scholes, and Robert Merton, even earned the Nobel Prize in Economics for their development of this model.

The underlying math of the Black Scholes model is quite intricate, but in practice, it’s not necessary to grasp every detail. The spreadsheet discussed next simplifies this model significantly, allowing for easy application.

Related Read: Options Strategy Payoff Calculator Excel Sheet

The Black Scholes Options Premium Calculator Spreadsheet

Let’s explore this user-friendly spreadsheet and its features. Instead of delving into the intricate calculations, this discussion will focus on its practical application. For the curious, the VBA code within the spreadsheet is unlocked for further exploration.

This calculator consists of three main workbooks:

Basic Workbook

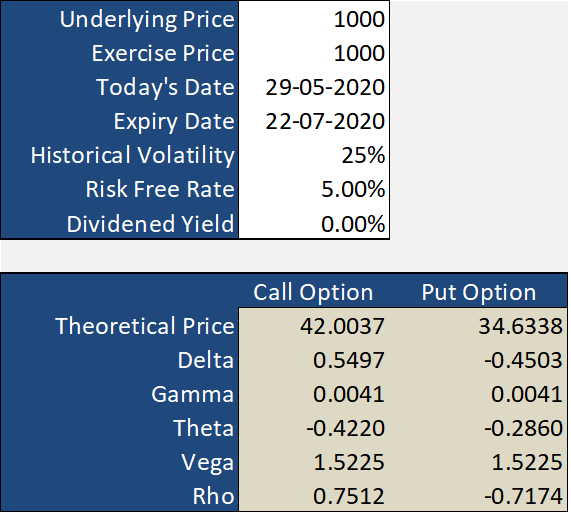

The basic workbook is designed to calculate the theoretical prices for call and put options along with the Greeks, based on your inputs in Cells C3 to C9.

Ensure accurate calculations by entering the correct values in the white cells (C3 to C9).

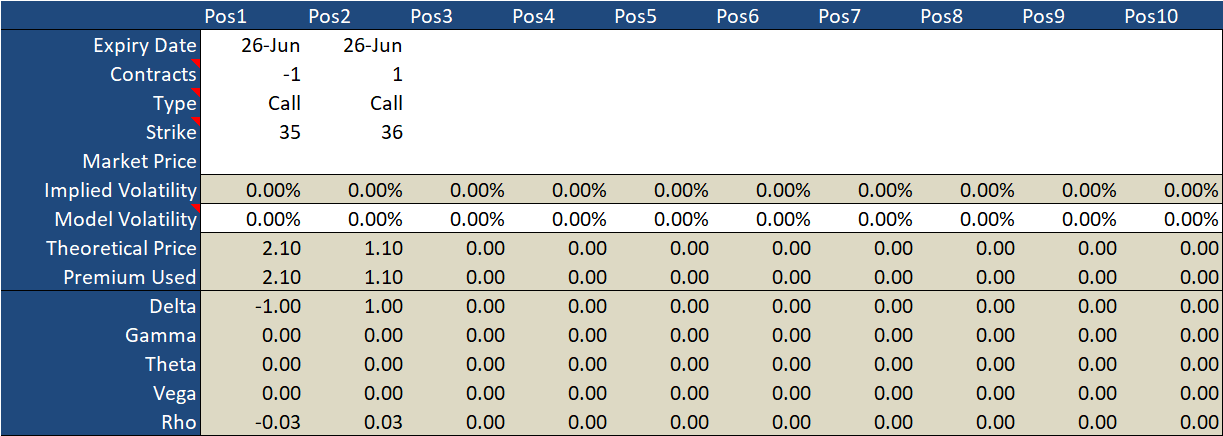

Additionally, this workbook allows you to calculate the implied volatility of call and put options. Simply input the current market prices of the option strikes in cells C20 and D20 and view the results immediately below.

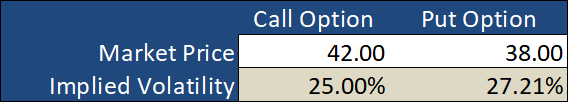

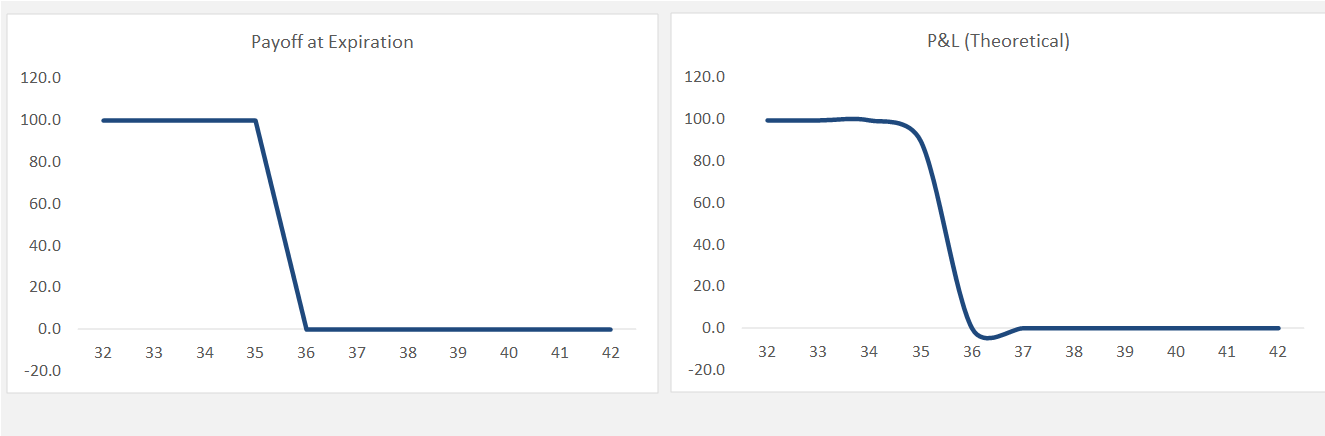

Payoff Graphs Workbook

This workbook helps you visualize profits through payoff graphs for various option positions such as buying or selling calls and puts.

To use this sheet, enter the same variables as in the ‘Basic Workbook’, and select the type of option position from the dropdown menu.

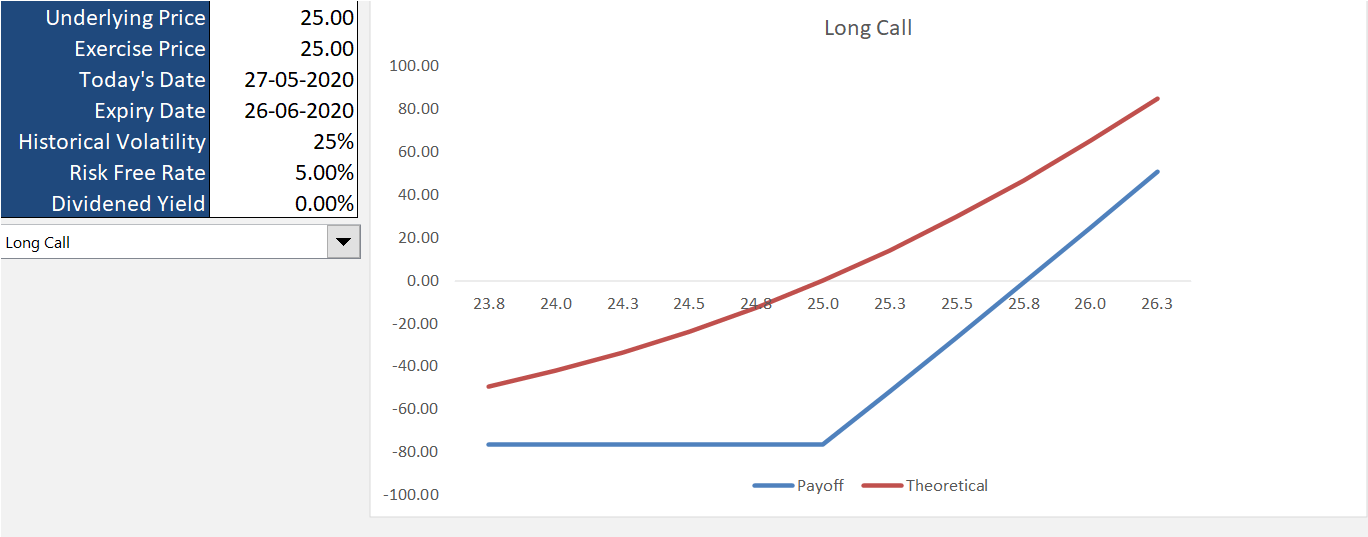

Strategies Workbook

In the Strategies Workbook, you can combine various option positions and calculate the overall payoff. It allows adding up to 10 option positions and computes not just the payoff but also theoretical prices, Greeks, and volatility.

Like the other workbooks, input your data in the white cells for your calculations.

Download the Excel Sheet

You can download the Black Scholes Model Options Calculator Excel sheet from the link below:

2 Comments