If you’re delving into the world of Algorithmic Trading, or Algo Trading for short, you’re entering a realm where math and speed reign supreme. This trading style leverages sophisticated math models and rapid computers to optimize decision-making and transactions in financial markets. If you’re new and feeling a bit lost regarding the right tools or platforms, fear not. We’re here to guide you. Below, we’ve curated a list of the top-notch Algo Trading Softwares to kickstart your journey towards optimal returns.

In Algo Trading, machines take the reins, making trading systematic and injecting a healthy dose of liquidity into ever-evolving markets. By employing algorithmic trading systems, traders can smartly navigate through arbitrage, hedging, and market making. SEBI’s nod to advanced tech in the equity market has fueled its growth in India.

Also Read: Machine Learning in Trading: Unlocking the Power of Algorithms

Presto ATS

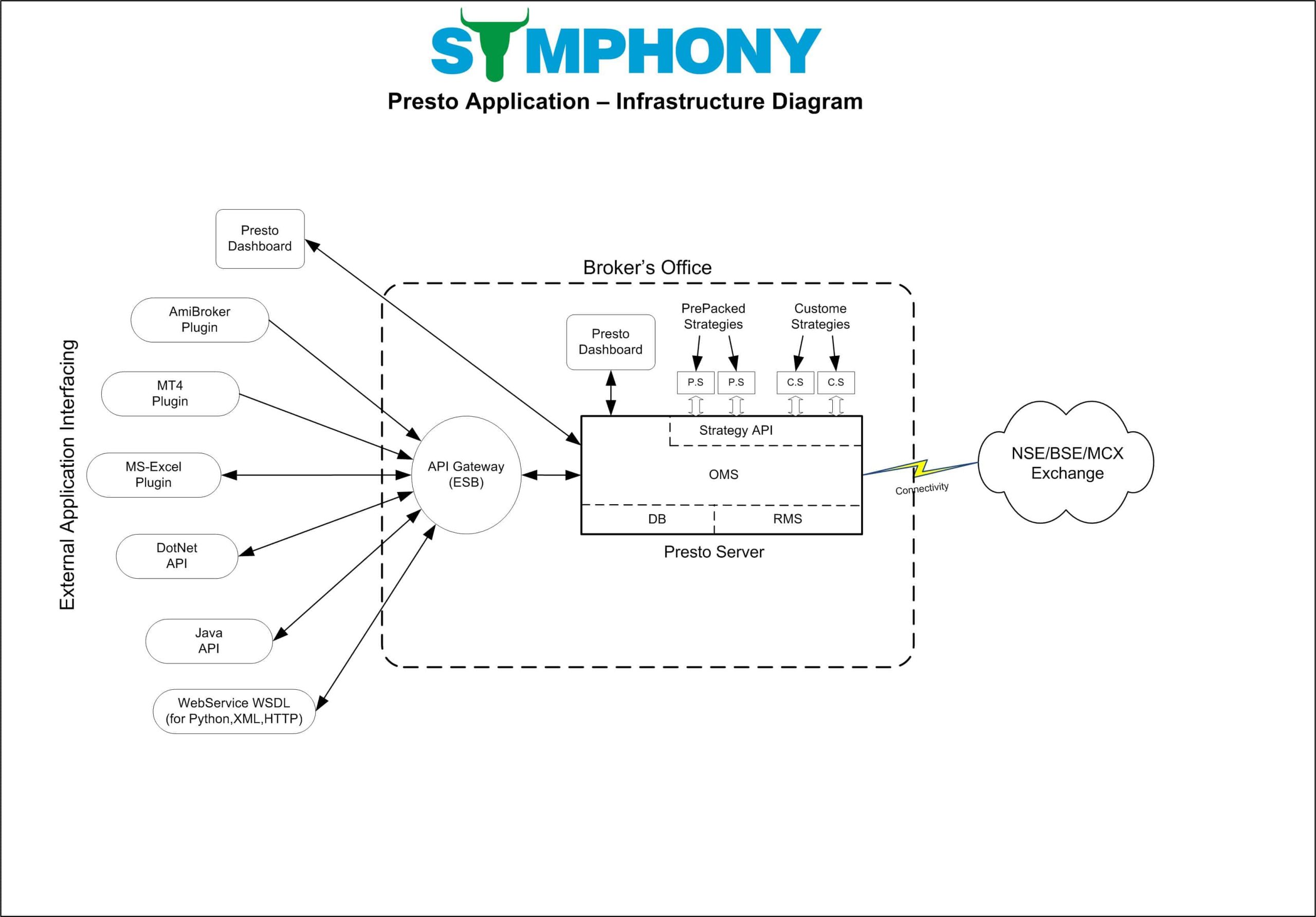

Crafted by the reputed Symphony Fintech, Presto ATS has earned its stripes in India for automating trades across a variety of assets. It shines in three core areas of algo trading:

Crafted by the reputed Symphony Fintech, Presto ATS has earned its stripes in India for automating trades across a variety of assets. It shines in three core areas of algo trading:

(A) Crafting Strategies

(B) Seamless Trading

(C) Performance Testing

Boasting a plethora of APIs, Presto ATS can integrate with numerous Indian exchanges. Its licensed software, priced between Rs. 25,000 to Rs 35,000 annually, has found favor among retail clients. By linking your trading algorithms crafted in Amibroker or Excel Sheet with Presto’s interfaces, you can automate your trading realm. Undoubtedly, it ranks among the most feature-packed algo trading softwares in India.

AlgoNomics

Brought to life by NSEIT, AlgoNomics facilitates the deployment and execution of trading strategies across diverse exchanges and instruments. It’s engineered for low latency intelligent execution coupled with robust monitoring. Not only does it aid in reducing transaction costs, but it also empowers smart trading for maximizing profits. Its user-friendly GUI provides a seamless experience for executing your trading algorithms.

Omnesys NEST

Omnesys NEST is your go-to platform for handling multiple asset classes such as Derivatives, Commodities, Currency, and Equities. It’s adept at executing various business strategies like 2L and 3L spreading, order slicing, and basket trading.

The Nest Plus API operates in two modes: (A) Semi-auto mode for retail clients and (B) Full-auto mode for sub-brokers. Whether it’s keeping an eye on the market, getting news updates or charts, this trading terminal can be tailored to your needs. The Omnesys Nest Gate tool helps create customizable directional execution algorithms. Real-time recommendations are also on offer to assist traders in making informed decisions, complemented by scrip based news from partner Dow Jones.

Also Read: Top Auto Trading Software and Plugins in India

ODIN

ODIN is celebrated for its risk management prowess and multi-exchange capabilities among the Algo trading software realm. Its Order Management System (OMS) has garnered applause for all the right reasons. The recent additions from Heckyl and Dow Jones, along with features like heatmap, smart order routing, conditional ticker, and bulk order entry make it a remarkable platform. Its flexible API-based integration is a plus. Lately, ODIN has expanded to include new exchange segments like UCX (Universal Commodity Exchange), MCS-SX equity and market for OFS segment.

MetaTrader

MetaTrader stands as a time-tested platform enabling users to craft, test, and automate trading strategies. It facilitates automation by allowing users to script in the MQL4.5 language. Real-time charts and prices are at your fingertips, along with an embedded MQL4 IDE for developing trading robots (expert advisors).

MetaTrader stands as a time-tested platform enabling users to craft, test, and automate trading strategies. It facilitates automation by allowing users to script in the MQL4.5 language. Real-time charts and prices are at your fingertips, along with an embedded MQL4 IDE for developing trading robots (expert advisors).

Amibroker

Lastly, we present Amibroker, a versatile tool to code, backtest, and breathe life into your trading system. Though not purely an Algo trading software, it’s a powerhouse for crafting robust trading systems. Features like Portfolio backtesting, Monte Carlo simulation, Optimization, Custom Backtester, and Quant trading support are its forte. You’ll be scripting in AFL (Amibroker Formula Language). Plugins like Pi Bridge for Amibroker facilitate automated order processing based on your buy/sell signals.

All the Algo Trading softwares illustrated above are comprehensive, multi-tasking platforms, adept at a range of functions from risk management to smart order routing. However, the price tag could be a deterrent for retail traders. Yet, with rising popularity and competition, we’re optimistic that prices will become more accessible in the near future. Here’s to hopeful tomorrows.

One Comment