Transforming Finance: The Rise of Automated Trading

Automated Trading is becoming a pivotal element in the financial markets. Many seek to minimize manual trading, particularly those balancing trading with other professional commitments. It’s estimated that in the US equity market, 50-60% of trades are executed through automated systems, a trend that’s on the rise. This post delves into the realm of auto trading and highlights some prominent automated trading software in India.

Understanding Automated Trading

Automated Trading, or Auto Trading, is a system that replaces human decision-making in trading with automated processes. Imagine a “Robot” executing trades on your behalf. This system is powered by an algorithm crafted in high-level programming languages like ‘Python’ or tools like ‘Amibroker’.

Essentially, automated trading comprises:

- An algorithm pinpointing profitable trades

- Software executing trades autonomously

Our focus here is on the latter. For insights into algorithmic trading platforms, explore the following:

5 Excellent Algorithmic Trading Platforms

Top Automated Trading Software Picks

Searching for the best automated trading software in India reveals numerous options. Beware of black hat vendors offering subpar software. Selecting reliable software is crucial as any flaws could jeopardize your investments.

After thorough evaluations, we’ve compiled a list of top automated trading software, based on:

- Software’s technological foundation

- User base and reputation

- Execution speed and error management

Here are our top picks, applicable to both Indian and global exchanges:

-

TRADETRON

Tradetron, a rising star in India’s automated trading platform arena, is a comprehensive tool for building, backtesting, and deploying algorithms. This cloud-based platform requires no installation and simplifies strategy building, even for non-coders. It integrates seamlessly with existing strategies written in Amibroker, Python, and more.

Tradetron’s standout feature is its strategy marketplace, allowing you to buy or sell algo strategies. These strategies undergo rigorous evaluation, including backtesting and forward testing, on metrics like CAGR and Sharpe ratio.

Integrated with major brokers in India and the US, Tradetron ensures seamless, automated execution of trading signals on your broker’s terminal. It also boasts features like risk management and paper trading, making it an exceptional platform.

Website: https://www.tradetron.tech/

Type: Web-based

Cost: Free for paper-trading; paid plans start at INR 300 (India) and $50 (US). For the latest pricing, visit here.

Unique Selling Point (USP): Advanced technology, strategy builder and backtester, marketplace, multi-exchange support

Programming Languages Supported: Inbuilt language, Python, AFL, MQL

Getting Started: Explore demo videos on strategy creation at Tradetron’s official website.

-

STREAK

Streak is a cloud-based, user-friendly auto trading platform. It’s designed for traders who prefer an intuitive interface over coding. With support for about 70 technical indicators, it empowers you to construct diverse trading strategies.

Streak notifies you with actionable alerts when your strategy conditions are met, rather than fully automating trades. It’s equipped with a powerful Scanner feature for scanning thousands of symbols simultaneously, and its Discover feature offers ready-to-deploy strategies with proven track records.

Website: https://www.streak.tech/

Type: Web-based

Cost: Starting at INR 690 per month with a 7-day free trial for new users. Current pricing details are available here.

Unique Selling Point (USP): Intuitive interface, Scanner feature, affordable pricing

Programming Languages Supported: Inbuilt language

Getting Started: Learn more at Streak’s Help portal.

-

SYMPHONY BLITZTRADER

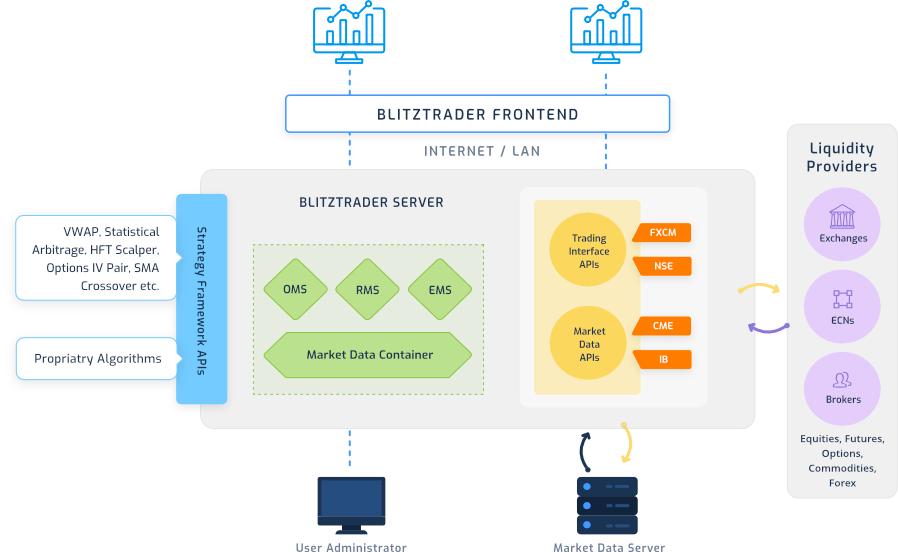

Symphony Fintech is a pioneer in providing tech solutions for financial markets in India. Among their products, BlitzTrader is a standout for algorithmic trading. This enterprise-grade software enables the creation and execution of complex trading strategies.

BlitzTrader is scalable and broker-agnostic, suitable for high-frequency trading setups. It allows rapid development of strategies with its microservices-based architecture and inbuilt templates. Its HFT support is notable for offering proximity hosting to exchanges.

Website: https://symphonyfintech.com/blitztrader/

Type: Desktop application

Cost: Not disclosed

Unique Selling Point (USP): High scalability, Broker agnostic, HFT support

Programming Languages Supported: Any .NET supported language (C#, VB.NET, C++, J#…)

Getting Started: Request a trial on their website. Documentation available here.

-

ROBO TRADER

RoboTrader is an automated trading software compatible with Amibroker, perfect for executing predefined AFL codes. It seamlessly transfers buy-sell signals from Amibroker to your NEST/ODIN platform with minimal delay.

RoboTrader offers proprietary strategies like AmiGO and EnnGinoid, in addition to its BRAVO Cloud+ for vanilla automated trading. It comes with extensive customizable settings such as stop-loss, order type, and execution mode, ensuring a personalized trading experience.

Website: https://robotrader.in

Type: Desktop application

Cost: Starting at INR 3500 per month

Unique Selling Point (USP): Low latency, Amibroker integration, ease of use for Amibroker users

Programming Languages Supported: Amibroker formula language (AFL)

-

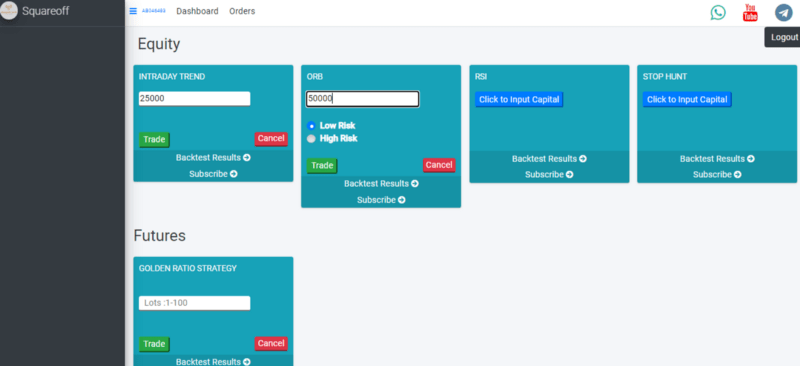

SQUAREOFF

SquareOff provides automated trading bots, ready to trade on your behalf. Select from a variety of bots based on your risk preference and return expectation. Each bot is backed by a proven trading system and historical performance data.

Simply log in to the bot dashboard, specify your trading capital, and let the bots handle the trading. The platform doesn’t support custom strategies but offers impressive historical performances for their existing bots.

Website: https://www.squareoff.in

Type: Web-based

Cost: Single bot subscriptions start at INR 17700 per year

Unique Selling Point (USP): User-friendly, impressive historical bot performance

Programming Languages Supported: Custom coding not supported

Getting Started: Explore bots and their metrics here

Other Promising Automated Trading Software in India

These additional software options also show promise based on their feature descriptions, though they haven’t been fully tested:

Choosing the Best Automated Trading Software

Each automated trading software has its unique strengths. Tradetron is ideal for building, backtesting, and deploying automated systems with its user-friendly features. RoboTrader is perfect for those with existing Amibroker systems. Symphony BlitzTrader caters to enterprise-level automated trading with HFT capabilities, while SquareOff is excellent for professionals seeking pre-built trading bots. Streak is similar to Tradetron but is exclusive to Zerodha users and lacks full automation.

Your choice should align with your specific needs and preferences in automated trading.

Feel free to ask questions or share your thoughts on automated trading software in India in the comments section.

4 Comments