Exploring the Fallen Angel Screener

The Fallen Angel Screener expertly identifies stocks that are significantly undervalued in daily or weekly charts, highlighting them as prime buying opportunities.

How the Screener Works

To detect oversold stocks, the screener compares their current closing price against the highs and lows of the previous 200 days. Moreover, it incorporates volume as an additional safeguard, thereby reducing the likelihood of false signals. For an in-depth understanding, refer to the AFL formula.

The Screener’s Inception

Dr. Alexander Elder, a renowned figure in trading, crafted this screener. He first introduced it to the trading world in one of his influential books, marking a significant contribution to trading methodologies.

Optimal Timeframe for Screener Usage

Applying this screener yields the best results in Daily or Weekly timeframes, as these periods provide a comprehensive view of market trends.

Recommended Further Reading: Trend Intensity Index (TII) AFL Code

Visual Demonstration

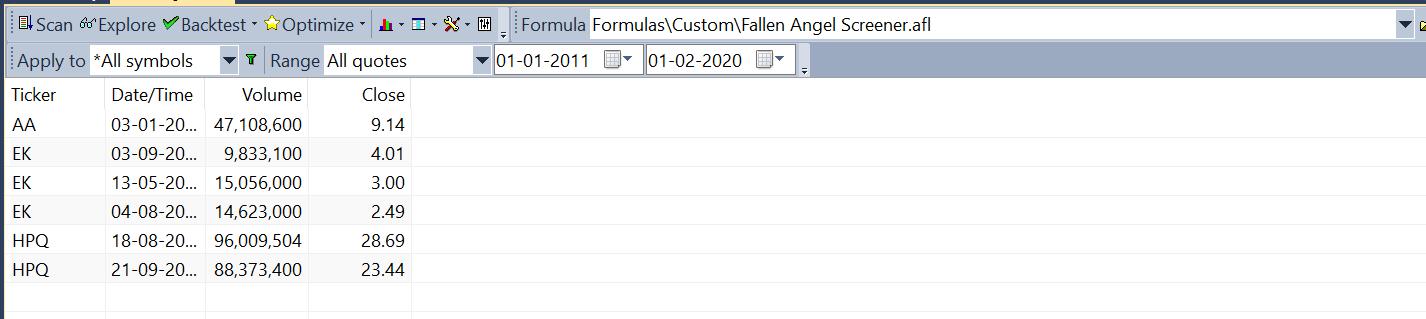

In the screenshot from Amibroker below, you can see the effective results of the Fallen Angel Screener. It meticulously lists all stocks that conform to its stringent criteria:

Accessing the Screener’s AFL

Accessing the Screener’s AFL

Download the Screener Code/h3>

//------------------------------------------------------

//

// Formula Name: Fallen Angel Screener

// Website: https://zerobrokerageclub.com/

//------------------------------------------------------

_SECTION_BEGIN("Fallen Angel Screener");

//Calulate difference between highest high value and lowest low value for 200 periods

HighLowRange200Periods = HHV(H, 200) - LLV(L, 200);

//Calulate deviation of current close price with respect to lowest low value for 200 periods

CloseDev = C-LLV(L, 200);

//Calulate simple moving average of volume multiplied by close for 52 periods

VolumeCloseSMA = MA(V * C, 52);

c1 = (CloseDev/HighLowRange200Periods)*100;

c2 = c1 < 10;

c3 = VolumeCloseSMA > 3000000;

c4 = V*C > VolumeCloseSMA;

c5 = H >= HHV(H, 10);

Filter = c2 AND c3 AND c4 AND c5;

AddColumn(Volume,"Volume",1.0);

AddColumn(Close, "Close", 1.2);

_SECTION_END();

A Closer Look at the Screener’s Parameters

The AFL code specifies that a stock must meet several criteria to qualify as a Fallen Angel. These criteria are outlined in the following parameters:

Parameter 1: The ratio of CloseDev to HighLowRange200Periods (in percentage) is expected to be below 10.

Key Definitions:

CloseDev = It represents the difference between the Current Close and the Lowest low of the preceding 200 periods

HighLowRange200Periods = This is the range from the highest high to the lowest low over the last 200 periods

Parameter 2: Importantly, the 52-period simple moving average of the volume multiplied by close should be above 3 million

Parameter 3: Furthermore, the current product of volume and close must be greater than the 52-period simple moving average of the same

Parameter 4: Lastly, the current high should be higher than the highest high of the past 10 periods

One Comment