Volume Spread Analysis aims to forecast market trends. If you aspire to follow the big players’ steps in the market, merely focusing on price action won’t cut it. It’s crucial to examine both price and volume to see the complete picture. Essentially, VSA explores the relationship between price and volume, zooming in on three factors: Volume, the range/spread (difference between high and close price), and the closing price relative to Range.

Also Read: On Balance Volume Trading Strategy – Learn, Apply, Excel

Demystifying Volume Spread Analysis (VSA)

Most traders globally rely on either fundamental or technical analysis. The former speculates market direction based on macroeconomic factors and company financial data, while the latter involves chart interpretation, quantitative indicators, and Dow theory. Yet, a third avenue exists – volume spread analysis. VSA aims to anticipate the maneuvers of professional traders (or smart money), who primarily drive significant market movements, by studying volume in relation to price.

The term volume spread analysis (VSA) originated from trader Tom Williams, who popularized this concept among modern traders. However, the methodology traces back to the works of Richard Wyckoff and Jesse Livemore.

Mastering Volume Spread Analysis

Mastering VSA is a tall order. Its interpretation varies among traders. Only relentless market observation and years of practice can enable proficient trading using VSA. The effectiveness of VSA for different traders warrants thorough examination. But first, let’s delve into two fundamental VSA concepts:

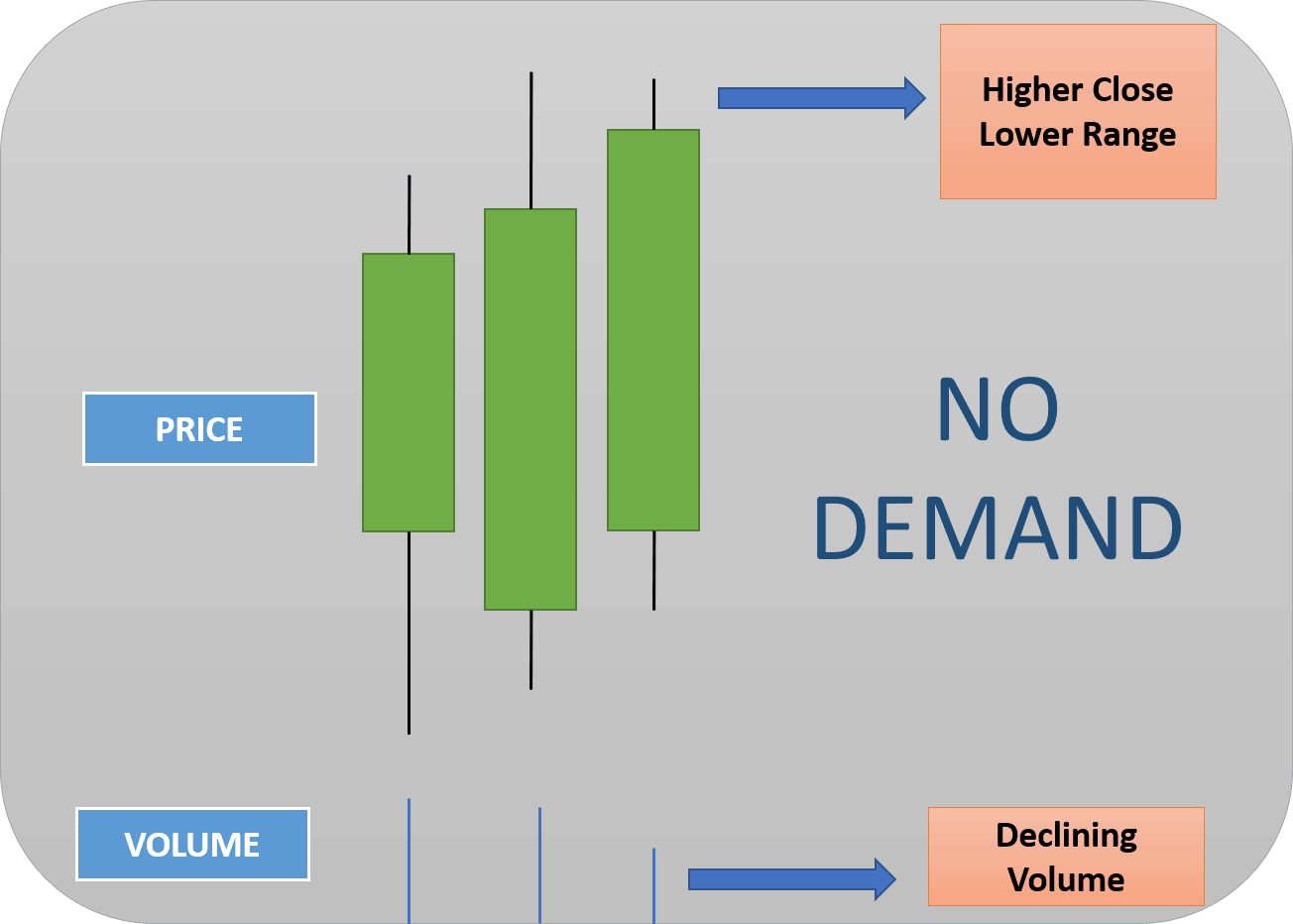

Understanding No Demand

A decline in the spread and volume of the current bar compared to previous ones, despite a higher close price, indicates No Demand. Essentially, No Demand on an Up Bar signifies the smart money isn’t backing higher stock prices, with only weak money participating in buying and selling. A No Demand bar emerges when the following conditions align:

A decline in the spread and volume of the current bar compared to previous ones, despite a higher close price, indicates No Demand. Essentially, No Demand on an Up Bar signifies the smart money isn’t backing higher stock prices, with only weak money participating in buying and selling. A No Demand bar emerges when the following conditions align:

- Closing price is higher than the previous bar.

- Volume is lower than the two preceding bars.

- The range is narrow.

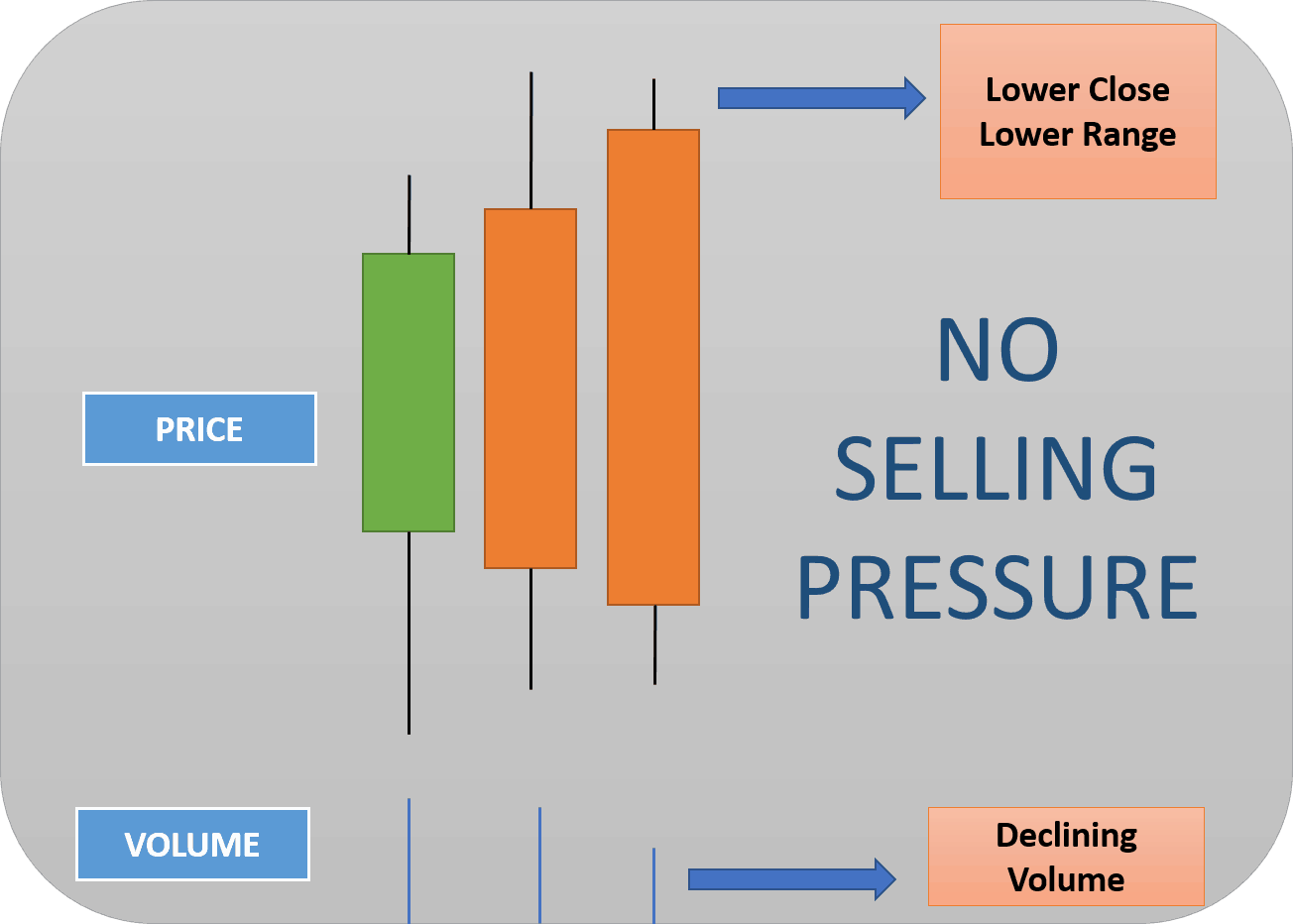

Deciphering No Selling Pressure

Conversely, No Selling Pressure occurs when the spread and volume decrease while the market declines, showcasing disinterest in selling, hence the market is likely to halt its fall. No Selling Pressure bars manifest when:

Conversely, No Selling Pressure occurs when the spread and volume decrease while the market declines, showcasing disinterest in selling, hence the market is likely to halt its fall. No Selling Pressure bars manifest when:

- Closing price is lower than the previous bar.

- Volume is lower compared to the two preceding bars.

- The range is narrow.

Identifying No Demand and No Selling Pressure bars is pivotal to VSA. Mastering this enables you to trail the smart money, aligning you with winning trades more often.

Now, you should have a clearer grasp of volume spread analysis. It’s a proprietary market analysis method, drawing insights from market rhythms to highlight supply and demand disparities. It unveils the digital traces of professional traders, open for anyone to follow and trade accordingly.

Also Read: Ed Seykota: A Legendary System Trader

Volume Spread Analysis AFL Code

//====================================================================================

_SECTION_BEGIN("Volume Price Analysis - V.1.0");

SetChartBkColor(16 ) ;

SetChartOptions(0,chartShowArrows|chartShowDates);

//=======================================================================================

DTL=Param("Linear regression period",60,10,100,10);

wbf=Param("WRB factor",1.5,1.3,2.5,.1);

nbf=Param("NRB factor",0.7,0.3,0.9,0.1);

TL=LinRegSlope(MA(C, DTL),2);

Vlp=Param("Volume lookback period",15,10,300,10);

Vrg=MA(V,Vlp);

St = StDev(Vrg,Vlp);

Vp3 = Vrg + 3*st;

Vp2 = Vrg + 2*st;;

Vp1 = Vrg + 1*st;;

Vn1 = Vrg -1*st;

Vn2 = Vrg -2*st;

rg=(H-L);

arg=Wilders(rg,30);

wrb=rg>(wbf*arg);

nrb=rg<(nbf*arg);

Vl=VRef(C,-1);

dnbar=CRef(V,-1) AND Ref(V,-1)>Ref(V,-2);

Cloc=C-L;

x=rg/Cloc;

x1=IIf(Cloc==0,arg,x);

Vb=V>Vrg OR V>Ref(V,-1);

ucls=x1<2;

dcls=x1>2;

mcls=x1<2.2 AND x1>1.8 ;

Vlcls=x1>4;

Vhcls=x1<1.35;

j=MA(C,5);

TLL=LinRegSlope(j,40) ;

Tlm=LinRegSlope(j,15) ;

tls=LinRegSlope(j,5);

mp=(H+L)/2;

_SECTION_END();

//==========================================================================================

_SECTION_BEGIN("VSA");

utbar=wrb AND dcls AND tls>0 ;

utcond1=Ref(utbar,-1) AND dnbar ;

utcond2=Ref(utbar,-1) AND dnbar AND V>Ref(V,-1);

utcond3=utbar AND V> 2*Vrg;

trbar=Ref(V,-1)>Vrg AND Ref(upbar,-1) AND Ref(wrb,-1) AND dnbar AND dcls AND wrb AND tll>0 AND H==HHV(H,10);

Hutbar=Ref(upbar,-1) AND Ref(V,-1)>1.5*Vrg AND dnbar AND dcls AND NOT wrb AND NOT utbar;

Hutcond=Ref(Hutbar,-1) AND dnbar AND dcls AND NOT utbar;

tcbar=Ref(upbar,-1) AND H==HHV(H,5)AND dnbar AND (dcls OR mcls) AND V>vrg AND NOT wrb AND NOT Hutbar ;

Scond1=(utcond1 OR utcond2 OR utcond3) ;

Scond2=Ref(scond1,-1)==0;

scond=scond1 AND scond2;

stdn0= tll<0 AND V>Ref(V,-1) AND Ref(dnbar,-1) AND upbar AND (ucls OR mcls) AND tls<0 AND tlm<0;

stdn= V>Ref(V,-1) AND Ref(dnbar,-1) AND upbar AND (ucls OR mcls) AND tls<0 AND tlm<0;

stdn1= tll<0 AND V>(vrg*1.5) AND Ref(dnbar,-1) AND upbar AND (ucls OR mcls)AND tls<0 AND tlm<0;

stdn2=tls<0 AND Ref(V,-1)Vrg;

bycond1= stdn OR stdn1;

bycond= upbar AND Ref(bycond1,-1);

stvol= L==LLV(L,5) AND (ucls OR mcls) AND V>1.5*Vrg AND tll<0;

ndbar=upbar AND nrb AND Vl AND dcls ;

nsbar=dnbar AND nrb AND Vl AND dcls ;

nbbar= C>Ref(C,-1) AND Vl AND nrb AND x1<2;

nbbar= IIf(C>Ref(C,-1) AND V0 AND tlm>0 AND wrb;

lvtbar2= Ref(Lvtbar,-1) AND upbar AND ucls;

dbar= V>2*Vrg AND dcls AND upbar AND tls>0 AND tlm>0 AND NOT Scond1 AND NOT utbar;

eftup=H>Ref(H,-1) AND L>Ref(L,-1) AND C>Ref(C,-1) AND C>=((H-L)*0.7+L) AND rg>arg AND V>Ref(V,-1);

eftupfl=Ref(eftup,-1) AND (utbar OR utcond1 OR utcond2 OR utcond3);

eftdn=Harg AND V>Ref(V,-1);

_SECTION_END();

//=======================================================================================================================

_SECTION_BEGIN("Chart");

Vcolor=IIf(tls>0 AND tlm>0 AND tll>0,colorLime,IIf(tls>0 AND tlm>0 AND tll<0,colorGreen,

IIf(tls>0 AND tlm<0 AND tll<0,colorPaleGreen,IIf(tls<0 AND tlm<0 AND tll<0,colorRed,IIf(tls<0 AND tlm>0 AND tll>0,colorPaleGreen,

IIf(tls<0 AND tlm<0 AND tll>0,colorOrange,colorBlue))))));

GraphXSpace = 5;

Vpc= utbar OR utcond1 OR utcond2 OR utcond3 OR stdn0 OR stdn1 OR stdn2 OR stdn OR lvtbar1 OR Lvtbar OR Lvtbar2 OR Hutbar OR Hutcond OR ndbar OR stvol OR tcbar;

//PlotOHLC( Open, High, Low, Close, "", vcolor, styleCandle | styleThick );

_SECTION_END();

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////

_SECTION_BEGIN("MACD Fill");

// Parameters

PeriodEMA = 13;

MACDIndicatorRange = 50;

// Volume filter

VolumeFilter = Param( "Volume MA filter", 100000, 50000, 500000, 100000 );

Timeframe = Interval(2);

// Adjust for weekly if necessary

if( Timeframe == "5-day" || Timeframe == "Weekly" ) {

VolumeFilter = VolumeFilter * 5;

}

else if( Timeframe == "Monthly") {

VolumeFilter = VolumeFilter * 20;

}

else if( Timeframe != "Daily" ) {

VolumeFilter = 0;

}

// Minimum number of bars required to form a divergence pattern. For a

// positive divergence, this is the number of falling bars in the context

// of a rising MACD or MACD-H pattern. Vice versa for negative divergence

MACDDivMinWidth = Param("Divergence min width", 4, 1, 10, 1 );

// Minimum width of negative projecting wave between two positive MACD-H waves,

// otherwise two positive waves will be considered as one single wave. This

// minimises invalid divergences, to ensure that "back of bears is broken".

// The same applies for a positive wave between two negative waves.

HistMinWidth = Param("Histogram min width", 4, 1, 10, 1 );

PeriodEMA = Optimize( "PeriodEMA ", 13, 5, 23, 1 );

// Other parameters

OpenPositions = 10;

ATRPeriod = 5;

InitialCapital = 100000;

PeriodFast = Param( "Fast EMA", 8, 2, 200, 1 );

PeriodSlow = Param( "Slow EMA", 17, 2, 200, 1 );

PeriodSignal = Param( "Signal EMA", 9, 2, 200, 1 );

MACDInd = MACD(PeriodFast, PeriodSlow );

SigInd = Signal(PeriodFast, PeriodSlow , PeriodSignal );

HistInd = MACDInd - SigInd ;

_N( macdStr = WriteVal( PeriodFast, 1.0 )+","+WriteVal( PeriodSlow , 1.0 ) );

_N( sigStr = macdStr + ","+WriteVal( PeriodSignal , 1.0 ) );

// Get displayed min and max value of MACD and MACD-H, to rescale it for better visibility

scMACDMax = LastValue(HHV(Max(MACDInd, sigInd),

BarsSince( Status("barvisible") AND NOT Ref(Status("barvisible"),-1) )));

scMACDMin = LastValue(LLV(Min(MACDInd, sigInd),

BarsSince( Status("barvisible") AND NOT Ref(Status("barvisible"),-1) )));

scaleMACD = Max( abs(scMACDMax), abs(scMACDMin) );

scHistMax = LastValue(HHV(HistInd,

BarsSince( Status("barvisible") AND NOT Ref(Status("barvisible"),-1) )));

scHistMin = LastValue(LLV(HistInd,

BarsSince( Status("barvisible") AND NOT Ref(Status("barvisible"),-1) )));

scaleHist = Max( abs(scHistMax), abs(scHistMin) );

_SECTION_END();

//////////////////////////////////////////////////////////////////////////////////////////////////////////MACD Fill

///MACD Fill////////End///////////////////////////////////////////////////////////////////////////////////MACD Fill

//////////////////////////////////////////////////////////////////////////////////////////////////////////MACD Fill

_SECTION_BEGIN("Matrix Swing");//=======================================================================================================\\

UpBarColor = ParamColor( "UpBar Color", colorGreen );

DownBarColor = ParamColor( "DownBar Color", colorRed );

MatixSwingSmoother= Param("Smoother", 20, 1, 100, 1);

MatrixBuy = ParamColor( "Buy Color", colorGreen );

MatrixSell = ParamColor( "Sell Color", colorRed );

n=20;

Var1=HHV(High,9)-LLV(Low,9);

Var2=HHV(High,9)-Close;

Var3=Close-LLV(Low,9);

Var4=Var2/Var1*100-70;

Var5=(Close-LLV(Low,60))/(HHV(High,60)-LLV(Low,60))*100;

Var6=(2*Close+High+Low)/4;

Var7=WMA(Var3/Var1*100,3);

Var8=LLV(Low,34);

Var9=WMA(Var7,3)-WMA(Var4,9);

VarA=IIf(Var9>100,Var9-100,0);

VarB=HHV(High,34);

AA= VarA*2;

BB= EMA((Var6-Var8)/(VarB-Var8)*100,13);

VarC=EMA(0.667*Ref(BB,-1)+0.333*BB,2);

VAR1a=(HHV(High,9)-Close)/(HHV(High,9)-LLV(Low,9))*100-70;

VAR2a=WMA(VAR1a,9)+100;

VAR3a=(Close-LLV(Low,9))/(HHV(High,9)-LLV(Low,9))*100;

VAR4a=WMA(VAR3a,3);

VAR5a=WMA(VAR4a,3)+100;

VAR6a=VAR5a-VAR2a;

S= IIf(VAR6a>n,VAR6a-n,Var6a);

barcolor=IIf(Ref(S,-1)s,Ref(s,-1),s);

Cc=Ll;

MatrixBB = (Close - BBandBot (Close, MatixSwingSmoother, 2))

/ ((BBandTop (Close, MatixSwingSmoother, 2) - BBandBot (Close, MatixSwingSmoother, 2)));

//PlotOHLC( Oo,hh,ll,Cc, "Matrix Swing", barcolor, styleCandle|styleNoLabel );

MBuy=Cross(MatrixBB,0);

MSell=Cross(1, MatrixBB);

//PlotShapes (IIf(MBuy, shapeCircle, shapeNone) ,MatrixBuy, layer = 0, yposition =Oo, offset = 1 );

//PlotShapes (IIf(MSell, shapeCircle, shapeNone) ,Matrixsell, layer = 0, yposition = Ll, offset = 1 );

_SECTION_END();//=======================================================================================================================\\

///////////////////////////////////////////////////////////////////////////////////////

//////////////////////////////////////Candle DES////////////////////////////////////////

////////////////////////////////////////Starts//////////////////////////////////////////

_SECTION_BEGIN("hai");

/*ndele

Copiare questo dile nell'area commenti "Formula" del "Guru Commentary" di Amibroker.

Le frecce Verdi piene indicano candele Bullish "rialziste" con elevata affidabilità.

Le frecce Verdi vuote indicano candele Bullish "rialziste" con moderata e bassa affidabilità.

Le frecce Rosse piene indicano candele Bearish "ribassiste" con elevata affidabilità.

Le frecce Rosse vuote indicano candele Bearish "ribassiste" con moderata e bassa affidabilità.

Spostare il cursore e cliccare sulla candela prescelta per avere il commento.

I commenti sono di Steve Nison "Japanese Candlestick Charting Techniques" e dal sito LitWick.

**********************************************************/

/*Colori candele*/

whiteBody=C>=O;

blackBody=O>C;

/*Ampiezza candele*/

smallBodyMaximum=0.0025;//meno di 0.25%

LargeBodyMinimum=0.01;//meno di 1.0%

smallBody=(O>=C*(1-smallBodyMaximum) AND whiteBody)

OR (C>=O*(1-smallBodyMaximum) AND blackBody);

largeBody=(C>=O*(1+largeBodyMinimum) AND whiteBody)

OR C<=O*(1-largeBodyMinimum) AND blackBody;

mediumBody=NOT LargeBody AND NOT smallBody;

identicalBodies=abs(abs(Ref(O,-1)-Ref(C,-1))-abs(O-C)) <

abs(O-C)*smallBodyMaximum;

realBodySize=abs(O-C);

/*Shadows*/

smallUpperShadow=(whiteBody AND H<=C*(1+smallBodyMaximum))

OR (blackBody AND H<=O*(1+smallBodyMaximum));

smallLowerShadow=(whiteBody AND L>=O*(1-smallBodyMaximum))

OR (blackBody AND L>=C*(1-smallBodyMaximum));

largeUpperShadow=(whiteBody AND H>=C*(1+largeBodyMinimum))

OR (blackBody AND H>=O*(1+largeBodyMinimum));

largeLowerShadow=(whiteBody AND L<=O*(1-largeBodyMinimum))

OR (blackBody AND L<=C*(1-largeBodyMinimum));

/*Gaps*/

upGap= IIf(Ref(blackBody,-1)AND whiteBody AND O>Ref(O,-1),1,

IIf(Ref(blackbody,-1) AND blackBody AND C>Ref(O,-1),1,

IIf(Ref(whiteBody,-1) AND whiteBody AND O>Ref(C,-1),1,

IIf(Ref(whiteBody,-1) AND blackBody AND C>Ref(C,-1),1,0))));

downGap=IIf(Ref(blackBody,-1)AND whiteBody AND C2*realBodySize) OR

(whiteBody AND abs(H-C)>2*realBodySize));

Hammer=smallUpperShadow AND NOT doji AND

((blackBody AND abs(C-L)>2*realBodySize) OR

(whiteBody AND abs(L-O)>2*realBodySize));

tweezerTop=abs(H-Ref(H,-1))<=H*0.0025;

tweezerBottom=abs(L-Ref(L,-1))<=L*0.0025;

engulfing=

IIf(blackBody AND Ref(blackbody,-1) AND CRef(O,-1),1,

IIf(blackBody AND Ref(whiteBody,-1) AND O>Ref(C,-1) AND CRef(C,-1) AND ORef(O,-1)AND ORef(C,-1),1,

IIf(blackBody AND Ref(whiteBody,-1) AND C>Ref(O,-1) AND ORef(O,-1),1,

IIf(whiteBody AND Ref(blackBody,-1) AND O>Ref(C,-1) AND CRef(O, -3)

AND CRef(C,-2)AND Ref(blackbody,-1)AND

blackBody AND engulfing;

/*Doji Star Bullish*/

dojiStarBullish=(dojiStar AND (MLT OR MLY))OR

(doji AND (C=Ref( C, -1) AND CRef(C,-1)*0.9975 AND C< Ref(C,-1)*1.0025;

/*Morning Doji Star*/

morningDojiStar= Ref(LargeBody,-2) AND Ref(blackBody,-2) AND

Ref(doji,-1) AND Ref(O,-1)Ref(C,-2) AND MLY;

/* Morning Star*/

morningStar =Ref(largeBody,-2) AND Ref(blackBody,-2)//Large black candle

AND Ref(downGap,-1)//Gap down yesterday

AND whiteBody AND LargeBody AND C>Ref(C,-2)//Large white candle today

AND MLY; //Yesterday was the low

/* Piercing Line*/

piercingLine= Ref(largeBody,-1) AND Ref(blackBody,-1)AND

O=(Ref(O,-1)+Ref(C,-1))/2 AND C=Ref(C,-2) AND O>=Ref(C,-1) AND

abs(C-Ref(C,-2))<=C*0.0025;

/*Three Inside Up harami confirming*/

threeInsideUp =Ref(Haramibullish,-1) AND whiteBody AND

largeBody AND C>Ref(C,-1);

/* Three Outside Up Engulfing confirmation*/

threeOutsideUp =Ref(engulfingBullish,-1) AND whiteBody AND C>Ref(C,-1);

/* Three Stars in the South*///Rewrite???

threeStarsInTheSouth=

Ref(LargeBody,-2) AND Ref(blackBody,-2) AND Ref(largelowerShadow,-2)

AND Ref(blackBody,-1) AND Ref(largeLowerShadow,-1) AND

Ref(L,-1)>Ref(L,-2) AND blackBody AND smallUpperShadow AND

smallLowerShadow AND L>Ref(L,-1) AND HRef(C,-2) AND

whiteBody AND CRef(O,-4) AND NOT Ref(LargeBody,-1) AND Ref(C,-1)Ref(C,-4);

/*RisingThreeMethods*/

risingThreeMethods=Ref(LargeBody,-4) AND Ref(whiteBody,-4) AND NOT

Ref(LargeBody,-3) AND NOT Ref(LargeBody,-2)AND NOT Ref(LargeBody,-1) AND

Ref(C,-3)Ref(C,-4);

/* Seperating Lines Bullish*/

separatingLinesBullish=Ref(blackBody,-1) AND whiteBody AND LargeBody AND

smallLowerShadow AND MHT AND abs(O-Ref(O,-1))<=O*0.0025;

/*Side by Side White Lines*/

sideBySideWhiteLines=NOT Ref(smallBody,-2) AND Ref(whiteBody,-2)

AND Ref(upGap,-1) AND Ref(whitebody,-1)AND whiteBody AND

identicalBodies AND abs(O-Ref(O,-1))Ref(C,-1) AND Ref(C,-1)>Ref(C,-2) AND

Ref(O,-1)>Ref(O,-2) AND Ref(O,-1)Ref(O,-1) AND Ref(smallUpperShadow,-2) AND

Ref(smallUpperShadow,-1) AND smallUppershadow AND LLV(L,12)==Ref(L,-2);

/*Upside Gap Three Methods not very good*/

upsideGapThreeMethods=Ref(Largebody,-2) AND Ref(whiteBody,-2) AND

Ref(LargeBody,-1) AND Ref(whiteBody,-1) AND Ref(upGap,-1) AND

blackBody AND O>Ref(O,-1) AND CRef(O,-2) AND

MHY;

/*Three Line Strike not good signals*/

threeLineStrike=NOT Ref(smallBody,-3) AND NOT Ref(smallBody,-2) AND

NOT Ref(smallBody,-1) AND Ref(whiteBody,-3) AND Ref(whiteBody,-2) AND

Ref(whiteBody,-1) AND Ref(C,-1)>Ref(C,-2) AND Ref(C,-2)>Ref(C,-3) AND

blackBody AND O>Ref(C,-1) AND CRef(O,-1) AND CRef(C,-2) AND

identicalBodies AND ORef(O,-2) AND Ref(O,-1)Ref(C,-2) AND C>Ref(C,-1) AND

ORef(O,-1) AND Ref(LargeUpperShadow,-1) AND LargeUpperShadow

AND C-ORef(O,-3) AND CRef(H,-1) AND C>Ref(O,-1) AND C<(Ref(O,-1)+Ref(C,-1))/2

AND MHT;

/*Deliberation Bearish: needs confirmation*/

deliberationBearish=Ref(LargeBody,-2) AND Ref(whiteBody,-2) AND

Ref(LargeBody,-1) AND Ref(whiteBody,-1) AND Ref(C,-1)>Ref(C,-2) AND

smallbody AND upGap;

/*CounterAttackBearish*/

CounterAttackBearish=MHT AND LargeBody AND blackbody AND

Ref(largeBody,-1) AND Ref(whiteBody,-1) AND

CRef(C,-1)*0.9975;;

/*Doji Star Bearish*/

dojiStarBearish=(dojiStar AND (MHT OR MHY))OR

(doji AND (C>Ref(C,-1) OR O>Ref(C,-1))AND Ref(whiteBody,-1)

AND Ref(LargeBody,-1));

/*Engulfing Bearish*/

engulfingBearish=engulfing AND largeBody AND blackBody AND

(Ref(whitebody,-1) OR Ref(Doji,-1))AND (MHT OR MHY);

/*Evening Doji Star check formula???*/

eveningDojiStar=Ref(LargeBody,-2) AND Ref(whiteBody,-2) AND

Ref(dojiStar,-1) AND Ref(GapUp(),-1) AND (MHY OR MHT);

/*Evening Star*/

eveningStar=Ref(LargeBody,-2) AND Ref(whiteBody,-2) AND

Ref(upGap,-1) AND NOT Ref(largeBody,-1) AND blackBody AND NOT smallBody AND

(MHT OR MHY);

/*Hammer Bearish*/

HammerBearish=Hammer AND HHV(H,8)==H;

/*hangingMan*/

HangingMan=NOT largeBody AND smallUpperShadow AND LargeLowerShadow AND MHT;

/*dragonfly Doji Bearish*/

dragonflyDojiBearish=doji AND smallUpperShadow AND LargeLowerShadow AND MHT;

/*Harami Bearish-*/

HaramiBearish=harami AND Ref(Largebody,-1) AND Ref(whiteBody,-1)AND blackBody

AND (MHY OR MHT);

/*HaramiCross Bearish*/

HaramiCrossBearish=harami AND doji AND Ref(whiteBody,-1) AND Ref(Largebody,-1);

/*Identical three black crows*/

idendicalThreeBlackCrows=Ref(blackBody,-2) AND Ref(blackBody,-1) AND blackBody AND

abs(Ref(C,-2)-Ref(O,-1))Ref(C,-1)AND CRef(O,-2) AND MHY;//Third day

/*Upside Gap Two Crows*/

upsideGapTwoCrows= Ref(whiteBody,-2) AND Ref(LargeBody,-2)// first day

AND Ref(upGap,-1) AND Ref(blackBody,-1) // 2nd day

AND blackbody AND O>Ref(O,-1) AND CRef(C,-2);

/*Doji Star Bearish needs confirmation

dojiStarBearish=Ref(LargeBody,-1) AND Ref(whiteBody,-1) // first day

AND doji AND upGap AND MHT;*/

/* Downside Gap Three Methods*/

downsideGapThreeMethods=

Ref(LargeBody,-2) AND Ref(blackBody,-2) AND Ref(downGap,-2) //first day

AND Ref(LargeBody,-1) AND Ref(blackBody,-1)//2nd day

AND whitebody AND ORef(C,-2)

AND LLV(L,8)==Ref(L,-1);

/*Downside Tasuki Gap*/

downsideTasukiGap=

Ref(blackBody,-2)//first day

AND Ref(blackbody,-1) AND Ref(downgap,-1) //2nd day

AND whiteBody AND ORef(C,-1) AND C>Ref(O,-1) AND CRef(C,-2)

AND Ref(C,-2)>Ref(C,-3) AND LargeBody AND blackBody AND O>Ref(C,-4) AND

O=Ref(C,-1);

/*On Neck Bearish not good*/

OnNeckBearish=Ref(LargeBody,-1) AND Ref(blackBody,-1) AND

whiteBody AND O=Ref(L,-1)*0.9975;

/*separating Lines Bearish*/

separatingLinesBearish=Ref(LargeBody,-1) AND Ref(whiteBody,-1) AND

blackBody AND O>Ref(O,-1)*0.9975 AND O<=Ref(O,-1)*1.0025;

/*Side By Side White Lines Bearish*/

sideBySideWhiteLinesBearish=NOT Ref(smallBody,-2) AND Ref(blackBody,-2) AND

Ref(whiteBody,-1) AND whiteBody AND Ref(downGap,-1) AND identicalBodies

AND abs(C-Ref(C,-1)Ref(O,-3);

/*Thrusting Bearish*/

thrustingBearish=Ref(blackBody,-1) AND Ref(LargeBody,-1) AND LargeBody AND

whitebody AND ORef(C,-1);

/*Tweezer Top*/

tweezerTop= (abs(H-Ref(H,-1))/H<0.0025 OR

abs(H-Ref(H,-2))/H<0.0025)

AND (MHT OR MHY);

/* ***********************************************

Regole di Buy (Alta Affidabilità)

**************************************************

Buy=

abandonedBabybullish OR

ConcealingBabySwallow OR

morningDojiStar OR

morningStar OR

threeInsideUp OR

threeOutsideUp OR

MAtHoldBullish OR

risingThreeMethods OR

sideBySideWhiteLines OR

threeWhiteSoldiers;

/* ***********************************************

Regole di Cover (Moderata e Bassa Affidabilità)

**************************************************

Cover=

beltHoldBullish OR

breakAwayBullish OR

dojiStarBullish OR

engulfingBullish OR

hammerBullish OR

dragonflyDoji OR

haramiBullish OR

HaramiCross OR

homingPigeon OR

invertedHammer OR

meetingLinesbullish OR

piercingLine OR

stickSandwich OR

threeStarsInTheSouth OR

triStarBullish OR

threeriverBottom OR

separatingLinesBullish OR

upsideGapThreeMethods OR

threeLineStrike OR

tweezerBottom OR

upsideTasukiGap;

/************************************

Regole di Short (bassa e media affidabilità)

*************************************

Short=

advanceBlockBearish OR

beltHoldBearish OR

breakAwayBearish OR

HangingMan OR

deliberationBearish OR

CounterAttackBearish OR

engulfingBearish OR

HammerBearish OR

dragonflyDojiBearish OR

HaramiBearish OR

HaramiCrossBearish OR

MeetingLinesBearish OR

shootingStarGap OR

gravestoneDoji OR

triStarBearish OR

twoCrows OR

dojiStarBearish OR

downsideGapThreeMethods OR

downsideTasukiGap OR

inNeckBearish OR

OnNeckBearish OR

separatingLinesBearish OR

sideBySideWhiteLinesBearish OR

threeLineStrike OR

thrustingBearish OR

tweezerTop;

/************************************

Regole di Sell (alta affidabilità)

*************************************

Sell=

AbandonedBabyBearish OR

darkCloudCover OR

eveningDojiStar OR

eveningStar OR

idendicalThreeBlackCrows OR

kickingBearish OR

threeInsideDownBearish OR

threeoutsideDownBearish OR

upsideGapTwoCrows OR

fallingThreeMethods OR

threeBlackCrows;

*/

_SECTION_END();

///////////////////////////////////////////Candle Des///////////////////////////////////

///////////////////////////////////////////////End////////////////////////////////////////////////////////////////////

// Trend Detection

// Graham Kavanagh 11 Jan 05

// I am using version 4.66.2, but believe this will work with last offical Version.

function Rise( Pd, perd, Pl, perl )

{

MAD = DEMA(Pd,perd);

MAL = LinearReg(Pl,perl);

CondR = ROC(MAD,1)>0 AND ROC(MAL,1)>0;

CondF = ROC(MAD,1)<0 AND ROC(MAL,1)<0;

R[0] = C[0]>(H[0]+L[0])/2;

for(i=1;i 0 AND ROC(Confirm,5) > 0;

Downward = ROC(Confirm,1) < 0 AND ROC(Confirm,5) < 0;

Select = Rs AND Ref(Fs,-1);

Caution = Fs AND Ref(Rs,-1);

Change = IIf( Rs, H/ValueWhen(Fs,L)*100, L/ValueWhen(Rs,H)*100 );

//Plot( C, "close", IIf( Rs, colorGreen, IIf( Fs, colorRed, colorBlack )), styleBar);

//GraphXSpace=10;

//_N( Title = "{{NAME}} - {{INTERVAL}} {{DATE}} Trend Plot - "+prdd+" Day" );

Filter = Select OR Caution;

AddColumn( Select, "UpTurn", 1 );

AddColumn( Caution, "DownTurn", 1 );

// ---indicator end---

//"Rise = " + Rs;

//"Fall = " + Fs;

//"Current Trend Bars = " + Bs;

//"Trend Move = " + Change + " %";

/*

Heikin-Ashi(Koma-Ashi) with Moving Average Type

*/

UpCandle = ParamColor("Up Color", colorBrightGreen );

DownCandle = ParamColor("Down Color", colorRed );

Consolidation = ParamColor("Consolidation", colorWhite );

MACDColorUp = ParamColor("MACD Up", colorDarkGreen );

MACDColorDown = ParamColor("MACD Down", colorDarkRed );

Prd1=Param("ATR Period",4,1,20,1);

Prd2=Param("Look Back",8,1,20,1);

SetChartOptions(2, chartWrapTitle);

// Calculate Moving Average

MAPeriod = Param("MA Period", 4, 1, 100);

MAOpen = EMA(Open, MAPeriod);

MAHigh = EMA(High, MAPeriod);

MALow = EMA(Low, MAPeriod);

MAClose = EMA(Close, MAPeriod);

HaClose = (MAOpen + MAHigh + MALow + MAClose) / 4;

HaOpen = AMA(Ref(HaClose, -1), 0.5);

// for graph collapse

//for(i = 0; i <= MAPeriod; i++) HaClose[i] = Null;

/*

// same

// HaOpen = (Ref(HaOpen, -1) + Ref(HaClose, -1)) / 2;

HaOpen[ 0 ] = HaClose[ 0 ];

for(i = 1; i < BarCount; i++) {

HaOpen[i] = (HaOpen[i - 1] + HaClose[i - 1]) / 2;

}

*/

HaHigh = Max(MAHigh, Max(HaClose, HaOpen));

HaLow = Min(MALow, Min(HaClose, HaOpen));

// outs comments

"BarIndex = " + BarIndex();

"Open = " + Open;

"High = " + High;

"Low = " + Low;

"Close = "+ Close;

"HaOpen = " + HaOpen;

"HaHigh = " + HaHigh;

"HaLow = " + HaLow;

"HaClose = "+ HaClose;

PlotShapes( shapeHollowSmallCircle* select, colorBrightGreen, 0, HaLow, -21 );

PlotShapes( shapeHollowSmallCircle* Caution, colorRed, 0, HaHigh,21 );

pricechange=(C-Ref(C,-1))*100/Ref(C,-1);

changeponit=C-Ref(C,-1);

BrightGreen=HHV(LLV(L,Prd1)+ATR(Prd1),Prd2);

BrightRed=LLV(HHV(H,Prd1)-ATR(Prd1),Prd2);

xDiff = (HaHigh - Halow) * IIf(StrFind(Name(),"JPY"),100,10000);

barcolor = IIf(C>BrightGreen ,UpCandle,IIf(C < BrightRed,DownCandle,Consolidation));

//SetBarFillColor( );

SetBarFillColor(IIf(Mbuy,colorBlue,IIf(MSell, colorYellow,IIf(MACDInd >SigInd, MACDColorUp,MACDColorDown))));

PlotOHLC( HaOpen, HaHigh, HaLow, HaClose, "", barcolor, styleCandle|styleNoLabel );

//////////////////////////////////////////////////////////////////////////////

_SECTION_BEGIN("Pivot");

nBars = Param("Number of bars", 12, 5, 40);

bShowTCZ = Param("Show TCZ", 1, 0, 1);

nExploreBarIdx = 0;

nExploreDate = 0;

nCurDateNum = 0;

DN = DateNum();

DT = DateTime();

bTCZLong = False;

bTCZShort = False;

nAnchorPivIdx = 0;

ADX8 = ADX(8);

if(Status("action")==1) {

bDraw = True;

bUseLastVis = 1;

} else {

bDraw = False;

bUseLastVis = False;

bTrace = 1;

nExploreDate = Status("rangetodate");

for (i=LastValue(BarIndex());i>=0;i--) {

nCurDateNum = DN[i];

if (nCurDateNum == nExploreDate) {

nExploreBarIdx = i;

}

}

}

GraphXSpace=7;

if (bDraw) {

}

aHPivs = H - H;

aLPivs = L - L;

aHPivHighs = H - H;

aLPivLows = L - L;

aHPivIdxs = H - H;

aLPivIdxs = L - L;

aAddedHPivs = H - H;

aAddedLPivs = L - L;

aLegVol = H - H;

aRetrcVol = H - H;

nHPivs = 0;

nLPivs = 0;

lastHPIdx = 0;

lastLPIdx = 0;

lastHPH = 0;

lastLPL = 0;

curPivBarIdx = 0;

aHHVBars = HHVBars(H, nBars);

aLLVBars = LLVBars(L, nBars);

aHHV = HHV(H, nBars);

aLLV = LLV(L, nBars);

nLastVisBar = LastValue(

Highest(IIf(Status("barvisible"), BarIndex(), 0)));

curBar = IIf(nlastVisBar > 0 AND bUseLastVis, nlastVisBar,

IIf(Status("action")==4 AND nExploreBarIdx > 0, nExploreBarIdx,

LastValue(BarIndex())));

curTrend = "";

if (aLLVBars[curBar] < aHHVBars[curBar])

curTrend = "D";

else

curTrend = "U";

if (curBar >= 120) {

for (i=0; i<120; i++) {

curBar = IIf(nlastVisBar > 0 AND bUseLastVis,

nlastVisBar-i,

IIf(Status("action")==4 AND nExploreBarIdx > 0,

nExploreBarIdx-i,

LastValue(BarIndex())-i));

if (aLLVBars[curBar] < aHHVBars[curBar]) {

if (curTrend == "U") {

curTrend = "D";

curPivBarIdx = curBar - aLLVBars[curBar];

aLPivs[curPivBarIdx] = 1;

aLPivLows[nLPivs] = L[curPivBarIdx];

aLPivIdxs[nLPivs] = curPivBarIdx;

nLPivs++;

}

} else {

if (curTrend == "D") {

curTrend = "U";

curPivBarIdx = curBar - aHHVBars[curBar];

aHPivs[curPivBarIdx] = 1;

aHPivHighs[nHPivs] = H[curPivBarIdx];

aHPivIdxs[nHPivs] = curPivBarIdx;

nHPivs++;

}

}

}

}

curBar =

IIf(nlastVisBar > 0 AND bUseLastVis,

nlastVisBar,

IIf(Status("action")==4 AND nExploreBarIdx > 0,

nExploreBarIdx,

LastValue(BarIndex()))

);

if (nHPivs >= 2 AND nLPivs >= 2) {

lastLPIdx = aLPivIdxs[0];

lastLPL = aLPivLows[0];

lastHPIdx = aHPivIdxs[0];

lastHPH = aHPivHighs[0];

nLastHOrLPivIdx = Max(lastLPIdx, lastHPIdx);

nAddPivsRng = curBar - nLastHOrLPivIdx;

aLLVAfterLastPiv = LLV(L, nAddPivsRng);

nLLVAfterLastPiv = aLLVAfterLastPiv[curBar];

aLLVIdxAfterLastPiv = LLVBars(L, nAddPivsRng);

nLLVIdxAfterLastPiv = curBar - aLLVIdxAfterLastPiv[curBar];

aHHVAfterLastPiv = HHV(H, nAddPivsRng);

nHHVAfterLastPiv = aHHVAfterLastPiv[curBar];

aHHVIdxAfterLastPiv = HHVBars(H, nAddPivsRng);

nHHVIdxAfterLastPiv = curBar - aHHVIdxAfterLastPiv[curBar];

if (lastHPIdx > lastLPIdx) {

/* There are at least two possibilities here. One is that

the previous high was higher, indicating that this is a

possible short retracement or one in the making.

The other is that the previous high was lower, indicating

that this is a possible long retracement in the working.

However, both depend on opposing pivots. E.g., if I find

higher highs, what if I have lower lows?

If the highs are descending, then I can consider:

- a lower low, and leave it at that

- a higher high and higher low

- a lower low and another lower high

*/

if (aHPivHighs[0] < aHPivHighs[1]) {

if (nLLVAfterLastPiv < aLPivLows[0] AND

(nLLVIdxAfterLastPiv - lastHPIdx - 1) >= 1

AND nLLVIdxAfterLastPiv != curBar ) {

// -- OK, we'll add this as a pivot.

// Mark it for plotting...

aLPivs[nLLVIdxAfterLastPiv] = 1;

aAddedLPivs[nLLVIdxAfterLastPiv] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j aLPivLows[0] AND

(nLLVIdxAfterLastPiv - lastHPIdx - 1) >= 1

AND nLLVIdxAfterLastPiv != curBar ) {

// -- OK, we'll add this as a pivot.

// Mark it for plotting...

aLPivs[nLLVIdxAfterLastPiv] = 1;

aAddedLPivs[nLLVIdxAfterLastPiv] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j= 1

AND nHHVIdxAfterLastPiv != curBar ) {

// -- OK, we'll add this as a pivot.

// Mark that for plotting

aHPivs[nHHVIdxAfterLastPiv] = 1;

aAddedHPivs[nHHVIdxAfterLastPiv] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j aHPivHighs[0] AND

(nHHVIdxAfterLastPiv - lastLPIdx - 1) >= 1

AND nHHVIdxAfterLastPiv != curBar ) {

// -- OK, we'll add this as a pivot.

// Mark it for plotting...

aHPivs[nHHVIdxAfterLastPiv] = 1;

aAddedHPivs[nHHVIdxAfterLastPiv] = 1;

// ...and then rearrange elements in the

// pivot information arrays

for (j=0; j Ref(HaHigh,-1) AND Ref(HaHigh,1) < HaHigh;//Peak

PKV0 = ValueWhen(PK,HaHigh,0);//PeakValue0

PKV1 = ValueWhen(PK,HaHigh,1);//PeakValue1

PKV2 = ValueWhen(PK,HaHigh,2);//PeakValue2

MPK = PKV2 < PKV1 AND PKV1 > PKV0 ;//MajorPeak

MPKV = ValueWhen(Ref(MPK,-1) == 0 AND MPK == 1, PKV1,1); //MajorPeakValue

MPKD = ValueWhen(Ref(MPK,-1) == 0 AND MPK == 1, DateNum(),1); //MajorPeakDate

SD = IIf(DateNum() < LastValue(MPKD,lastmode = True ), Null, LastValue(MPKV,Lastmode = True));//SelectedDate

Plot(SD, "LastMinorResistance",colorDarkGrey,styleLine);

//PLOT THE SECOND LAST MAJOR PEAK RESISTANCE LINE

MPKV2 = ValueWhen(Ref(MPK,-1) == 0 AND MPK == 1, PKV1,2); //MajorPeakValue

MPKD2 = ValueWhen(Ref(MPK,-1) == 0 AND MPK == 1, DateNum(),2); //MajorPeakDate

SD2 = IIf(DateNum() < LastValue(MPKD2,lastmode = True ), Null, LastValue(MPKV2,Lastmode = True));//SelectedDate

Plot(SD2, "LastMajorResistance",colorDarkGrey,styleLine);

_SECTION_END();

_SECTION_BEGIN("Support");

SP = Ref(HaLow,1) > HaLow AND HaLow < Ref(HaLow,-1);//Peak

SPV0 = ValueWhen(SP,HaLow,0);//PeakValue0

SPV1 = ValueWhen(SP,HaLow,1);//PeakValue1

SPV2 = ValueWhen(SP,HaLow,2);//PeakValue2

MSP = SPV2 > SPV1 AND SPV1 < SPV0 ;//MajorPeak

MSPV = ValueWhen(Ref(MSP,-1) == 0 AND MSP == 1, SPV1,1);

MSPD = ValueWhen(Ref(MSP,-1) == 0 AND MSP == 1, DateNum(),1);

SD = IIf(DateNum() < LastValue(MSPD,lastmode = True ), Null, LastValue(MSPV,Lastmode = True));

Plot(SD,"LastMinorSupport",colorDarkGrey,styleLine);

MSPV2 = ValueWhen(Ref(MSP,-1) == 0 AND MSP == 1, SPV1,2);

MSPD2 = ValueWhen(Ref(MSP,-1) == 0 AND MSP == 1, DateNum(),2);

SD2 = IIf(DateNum() < LastValue(MSPD2,lastmode = True ), Null, LastValue(MSPV2,Lastmode = True));

Plot(SD2,"LastMajorSupport",colorDarkGrey,styleLine);

_SECTION_END();

_N(Title = StrFormat("\\c02**AAA2nd.formula**...{{NAME}} | {{DATE}} | {{VALUES}}",O, H, L, C, SelectedValue( ROC( C, 1 )) )

+"\n"+EncodeColor(colorOrange) +"Open = " + EncodeColor(colorWhite) + O +

"\n"+EncodeColor(colorOrange) +"High = " + EncodeColor(5) + H +

"\n"+EncodeColor(colorOrange) +"Low = " + EncodeColor(colorRed) + L

+"\n"+WriteIf( Ref(C,-1)Vp2,EncodeColor(colorLime)+"Very High",WriteIf(V>Vp1,EncodeColor(colorLime)+" High",WriteIf(V>Vrg,EncodeColor(colorLime)+"Above Average",

WriteIf(VVn1,EncodeColor(colorRed)+"Less than Average",WriteIf(V\nNison: Ha maggior significato se il volume delle candele bianche è maggiore rispetto a quello delle candele nere.\nReliability second LitWick: High. \n","") +

WriteIf(sideBySideWhiteLines,"(+) Side by Side White Lines. Pattern continued.\nNison: if in a downtrend may be caused by ricoperture be Short.\nReliability Second LitWick: High. \n","") +

WriteIf(threeWhiteSoldiers,"(+) 3 White Soldiers. Pattern continued.\nNison: Positive, but pay attention to such negative pattern of stalemate and subsequent pattern of the block.\nReliability second LitWick: High. \n","") +

/***************************************

Candle Down - Bearish

********************************************/

EncodeColor(colorRed)+

WriteIf(AbandonedBabyBearish,"(-) Abandoned Baby Bearish. Pattern reversal.\nNison: Extremely rare.\nReliability second LitWick: High. \n","") +

WriteIf(advanceBlockBearish,"(-) Advancing Block Bearish. Pattern reversal.\nNison: Rally has problems. A sign of weakness could be a gradual decrease in the bodies of white candles OR the presence of relatively higher long queues on the last two white candles. NOT necessarily a reversal pattern.\nReliability Second LitWick: Moderate \n","") +

WriteIf(darkCloudCover,"(-) Dark Cloud Cover. Pattern reversal.\nNison: Factors that indicate the importance of this signal is: \\ n 1) Magggior penetration of the first candle in the second. \\ n 2) If both candles are marabozu. \\ n 3) The body of the second candle on a significant level of resistance. \n 4) High-volume days in socondo.\nReliability second LitWick: High. \n","") +

WriteIf(eveningDojiStar,"(-) Evening Doji Star. Pattern reversal.\nNison: must be confirmed by a long black candle.\nReliability second LitWick: High. \n","") +

WriteIf(eveningStar,"(-) Evening Star. Pattern reversal.\nNison: the gap between the second and third candle body is not always present.\nReliability second LitWick: High. \n","") +

WriteIf(HammerBearish,"(-) Bearish Hammer. Pattern reversal.\nNison: more bearish if the hammer is black. E 'bearish confirmation needed. A significant gap down the next day will be confirmed. \n","") +

WriteIf(dragonflyDojiBearish,"(-) Dragonfly Bearish. Pattern reversal.\nNison: as in 'Hanging Man'.\nReliability Second LitWick: Moderate \n","") +

WriteIf(HaramiBearish,"(-) Harami Bearish. Pattern reversal.\nNison: not as significant as' hanging man 'and' engulfing '.\nReliability second LitWick: Low. \n","") +

WriteIf(idendicalThreeBlackCrows,"(-) Identical 3 Black Crows. Pattern di inversione in uptrend.\nNison: very bearish.\nReliability Second LitWick: High. \n","") +

WriteIf(kickingBearish,"(-) Kicking Bearish. Pattern reversal.\nReliability second LitWick: High. \n","") +

WriteIf(threeInsideDownBearish,"(-) 3 Inside Down. Pattern reversal.\nReliability second LitWick: High. \n","") +

WriteIf(threeoutsideDownBearish,"(-) 3 Outside Down. Pattern reversal.\nReliability second LitWick: High. \n","") +

WriteIf(upsideGapTwoCrows,"(-) Upside Gap 2 Crows. Pattern reversal.\nNison: requires confirmation with inversion continued on the third day.\nReliability second LitWick: High. \n","") +

WriteIf(fallingThreeMethods,"(-) Falling 3 Methods. Pattern continued.\nReliability second LitWick: High. \n","") +

WriteIf(threeBlackCrows,"(-) 3 Black Crows. Pattern reversal.\nNison: should look after a rise 'mature'.\nReliability Second LitWick: High. \n","") +

/***********************************************

Short sell

**************************************************/

EncodeColor(colorPink)+

WriteIf(beltHoldBearish,"(-) Belt Hold Bearish. Pattern reversal.\nNison: The longer the height of the candle is the most significant pattern.\nReliability second LitWick: Low. \n","") +

WriteIf(breakAwayBearish,"(-) breakvar Away Bearish. Pattern reversal.\nReliability second LitWick: Moderate \n","") +

WriteIf(HangingMan,"(-) Hanging Man. Pattern reversal.\nNison: Such a 'bearish hammer' with a significant gap down the next day. \nReliability second LitWick: Low. \n","") +

WriteIf(deliberationBearish,"(-) Deliberation Bearish. Pattern reversal.\nNison: It is not a real pattern of reversal, but a sign that the rally is weakening. \n Reliability second LitWick: Moderate \n","") +

WriteIf(CounterAttackBearish,"(-) Counter Attack Bearish.\nNison: un potenziale stallo del rally. \n","") +

WriteIf(engulfingBearish,"(-) Engulfing Bearish. Pattern reversal.\nNison: Important sign of reversal. The factors that increase the importance of the patterns are: \n 1) above the candle has a very small body AND the Second candle is a very large body. \n 2) the pattern appears after a protracted OR moving very fast. \n 3 ) High volumes in the Second Day. \n 4) on the Second Day covers the body more than a body of candles before.\nReliability Second LitWick: Moderate \n","") +

WriteIf(HaramiCrossBearish,"(-) Harami Cross Bearish. Pattern reversal.\nNison: more significant downtrend pattern of 'Harami'. The second day, the candle can be white or black.\nReliability second LitWick: Moderate \n","") +

WriteIf(MeetingLinesBearish,"(-) Meeting Lines Bearish. Pattern reversal.\nReliability second LitWick: moderate, but not so strong as' Dark Cloud Cover '. \n","") +

WriteIf(shootingStarGap,"(-) Shooting Star. Pattern reversal.\nNison: not so important as an 'evening star'. Ideally, the body of the candle should be in a gap from the body of the candle before. It should appear after a positive trend.\nReliability second LitWick: Low. \n","") +

WriteIf(gravestoneDoji,"(-) Gravestone Doji. Pattern reversal.\nNison: more significant when touching a new all-time high.\nReliability second LitWick: Moderate \n","") +

WriteIf(triStarBearish,"(-) Tri-Star Bearish. Pattern reversal.\nNison: pattern of very significant reversal.\nReliability second LitWick: Moderate \n","") +

WriteIf(twoCrows,"(-) 2 Crows. Pattern reversal.\nReliability second LitWick: Moderate \n","") +

WriteIf(dojiStarBearish,"(-) Doji Star Bearish. Pattern reversal.\nNison: Requires confirmation.\nReliability second LitWick: Moderate \n","") +

WriteIf(downsideGapThreeMethods,"(-) Downside Gap 3 Methods. Pattern continued.\nReliability second LitWick: Moderate \n","") +

WriteIf(downsideTasukiGap,"(-) Downside Tasuki Gap. Method of continuation.\nNison: if the last Day we closed the gap, the pattern to continuevar is denied.\nReliability Second LitWick: Moderate \n","") +

WriteIf(inNeckBearish,"(-) In Neck Bearish. Pattern continued.\nNison: as in 'piercing pattern' but more bearish on the second day because there is no penetration.\nReliability second LitWick: Moderate \n","") +

WriteIf(OnNeckBearish,"(-) On Neck Bearish. Pattern continued. Similar to 'piercing'ma more bearish because there is no penetration on the second day.\nReliability second LitWick: Moderate \n","") +

WriteIf(separatingLinesBearish,"(-) Separating Lines Bearish. \n","") +

WriteIf(sideBySideWhiteLinesBearish,"(-) Side by Side White Lines Bearish. Pattern continued.\nNison: very rare.\nReliability Second LitWick: Moderate \n","") +

WriteIf(threeLineStrike,"(-) 3 Line Strike. Pattern continued.\nReliability second LitWick: Low. \n","") +

WriteIf(thrustingBearish,"(-) Thrusting. Pattern continued.\nNison: is not a day of reversal because the second day does not engage the midpoint of the first day.\nReliability second LitWick: Low. \n","") +

WriteIf(tweezerTop,"(-) Tweezer Top. Pattern reversal.\nNison: Requires confirmation. \n","")

+"\n"

+"\n"

+"\n"

+"\n"

)

;

///////////////////////////////////////////////////////////////////////////////////////

_SECTION_BEGIN("WMA1");

P = ParamField("Price field",-1);

//Periods = Param("Periods",8, 2, 300, 1, 10 );

Plot( WMA( P, 8 ), "WMA(8)", colorOrange, ParamStyle("Style") );

_SECTION_END();

_SECTION_BEGIN("WMA3");

P = ParamField("Price field",-1);

//Periods = Param("Periods", 12, 2, 300, 1, 10 );

Plot( WMA( P, 12 ), "WMA(12)", colorGreen, ParamStyle("Style") );

_SECTION_END();

_SECTION_BEGIN("WMA4");

P = ParamField("Price field",-1);

//Periods = Param("Periods", 15, 2, 300, 1, 10 );

Plot( WMA( P, 15 ), "WMA(15)", colorRed, ParamStyle("Style") );

_SECTION_END();

_SECTION_BEGIN("WMA");

P = ParamField("Price field",-1);

//Periods = Param("Periods", 200, 2, 300, 1, 10 );

Plot( WMA( P, 200), "WMA(200)", colorYellow, 8 );

_SECTION_END();

_SECTION_BEGIN("WMA6");

P = ParamField("Price field",-1);

//Periods = Param("Periods", 50, 2, 300, 1, 10 );

Plot( WMA( P, 50 ), "WMA(50)", colorPink, ParamStyle("Style") );

_SECTION_END();

_SECTION_BEGIN("WMA7");

P = ParamField("Price field",-1);

//Periods = Param("Periods", 100, 2, 300, 1, 10 );

Plot( WMA( P, 100 ), "WMA(100)", ParamColor( "Color", colorCycle ), ParamStyle("Style") );

_SECTION_END();

Where Does Volume Spread Analysis Thrive?

VSA is applicable across a spectrum of financial markets including stocks, forex, and futures. Price and volume are fundamental concepts in every financial market, making VSA a versatile tool. However, in markets where volume levels are elusive or hard to calculate (like spot forex), VSA becomes challenging.

Final Thoughts

VSA is an invaluable addition to any trader’s toolkit. While it demands time and effort to grasp, it’s a worthy pursuit. Trailing smart money can significantly elevate your win rate and profitability.

Price and volume share a captivating bond in financial markets, with VSA serving as a formidable key to decipher this enigma.

One Comment