Considering trading? Paper Trading offers a risk-free way to navigate the market using ‘virtual cash‘. It’s a great learning tool because you won’t lose real money, even if trades don’t go your way.

While numerous paper trading platforms exist, many fall short in mirroring actual market conditions. This article sheds light on traditional paper trading’s limitations and introduces a more effective approach with the [eafl id=”229867″ name=”Tradetron” text=”Tradetron platform”].

Limitations of Conventional Paper Trading

Real-world trading is fraught with challenges like latency, slippages, and price volatility. Traditional paper trading platforms often overlook these factors, leading to misleading results.

Consider a strategy where you buy a stock daily at 9:30 AM and sell at 3:15 PM. The stock may be listed at 100 at 9:30 AM, but actual execution prices can differ due to the bid-ask spread and order delays.

While ordinary paper trading platforms would simply log the buy price as 100, they ignore these vital market dynamics.

In contrast, advanced platforms like Tradetron simulate real trades on exchanges, capturing a more realistic execution price.

This explains why strategies may seem profitable in paper trading but fall flat in live markets.

Further Reading: Mastering Stocks: Top 5 Virtual Trading Platforms in India

Accurate Paper Trading with Tradetron

Tradetron revolutionizes paper trading by allowing you to build strategies and test them in real-market conditions, without any coding.

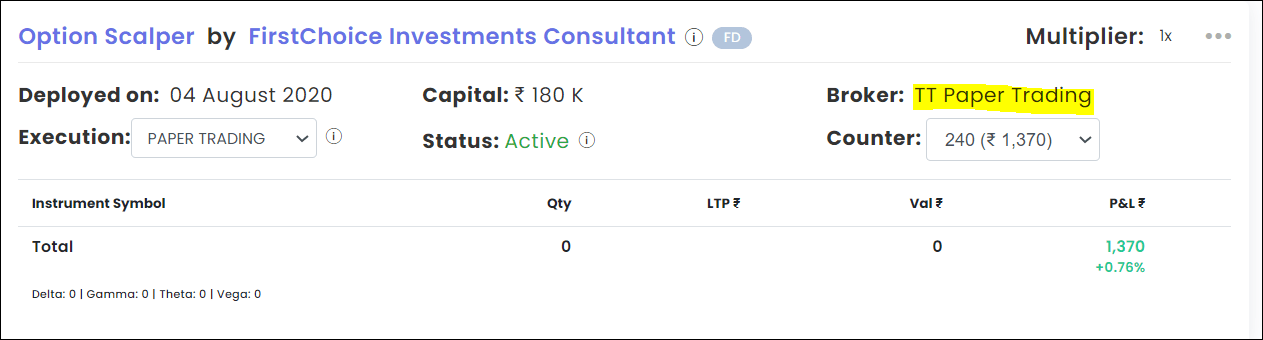

Using Tradetron, you select “TT Paper Trading” as your broker, which provides daily insights into your strategy’s performance and potential profits and losses, closely resembling real trading scenarios.

When you’re confident with the paper trading outcomes, you can seamlessly switch to live trading with your actual broker.

When you’re confident with the paper trading outcomes, you can seamlessly switch to live trading with your actual broker.

Even on Tradetron, expect minor differences between paper and real trade prices due to the involvement of third-party brokers. This slight variation is a natural part of transitioning to actual trading.

Discover how to begin with Tradetron here.

It’s advisable to paper trade your strategy for at least a month before entering live trading to ensure thorough preparation.