Maximizing Your Trading Success: A Guide to Risk Reward Ratio

Have you checked out our article on Risk Reward Ratio? If not, give it a read here. It’s a game-changer!

Profitability Calculation Made Easy with Excel

Responding to our readers’ requests, we’re excited to share an Excel sheet for calculating profitability using the Risk Reward Ratio. You can download it attached to this post, and don’t worry, all formulas are visible and editable 🙂.

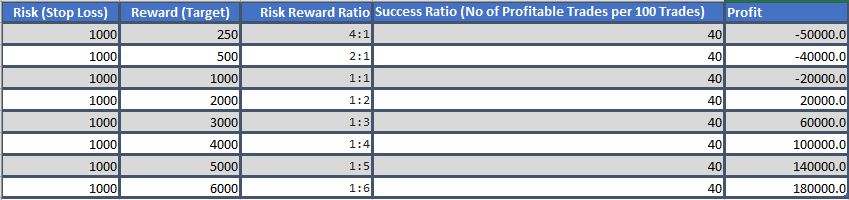

Worksheet Breakdown: Risk Reward Ratio and Profitability

1) Risk Reward Ratio and Profitability: This worksheet helps you calculate your trading profits based on your risk-reward ratio. Simply input your Risk and Reward in columns A and B. While we’ve set the Success Rate at 40% as a default, you can adjust it according to your strategy. Remember, Risk represents your potential loss per trade (like your stop loss value), and Reward is your target profit. We’ve based our calculations on 100 trades, and you can tweak these values as needed. Check out the pre-filled example and the corresponding area graph below for clarity.

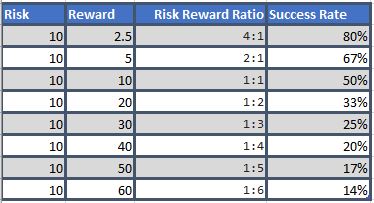

Understanding Risk Reward Ratio vs. Success Rate

2) Risk Reward Ratio vs Success Rate: In this worksheet, discover the success rate needed for your chosen risk-reward ratio, and vice versa. Just like the previous worksheet, enter your Risk and Reward in columns A and B. This tool calculates the success rate for a break-even scenario. We’ve pre-populated it with some standard figures, but feel free to make them your own. Below is a line graph based on the table’s values for better understanding.

Important Note and Download Link

Please note that brokerage or other charges are not included in these calculations. You can download the Excel sheet here. If you have any questions, feel free to drop them in the comments below.