Mastering Tradetron Keywords for Winning Strategies: In the world of Tradetron, keywords are your secret weapons. Think of them as special codes in a video game, each unlocking a unique power. Ready to explore the 10 must-know Tradetron keywords to level up your trading game? Let’s dive in!

Haven’t joined the Tradetron league yet? Click here to start your journey.

Top 10 Tradetron Keywords for Smarter Trading

These ten keywords are like the Swiss Army knife of trading tools. They’re all equally important, each serving a unique role in crafting winning strategies.

Keyword 1: Position

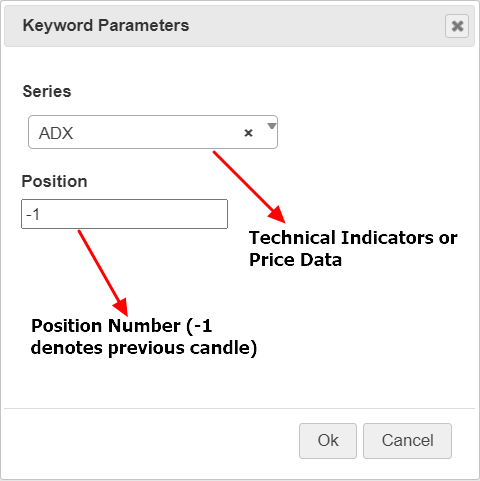

Meet ‘Position,’ the superstar of Tradetron keywords! It’s like having a crystal ball, giving you a peek into OHLC prices or any technical indicator for a specific candle. For example, need the ADX value from the last candle? ‘Position’ is your go-to keyword.

Think of it as a time machine, with the current candle marked as ‘position 0,’ and each step back in time getting a negative number.

Check out how to set up the Position keyword:

In short, ‘Position’ is the backbone of any strategy you cook up in Tradetron.

Keyword 2: LTP

‘LTP,’ or Last Traded Price, is like your trading radar. It helps set up stop loss and target conditions. Imagine setting a trap where, if the LTP dips below a certain percentage of your traded price, it triggers an exit strategy.

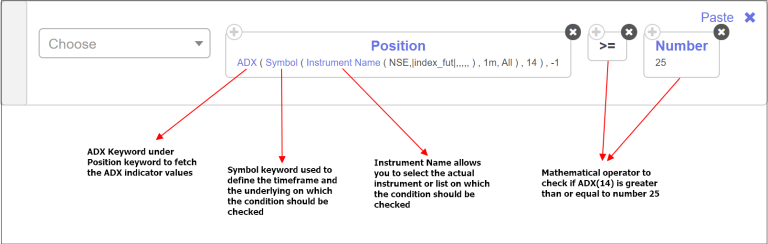

Here’s a glimpse of how LTP works its magic:

- ‘Futures’ for the quick scoop on futures instruments’ LTP.

- ‘Get runtime’ taps into custom python code variables for the LTP.

- ‘Instrument Name’ brings up the LTP for equities, futures, or options.

- ‘Traded Instrument Name’ zeroes in on the LTP of symbols you’ve traded.

For a more in-depth look at strategy creation in Tradetron, head over to this detailed guide.

Keyword 3: Traded Instrument

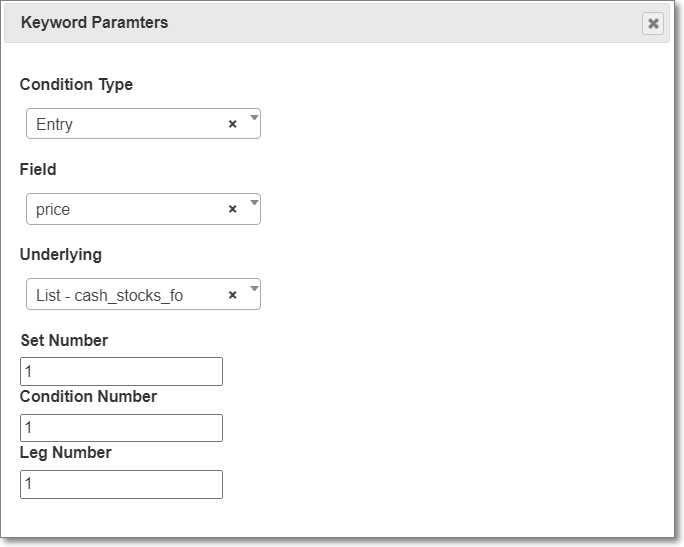

The ‘Traded Instrument’ keyword is like your trading diary. It recalls the price, strike, or quantity of instruments you’ve already traded in your strategy.

Say you want to compare the traded price with the current one. ‘Traded Instrument’ is your go-to tool for this analysis.

Here’s how to set it up:

- ‘Condition Type’ includes your entry, repair, or exit strategy.

- ‘Field’ lets you choose what detail you want: price, strike, or quantity.

- ‘Underlying’ is where you name your instrument.

- ‘Set’, ‘Condition’, or ‘Leg’ numbers pinpoint where in your strategy to pull data from.

Keyword 4: Positions Detail

‘Positions Detail’ is like your strategy’s guard dog. It keeps track of the quantity or value of positions already taken. Use it to keep your trades in check, ensuring you don’t overstep your strategy boundaries.

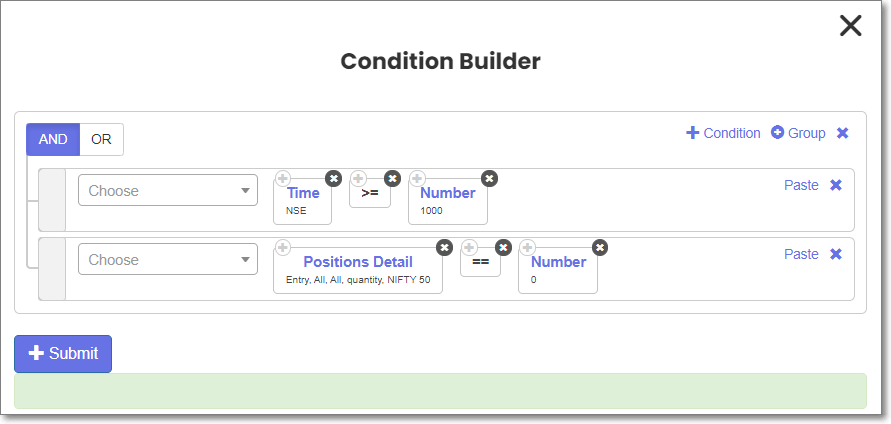

For example, if it’s past 10 AM and there’s no entry on Nifty 50, then it’s time to make a move.

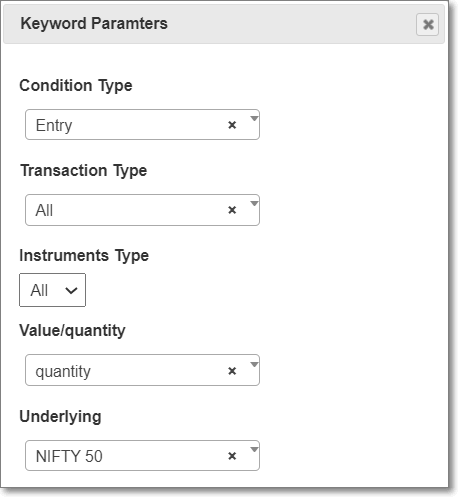

Peek into the Positions Detail keyword’s inner workings:

- ‘Condition Type’ is for entry or repair moves.

- ‘Transaction Type’ covers buys, sells, or all transactions.

- ‘Instrument Type’ includes options like CE, PE, or all.

- ‘Value/Quantity’ lets you choose between transaction value or quantity.

- ‘Underlying’ is where you name your instrument.

Keyword 5: ORB

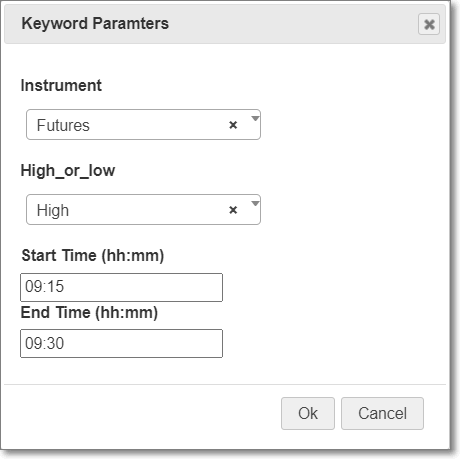

‘ORB’ stands for Opening Range Breakout, but it’s not just about the opening bell. Set any time range and let ORB find the highest high or lowest low prices for you.

Take a look at how ORB zeroes in on the highest price of the first 15-minute candle:

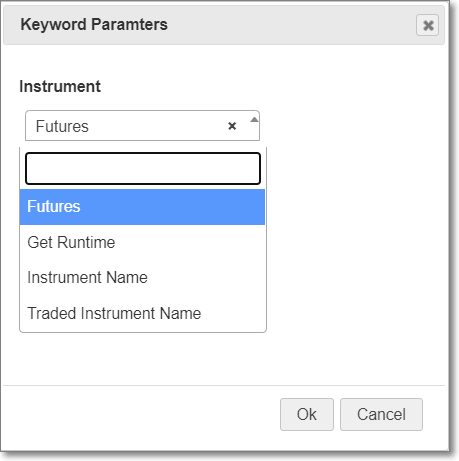

Choose your ‘Instrument’ from these options:

- Futures

- Get runtime

- Instrument Name

- Traded Instrument Name

Each option mirrors the function of the LTP keyword.

Also Read: Kickstart Your Journey with Tradetron – The Automated Trading Platform

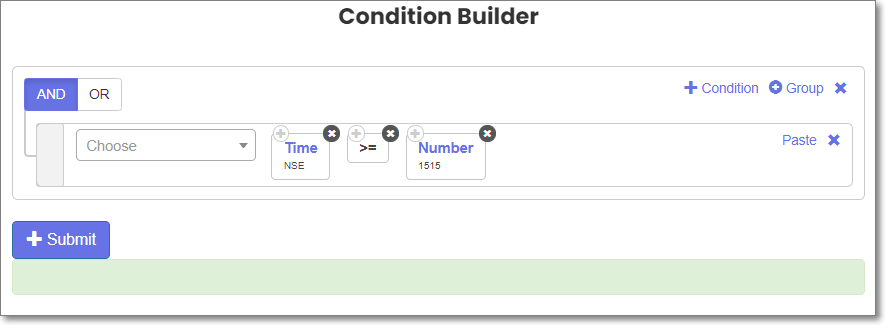

Keyword 6: Time

The ‘Time’ keyword is your trading clock, perfect for intraday strategies. It tells you the current time, military style. So when it says 1515, it’s 3:15 PM.

Check out this example where the current time is compared to 1515:

‘Exchange Name’ might be a parameter here, but remember, time waits for no exchange!

‘Exchange Name’ might be a parameter here, but remember, time waits for no exchange!

Keyword 7: PNL & PNL Underlying

‘PNL’ means Profit and Loss, showing you the score of your trading game. It calculates the PNL for your entire strategy, considering every move you’ve made.

PNL keeps it simple with no parameters, while ‘PNL Underlying’ lets you focus on a specific symbol’s profits or losses.

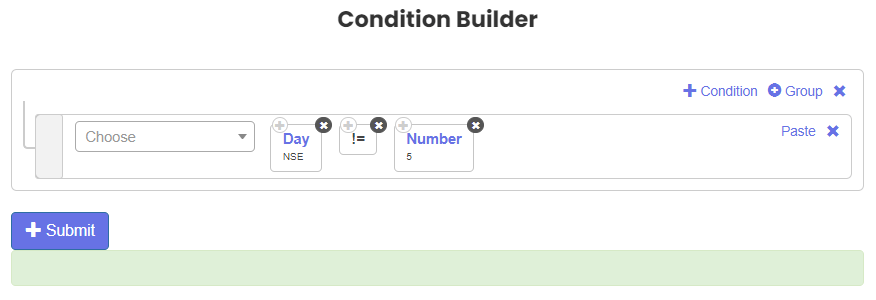

Keyword 8: Day

Need a strategy that plays by the calendar? The ‘Day’ keyword is your planner. It tells you what day it is, in numbers. Monday is 1, Sunday’s a lazy 0.

Here’s how it works, like making sure it’s not a trade-on-Friday kind of day:

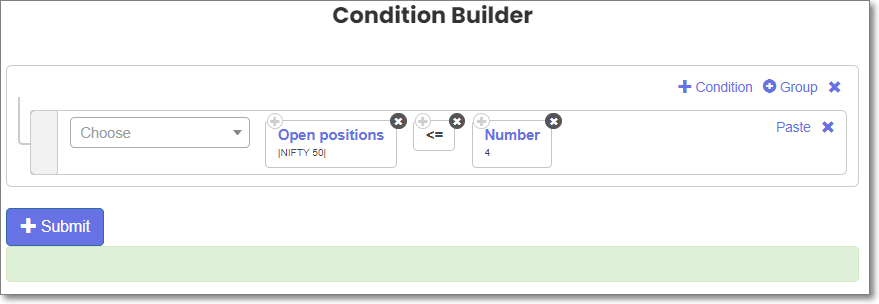

Keyword 9: Open Positions

‘Open Positions’ is like your strategy’s headcount, keeping track of how many positions are open at any moment. It’s like having a bouncer at the door of your strategy, making sure you don’t overcrowd your trades.

For instance, want to cap your trades at 4? This keyword’s got your back.

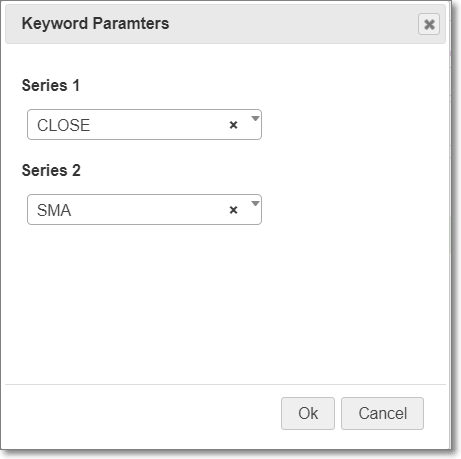

Keyword 10: Cross

‘Cross’ is your strategy’s matchmaker, perfect for pairing up moving averages or other indicators. It takes two data series and tells you when they’ve crossed paths.

Imagine setting up a romance between the closing price and the moving average. ‘Cross’ will let you know the moment they meet.

This keyword’s a binary Cupid – it’s either a match (TRUE) or not (FALSE).

So there you have it, the 10 Tradetron keywords that are game-changers in the world of algorithmic trading. They’re like a Swiss Army knife for your strategies, and the best part? No coding needed! Just drag, drop, and configure away in Tradetron’s user-friendly setup.

While there’s a whole universe of keywords out there, these ten are your starters kit. Need more details on any specific keyword? Just give us a shout, and we’ll dive into it.

Ready to unleash the power of these keywords? Start your Tradetron journey right here and watch your strategies take off!

2 Comments