Exploring Stock Price Prediction Methods

Stock price prediction encompasses two primary methods: Technical Analysis and Fundamental Analysis. Investors and traders frequently debate which of these approaches is superior, but there’s no one-size-fits-all answer. Your choice depends on your trading style and your belief in your method. In this blog, we’ve primarily focused on technical analysis, but let’s conduct an impartial comparison of Technical Analysis versus Fundamental Analysis.

Understanding Fundamental Analysis

Fundamental Analysis is, in simple terms, a qualitative assessment of a company’s value based on its financial statements, future prospects, and cash flows. As a fundamental analyst, you invest in companies with strong fundamentals and significant growth potential. This method involves scrutinizing a company’s revenues, earnings, assets, and liabilities. For instance, consistent quarter-over-quarter earnings growth and positive guidance indicate a fundamentally strong company, attracting many investors.

Comparatively, Technical analysts perform quantitative analysis of stock prices and trading volume to make buy/sell decisions. They assume that price movements are reflected on charts regardless of any company-related news or events. A Technical analyst studies historical price charts to identify patterns that help predict future movements. These analysts believe certain chart patterns repeat, and they also utilize technical indicators like Moving Averages, RSI, and MACD. For example, a “Golden Cross” occurs when a 50-period moving average crosses over a 200-period moving average, signifying a strong bullish signal (learn more).

Exploring Technical Analysis

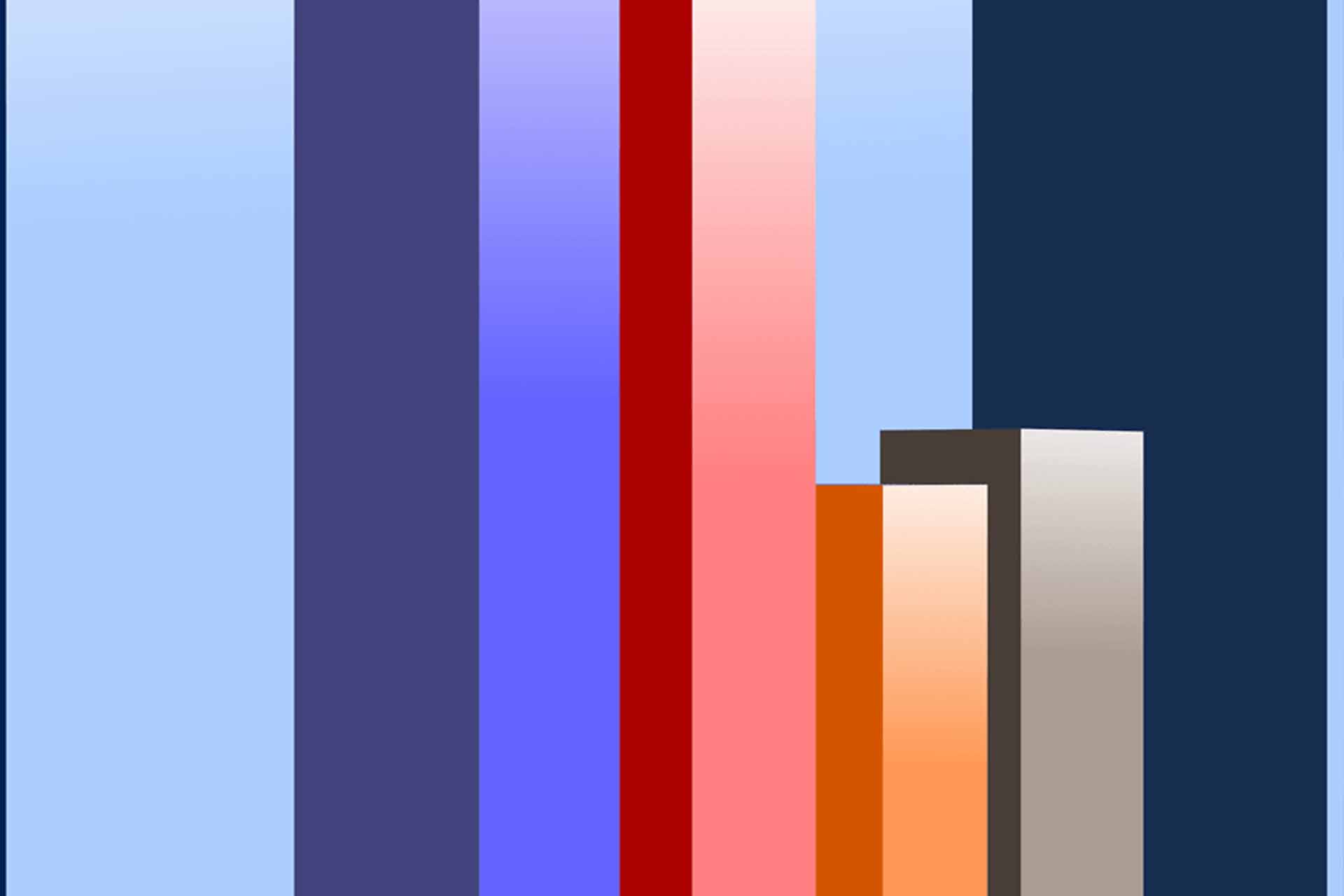

Below is an infographic that offers a comprehensive comparison of Technical Analysis versus Fundamental Analysis:

Final Thoughts

We consistently recommend Technical Analysis to our readers due to its data-driven, scientific, and realistic approach. While it isn’t without flaws, proper risk management and discipline can overcome these shortcomings. Some still favor Fundamental Analysis and criticize technical analysts, but we respect differing viewpoints. Success as a trader often hinges on confidence in your chosen method. Long-term traders may find success by combining both fundamental and technical analysis. Use fundamentals for stock selection and technical indicators for timing your entries. It’s worth noting that many modern brokers and hedge funds have adopted technical analysis in building their algorithmic trading systems. Additionally, there are reputable certifications available in the field of technical analysis. Explore them here.

We welcome your thoughts in the comments section below.

5 Comments