Introduction

Many of us start with high hopes in Options trading, dreaming of quick riches. We hear tales of doubling or even quadrupling investments by trading Options. Yet, very few turn this dream into reality, and often, it’s due to sheer luck. Relying solely on luck isn’t a wise strategy for consistent success. It’s better to aim for regular income rather than a one-time jackpot. In this post, we’ll explore proven Options trading strategies that provide a steady monthly income. These strategies, which I have personally used, often yield profits without frequent adjustments.

Explore Our Recommendations

Before diving into the strategies, check out our Options trading recommendations.

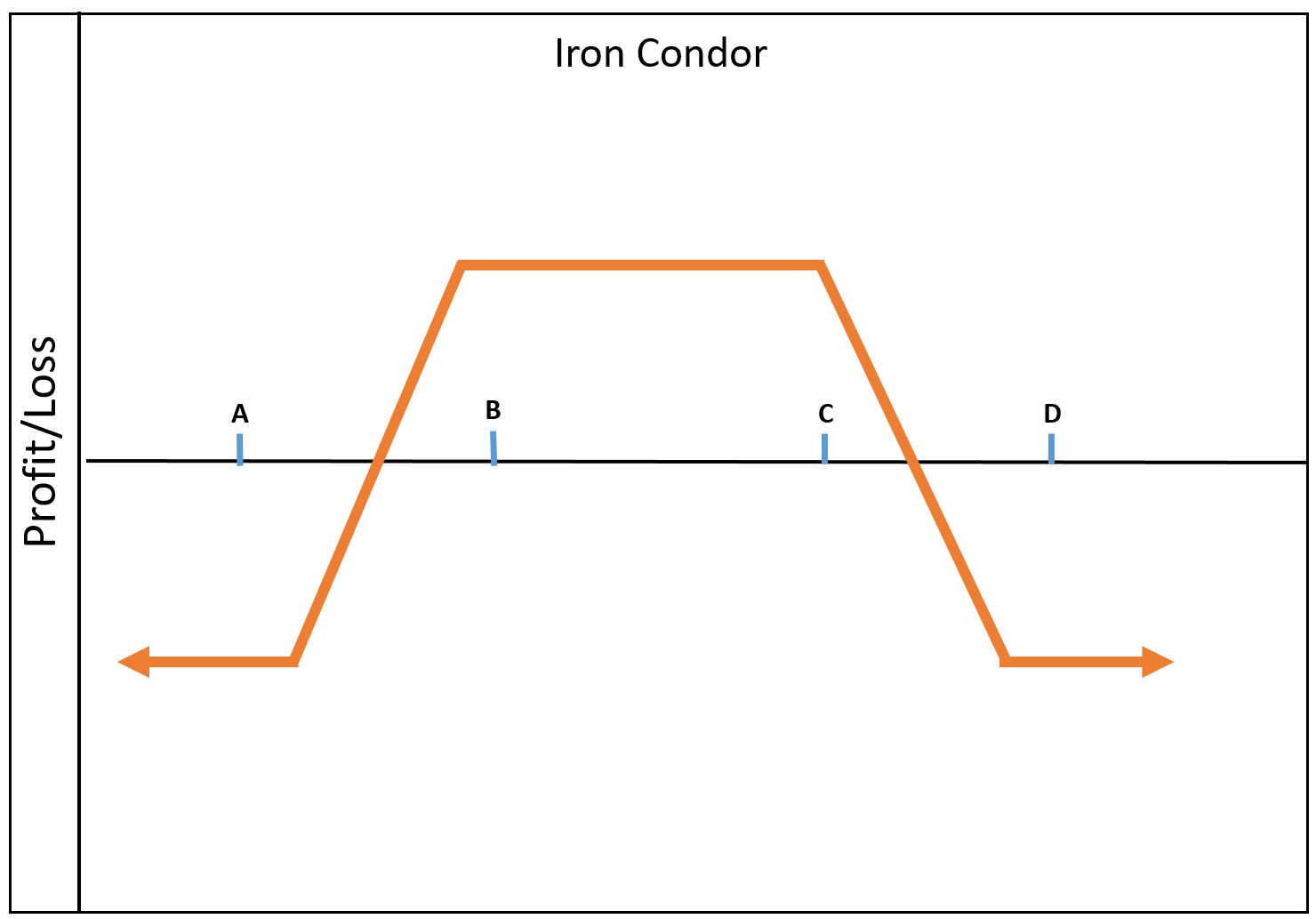

1. Iron Condor Strategy

The Iron Condor is among the most popular Options Trading strategies for consistent monthly income. It’s a non-directional strategy with four components, which means you execute four options simultaneously. This strategy has a slightly higher margin requirement due to this complexity. The Iron Condor combines elements of both the Bull Put Spread and the Bear Call Spread.

How the Iron Condor is constructed:

- Sell 1 OTM Put (Option A)

- Buy 1 OTM Put (Lower Strike, Option B)

- Sell 1 OTM Call (Option C)

- Buy 1 OTM Call (Higher Strike, Option D)

Key Features of the Iron Condor:

- Profit Potential: Your profit is limited to the net credit received. The maximum profit happens when the underlying asset’s price stays between the strike prices of the Short Put and the Short Call.

- Maximum Loss: The maximum loss is calculated as the Strike Price of the Long Call minus the Strike Price of the Short Call minus the net credit received.

- Breakeven Points:

- Upper Breakeven Point = Strike Price of Short Call plus the net credit received.

- Lower Breakeven Point = Strike Price of Short Put minus the net credit received.

- When to Execute this Strategy: This strategy is suitable when you anticipate minimal stock movement or a consolidation phase.

Payoff Graph of the Iron Condor Strategy:

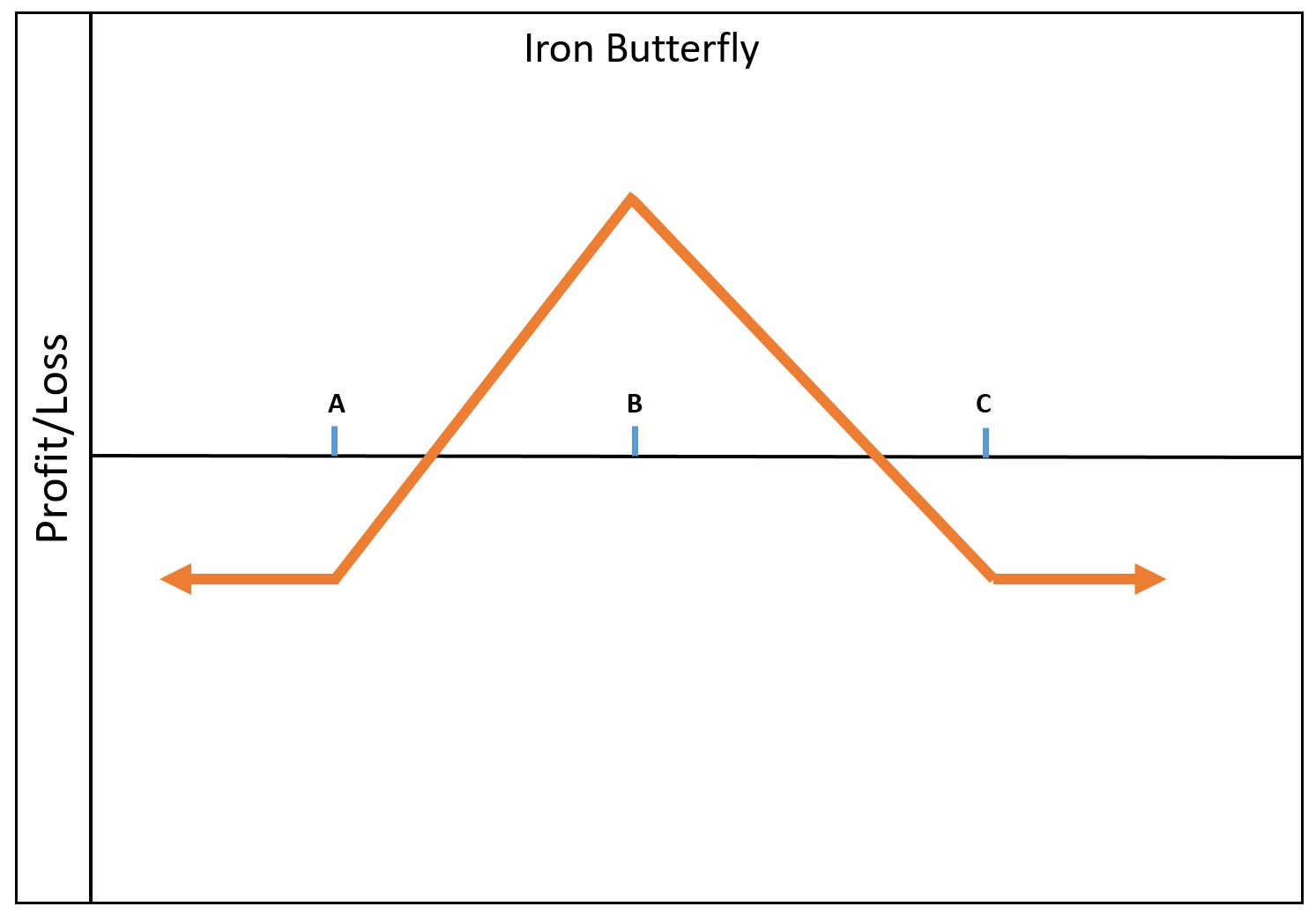

2. Iron Butterfly Strategy

The Iron Butterfly is quite similar to the Iron Condor, except for one key difference: it involves selling At-the-Money (ATM) options. This strategy is suitable for more aggressive traders, yet it still keeps risks limited.

How the Iron Butterfly is constructed:

- Sell 1 ATM Put (Option A)

- Buy 1 OTM Put (Lower Strike, Option B)

- Sell 1 ATM Call (Option C)

- Buy 1 OTM Call (Higher Strike, Option D)

Key Features of the Iron Butterfly:

- Profit Potential: Your profit is limited to the net credit received. The maximum profit occurs when the underlying asset’s price expires exactly at the strike price where Call and Put options are sold.

- Maximum Loss: The maximum loss is calculated as the Strike Price of the Long Call minus the Strike Price of the Short Call minus the net credit received.

- Breakeven Points:

- Upper Breakeven Point = Strike Price of Short Call plus the net credit received.

- Lower Breakeven Point = Strike Price of Short Put minus the net credit received.

- When to Execute this Strategy: This strategy is suitable when you anticipate minimal stock movement or a consolidation phase.

Payoff Graph of the Iron Butterfly Strategy:

3. Iron Condor vs. Iron Butterfly

You may have noticed that these strategies are quite similar in execution and breakeven points. Choosing between them isn’t always easy. While the Iron Condor is more popular, the Iron Butterfly offers higher profit potential due to the sale of ATM options, resulting in a larger premium. The Iron Condor is better in terms of the probability of success since it has a wider profitable range.

4. Diagonal Spread Options Strategy

The Diagonal Spread is an options spread that involves buying a far-month option and selling a near-month option. For example, a bullish diagonal spread could involve buying the December contract for the 8600 Nifty CE and selling the November contract for the 8800 Nifty CE. Buying and selling Puts constitutes a bearish diagonal spread. The strategy is based on the idea that far-month options contracts decay less over time compared to near-month contracts. This means that even if the trade goes against you, the loss will be minimal. Furthermore, a sideways market doesn’t lead to losses, making it one of the less risky Options trading strategies for consistent monthly income.

Rules for Selecting Strike Prices:

- For the long option, select a strike from the next or far month that’s ATM or slightly OTM.

- For the short option, choose a strike from the current or near month that’s two strikes OTM from the long strike you’ve chosen.

- Calculate the hedge percentage using this formula: Hedge % = (Price of the short call / Price of the long call) * 100.

- If the hedge percentage is above 30%, you can proceed with this strike combination. If it’s below 30%, restart from step #1, opting for a closer ATM or ITM option for the long position, then repeat the steps and recompute the hedge percentage.

- In most cases, you’ll end up with an ITM long and OTM short option, which is typically the best combination unless you’re initiating the trade close to expiry when the position needs to be more ITM for sufficient protection.

- Once you have a strike combination with a hedge percentage greater than 30%, you can use it to enter the trade.

For more information about this strategy and to download its Excel sheet, visit the link below:

Diagonal Spread Options Strategy

Conclusion

These are our top recommended Options Trading Strategies for generating consistent monthly income. While there are no guarantees in financial markets, these strategies, when applied with proper risk management and discipline, can yield a reliable monthly income. Don’t expect to double your money every month, but aiming for at least a 25-30% annual return is a reasonable target. Best of luck in your endeavors.