Market Profile is one of the most advanced charting techniques used by technical traders to predict future price movements. Technical traders have increasingly embraced it in recent years in the algorithmic trading ecosystem. Read our introductory article on Market Profile here to gain a better understanding of the basic concepts. In this post, we will explore how to trade options using Market Profile.

The leverage that options provide can be risky for your capital if you don’t manage the risks properly. Many experts suggest using option spreads to mitigate risk, while others recommend using options as hedging instruments for future and cash positions. However, these approaches are more suitable for those with a slightly longer-term view of the markets.

If, like me, you prefer minimizing exposure duration, you need to trade options at the right time. Timing is crucial for successful short-term option trading. Market Profile is one of the most effective methods for timing your option trades.

Why Timing Option Trades Matters

The timing of your trades is vital for several reasons:

- Time value of options: We all know the inverse relationship between time to expiry and the value of options. This is especially significant when trading out-of-the-money options.

- The Non-linear nature of option movements: At-the-money options are expected to have a delta of 0.5, meaning a 10-point move in the underlying should result in a 5-point move in the option. However, this relationship doesn’t always hold.

- Effect of volatility on premium: Volatility can have a significant impact on option premium.

Many accounts have suffered significant losses due to options trading, which promises substantial rewards with limited upfront capital.

For example, at the time of writing, a Nifty ATM Call option with a 10,000 strike price is trading at 110, with a total cost of 8,250/-. Compare this to the contract value of roughly 7,50,000/-. This leverage allows you to benefit from trading a substantial Nifty value by paying a fraction of the contract’s cost.

However, this extreme leverage also comes with risks. If the price doesn’t move in your favor or remains sideways, time decay sets in and erodes your capital. Even when the price moves in your favor, a drop in volatility can lead to minimal profits due to the decrease in option premium.

Common Solutions to Avoid

Traders often attempt various solutions to address these challenges, such as ratio spreads, black box timing systems, technical studies on option charts, and chasing breakouts and breakdowns. However, these methods have questionable success rates, as I’ve discovered through over 12 years of trading.

So, is there a way out of this situation? I believe there is. You can use these powerful trading instruments to your advantage, while avoiding common traps set for gullible traders seeking quick profits.

Remember, there’s no such thing as a free lunch on the street.

Market Profile – The Preferred Solution

I’ve grappled with the aforementioned problems and found that the best solution is Market Profile. While it’s not a trading system, Market Profile greatly enhances your understanding of the market.

How does improved market understanding benefit options trading?

It provides the following advantages:

- Timing your trades perfectly.

- Avoiding entering options at the wrong time.

- Achieving favorable reward-to-risk ratios.

- Most importantly, reducing the stress associated with trading options.

Simply follow the step-by-step model outlined below to start trading options using Market Profile.

Also Read: 5 Bold Predictions for the Future of Stock Markets

See Market Profile In Action – Real Trade Example

First, let me walk you through an example of trading options using Market Profile. This is a real trade I took and shared with my private Slack group.

One of the key principles in my trading is that of “expected and unexpected behavior.” The following examples illustrate this essential concept in trading. Let’s examine the charts below:

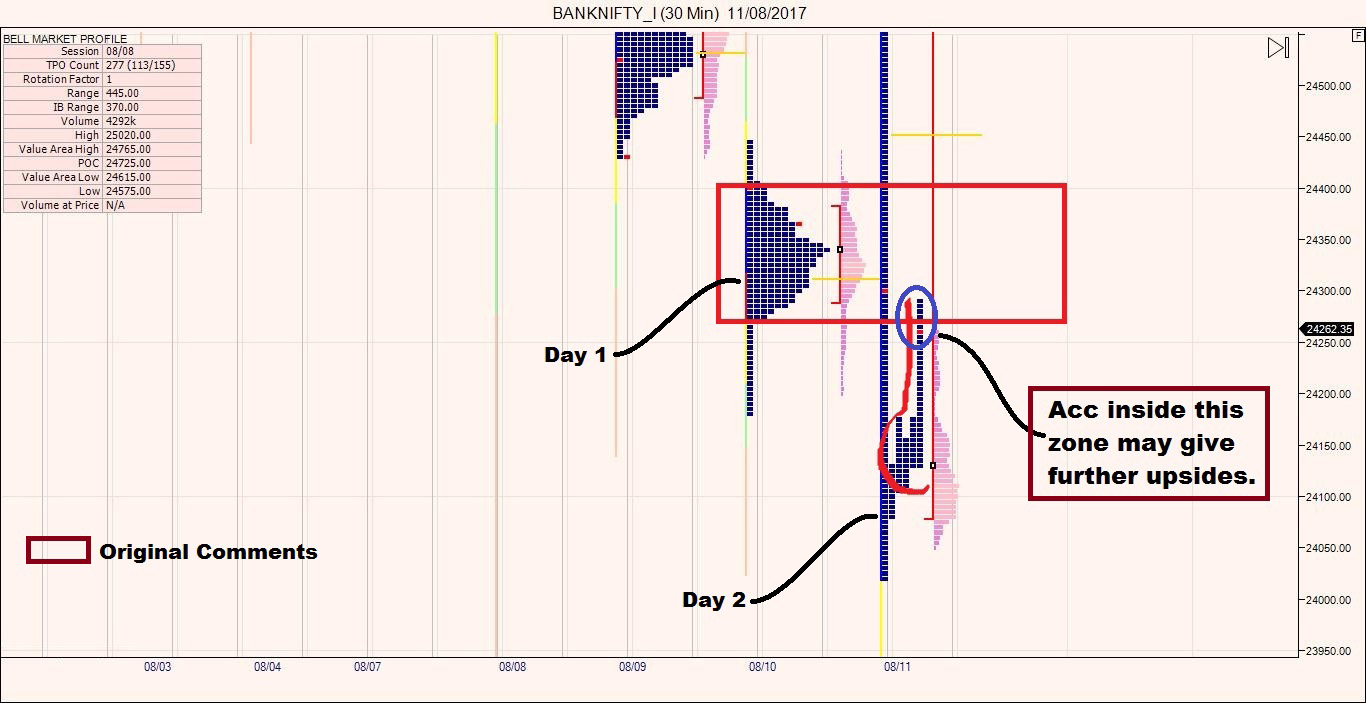

Chart 1

The chart shows that Day 1 formed a nice ‘D’-shaped curve, indicating market balance according to Market Profile. Both buyers and sellers are present in equal strength.

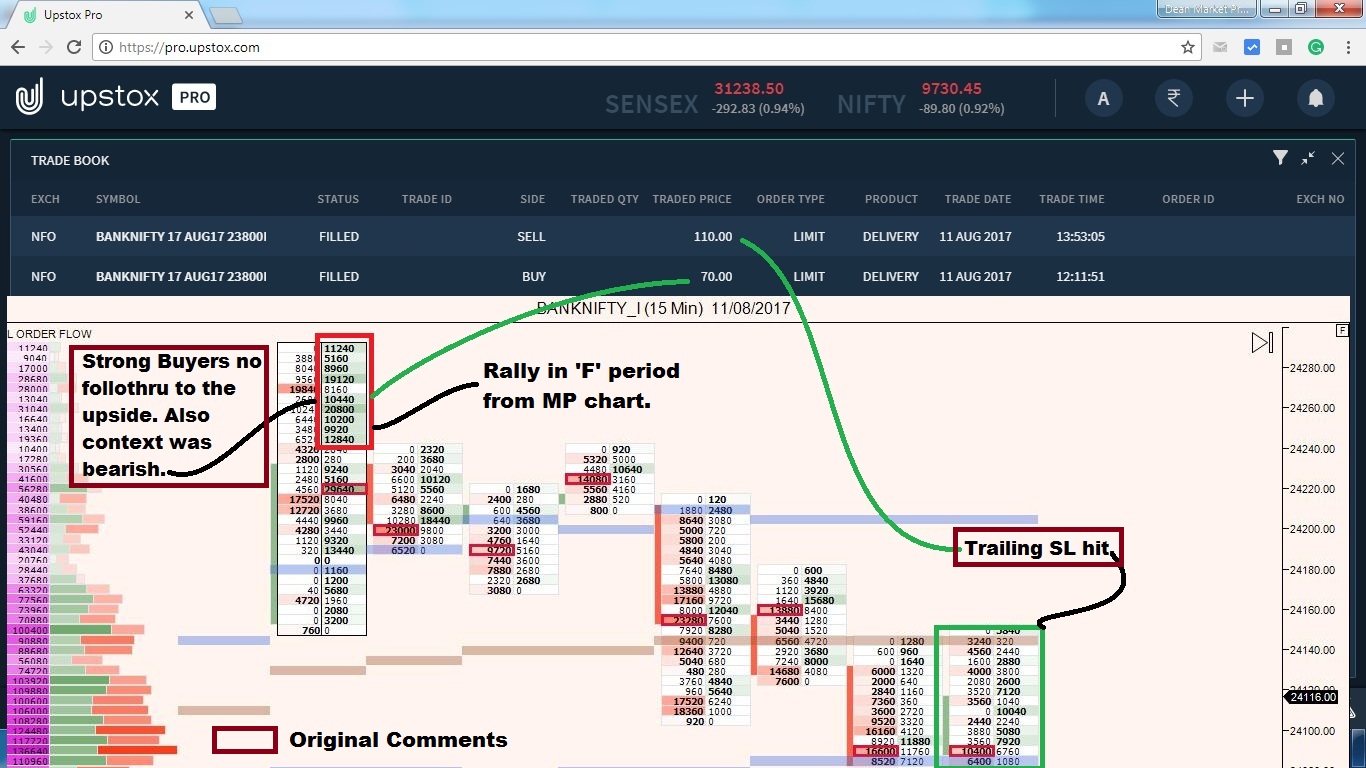

Chart 2

This chart presents an Order Flow Chart (my primary timing tool). The rally in F period, as seen in the above chart, indicates the market’s attempt to enter the supply zone from Day 1. If the market finds acceptance within the supply zone, we can expect a continuation of the uptrend.

However, the Order Flow chart shows significant buying (deep green prints) when the price tried to enter the supply zone. Such strong buying typically suggests a continuation of the uptrend. Yet, the next period, ‘G,’ couldn’t surpass the high of ‘F,’ indicating buyer exhaustion.

This was our opportunity to initiate a short trade or buy put options.

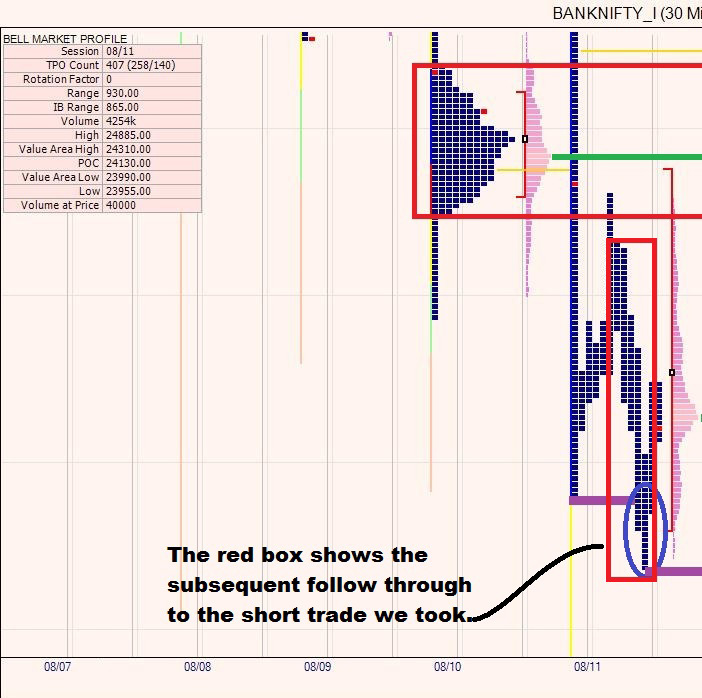

Chart 3

This chart illustrates the subsequent follow-through in the short trade. We exited part of our positions at a fixed target with a 2:1 reward-to-risk ratio.

These examples are shared for educational purposes, demonstrating how Market Profile and Order Flow charts can improve trade timing.

Step by Step Process to Trade Options using Market Profile

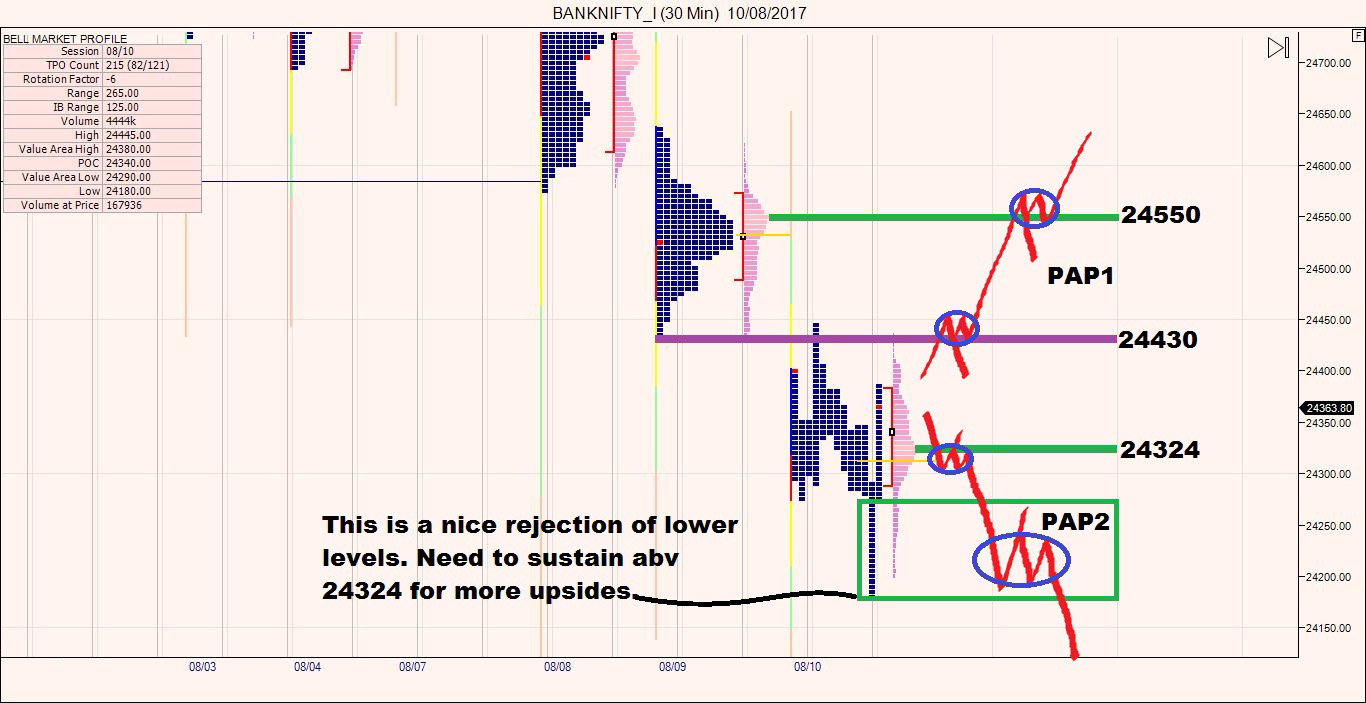

Step 1: Study the Prior Day’s Activity

Review the previous day’s activity and outline 2-3 potential scenarios to guide your trading decisions for the next day. The chart below illustrates our preparation for the prior day, marking important levels and outlining potential bearish scenarios.

Step 2: Be Flexible

Markets may not align with your preparation, so it’s essential to adapt to real-time market developments. In our case, the market moved lower than what was envisioned in our potential scenarios.

Step 3: Use Reliable Timing Tools

Utilize reliable timing tools to identify precise entry points. Avoid blindly placing trades at pre-marked reference levels. Instead, assess real-time market developments and position yourself to seize opportunities. In this case, we acted based on the Order Flow chart’s signal for a potential short trade.

Step 4: Have a Sensible Trade Management Plan

While successful options trades can yield substantial returns, they also come with significant risks. Have a sensible trade management plan in place to book profits systematically.

Step 5: Keep Records

Record all your trades, both profitable and loss-making, to learn from past experiences and make informed decisions in future trades.

Conclusion

This is how I trade markets using Market Profile charts. Market Profile enhances my understanding of the market’s current context, allowing me to formulate potential scenarios and seize opportunities.

I use Order Flow charts, my preferred timing tool, to pinpoint entries and exits, as demonstrated in the examples above.

Feel free to share your thoughts on my approach in the comments section. If you have any questions or doubts, I’ll be happy to respond.

3 Comments