Many of us have probably heard tales of individuals becoming millionaires through penny stock investments. While it may not be as glamorous as it sounds, it’s definitely possible to accumulate a decent wealth by carefully identifying and trading penny stocks. In this blog post, we’ll explore some proven methods for making money by trading penny stocks. We’ll also introduce you to some reputable penny stock brokers and share a few success stories.

What Are Penny Stocks?

In simple terms, penny stocks are low-priced stocks and are among the riskiest and most speculative investments. They typically trade for less than $1 (less than INR 10 in India). They exist on the fringes of major stock exchanges and are often considered volatile and unpredictable. These stocks have low market capitalization and are usually not listed on major national exchanges.

Trading penny stocks requires hard work and thorough research if you hope to become wealthy. It’s not for everyone, but anyone can learn strategies that can lead to success in penny stock trading. Due to the erratic price fluctuations, it’s easy to lose money.

For novice investors drawn to penny stocks, it’s important to be cautious because they come with high-risk losses. While the allure of high returns from penny stocks may be tempting, if you’re not careful, you could quickly lose everything due to fluctuating prices. It’s worth noting that penny stocks are attractive to scammers, but that doesn’t mean there isn’t potential for honest and profitable trading.

How to Profit from Trading Penny Stocks?

When trading penny stocks, it’s crucial to minimize risk and invest in high-quality stocks with the potential for significant returns. If you have a registered broker, they’ll guide you on the best strategies. If you’re on your own, you should tread carefully and aim for success step by step. Here are five ways to make money trading penny stocks:

Sell Your Stocks Promptly

In the world of penny stocks, traders are often lured by the promise of 1000% returns, which can often lead to disaster. It’s vital to sell your penny stocks as soon as possible and secure a 20%-30% return rather than waiting indefinitely.

Trade One Stock at a Time

Instead of striving for substantial profits in a single trade, consider making multiple trades in a day, each with a specific goal in mind. Small profits can eventually add up to significant gains. This approach reduces the risk of losing money and increases the chances of maintaining a steady income from penny stock trading.

Choose Penny Stocks with High Volume

Opt for stocks that trade at least 10,000 shares a day, as opposed to those with low trading volume. Stocks with low volume often have wide bid-ask spreads, making it challenging to exit positions. Both the dollar volume and the number of shares traded are important factors to consider.

Read Disclaimers

It’s essential to carefully read penny stock disclaimers since salespeople don’t always have your best interests at heart. Reviewing disclaimers will help you spot any false promises hidden behind aggressive pitches.

Risk Is Necessary but Not Inescapable

Profitable penny stock trading is not achievable without some degree of risk. Given their high volatility, it’s imperative to implement strict stop-loss orders. It’s also wise to aim for modest profits to keep potential losses manageable.

Also Read: Machine Learning in Trading: Unlocking the Power of Algorithms

Penny Stock Success Stories

While there’s a fair amount of skepticism surrounding penny stock trading success, it’s important to note that it’s not all doom and gloom. There are numerous success stories involving companies and investors that can inspire you. Here are two remarkable penny stock trading success stories:

Kumar Wire Cloth Manufacturing (BOM:513703):

This Indian textile stock was once trading at just 2 Rupees (3 Cents) due to high costs and no profitability. Today, it’s trading at around 40 Rupees (60 Cents), marking a tremendous 2000% gain, which is an astonishing penny stock success story.

Quality Systems (QSII)

Quality Systems, a healthcare software and tech provider, was trading below $1 until the healthcare industry shifted toward cloud solutions in recent years. In a short span, their gains soared by 1400%.

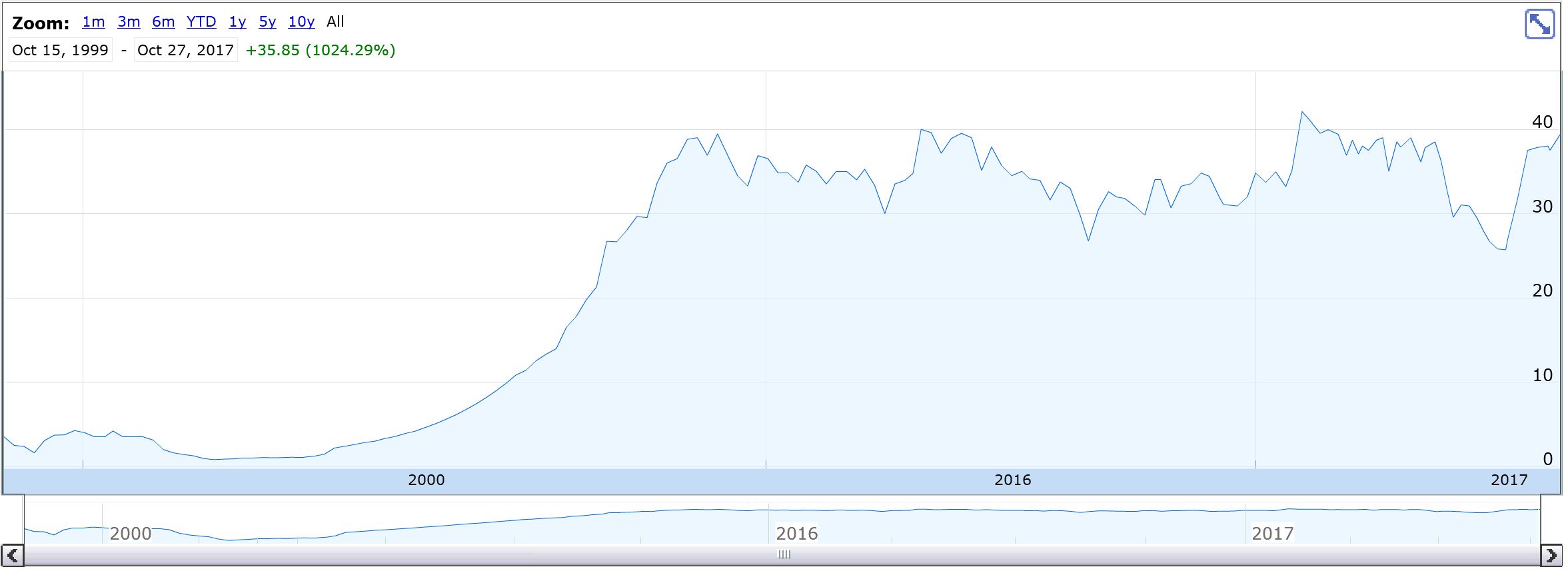

See how the price surged from $0.8 in 1998 to $15 in 2017 (reaching a peak of $45 in 2011)

Where to Purchase Penny Stocks?

You can either research and identify promising companies to invest in or join an online brokerage service to buy penny stocks. If you choose to research companies yourself, you’ll need to conduct your own due diligence and identify emerging companies with growth potential. If you opt for a broker’s service, exercise caution when selecting one, as some brokers charge high fees. Here are five of the best penny stock brokers for new investors. Please note that there are no specific penny stock brokers in India; you can trade penny stocks through your regular brokers.

Charles Schwab

Charles Schwab boasts a transparent fee structure and is one of the oldest and most trusted brokers. They charge a flat trading fee of $8.95 and offer high-volume penny stock trading without additional fees. Charles Schwab is an excellent choice for beginners, offering reasonable rates and portfolio expansion opportunities.

Ameritrade

Ameritrade is another top penny stock broker in 2017, charging $6.95 per trade. They provide outstanding service and offer quality research to help clients achieve the best results from their investments. Unlike cheaper discount brokers, Ameritrade delivers superior value and offers advanced trading platforms for active trading.

Ally Invest

Ally Invest is an affordable trading platform suitable for both novice and experienced investors. They offer commissions as low as $3.95 and provide convenient investment products to help new investors improve their trading skills. Ally Invest’s user-friendly interface and reliable research tools make it one of the best penny stock brokers for 2017-2018.

eTrade

eTrade is an online trading platform that facilitates penny stock trading for new investors. Depending on your risk tolerance, they offer guidance and advice for penny stock investments, aiming for good returns. While their fees may be higher than other platforms, eTrade is known for exceptional service quality.

Merrill Edge

Merrill Edge is a penny stock broker that provides investment advice at Bank of America branches. They charge a stock trading fee of $6.95 and offer 24/7 customer support, along with high-quality research for penny stock investors.

To succeed in making money by trading penny stocks, patience and proper risk management are key. If you believe that it can make you rich overnight, you may be gambling rather than investing. While technical analysis may not always be foolproof for penny stocks, it’s essential to examine a company’s fundamentals before investing. Feel free to ask any questions in the comments section.

One Comment