How to Build a Profitable Trading System

Discover the secrets of creating a trading system that consistently makes money. Building a profitable trading system requires determination, not just knowledge. Forget complex strategies; a simple, effective trading system is within your reach. Follow our easy steps to success and start building your profitable trading system today.

Adopt the KISS strategy for trading success: Keep It Simple and Stupid. Complexity can lead to unexpected mistakes while simplicity leads to consistent performance.

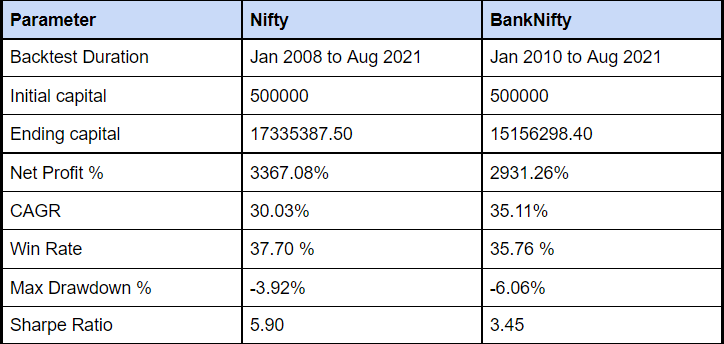

Consider this: A simple system using basic Open, High, Low, Close (OHLC) data could be your ticket to profitable trading. Check out the performance chart of our straightforward range breakout system:

With an initial investment of 500K in 2008, you could have seen it grow to approximately 17 million by 2021. That’s a staggering 30-fold increase over 13 years, not accounting for compound interest.

Our system, powered by Amibroker software, has straightforward rules:

Buy Rule: Purchase when today’s highest price exceeds the last five days’ highs.

Short Rule: Sell when today’s lowest price drops below the last five days’ lows.

Trade exits mirror entry rules. A 5-period Average True Range (ATR) determines our stop loss, and we don’t set fixed profit targets. It’s simplicity at its best.

Now, let’s dive into the “Steps to Build Your Own Profitable Trading System“:

Step 1: Master Technical Analysis

Deepen your technical analysis expertise to build a foundation for a profitable trading system. Continuously hone your skills, as technical analysis is an evolving art. Learn by analyzing price charts and applying observations to your trading.

Varsity is an excellent online resource for technical analysis. For those who prefer print, check out these book recommendations.

Step 2: Gain Real Market Experience

Simulated trading isn’t enough. Open a trading account and trade with real money to test your technical analysis. Document each trade and the reasoning behind it to form the cornerstone of your profitable trading system.

Also Read: How to Make Passive Income with Algorithmic Trading

Step 3: Code Your Trading System

For a reliable trading system, convert your rules into code. Learn basic coding in Python, or partner with a programmer. Coding ensures your system operates consistently with your strategy.

Also Read: The Importance of Coding in Algorithmic Trading

Step 4: Backtest Your Trading System

Validate your system by backtesting with historical data. This step is crucial for assessing the potential of your system to be profitable. Accurate data and honest evaluation of backtesting results are imperative.

Also Read: How to Backtest Your Trading Strategy Correctly

Step 5: Trade with Real Money

If backtesting is successful, start trading with small amounts of real money. Adjust your system based on actual performance and experiences. The goal is to develop a system that wins consistently over time.

Also Read: Why You Should Trade with Real Money

In conclusion, patience and perseverance are key when you set out to build a profitable trading system. Stick with it, refine it, and watch your efforts pay off.

3 Comments