Optimizing Automated Trading with Tradetron: Tradetron stands out for automating trading strategies. However, like any automation, it comes with risks, particularly due to the lack of human judgment. Execution errors are the most common challenge with Tradetron. But, with the right knowledge, these can be managed effectively. This article will guide you through a detailed process for handling execution errors in Tradetron.

Understanding Execution Errors in Tradetron

Tradetron automates trade execution based on your strategy’s predefined rules. When these conditions are met, it automatically executes orders through your broker.

Execution errors occur when these orders fail to place, potentially leading to issues like:

- Failure to take positions as per strategy rules

- Equity short positions remaining open at the end of the day

- Missed stop-loss orders, exposing you to higher risk

- Incomplete execution of multi-legged options strategies

Also Read: How to find the Best Strategies from Tradetron Marketplace?

Tradetron’s Execution Error Notifications

Luckily, Tradetron’s advanced notification system alerts you immediately when an execution error occurs.

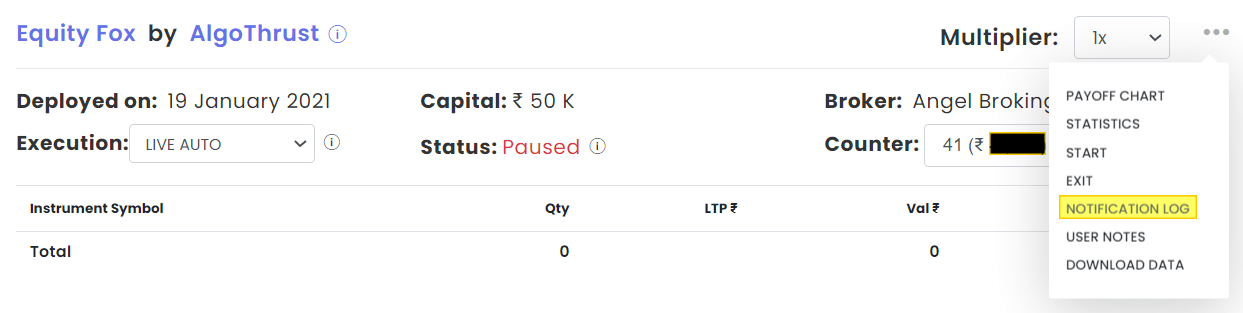

You’ll receive real-time notifications via phone, email, or WhatsApp. Upon receiving an alert, you can check the strategy’s notification logs in your Tradetron dashboard to understand the cause of the error.

After reviewing the notification logs, you can either fix the errors or retry execution.

Typical Execution Errors in Tradetron

Common execution errors include:

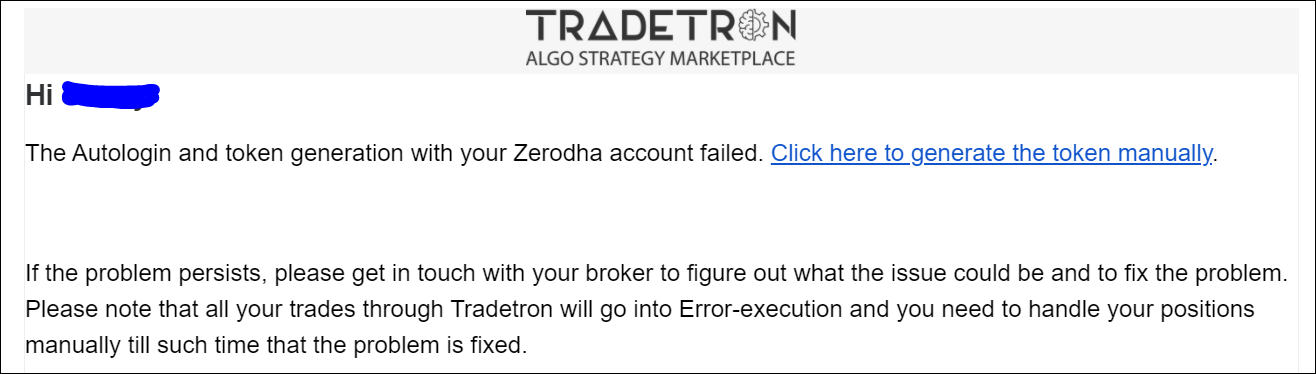

Token Generation Error

Tradetron uses tokens for broker terminal interactions. These tokens, needing renewal every 24 hours, can sometimes encounter issues.

You’ll receive an email notification before market opening if there’s a token generation issue.

To resolve this, manually generate the token via the “Broker and Exchanges” page, ensuring a valid API subscription with your broker.

Insufficient Funds

Changes in broker margin requirements can lead to errors if not anticipated. Especially risky in multi-legged options, it’s advised to square off any executed positions immediately in such cases.

Far Month Options Rejected

Liquidity issues often lead brokers to reject market orders for far-month options. The solution is to either avoid far-month options in your strategy or choose brokers that allow them.

Unknown Errors

Occasionally, you might encounter unexplained errors. Often, these are due to communication glitches between Tradetron and brokers.

In such cases, immediately report the issue to Tradetron support.

Also Read: Getting Started with Tradetron – The Automated Trading Platform

Managing Execution Errors in Tradetron

Stay vigilant with your deployments. Resolving execution errors quickly is crucial. Inactive deployments mean inactive risk management.

Firstly, remain calm. There’s always a chance of a favorable outcome. For example, an error in selling a PE leg in a falling market can be beneficial. You have three ways to handle errors:

COMPLETE MANUALLY

First, verify with your broker terminal. Sometimes trades execute, but Tradetron isn’t notified.

- If executed, select “Completed manually” and accurately update the traded price.

- If not executed, place the trade manually on the broker terminal and update Tradetron.

TRY AGAIN

For unexecuted trades, use this option for another attempt at automatic execution. Be patient, as it may take a minute to process.

CANCEL

This stops the trade execution, not recommended for multi-legged options.

Strategy logic errors need review, whether self-created or from the marketplace. Test strategies in paper trade mode before going live.

Concluding Thoughts

Execution errors are common in automated platforms, often due to broker API or RMS issues, not necessarily Tradetron’s fault. Tradetron strives to minimize these errors with swift retries.

Follow the steps in this article to handle common execution errors. Yes, there’s risk, but the benefits of Tradetron outweigh these risks.

Start your journey with Tradetron by following this link.