When discussing Forex Trading in India, traders face limitations due to RBI regulations. Currently, currency pairs available for Forex trading in India are valued against the INR, which poses a significant disadvantage for those engaged in international transactions. Given that global Forex trading is heavily dominated by the USD, accounting for over 87% of trade practices, Indian investors find Forex trading less profitable.

RBI’s Perspective on Forex Trading

RBI, the regulatory authority for the nation’s financial implications, defines Forex Trading in India primarily as trading in currency derivatives convertible into INR. According to RBI, “A resident in India may engage in currency futures or currency options on a stock exchange recognized under section 4 of the Securities Contract (Regulation) Act, 1956, to hedge exposure to risk or otherwise, subject to the terms and conditions outlined in RBI directives.”

Regulations for Forex Trading in India

- Since 2008, RBI and SEBI have permitted trading in currency derivatives. Trading in the following currency pairs is permitted: USD-INR, EUR-INR, JPY-INR, and GBP-INR.

- Currency options are available to investors only for the USD-INR pair.

- As of now, trading is allowed on both BSE and NSE.

- Contracts will be settled only in cash, with the currency being INR.

- The futures lot size is fixed at 1000 units, except for the JPY/INR pair, which has a lot size of 100000 units.

Starting with Forex Trading in Currency Futures

Forex trading in India can be highly profitable with the right approach. Here’s a step-by-step guide to get you started:

- Open a trading account with a broker offering Currency Derivatives trading. Learn more about selecting the right stock broker.

- Since accounts are online and Forex trading is conducted online, you can access your account using a login ID and password, similar to equity and futures trading.

- Familiarize yourself with the operational guidelines of the platform you’re using.

- Keep an eye on brokerage rates, the exchanges the bank is affiliated with, and the products offered.

- Here’s an excellent trading system for the USD-INR pair: USD-INR Currency Trading Strategy

Advantages of Forex Trading in India

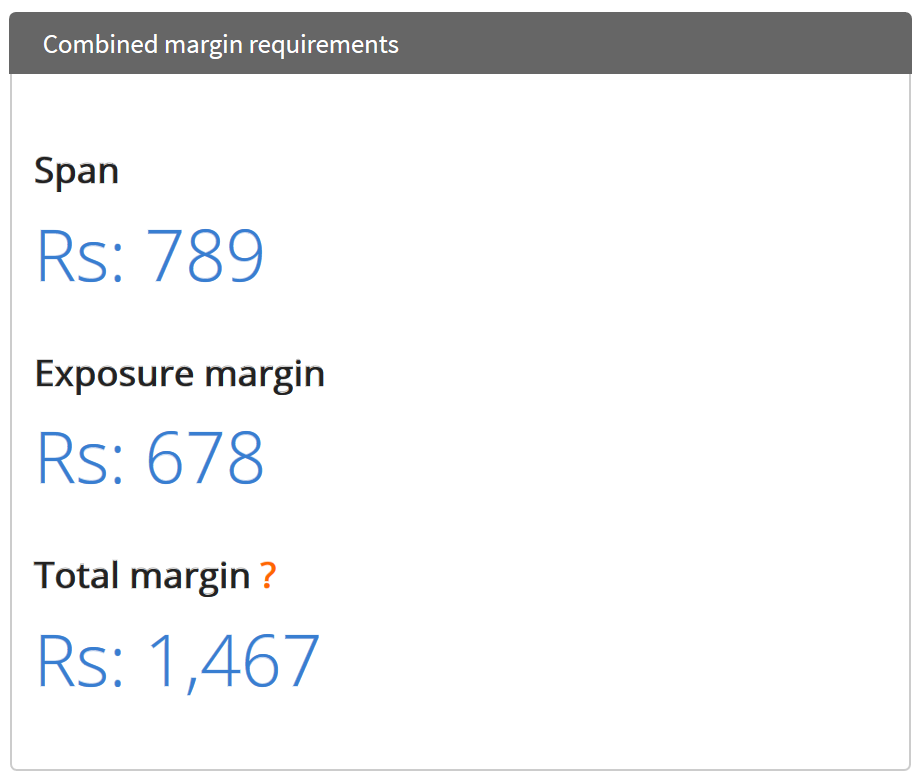

The most significant advantage of Forex Trading in India is the utilization of margin trading principles. This allows for more substantial trading with a smaller deposit. The margin required to trade 1 lot (1000 units) of the USD-INR pair on NSE is approximately 1500 INR, representing only 2.5% of the actual investment.

Effective Analysis for Forex Trading

The currency market is quite volatile, so effective analysis is crucial before making investment decisions. Several reputable firms and institutions offer valuable insights through various channels. Thus, observing them can lead to profitable investments and greater returns on your investment.