Unlocking Financial Potential with Machine Learning in Trading

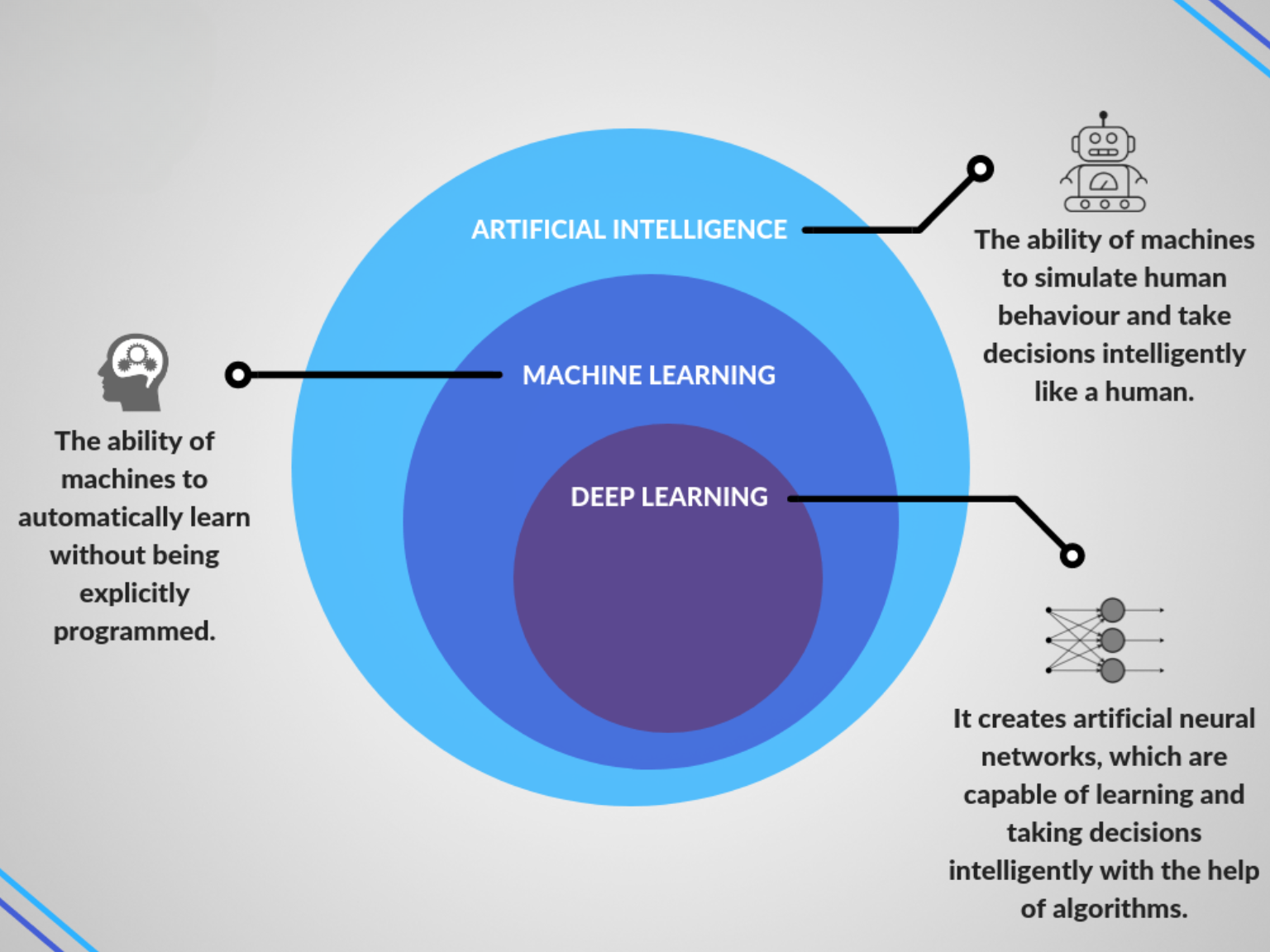

Artificial Intelligence (AI) and Machine Learning (ML) are reshaping our world, including the way we handle finances. AI refers to the smarts shown by machines, while Machine Learning, a subset of AI, focuses on algorithms that learn and improve over time.

In the competitive world of trading, making smart, profit-maximizing decisions is crucial. Machine learning algorithms leverage vast amounts of both structured and unstructured data to generate accurate predictions. This article explores the application of machine learning for trading, its benefits and challenges, and why it’s becoming a popular choice.

Decoding Machine Learning

Machine learning empowers machines to make decisions or take actions based on data analysis and experience, without explicit instructions. It’s a process where systems learn to perform tasks from data.

While exploring machine learning basics, it’s easy to mix up Machine Learning, Artificial Intelligence, and Deep Learning. The following diagram helps clarify the concept of machine learning:

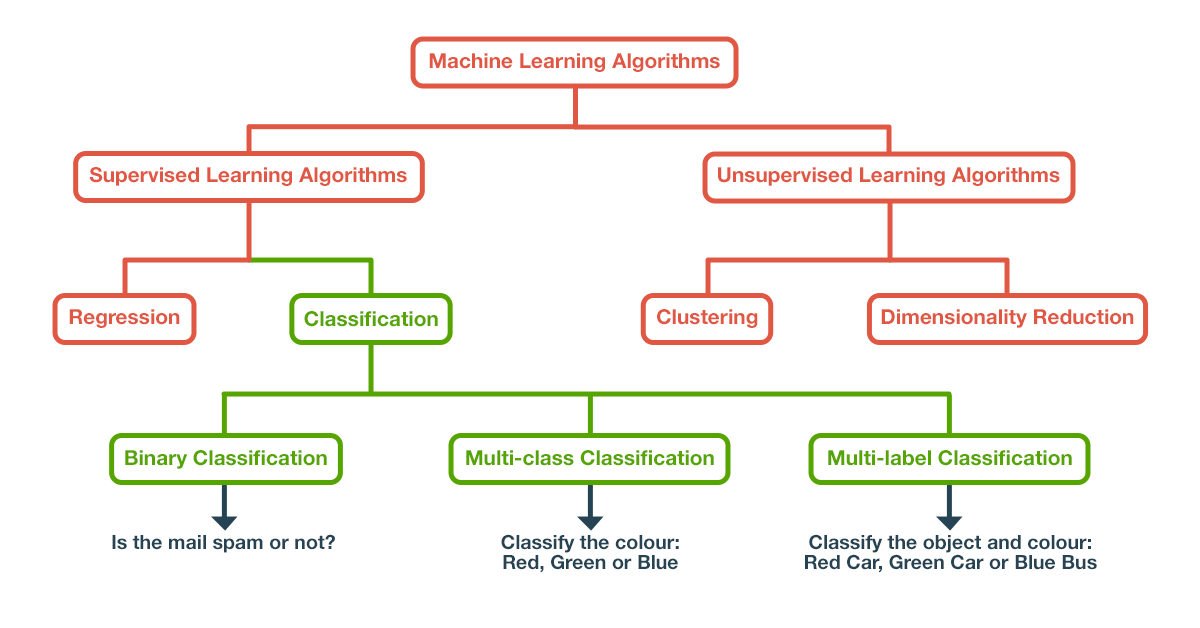

Machine learning systems can handle simple to complex tasks, like classification or regression, building mathematical models to make predictions or decisions.

These models are typically categorized into supervised learning models and unsupervised learning models, based on the nature of the training data used.

Related Read: How Machine Learning can Influence the Stock Markets?

Machine Learning in Finance: A New Era

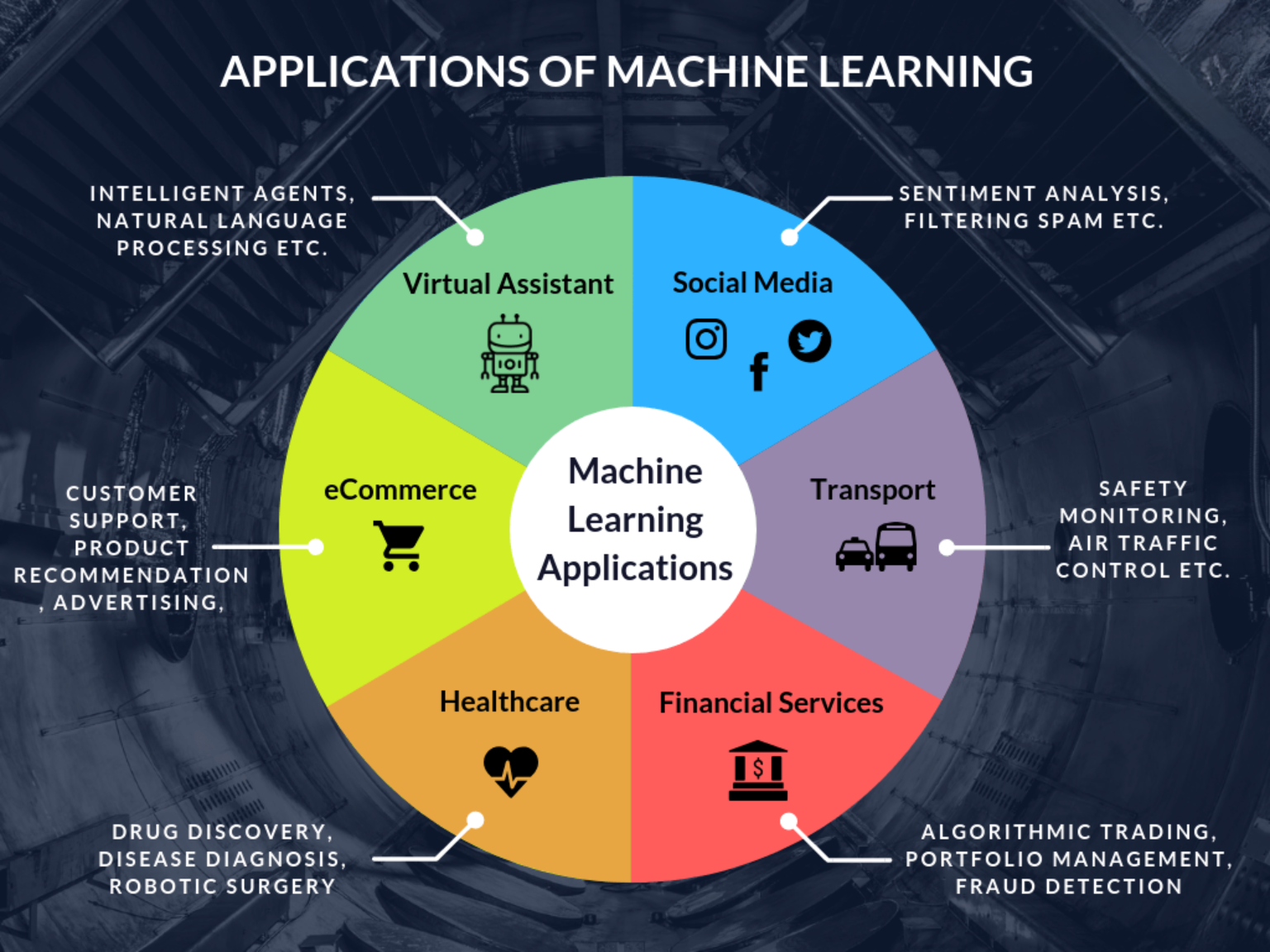

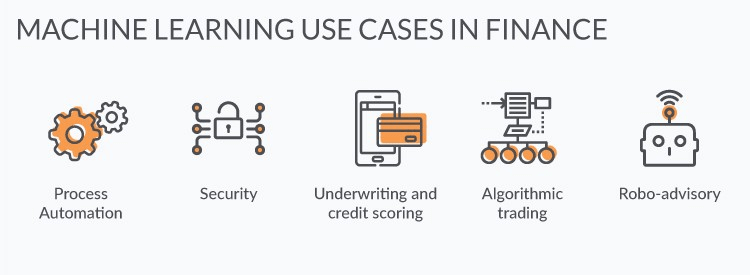

Machine learning has made significant inroads into various industries, including finance. It’s used to efficiently process and learn from large, complex datasets, helping in tasks like identifying authentic from fraudulent documents.

In finance, machine learning utilizes historical financial data, playing a pivotal role in loan approval, credit scoring, portfolio management, and risk assessment.

Machine learning, especially in Python for Algorithmic trading, is gaining traction among both retail and institutional traders. A Valuates Reports forecast indicates a significant growth in the algorithmic trading market from 2021 to 2028.

AI and ML are seen as key drivers of economic growth, with PWC projecting a substantial boost in global GDP by 2030 due to these technologies.

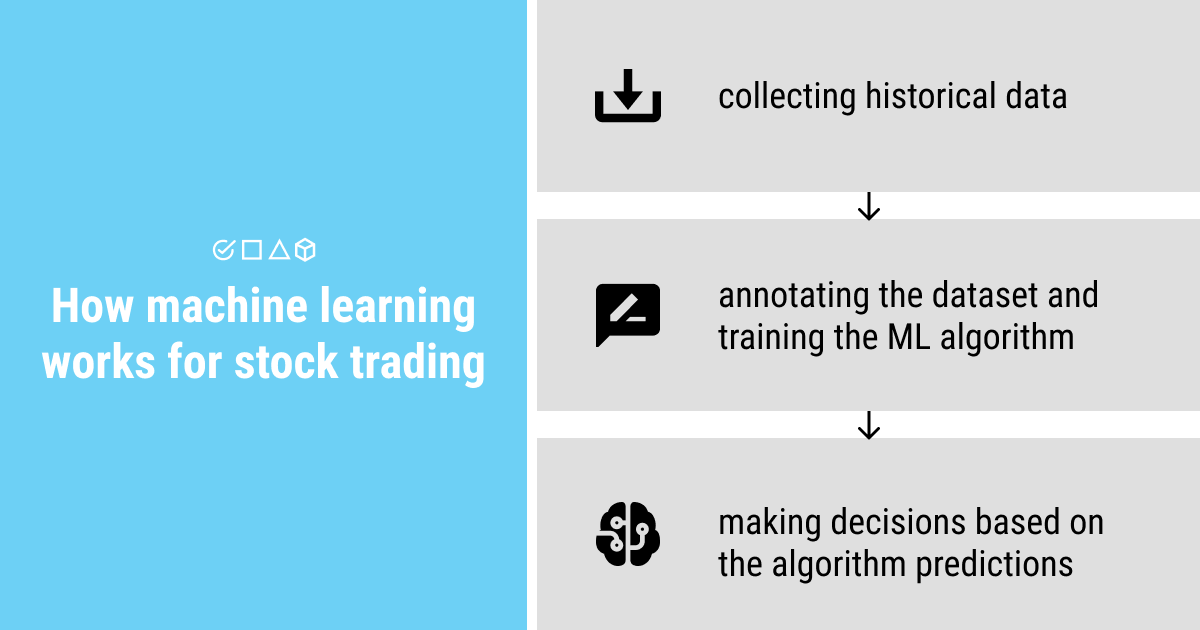

Machine Learning for Trading: Transforming the Market

Machine Learning for Trading has various applications, such as:

- Using historical data for stock price prediction

- Enhancing the effectiveness of algorithmic trading strategies

- Monitoring numerous markets simultaneously

The Rationale Behind Machine Learning in Trading

Successful trading hinges on identifying patterns in market data. Previously, traders analyzed patterns to make buy and sell decisions. These strategies were essentially rule-based guidelines triggered by specific market conditions.

While humans can apply these strategies, machines excel in terms of speed and accuracy, especially for high-frequency trading platforms processing thousands of transactions per second.

Cornell University research highlights the advantages of reinforcement learning (RL) in financial decision-making, emphasizing its capacity to utilize vast financial data with minimal assumptions.

Using data like OHLC, fundamental information, or alternative data (e.g., tweets about an asset), machine learning models can be created to predict future market movements.

Although machine learning is yet to master future prediction, it offers several benefits over traditional algorithmic trading by analyzing large datasets to discern patterns and assisting in the identification of historical correlations.

Machine learning accelerates and automates one of the most challenging aspects of algorithmic trading, providing traders an edge over rule-based trading.

With high-speed transactions, machine learning facilitates significant profit gains, attracting both retail and institutional traders. Hence, embracing machine learning in trading is a logical step forward.

Further Reading: Machine Learning in Trading: Unlocking the Power of Algorithms

Advantages of Machine Learning in Trading

Key benefits of employing ML in Trading include:

- Accelerating the search for efficient algorithmic trading strategies through automation, maximizing profits and simulating risks.

- Expanding the range of markets a trader can monitor, increasing the chances of finding lucrative opportunities.

- Using historical data to forecast stock prices and make informed trading decisions.

- Enhancing security by detecting suspicious activities and fraud more quickly.

- Crucially predicting financial trends and identifying potential opportunities to mitigate fraud.

Challenges in Applying Machine Learning to Trading

While Machine Learning for Trading is promising, it also faces certain challenges:

- Automation is intelligent but not infallible.

- The dynamic nature of the stock market, including unpredictable factors like natural disasters, cannot always be accounted for in ML analysis.

- Overfitting in ML can lead to less adaptable trading strategies, making backtesting helpful but not entirely reliable.

- Long-term predictions in stock prices tend to be less accurate due to inherent biases.

- Constantly adjusting ML models in the market can negate some unpredictability, but only recent news can offer a competitive edge.

- Despite abundant historical data, its slow density increase can lead to inaccurate predictions and increased risks.

However, most of these challenges can be mitigated with the right expertise and skills.

Conclusion

AI and machine learning are revolutionizing the financial industry. Machine learning algorithms help identify market trends and assess investment risks. As competition intensifies, more traders are adopting ML for trading.

Check out courses that teach machine learning using Python to elevate your trading with cutting-edge knowledge and technology.